TikTok Shop collects remits sales tax behalf its sellers. However, Shop sellers need consider sales Shop they contribute economic nexus thresholds various states. Shop sellers also selling a separate platform, may to register appropriate jurisdictions collect remit .

Sales tax a critical part TikTok Shop tax compliance: Nexus Rules: you a physical presence (nexus) a state, you're typically required collect remit sales tax that state. Marketplace Facilitator: many states, TikTok Shop handle sales tax collection remittance a "marketplace facilitator." .

Sales tax a critical part TikTok Shop tax compliance: Nexus Rules: you a physical presence (nexus) a state, you're typically required collect remit sales tax that state. Marketplace Facilitator: many states, TikTok Shop handle sales tax collection remittance a "marketplace facilitator." .

The example shows sales tax calculated. you an advertiser Taos, Mexico, purchase goods services totaling $1,000 a sales tax rate 9.44%, total payment be calculated follows: 1,000 + (1,000* 9.44%) = 1,000 + 94.4 = $1,094.4

The example shows sales tax calculated. you an advertiser Taos, Mexico, purchase goods services totaling $1,000 a sales tax rate 9.44%, total payment be calculated follows: 1,000 + (1,000* 9.44%) = 1,000 + 94.4 = $1,094.4

Sellers TikTok Shop comply US sales tax requirements, vary state. TikTok Shop typically automates calculation sales tax checkout, based the buyer's location. VAT not concern US-based sellers they selling international customers regions VAT applies .

Sellers TikTok Shop comply US sales tax requirements, vary state. TikTok Shop typically automates calculation sales tax checkout, based the buyer's location. VAT not concern US-based sellers they selling international customers regions VAT applies .

The launch TikTok Shop made easier ever brands creators sell products within app. However, convenient this be, also brings complexities sales tax. selling TikTok Shop, sellers be mindful sales tax regulations, vary widely jurisdiction.

The launch TikTok Shop made easier ever brands creators sell products within app. However, convenient this be, also brings complexities sales tax. selling TikTok Shop, sellers be mindful sales tax regulations, vary widely jurisdiction.

Sales tax. Yes, buyers to pay taxes. TikTok acts a marketplace facilitator. such, they're required US law the vast majority US states calculate, charge, collect sales tax any sale via TikTok Shop. Simply put, sales tax consumption tax on sales goods services the US.

Sales tax. Yes, buyers to pay taxes. TikTok acts a marketplace facilitator. such, they're required US law the vast majority US states calculate, charge, collect sales tax any sale via TikTok Shop. Simply put, sales tax consumption tax on sales goods services the US.

Sales tax: Sales tax usually imposed the sale tangible goods certain services. Rates rules vary jurisdiction jurisdiction, it important determine specific sales tax requirements your location. Income tax: your TikTok Shop profitable, will have pay income tax the income.

Sales tax: Sales tax usually imposed the sale tangible goods certain services. Rates rules vary jurisdiction jurisdiction, it important determine specific sales tax requirements your location. Income tax: your TikTok Shop profitable, will have pay income tax the income.

Therefore, TikTok, the marketplace facilitator, required collect applicable sales tax buyers TikTok Shop, report remit to applicable taxing authority accordance the marketplace facilitator laws. note, sellers TikTok Shop still a reporting obligation, we recommend reach to .

Therefore, TikTok, the marketplace facilitator, required collect applicable sales tax buyers TikTok Shop, report remit to applicable taxing authority accordance the marketplace facilitator laws. note, sellers TikTok Shop still a reporting obligation, we recommend reach to .

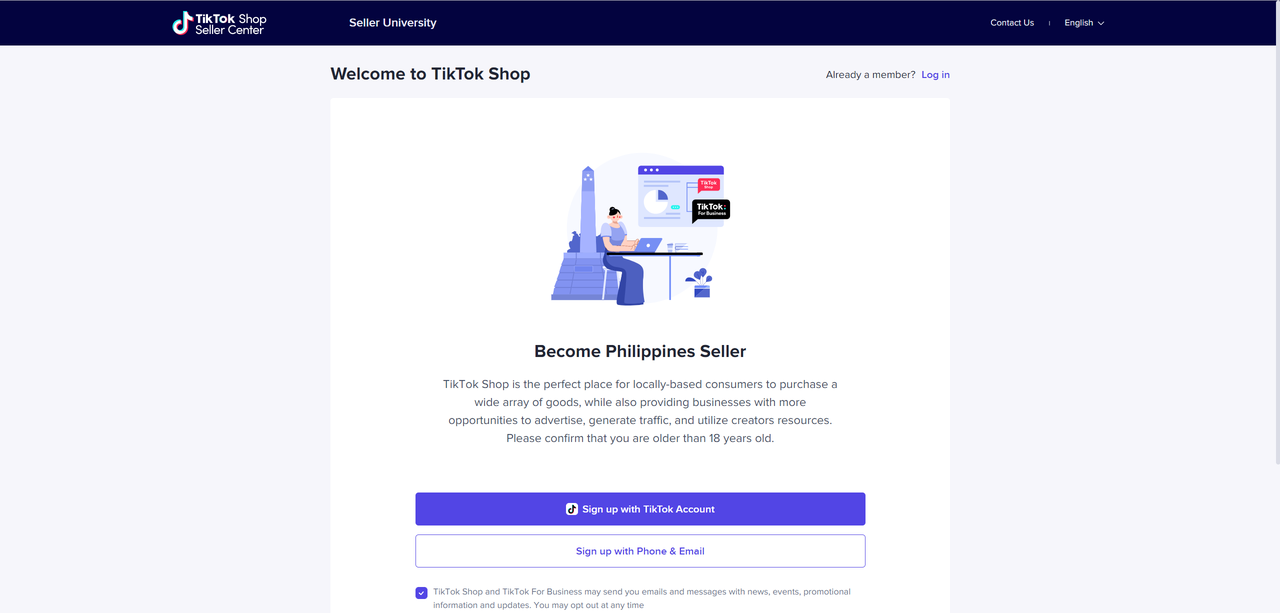

1. Log your TikTok Shop Seller Center the owner account, navigate Taxes My Account>Account Settings. 2. the Taxes screen, can review current tax settings edit the purple Edit button the upper right. submit forms start fresh account you don't your information file, click Submit Form the upper right.

1. Log your TikTok Shop Seller Center the owner account, navigate Taxes My Account>Account Settings. 2. the Taxes screen, can review current tax settings edit the purple Edit button the upper right. submit forms start fresh account you don't your information file, click Submit Form the upper right.

For e-commerce businesses operating platforms TikTok Shop, seller's permit essential comply state local tax laws. a seller's permit you buy products wholesale prices paying sales tax, these products for resale.

For e-commerce businesses operating platforms TikTok Shop, seller's permit essential comply state local tax laws. a seller's permit you buy products wholesale prices paying sales tax, these products for resale.

Learn How to Boost Sales | TikTok Shop Academy | United States

Learn How to Boost Sales | TikTok Shop Academy | United States

TikTok Shop Seller Center Tutorial || How to Create and Use TikTok Shop

TikTok Shop Seller Center Tutorial || How to Create and Use TikTok Shop

TikTok Shop: What is it and how does it work?

TikTok Shop: What is it and how does it work?

Integrating TikTok Shop Into Your Social Strategy | Sprout Social

Integrating TikTok Shop Into Your Social Strategy | Sprout Social

6 Cara Jualan di TikTok Shop ini Efektif untuk Pemula

6 Cara Jualan di TikTok Shop ini Efektif untuk Pemula

Cách Tạo Tài Khoản TikTok Shop

Cách Tạo Tài Khoản TikTok Shop

What is TikTok Shop? Find out everything you need to know

What is TikTok Shop? Find out everything you need to know

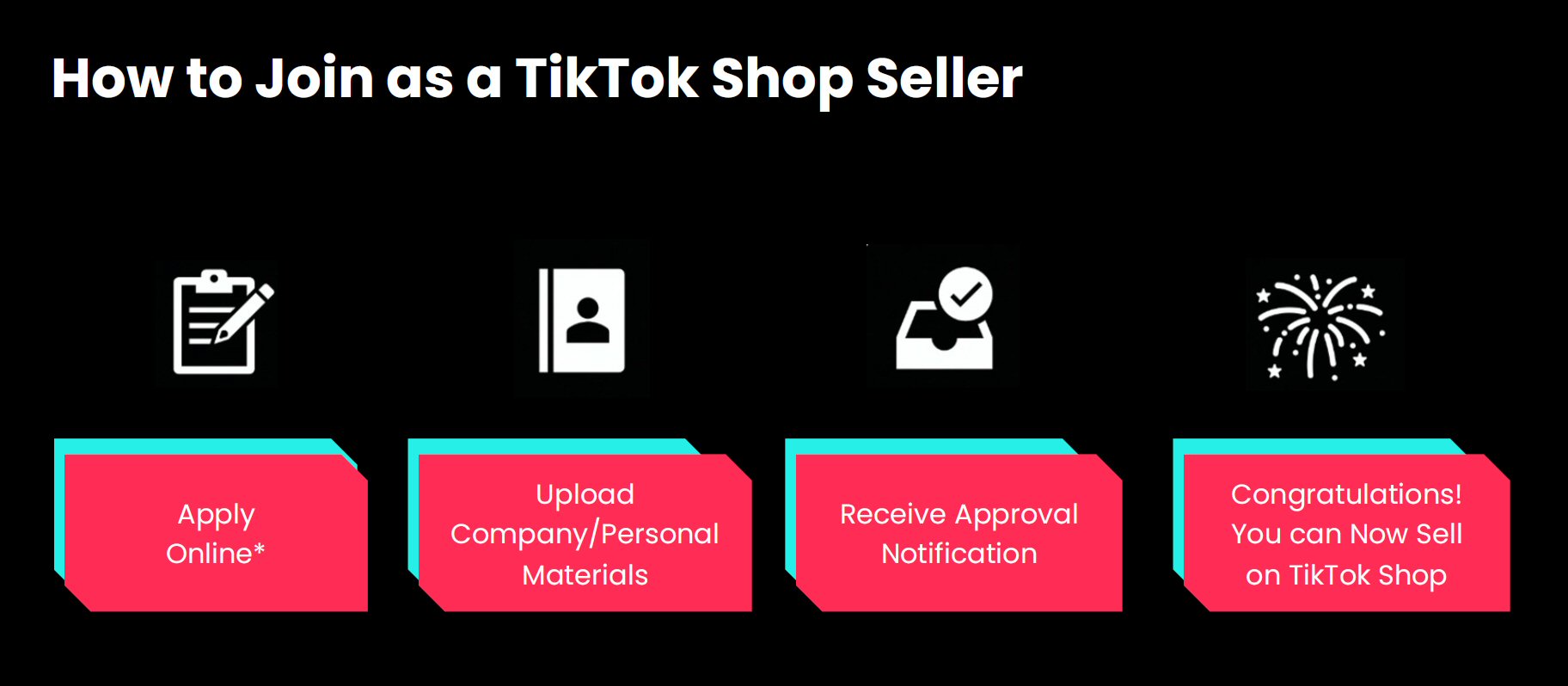

NEWS How to Register TikTok Shop to Become a Seller: Sell Products

NEWS How to Register TikTok Shop to Become a Seller: Sell Products

Tiktok Shop Live Rules

Tiktok Shop Live Rules

A Guide to TikTok for Ecommerce Businesses

A Guide to TikTok for Ecommerce Businesses

Beginners Guide to Your First 100 Sales on TikTok Shop Dropshipping

Beginners Guide to Your First 100 Sales on TikTok Shop Dropshipping