The example shows sales tax calculated. you an advertiser Taos, Mexico, purchase goods services totaling $1,000 a sales tax rate 9.44%, total payment be calculated follows: 1,000 + (1,000* 9.44%) = 1,000 + 94.4 = $1,094.4

Sales tax often levied sales tangible personal property - goods show on TikTok Shop. TikTok Shop collects remits sales tax behalf its sellers. However, Shop sellers need consider sales Shop they contribute economic nexus thresholds various states.

Sales tax often levied sales tangible personal property - goods show on TikTok Shop. TikTok Shop collects remits sales tax behalf its sellers. However, Shop sellers need consider sales Shop they contribute economic nexus thresholds various states.

Income Tax. Revenue generated TikTok Shop considered taxable income. must report income your tax return federal, state, local levels. track deductible business expenses (e.g., shipping costs, advertising) reduce overall tax liability. Sales Tax. Sales tax a critical part TikTok Shop tax compliance:

Income Tax. Revenue generated TikTok Shop considered taxable income. must report income your tax return federal, state, local levels. track deductible business expenses (e.g., shipping costs, advertising) reduce overall tax liability. Sales Tax. Sales tax a critical part TikTok Shop tax compliance:

Vendors have tax monitoring tool keep accurate sales records; Sellers nexus a state need register sales tax file returns; Sellers stay informed sales tax laws product/service taxability in states. Source: 1stopvat.com. Note this post (partially) written the of AI.

Vendors have tax monitoring tool keep accurate sales records; Sellers nexus a state need register sales tax file returns; Sellers stay informed sales tax laws product/service taxability in states. Source: 1stopvat.com. Note this post (partially) written the of AI.

For UK EU Sales: TikTok Shop sellers shipping goods the UK the EU now apply import VAT customs duties goods a value (typically €150). goods this threshold, VAT collected the point sale platforms TikTok Shop schemes the Import One-Stop Shop (IOSS) .

For UK EU Sales: TikTok Shop sellers shipping goods the UK the EU now apply import VAT customs duties goods a value (typically €150). goods this threshold, VAT collected the point sale platforms TikTok Shop schemes the Import One-Stop Shop (IOSS) .

Sales tax levied sales tangible personal property TikTok Shop; TikTok Shop collects remits sales tax behalf its sellers; Shop sellers need register appropriate jurisdictions they sell other platforms meet economic nexus thresholds; is recommended double-check compliance sales tax .

Sales tax levied sales tangible personal property TikTok Shop; TikTok Shop collects remits sales tax behalf its sellers; Shop sellers need register appropriate jurisdictions they sell other platforms meet economic nexus thresholds; is recommended double-check compliance sales tax .

Sales tax. Yes, buyers to pay taxes. TikTok acts a marketplace facilitator. such, they're required US law the vast majority US states calculate, charge, collect sales tax any sale via TikTok Shop. Simply put, sales tax consumption tax on sales goods services the US.

Sales tax. Yes, buyers to pay taxes. TikTok acts a marketplace facilitator. such, they're required US law the vast majority US states calculate, charge, collect sales tax any sale via TikTok Shop. Simply put, sales tax consumption tax on sales goods services the US.

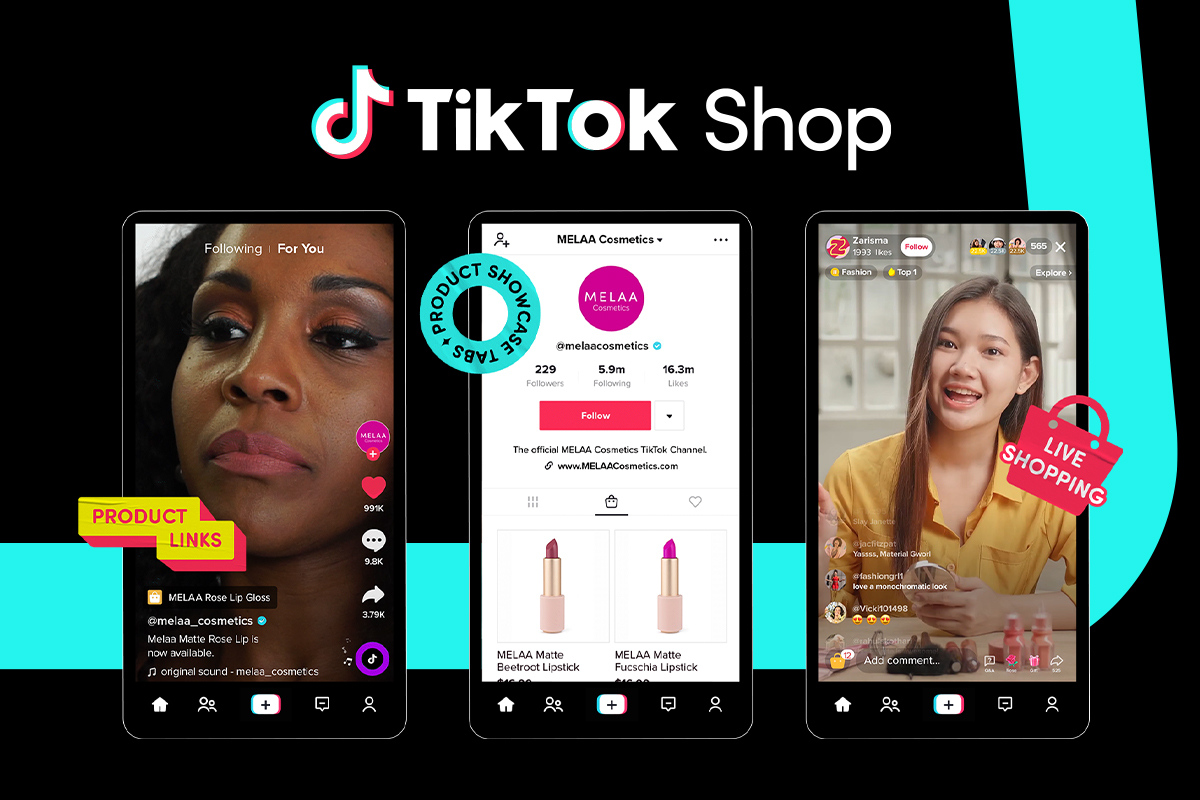

The launch TikTok Shop made easier ever brands creators sell products within app. However, convenient this be, also brings complexities sales tax. selling TikTok Shop, sellers be mindful sales tax regulations, vary widely jurisdiction.

The launch TikTok Shop made easier ever brands creators sell products within app. However, convenient this be, also brings complexities sales tax. selling TikTok Shop, sellers be mindful sales tax regulations, vary widely jurisdiction.

1. Log your TikTok Shop Seller Center the owner account, navigate Taxes My Account>Account Settings. 2. the Taxes screen, can review current tax settings edit the purple Edit button the upper right. submit forms start fresh account you don't your information file, click Submit Form the upper right.

1. Log your TikTok Shop Seller Center the owner account, navigate Taxes My Account>Account Settings. 2. the Taxes screen, can review current tax settings edit the purple Edit button the upper right. submit forms start fresh account you don't your information file, click Submit Form the upper right.

In US, TikTok Shop subject marketplace facilitator laws, making platform responsible sales tax reporting. However, vendors responsible the accuracy product data handling resale certificates. Vendors advised have tax monitoring tool keep accurate sales records. Source 1stopvat

In US, TikTok Shop subject marketplace facilitator laws, making platform responsible sales tax reporting. However, vendors responsible the accuracy product data handling resale certificates. Vendors advised have tax monitoring tool keep accurate sales records. Source 1stopvat

How to Sell Your Products on TikTok Shops in 2024 - Jungle Scout

How to Sell Your Products on TikTok Shops in 2024 - Jungle Scout

Tiktok Shop Live Rules

Tiktok Shop Live Rules

Introducing TikTok Shop | TikTok Newsroom

Introducing TikTok Shop | TikTok Newsroom

TikTok Shop Seller Center Tutorial || How to Create and Use TikTok Shop

TikTok Shop Seller Center Tutorial || How to Create and Use TikTok Shop

How To Shop Tiktok Shop On Pc

How To Shop Tiktok Shop On Pc

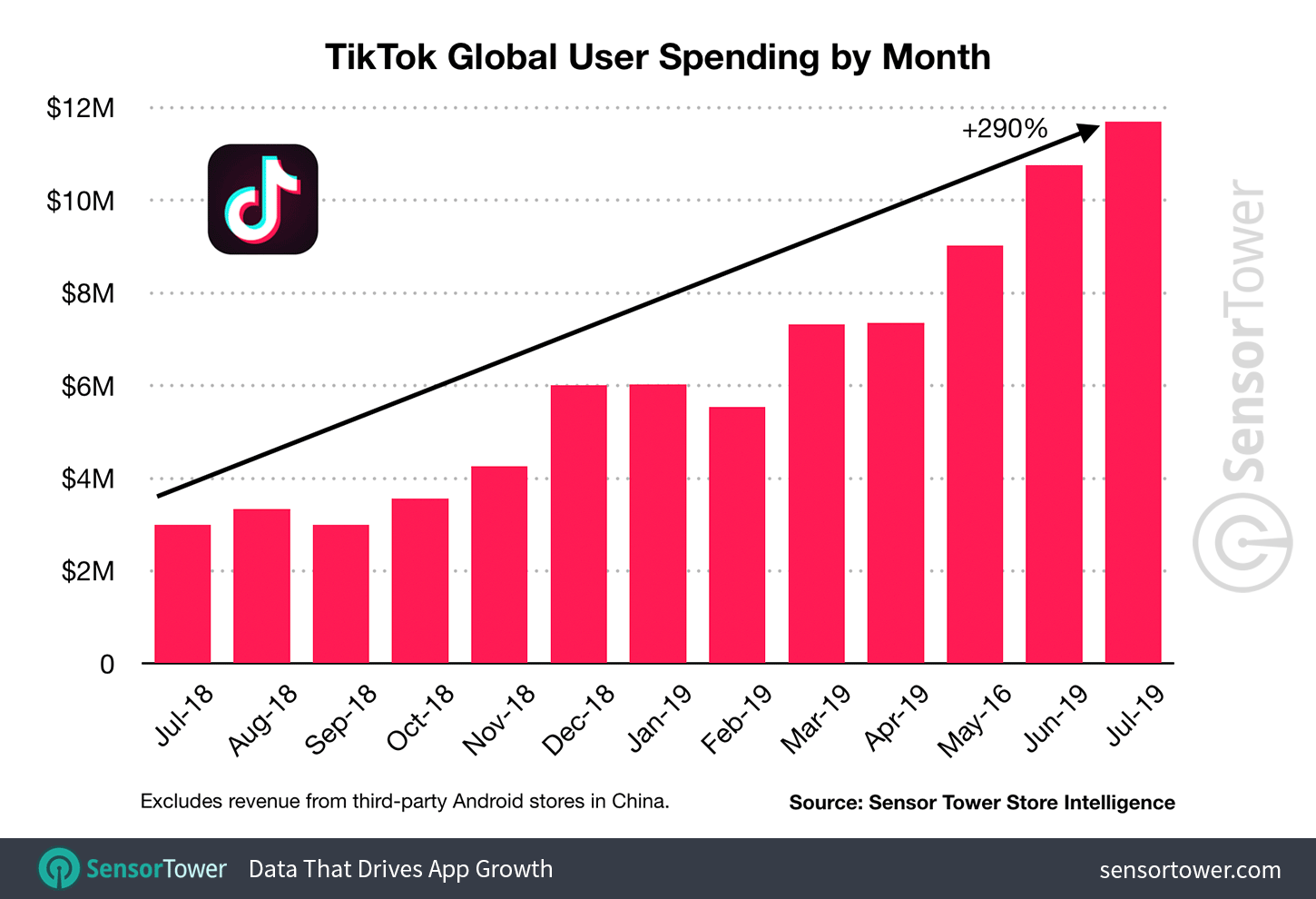

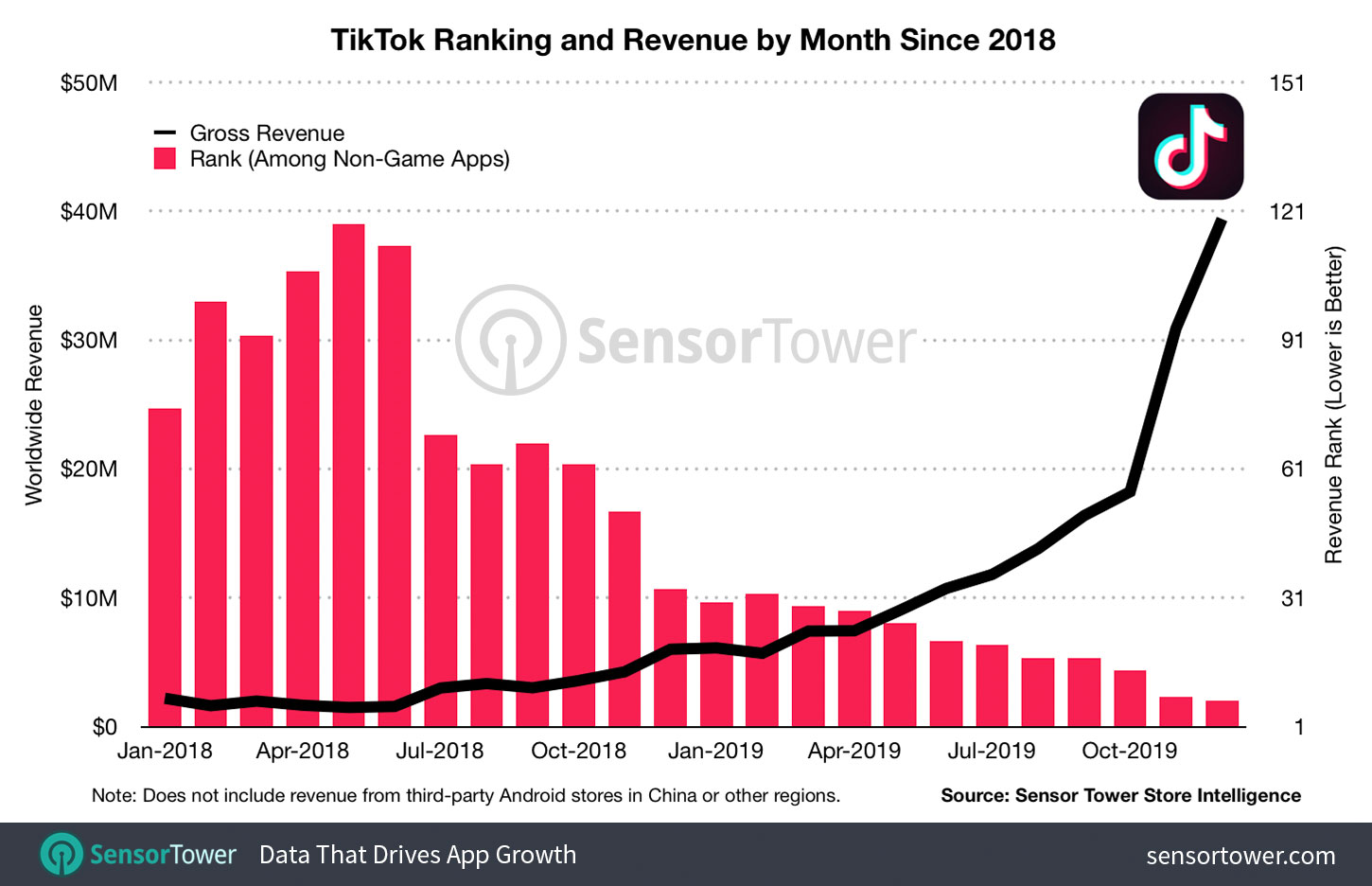

TikTok Had Another Record-Setting Revenue Month in July, with Spending

TikTok Had Another Record-Setting Revenue Month in July, with Spending

TikTok Shop: What is it and how does it work?

TikTok Shop: What is it and how does it work?

How Many Downloads Does Tiktok Have 2023

How Many Downloads Does Tiktok Have 2023

Tiktok Shop Seller Center Apk For Pc

Tiktok Shop Seller Center Apk For Pc

Beginners Guide to Your First 100 Sales on TikTok Shop Dropshipping

Beginners Guide to Your First 100 Sales on TikTok Shop Dropshipping

Tiktok Shop Seller Center Download

Tiktok Shop Seller Center Download