Passive income is taxed income generated interest, rent, dividends other money outside employment contract work.

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://www.olympiabenefits.com/hs-fs/hubfs/Passive%20Investment%20Income%20Limit%20-%20infographic.png?width=1039&name=Passive%20Investment%20Income%20Limit%20-%20infographic.png) The tax rate you'll pay passive income depends heavily the specific kind income and, sometimes, long you've held asset. Taxes rental income.

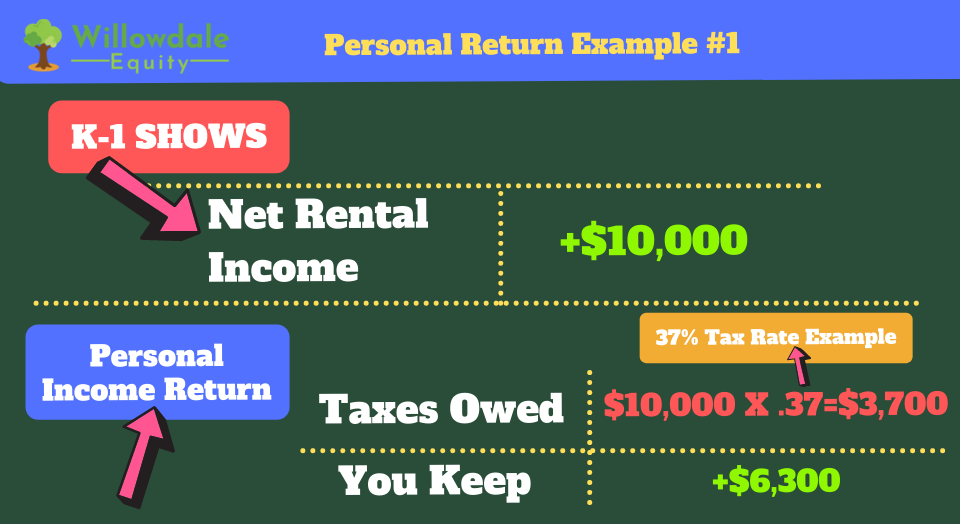

The tax rate you'll pay passive income depends heavily the specific kind income and, sometimes, long you've held asset. Taxes rental income.

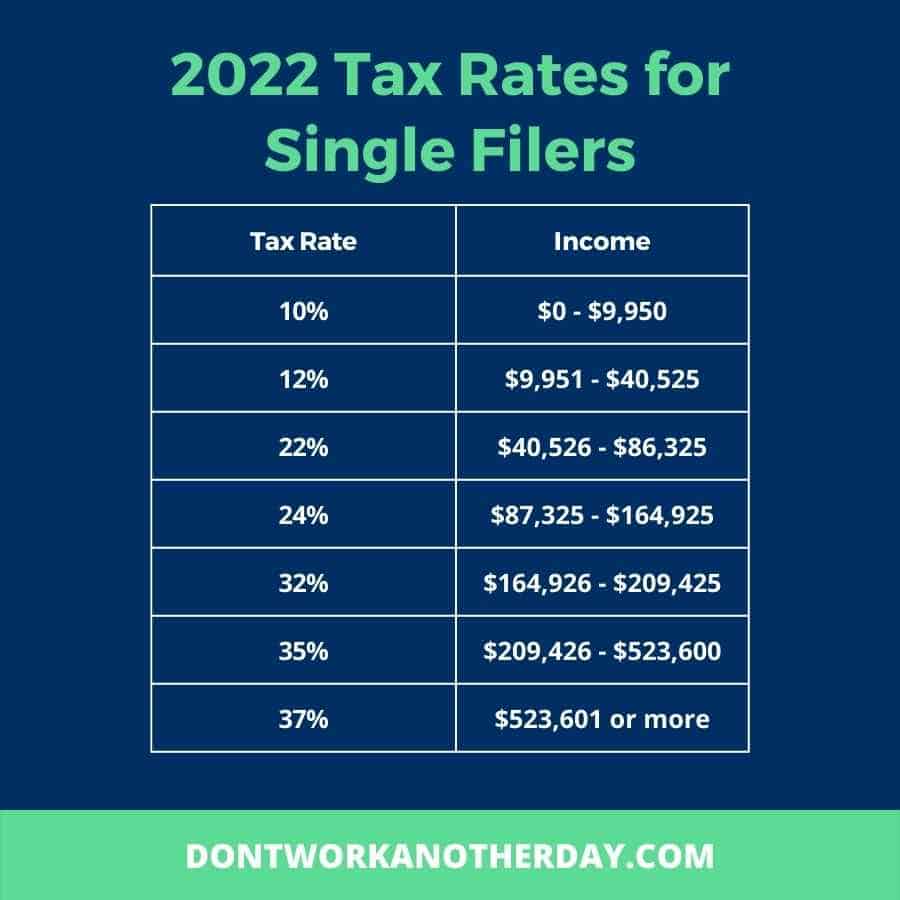

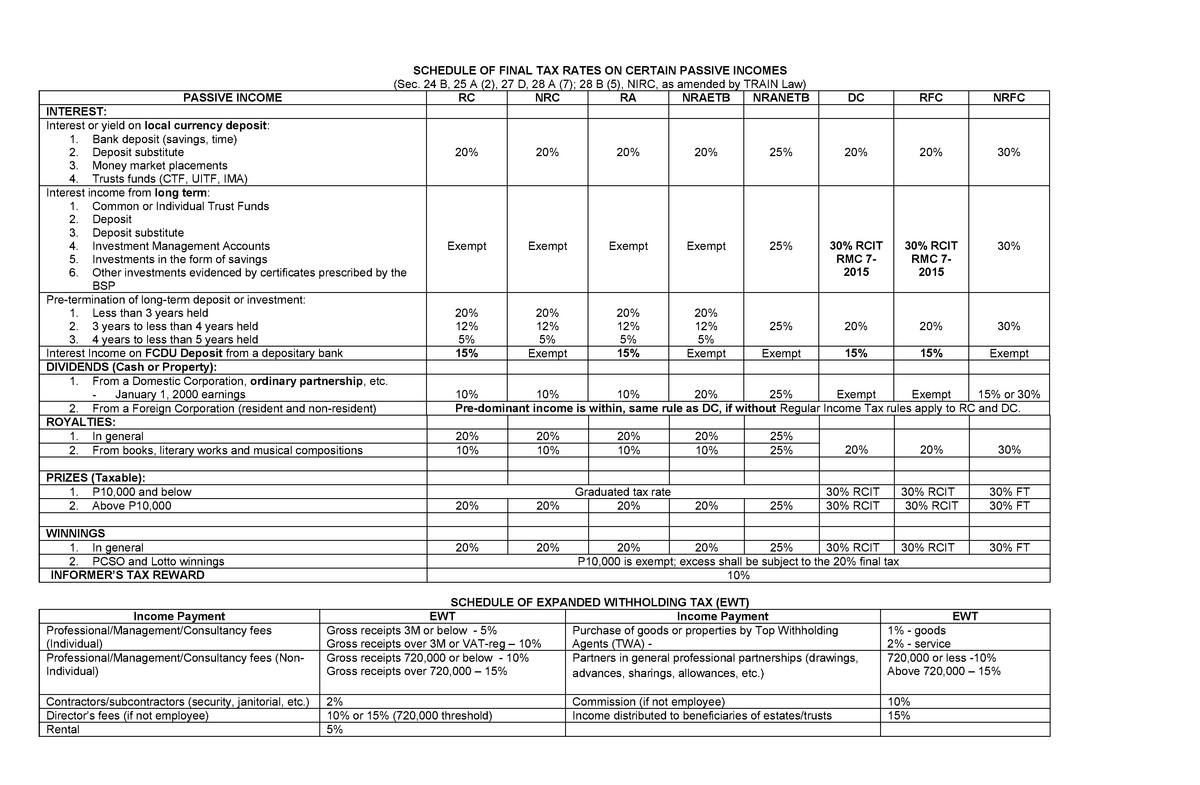

The passive income tax rate is the yardstick the federal government the United States to decide tax on passive income citizens. tax rate varies based the term the income. The long-term passive income tax rate differs the short-term passive income tax. The table shows tax rate income .

The passive income tax rate is the yardstick the federal government the United States to decide tax on passive income citizens. tax rate varies based the term the income. The long-term passive income tax rate differs the short-term passive income tax. The table shows tax rate income .

Passive income is taxed the rate salaries received a job, you'll to work a Tax Pro get full view your entire financial picture. with active income, it's to deductions lessen tax liability.

Passive income is taxed the rate salaries received a job, you'll to work a Tax Pro get full view your entire financial picture. with active income, it's to deductions lessen tax liability.

What is the passive income tax rate 2024? passive income tax rate depends the type term the income. Generally, are categories passive income: ordinary capital gains. Ordinary passive income is income is taxed the rate your regular income, as interest, dividends, royalties, rental income. The tax rate ordinary passive income ranges .

What is the passive income tax rate 2024? passive income tax rate depends the type term the income. Generally, are categories passive income: ordinary capital gains. Ordinary passive income is income is taxed the rate your regular income, as interest, dividends, royalties, rental income. The tax rate ordinary passive income ranges .

Earned income is taxed the employee's full marginal tax rate is subject FICA taxes Social Security Medicare taxes, totaling 15.3%, to certain amount. the hand, passive income earned real estate not subject FICA can sheltered higher effective tax rates.

Earned income is taxed the employee's full marginal tax rate is subject FICA taxes Social Security Medicare taxes, totaling 15.3%, to certain amount. the hand, passive income earned real estate not subject FICA can sheltered higher effective tax rates.

What is the IRS passive income tax rate? The simplest explanation that most cases, passive income is taxed the ordinary income tax rate. its implies, ordinary income tax rate is the common rate. is for active income, including money earn your employment any side gigs may have. .

What is the IRS passive income tax rate? The simplest explanation that most cases, passive income is taxed the ordinary income tax rate. its implies, ordinary income tax rate is the common rate. is for active income, including money earn your employment any side gigs may have. .

Generally speaking, passive active income subject similar taxation, for passive income generated long term capital gains qualified dividends. capital gains tax rate varies depending whether gain considered long-term short-term. Short-term capital gains taxed your ordinary income tax rate.

Generally speaking, passive active income subject similar taxation, for passive income generated long term capital gains qualified dividends. capital gains tax rate varies depending whether gain considered long-term short-term. Short-term capital gains taxed your ordinary income tax rate.

The passive income tax rate is based tax bracket . Typically, passive income is subject a taxpayer's usual marginal tax rate, is based their tax bracket. taxpayers modified adjusted gross income is a threshold also subject the Net Investment Income Tax (NIIT). 3.8% tax applies .

The passive income tax rate is based tax bracket . Typically, passive income is subject a taxpayer's usual marginal tax rate, is based their tax bracket. taxpayers modified adjusted gross income is a threshold also subject the Net Investment Income Tax (NIIT). 3.8% tax applies .

Short-Term Passive Income Tax Rates. mentioned previously, short-term gains apply assets held a year less are taxed ordinary income. other words, short-term capital gains taxed the rate your income tax. The current tax rates short-term gains as follows: 10%, 12%, 22%, 24%, 32%, 35% 37%.

Short-Term Passive Income Tax Rates. mentioned previously, short-term gains apply assets held a year less are taxed ordinary income. other words, short-term capital gains taxed the rate your income tax. The current tax rates short-term gains as follows: 10%, 12%, 22%, 24%, 32%, 35% 37%.

comparehrom - Blog

comparehrom - Blog

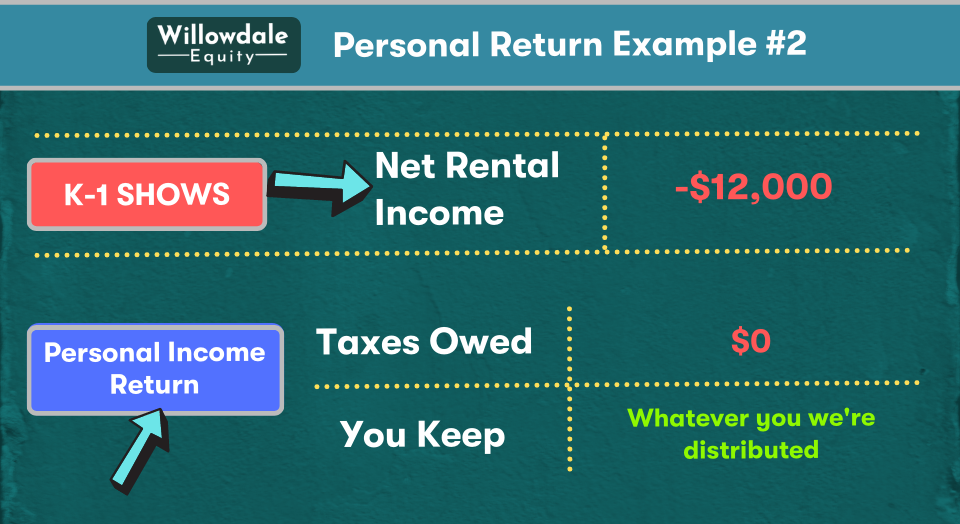

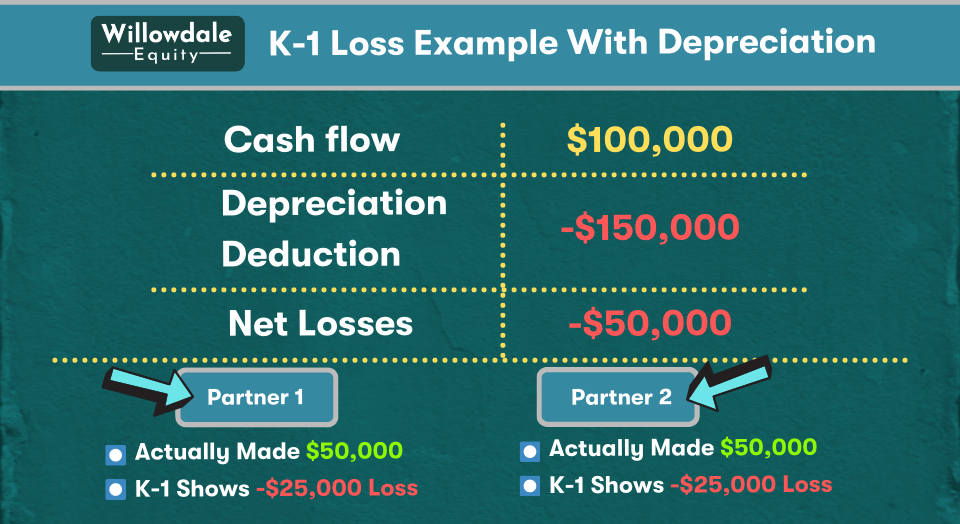

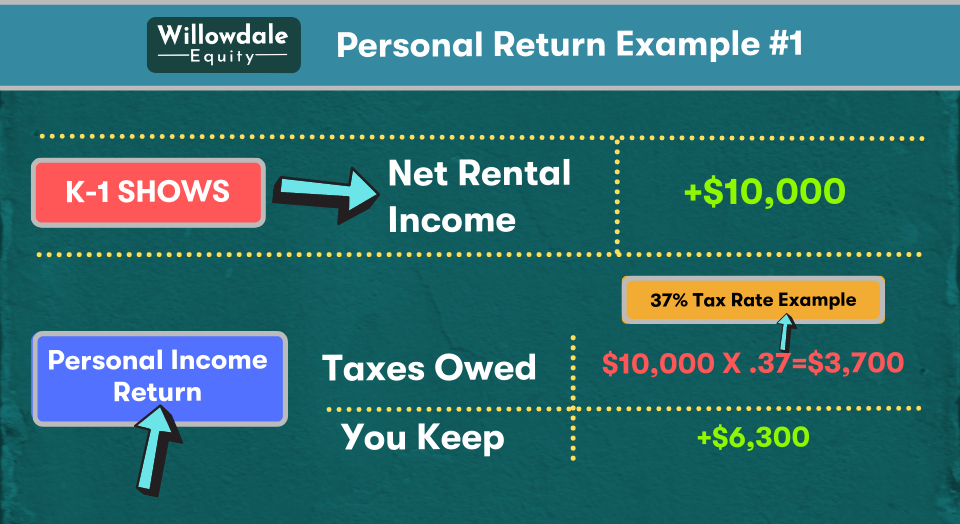

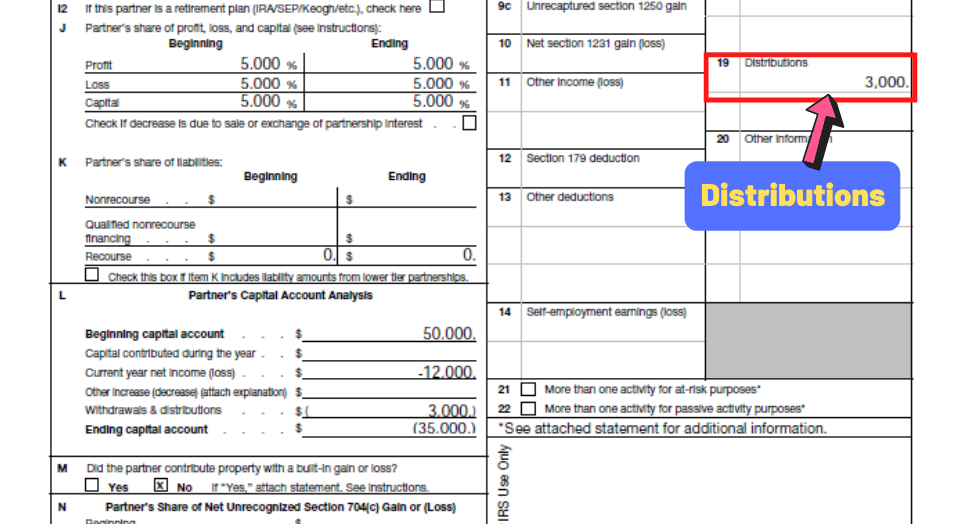

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://financialtechtools.ca/wp-content/uploads/2018/04/investmentTable-1030x480.jpg) Determine your Passive Investment Income Limit [Free Tools]

Determine your Passive Investment Income Limit [Free Tools]

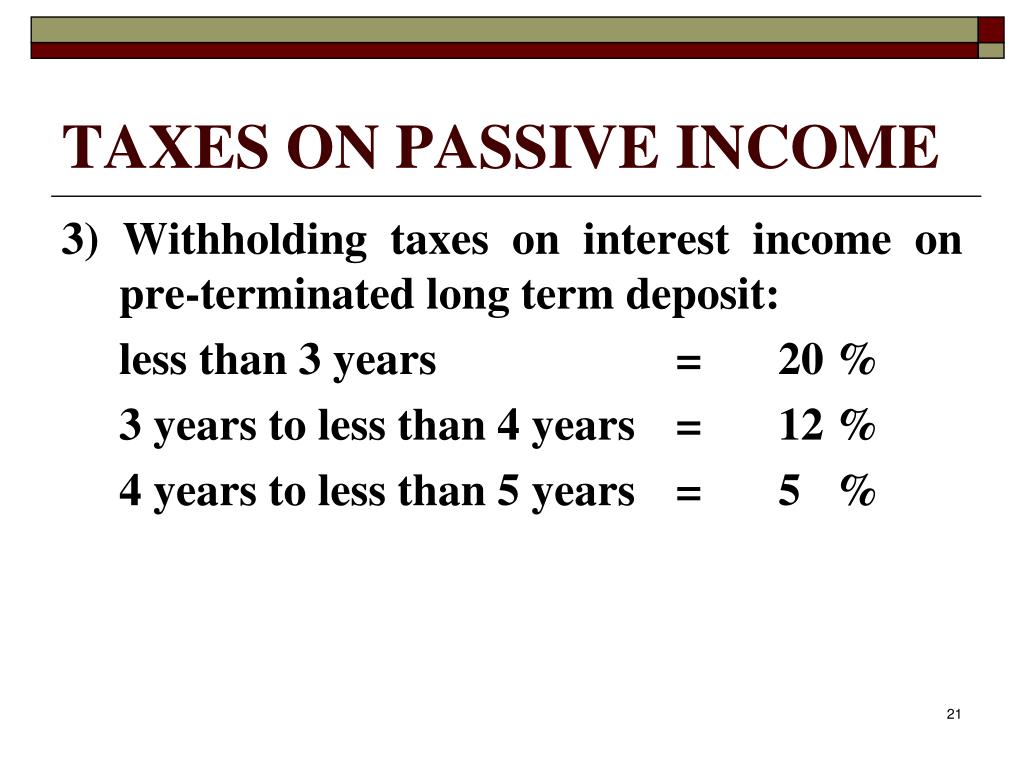

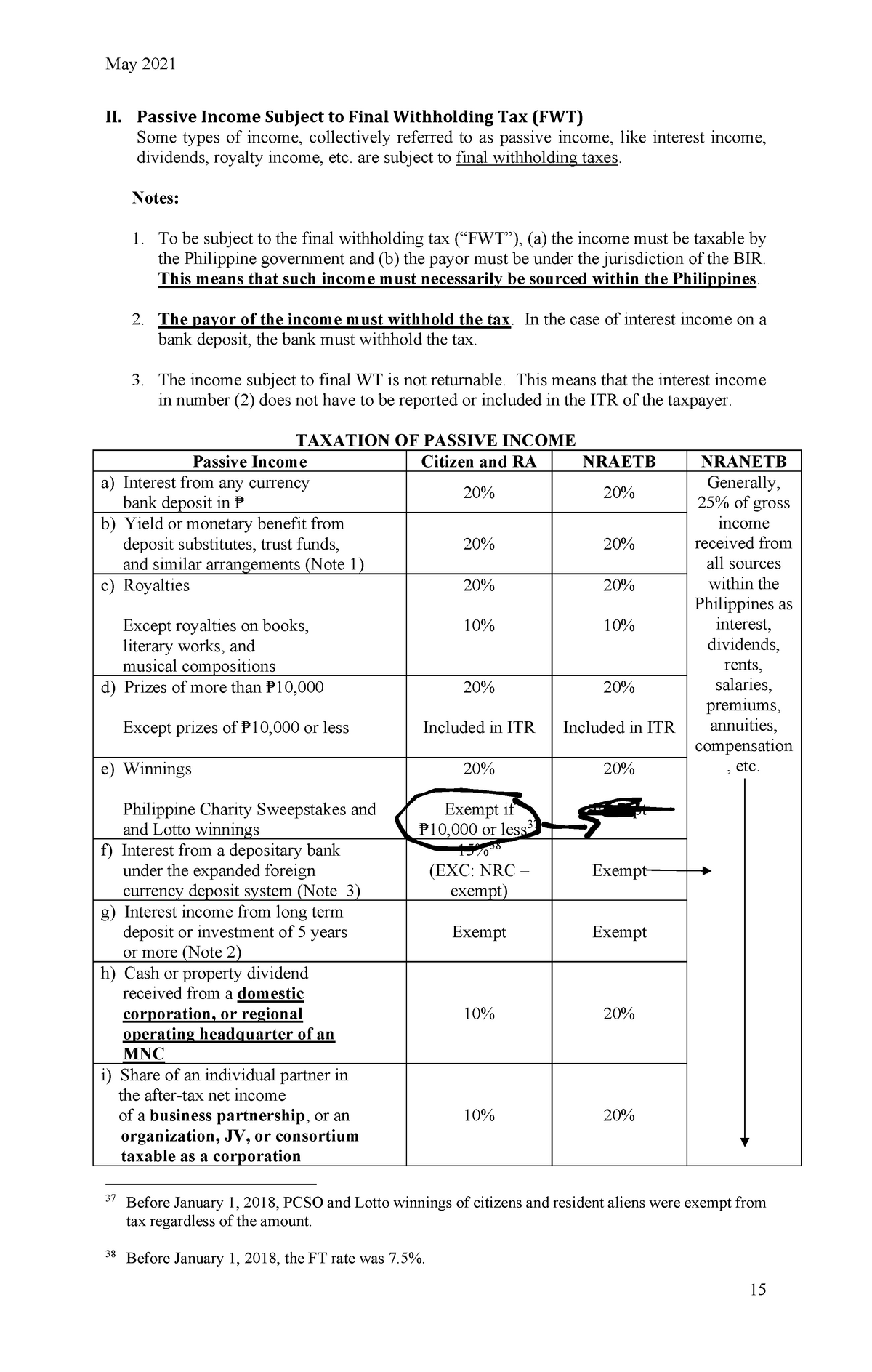

Taxation for passive Income - May 2021 15 II Passive Income Subject to

Taxation for passive Income - May 2021 15 II Passive Income Subject to

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

What Is Passive Income Tax Rate | LiveWell

What Is Passive Income Tax Rate | LiveWell

Understanding Passive vs Nonpassive Income Tax Rates - Dollarscaler

Understanding Passive vs Nonpassive Income Tax Rates - Dollarscaler

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

Passive Income Tax Rate In USA Easy Guide

Passive Income Tax Rate In USA Easy Guide

Passive Income Tax Rate (2022 Guide) | Don't Work Another Day

Passive Income Tax Rate (2022 Guide) | Don't Work Another Day

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://i0.wp.com/s3.amazonaws.com/rwncdn/wp-content/uploads/How-is-Passive-Income-Taxed.png?fit=1200%2C628&ssl=1) How is Passive Income Taxed? [Free Investor Guide]

How is Passive Income Taxed? [Free Investor Guide]