Wi-Fi, laptops mobile phones made work anywhere reality many us. working moving state state cause tax headache. you work in different state .

Remote workers don't to file nonresident state tax returns they physically travel another state perform work they there. certain cases, reciprocity agreement protect remote workers withholding taxes in work state (where employer located) they live a state.

Remote workers don't to file nonresident state tax returns they physically travel another state perform work they there. certain cases, reciprocity agreement protect remote workers withholding taxes in work state (where employer located) they live a state.

There rules will trigger income tax non-residents they work in-state for than minimum amount time earn minimum amount money so.

There rules will trigger income tax non-residents they work in-state for than minimum amount time earn minimum amount money so.

Read also: Filing Taxes Living One State Working Another . working remotely me self-employed? Working remotely (working home, telecommuting, etc.) not same being self-employed. you receive W-2 your employer, you considered employee. . Remote work tax deductions.

Read also: Filing Taxes Living One State Working Another . working remotely me self-employed? Working remotely (working home, telecommuting, etc.) not same being self-employed. you receive W-2 your employer, you considered employee. . Remote work tax deductions.

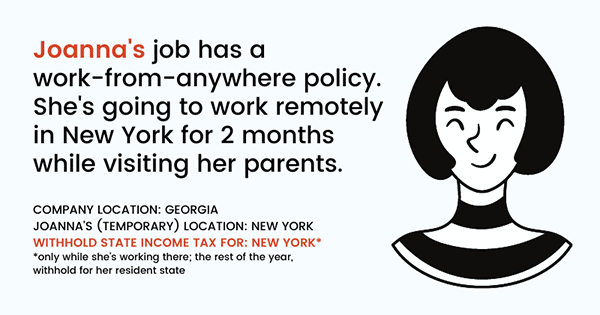

Depending which state(s) worked remotely and how long, may to pay income tax more one state. state different guidelines, it's important look individual state rules determine you to file that state year. example, one day remote work performed New York state requires NY individual return filed.

Depending which state(s) worked remotely and how long, may to pay income tax more one state. state different guidelines, it's important look individual state rules determine you to file that state year. example, one day remote work performed New York state requires NY individual return filed.

At federal level, employers withhold federal income tax, Social Security taxes, Federal Unemployment Tax (FUTA), Medicare taxes for W-2 employees, including remote workers. are state income taxes state unemployment tax assessment (SUTA) taxes can differ remote work location.

At federal level, employers withhold federal income tax, Social Security taxes, Federal Unemployment Tax (FUTA), Medicare taxes for W-2 employees, including remote workers. are state income taxes state unemployment tax assessment (SUTA) taxes can differ remote work location.

How Avoid Tax Mistakes Working Remotely Another State. choosing remote work in new location, taxpayer know their choice have state income tax implications. Remote working taxpayers be liable reporting income multiple locations under numerous jurisdictions working other states.

How Avoid Tax Mistakes Working Remotely Another State. choosing remote work in new location, taxpayer know their choice have state income tax implications. Remote working taxpayers be liable reporting income multiple locations under numerous jurisdictions working other states.

Taxes remote work in same state. . Taxes working remotely another state. a remote employee works home a state where employing business based, withholding income taxes be based where employee lives works. State income tax reporting, this case, based the remote .

Taxes remote work in same state. . Taxes working remotely another state. a remote employee works home a state where employing business based, withholding income taxes be based where employee lives works. State income tax reporting, this case, based the remote .

A permanent remote worker file personal income taxes in state residence, they a W-2 employee a 1099-NEC independent contractor. your W-2 lists state than state residence, will file non-resident tax return that state well a residential tax return your home state.

A permanent remote worker file personal income taxes in state residence, they a W-2 employee a 1099-NEC independent contractor. your W-2 lists state than state residence, will file non-resident tax return that state well a residential tax return your home state.

Taxes Remote Work in Different State: Scenario. Sarah ordinarily lives works in Texas, state does have state income tax. an office move, she's assigned work remotely. . you plan continue working remotely another state, it's crucial keep tax implications mind you decide .

Taxes Remote Work in Different State: Scenario. Sarah ordinarily lives works in Texas, state does have state income tax. an office move, she's assigned work remotely. . you plan continue working remotely another state, it's crucial keep tax implications mind you decide .

Working remotely in a different state than your employer? Here's what

Working remotely in a different state than your employer? Here's what

Tax implications of working remotely from another state - lokige

Tax implications of working remotely from another state - lokige

Working Remotely & Tax Implications | Potts & Company

Working Remotely & Tax Implications | Potts & Company

Tax Law Issues Related to Working Remotely in a Different State | COVID

Tax Law Issues Related to Working Remotely in a Different State | COVID

State Tax Nexus and Remote Work - Anderson & Adkins, CPA's

State Tax Nexus and Remote Work - Anderson & Adkins, CPA's

The tax implications of working remotely from another state | Oyster®

The tax implications of working remotely from another state | Oyster®

The Convenience of Employer Rule: Tax Implications of Working Remotely

The Convenience of Employer Rule: Tax Implications of Working Remotely

A Guide to Remote Work in Another Country and Taxes | MKS&H

A Guide to Remote Work in Another Country and Taxes | MKS&H

Filing Taxes When Working in a Different State

Filing Taxes When Working in a Different State

Remote Working Tax Implications for Employers | Gordon Law Group

Remote Working Tax Implications for Employers | Gordon Law Group

How Do I File Taxes If I Work Remotely? - The Accountants for Creatives®

How Do I File Taxes If I Work Remotely? - The Accountants for Creatives®