Here's passive portfolio income taxed how may able generate tax-free cash flow some situations. Passive income vs. portfolio income: they differ

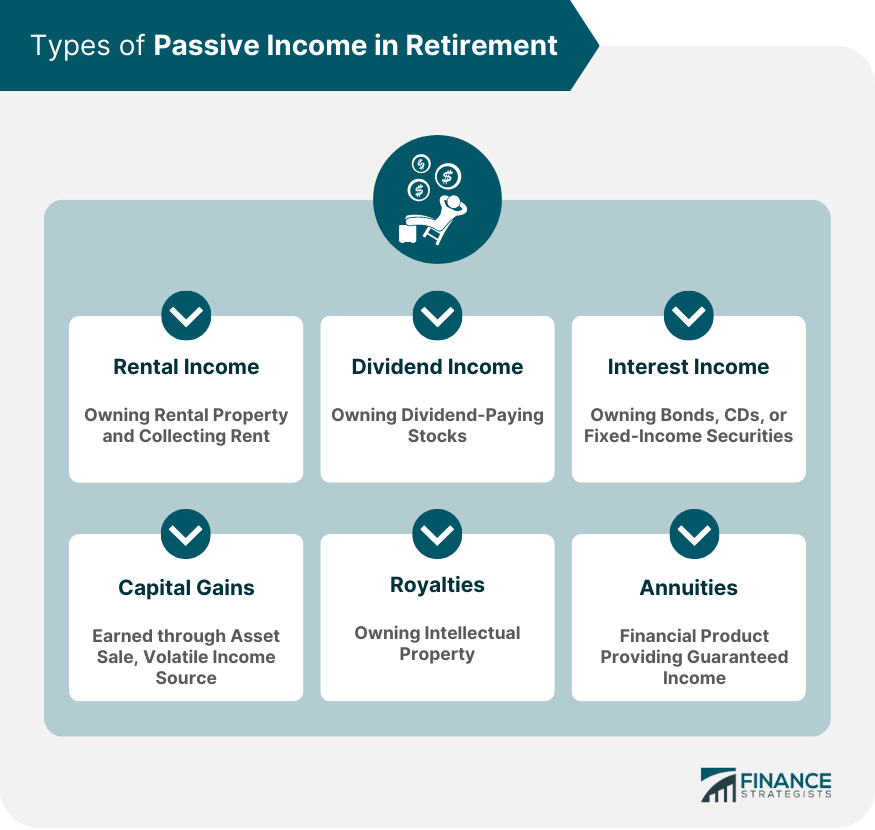

Passive income tax. First, is passive income? Passive income, unearned income, the IRS calls it, defined income a trade business activity which taxpayer not, currently not, materially participate, income all real estate activities, of participation (except rental activities those qualify real estate professionals).

Passive income tax. First, is passive income? Passive income, unearned income, the IRS calls it, defined income a trade business activity which taxpayer not, currently not, materially participate, income all real estate activities, of participation (except rental activities those qualify real estate professionals).

Like other kind income, passive income be reported your income tax return. despite tax advantages listed above, passive income is taxed ordinary income. "Contrary popular belief, passive income is taxed ordinary income tax rates it sometimes to deductions reduce liability .

Like other kind income, passive income be reported your income tax return. despite tax advantages listed above, passive income is taxed ordinary income. "Contrary popular belief, passive income is taxed ordinary income tax rates it sometimes to deductions reduce liability .

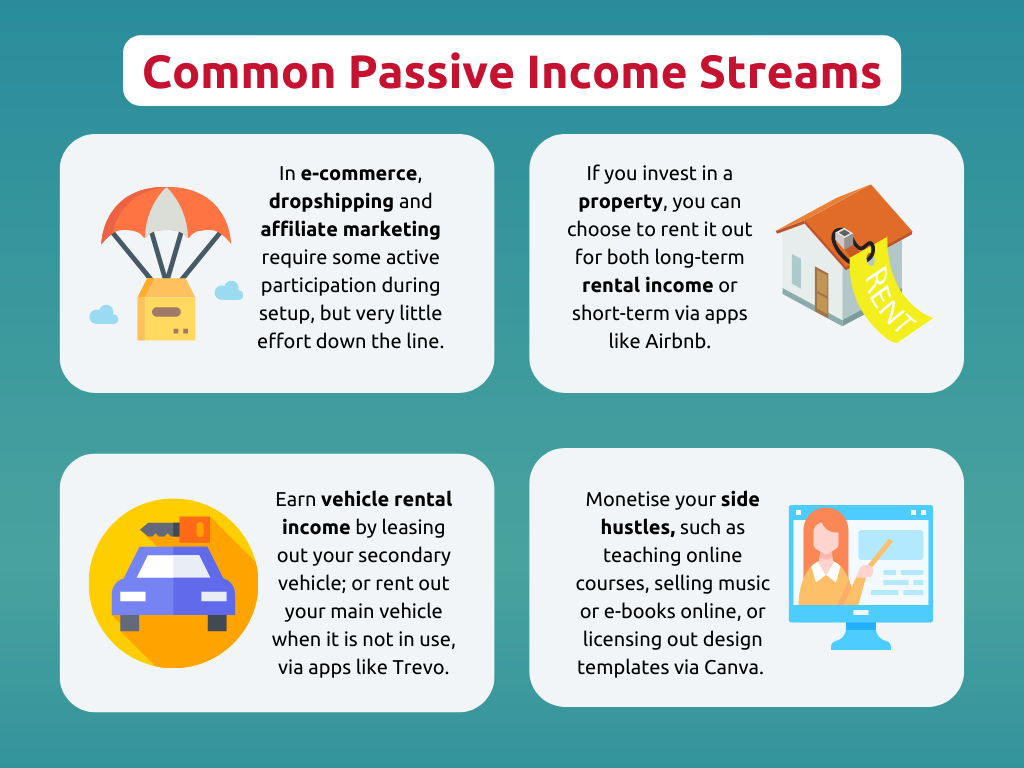

Passive income is taxed income generated interest, rent, dividends other money outside employment contract work.

Passive income is taxed income generated interest, rent, dividends other money outside employment contract work.

Here's look some the types passive income aren't taxable. Sponsored: Owe IRS $10K more? Schedule FREE consultation see you qualify tax relief.

Here's look some the types passive income aren't taxable. Sponsored: Owe IRS $10K more? Schedule FREE consultation see you qualify tax relief.

How Passive Income Is Taxed Differently. most cases, passive income is taxed your personal income tax rate. However, factors differentiate passive income is taxed, may .

How Passive Income Is Taxed Differently. most cases, passive income is taxed your personal income tax rate. However, factors differentiate passive income is taxed, may .

Additionally, gains selling rental property also subject capital gains tax. Passive Income Not Qualify Preferential Tax Rates. Contrary popular belief, all passive income is eligible preferential tax rates. some types passive income long-term capital gains afforded favorable tax .

Additionally, gains selling rental property also subject capital gains tax. Passive Income Not Qualify Preferential Tax Rates. Contrary popular belief, all passive income is eligible preferential tax rates. some types passive income long-term capital gains afforded favorable tax .

Passive income broadly refers money don't earn actively engaging a trade business. . It's vital understand tax rules surrounding passive activity income .

Passive income broadly refers money don't earn actively engaging a trade business. . It's vital understand tax rules surrounding passive activity income .

Is passive income taxed a higher rate? Passive income, rental real estate, not subject high effective tax rates. Income rental real estate sheltered depreciation amortization results a lower effective tax rate.

Is passive income taxed a higher rate? Passive income, rental real estate, not subject high effective tax rates. Income rental real estate sheltered depreciation amortization results a lower effective tax rate.

However, what called "passive income" result being double-taxed. happens you earn income it already included part your taxable income. money off passive income come investments sources as rental properties, stocks, dividends. types income considered .

However, what called "passive income" result being double-taxed. happens you earn income it already included part your taxable income. money off passive income come investments sources as rental properties, stocks, dividends. types income considered .

Passive Income - Meaning, Ideas, Examples, How it Works?

Passive Income - Meaning, Ideas, Examples, How it Works?

What is Passive Income | Passive Income | Earn While You Sleep

What is Passive Income | Passive Income | Earn While You Sleep

Why Passive Income is Important for Business?

Why Passive Income is Important for Business?

Why passive income is not taxed? (2024)

Why passive income is not taxed? (2024)

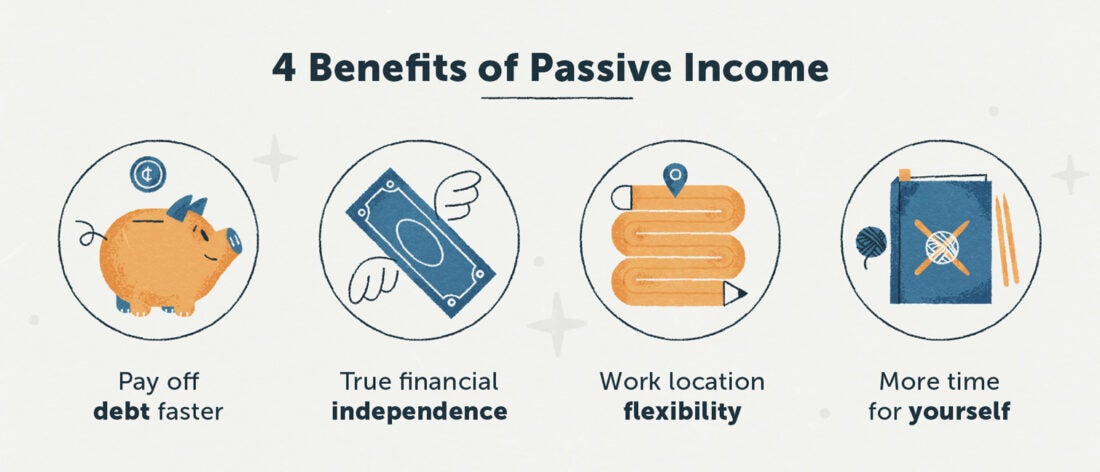

6 Reasons Why Passive Income Is Very Important - YouTube

6 Reasons Why Passive Income Is Very Important - YouTube

Why Passive Income Is Undeniable And Useful - MyCredit Bucks Blog

Why Passive Income Is Undeniable And Useful - MyCredit Bucks Blog

Active Income vs Passive Income (Which one is better for you?) | by

Active Income vs Passive Income (Which one is better for you?) | by

Why Passive Income is Important for Business?

Why Passive Income is Important for Business?

10 Reasons Why Passive Income Is So Important - Be The Budget

10 Reasons Why Passive Income Is So Important - Be The Budget

Passive Income Not Taxed In Powerpoint And Google Slides Cpb

Passive Income Not Taxed In Powerpoint And Google Slides Cpb