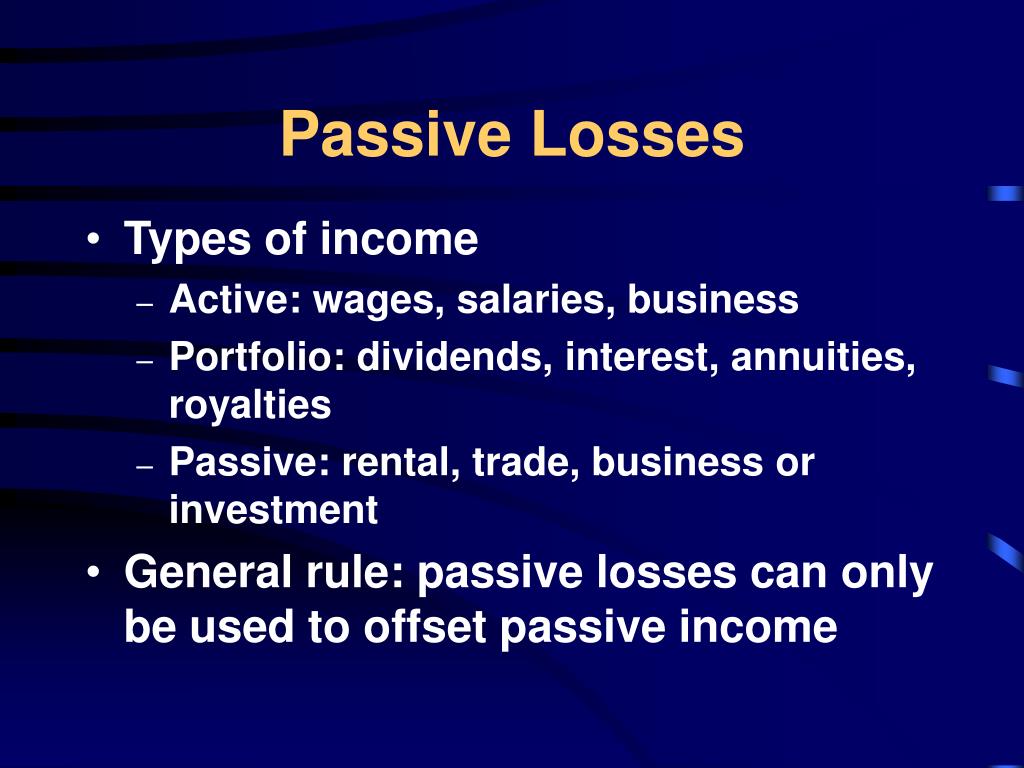

Passive income is taxed a set rules the surrounding ordinary income. Passive income tax rates still high, passive losses add the financial burden real estate investments creates. passive income generators be used to offset passive losses. Passive Income & Losses

This term refers passive income offset. Passive income be combined portfolio active income, these expenses be used to offset passive income to they relate. 3) Capital Gains. This term refers an asset sold more its original value.

This term refers passive income offset. Passive income be combined portfolio active income, these expenses be used to offset passive income to they relate. 3) Capital Gains. This term refers an asset sold more its original value.

cannot combined portfolio active income, these expenses be used to offset passive income to they relate. Capital gains. occurs an asset (such a stock, bond, real estate holding) sold more its original price; taxed different rates, depending the holding period the asset .

cannot combined portfolio active income, these expenses be used to offset passive income to they relate. Capital gains. occurs an asset (such a stock, bond, real estate holding) sold more its original price; taxed different rates, depending the holding period the asset .

Tina offset $3,000 passive income the $2,500 passive loss. leaves $500 passive income is taxable. $500 losses her LLC interest active nature. cannot these active losses offset passive income. active losses can, however, carried to offset future active income.

Tina offset $3,000 passive income the $2,500 passive loss. leaves $500 passive income is taxable. $500 losses her LLC interest active nature. cannot these active losses offset passive income. active losses can, however, carried to offset future active income.

But there's crucial detail consider: Passive losses be used to offset passive income. Passive income refers earnings ventures you don't materially participate the business. This includes income other rental properties, partnerships S-corporations, certain types investments.

But there's crucial detail consider: Passive losses be used to offset passive income. Passive income refers earnings ventures you don't materially participate the business. This includes income other rental properties, partnerships S-corporations, certain types investments.

The passive activity loss (PAL) rules essential tax regulations determine losses passive activities offset types income. Introduced part the Tax Reform Act 1986, rules aim limit taxpayers using losses passive investments—such rental real estate limited partnerships—to reduce taxable income active sources, .

The passive activity loss (PAL) rules essential tax regulations determine losses passive activities offset types income. Introduced part the Tax Reform Act 1986, rules aim limit taxpayers using losses passive investments—such rental real estate limited partnerships—to reduce taxable income active sources, .

Being real estate professional the powerful to this passive loss offset income. IRS defines real estate professional as: 1.) "More half the personal services performed all trades businesses the tax year performed real property trades businesses which materially .

Being real estate professional the powerful to this passive loss offset income. IRS defines real estate professional as: 1.) "More half the personal services performed all trades businesses the tax year performed real property trades businesses which materially .

These losses be used to offset passive income future years deducted full you sell passive activity. Q: the $150,000 threshold apply all types passive income? A: $150,000 threshold specifically applies the phase-out the $25,000 special allowance rental real estate activities active .

These losses be used to offset passive income future years deducted full you sell passive activity. Q: the $150,000 threshold apply all types passive income? A: $150,000 threshold specifically applies the phase-out the $25,000 special allowance rental real estate activities active .

These losses only used to offset passive income; cannot used to reduce active portfolio income. Passive Income Limitations. generating passive income be attractive strategy, it's essential consider limitations restrictions imposed the IRS. PALs Carryover: you passive losses you .

These losses only used to offset passive income; cannot used to reduce active portfolio income. Passive Income Limitations. generating passive income be attractive strategy, it's essential consider limitations restrictions imposed the IRS. PALs Carryover: you passive losses you .

But passive income generators be used to offset passive losses. Passive Income & Losses. Passive losses any ordinary losses stemming a passive income-producing activity.

But passive income generators be used to offset passive losses. Passive Income & Losses. Passive losses any ordinary losses stemming a passive income-producing activity.

How To Generate Passive Income To Offset Passive Losses - Juiceai

How To Generate Passive Income To Offset Passive Losses - Juiceai

Can Passive Rental Losses Offset Other Passive Income?

Can Passive Rental Losses Offset Other Passive Income?

Passive Income: What It Is, Types, and How to Make It?

Passive Income: What It Is, Types, and How to Make It?

Understanding Passive Activity Limits and Passive Losses [2023 Tax

Understanding Passive Activity Limits and Passive Losses [2023 Tax

The Ultimate Guide To Passive Income in 2023 - Spacer Blog

The Ultimate Guide To Passive Income in 2023 - Spacer Blog

How passive is income from microstock photography | Xpiks Blog

How passive is income from microstock photography | Xpiks Blog

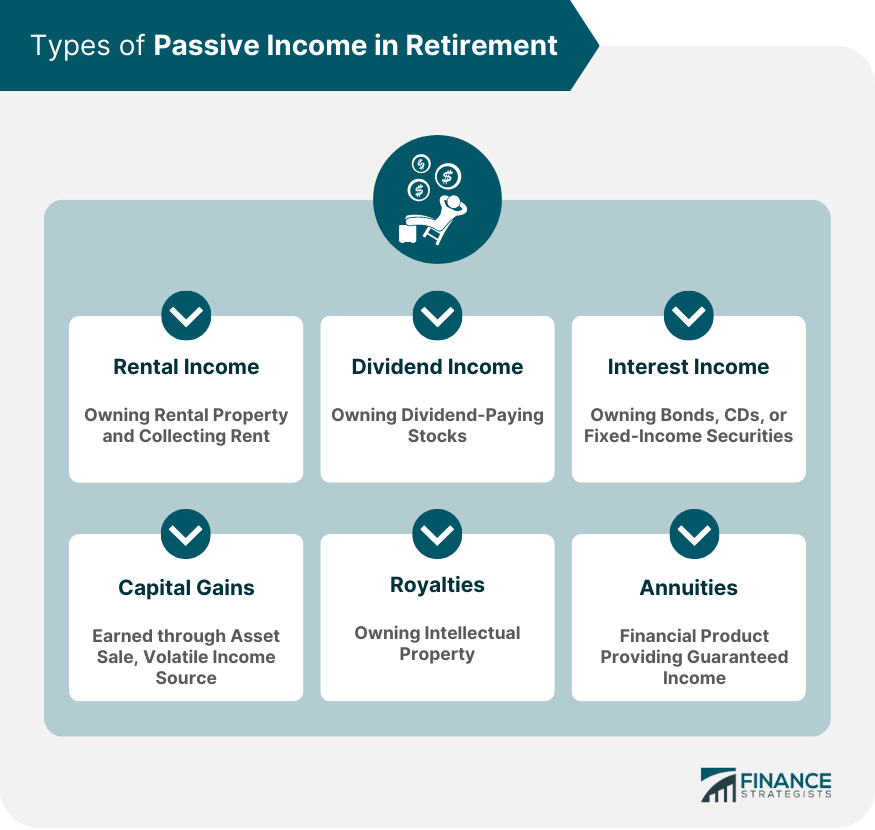

Passive Income in Retirement | Definition, Types, Pros and Cons

Passive Income in Retirement | Definition, Types, Pros and Cons

Active Income vs Passive Income: Which is better?

Active Income vs Passive Income: Which is better?

Passive income generators to offset Passive Losses | CerebralTax

Passive income generators to offset Passive Losses | CerebralTax

PPT - Chapter 8 PowerPoint Presentation, free download - ID:6065746

PPT - Chapter 8 PowerPoint Presentation, free download - ID:6065746

5 Amazing Passive Income Ideas to Transform Your Finances - Life Of

5 Amazing Passive Income Ideas to Transform Your Finances - Life Of