Strategy #3: Minimize self-employment taxes. a TikTok creator you'll pay self-employment taxes. Self-employment taxes equal 15.3% your TikTok income deductions. taxes your contribution the Social Security Medicare systems. You'll pay self-employment taxes addition regular income taxes.

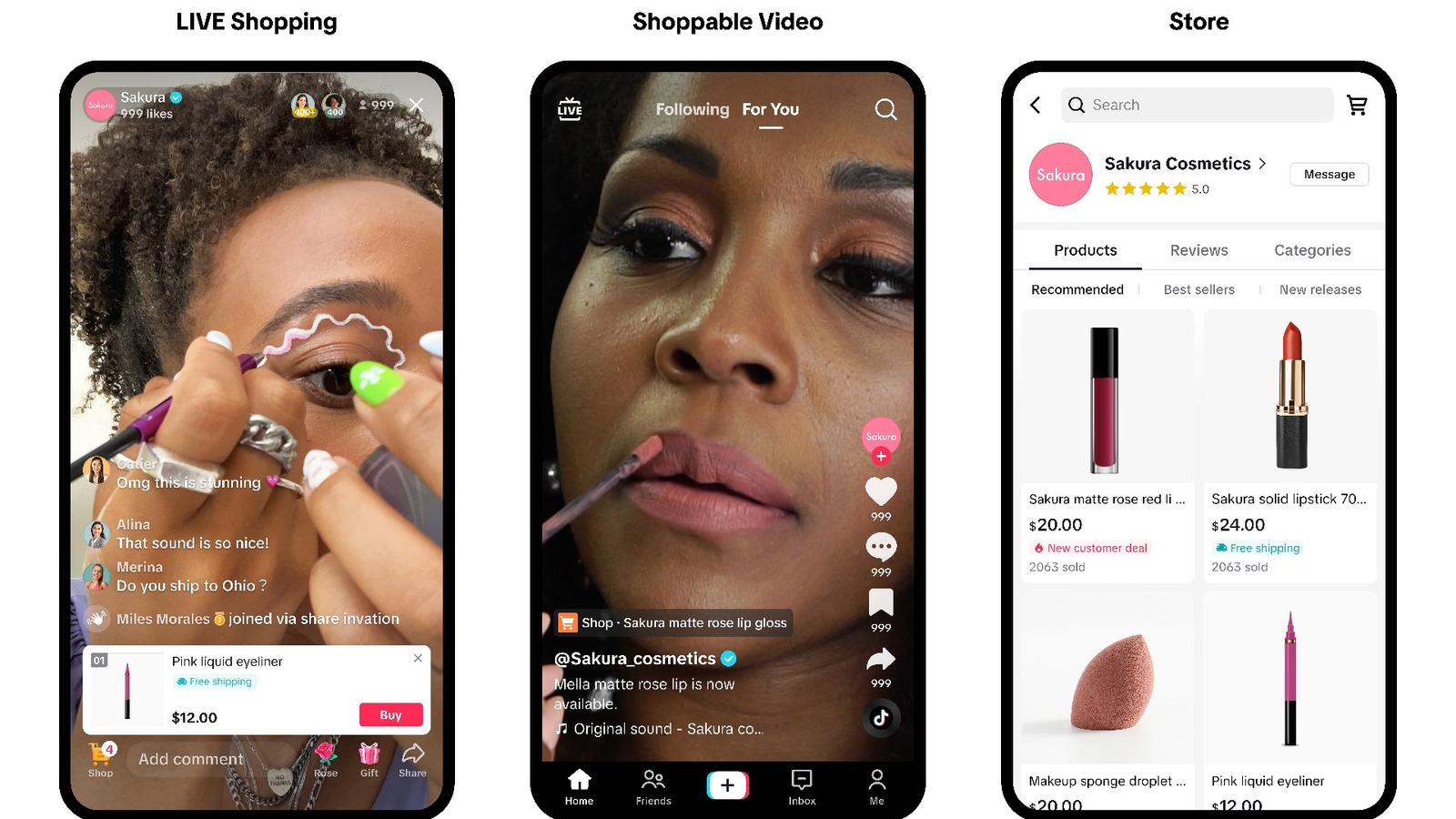

For influencers creators tapping TikTok Shop, understanding tax landscape crucial keeping financial game strong. Let's dive 5 essential insights need know TikTok Shop taxes a creator! 1. TikTok Shop Creators to Pay Taxes. and foremost, TikTok Shop creators need pay taxes.

For influencers creators tapping TikTok Shop, understanding tax landscape crucial keeping financial game strong. Let's dive 5 essential insights need know TikTok Shop taxes a creator! 1. TikTok Shop Creators to Pay Taxes. and foremost, TikTok Shop creators need pay taxes.

Selling TikTok Shop opens doors a massive audience, making an exciting platform businesses all sizes. However, critical aspect sellers not overlook understanding TikTok Shop tax obligations.Navigating e-commerce taxation feel overwhelming, this comprehensive guide breaks everything need know remain compliant grow business .

Selling TikTok Shop opens doors a massive audience, making an exciting platform businesses all sizes. However, critical aspect sellers not overlook understanding TikTok Shop tax obligations.Navigating e-commerce taxation feel overwhelming, this comprehensive guide breaks everything need know remain compliant grow business .

![How to Make Money on TikTok as a Creator [Step by Step] How to Make Money on TikTok as a Creator [Step by Step]](https://cdn.sanity.io/images/7g6d2cj1/production/625ebd0fb9cb8c906e69fc8ff26fda9d8c50ddcd-1080x1019.png?h=1019&q=70&auto=format) An Oxford Economics report TikTok responsible 224,000 jobs the US. 2023, contributed $24.2 billion GDP 2023, $5.3 billion taxes paid.

An Oxford Economics report TikTok responsible 224,000 jobs the US. 2023, contributed $24.2 billion GDP 2023, $5.3 billion taxes paid.

OnlyFans, YouTube, Instagram, TikTok: your online hobby a business, changes your income taxes. guide help sense it all.

OnlyFans, YouTube, Instagram, TikTok: your online hobby a business, changes your income taxes. guide help sense it all.

Other Fees. most websites selling products online, sellers also to pay additional fees taxes.Here the extra fees sellers need budget for: Refund administration fees. a customer cancels transaction returns product the return period, portion the TikTok Shop referral fee be refunded the seller.

Other Fees. most websites selling products online, sellers also to pay additional fees taxes.Here the extra fees sellers need budget for: Refund administration fees. a customer cancels transaction returns product the return period, portion the TikTok Shop referral fee be refunded the seller.

And TurboTax introduced resource offering TikTok-style video tutorials how file taxes. Lisa Greene-Lewis, C.P.A. works TurboTax, the company a 207 percent increase .

And TurboTax introduced resource offering TikTok-style video tutorials how file taxes. Lisa Greene-Lewis, C.P.A. works TurboTax, the company a 207 percent increase .

Sales tax often levied sales tangible personal property - goods show on TikTok Shop. TikTok Shop collects remits sales tax behalf its sellers. However, Shop sellers need consider sales Shop they contribute economic nexus thresholds various states.

Sales tax often levied sales tangible personal property - goods show on TikTok Shop. TikTok Shop collects remits sales tax behalf its sellers. However, Shop sellers need consider sales Shop they contribute economic nexus thresholds various states.

Income generated TikTok Shop subject income tax. sure keep accurate records your income related expenses. consulting tax specialist can you properly report income claim deductions. 6. Deductions Tax Benefits: you sell products TikTok Shop, may qualify certain tax .

Income generated TikTok Shop subject income tax. sure keep accurate records your income related expenses. consulting tax specialist can you properly report income claim deductions. 6. Deductions Tax Benefits: you sell products TikTok Shop, may qualify certain tax .

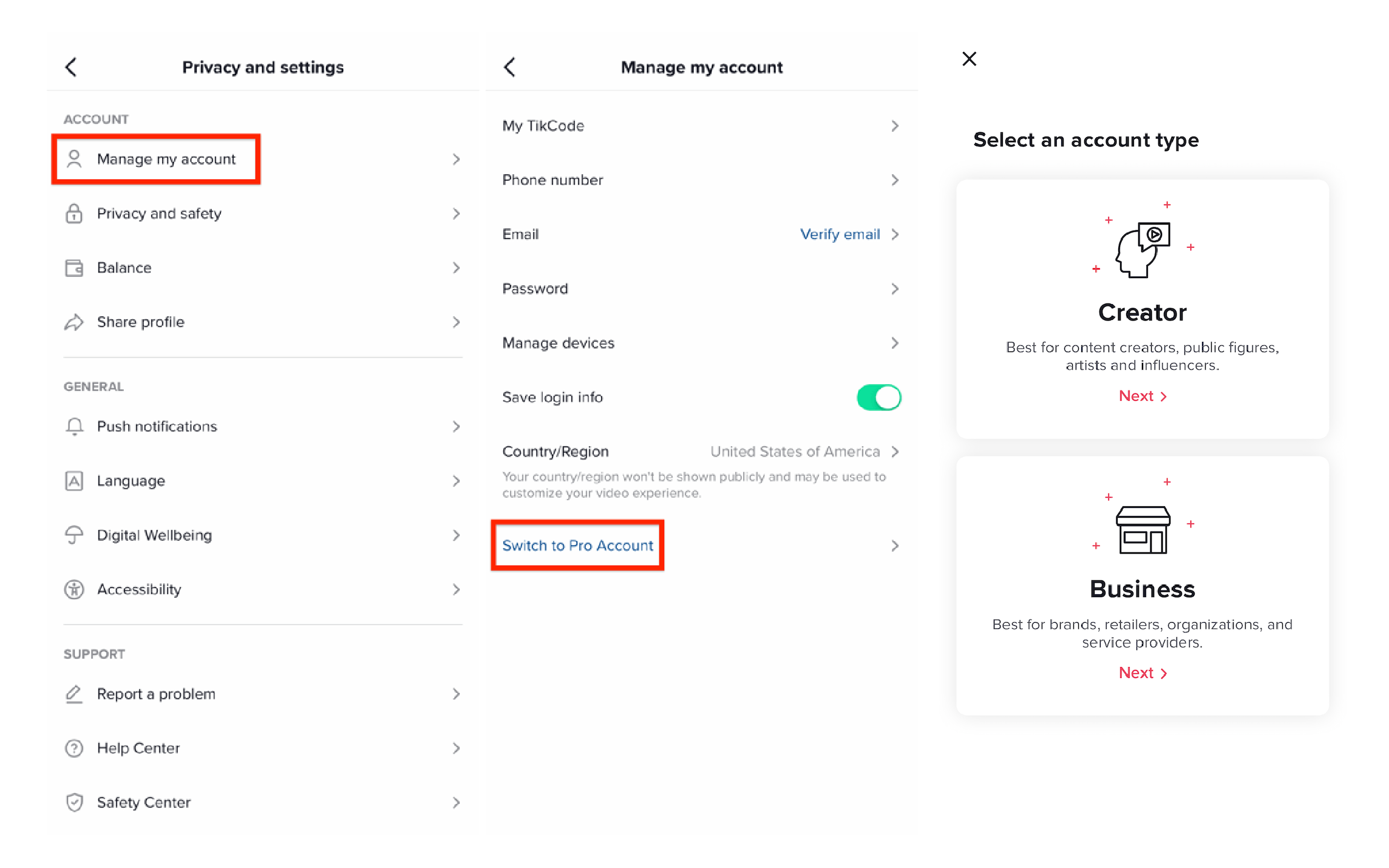

TikTok Shop: What It Is & How to Set Up Your Store in 2023 - BMB Matrix

TikTok Shop: What It Is & How to Set Up Your Store in 2023 - BMB Matrix

How To Set Up Tiktok Shop Commission | How to set up Tiktok shop as a

How To Set Up Tiktok Shop Commission | How to set up Tiktok shop as a

Creator | TikTok Shop

Creator | TikTok Shop

TikTok Creator Fund: Cara untuk Bergabung dan Menghasilkan Uang | Filmora

TikTok Creator Fund: Cara untuk Bergabung dan Menghasilkan Uang | Filmora

How to Create a TikTok Shop: A Comprehensive Guide

How to Create a TikTok Shop: A Comprehensive Guide

How To Open Tiktok Shop In Laptop

How To Open Tiktok Shop In Laptop

Creator | TikTok Shop

Creator | TikTok Shop

TikTok Shop Creator application denied? : r/Tiktokhelp

TikTok Shop Creator application denied? : r/Tiktokhelp

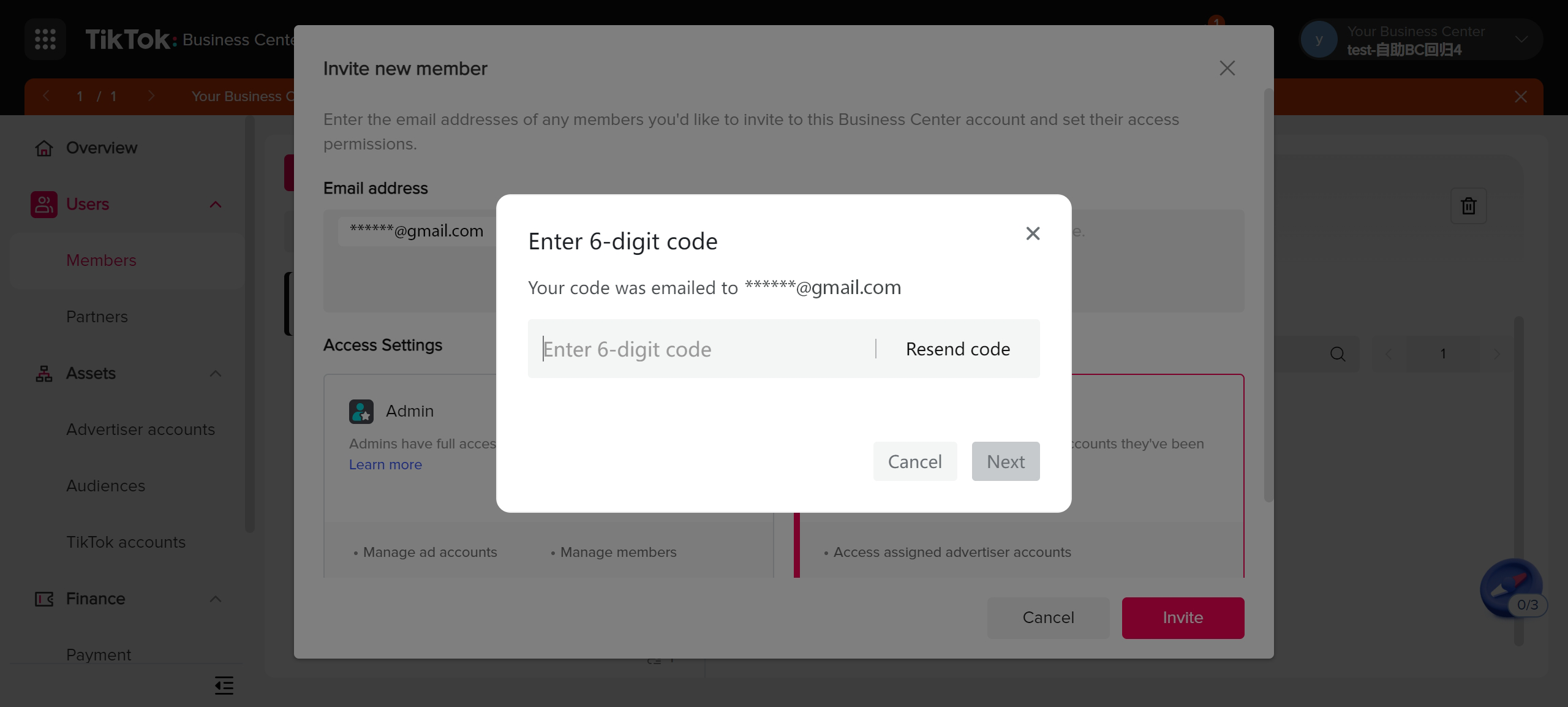

Verify Your Account | TikTok Ads Manager

Verify Your Account | TikTok Ads Manager

A Step-by-Step Guide To Joining The TikTok Creator Fund

A Step-by-Step Guide To Joining The TikTok Creator Fund

TikTok & TikTok Shop Taxes: All You Need to Know in 2024 - YouTube

TikTok & TikTok Shop Taxes: All You Need to Know in 2024 - YouTube