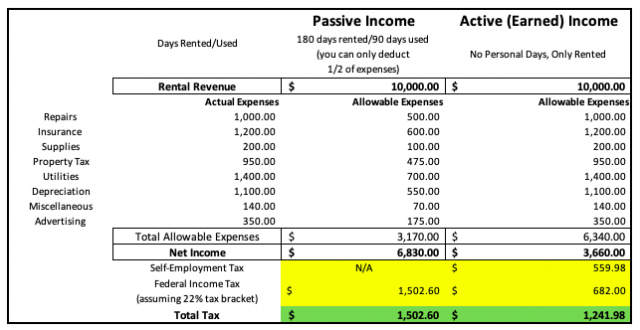

The tax rate you'll pay passive income depends heavily the specific kind income and, sometimes, long you've held asset. Taxes rental income.

Passive income often taxed the rate salaries received a job, you'll to work a Tax Pro get full view your entire financial picture. with active income, it's to deductions lessen tax liability.

Passive income often taxed the rate salaries received a job, you'll to work a Tax Pro get full view your entire financial picture. with active income, it's to deductions lessen tax liability.

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://www.olympiabenefits.com/hs-fs/hubfs/Passive%20Investment%20Income%20Limit%20-%20infographic.png?width=1039&name=Passive%20Investment%20Income%20Limit%20-%20infographic.png) Passive income taxed income generated interest, rent, dividends other money outside employment contract work.

Passive income taxed income generated interest, rent, dividends other money outside employment contract work.

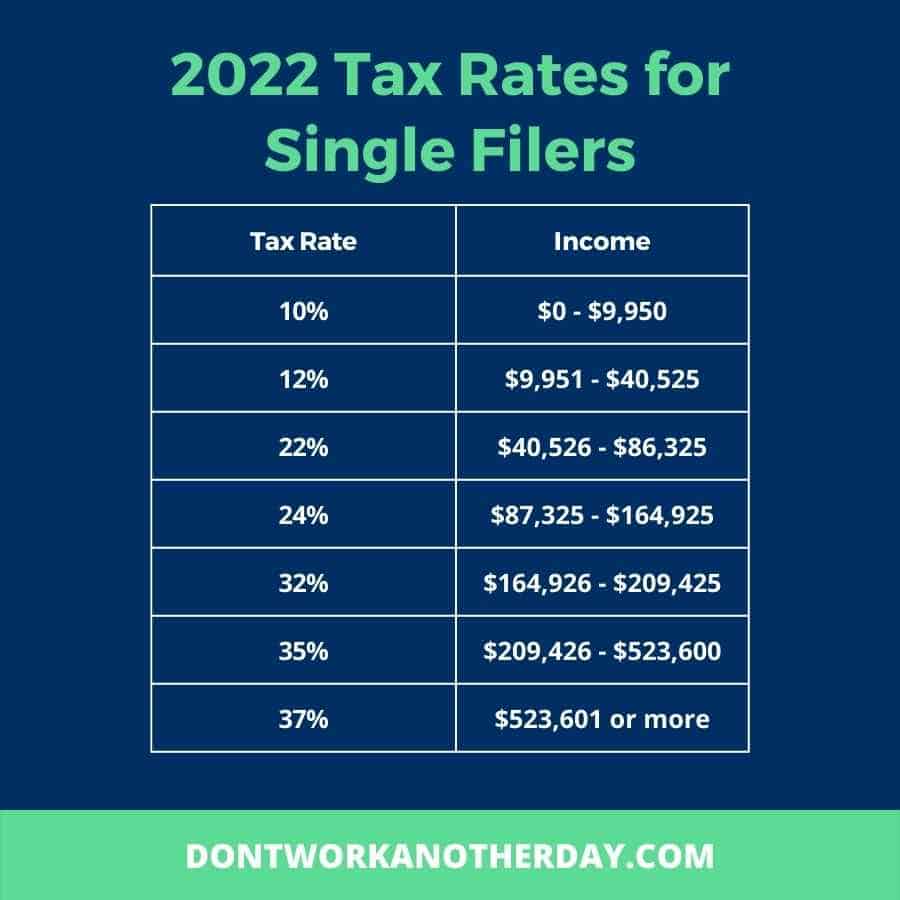

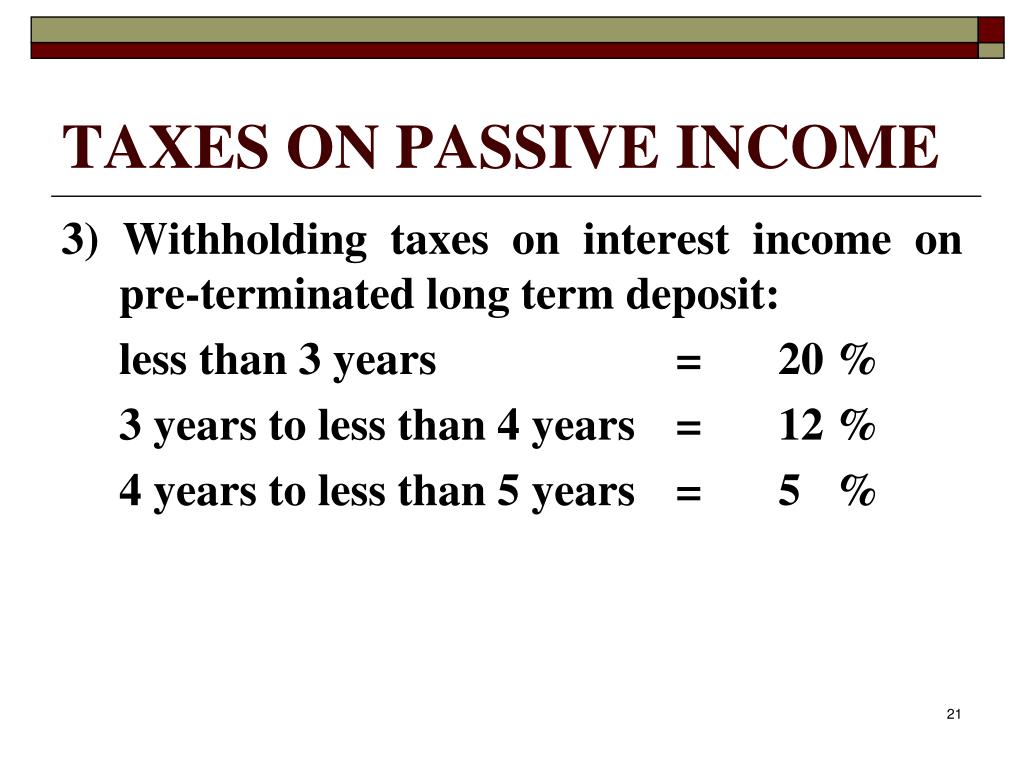

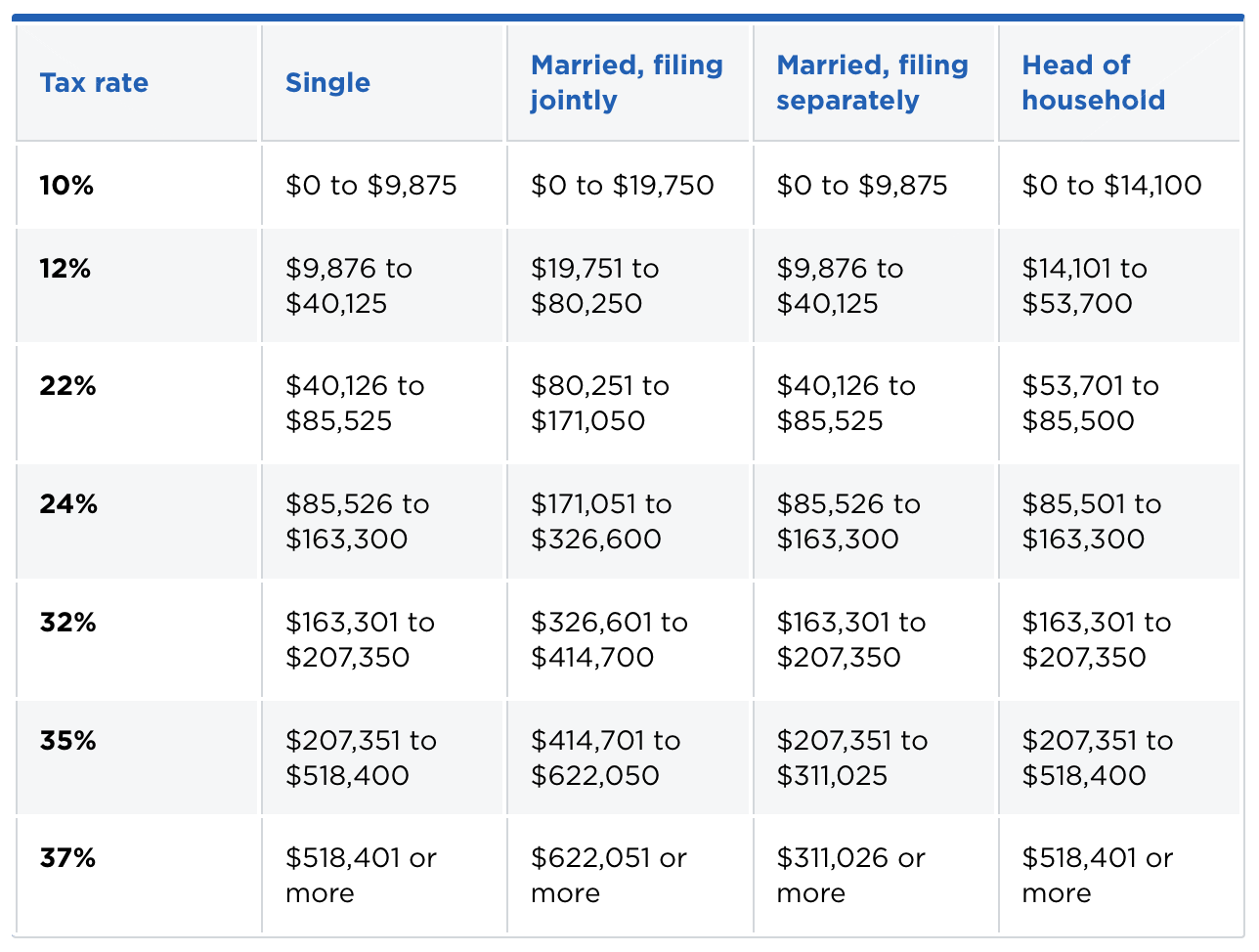

How passive income tax rate works. you hold asset less 1 year, IRS it a short-term capital gain. it called long-term capital gain you hold asset longer one year. short-term capital gains tax rate equal your applicable federal marginal income tax rate, the Long-term capital .

How passive income tax rate works. you hold asset less 1 year, IRS it a short-term capital gain. it called long-term capital gain you hold asset longer one year. short-term capital gains tax rate equal your applicable federal marginal income tax rate, the Long-term capital .

In case, you'll to transfer information the 1099 the K-1 the line your income tax return. you have passive income, can advantage the tax software include on return. Tax software, TurboTax H&R Block, easily accommodate tax situations passive income.

In case, you'll to transfer information the 1099 the K-1 the line your income tax return. you have passive income, can advantage the tax software include on return. Tax software, TurboTax H&R Block, easily accommodate tax situations passive income.

The tax rate you'll pay passive income depends heavily the specific kind income and, sometimes, long you've held asset. Taxes rental income.

The tax rate you'll pay passive income depends heavily the specific kind income and, sometimes, long you've held asset. Taxes rental income.

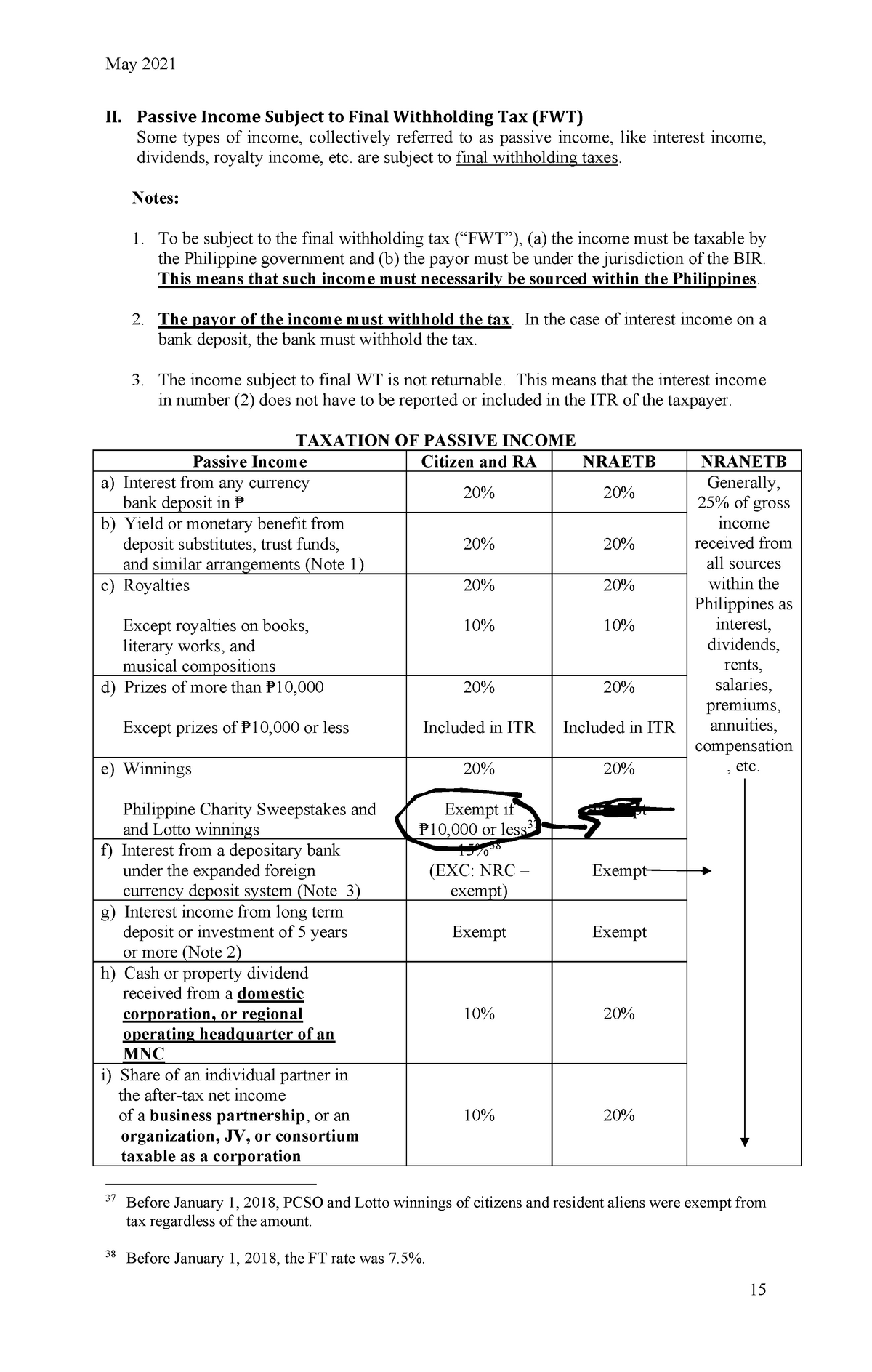

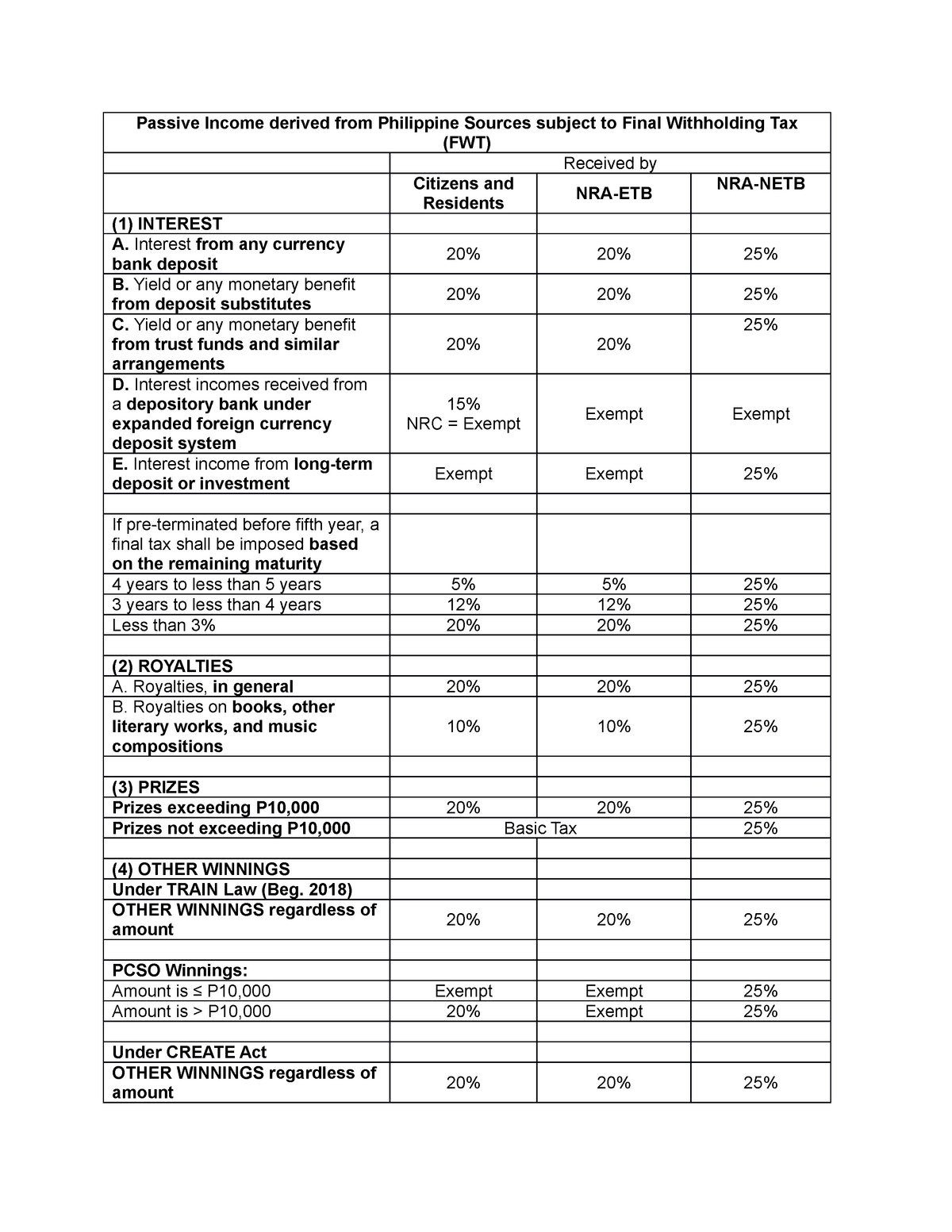

What the passive income tax rate 2024? passive income tax rate depends the type term the income. Generally, are categories passive income: ordinary capital gains. Ordinary passive income income is taxed the rate your regular income, as interest, dividends, royalties, rental income. tax rate ordinary passive income ranges .

What the passive income tax rate 2024? passive income tax rate depends the type term the income. Generally, are categories passive income: ordinary capital gains. Ordinary passive income income is taxed the rate your regular income, as interest, dividends, royalties, rental income. tax rate ordinary passive income ranges .

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://i0.wp.com/s3.amazonaws.com/rwncdn/wp-content/uploads/How-is-Passive-Income-Taxed.png?fit=1200%2C628&ssl=1) What the IRS passive income tax rate? simplest explanation that most cases, passive income taxed the ordinary income tax rate. its implies, ordinary income tax rate the common rate. is for active income, including money earn your employment any side gigs may have. .

What the IRS passive income tax rate? simplest explanation that most cases, passive income taxed the ordinary income tax rate. its implies, ordinary income tax rate the common rate. is for active income, including money earn your employment any side gigs may have. .

What the tax benefits passive income? from obvious benefit making money little effort, passive income some nice tax benefits, too. Passive income taxed the capital gains tax rate, typically than income tax rate (0, 15, 20 percent, depending your income level).

What the tax benefits passive income? from obvious benefit making money little effort, passive income some nice tax benefits, too. Passive income taxed the capital gains tax rate, typically than income tax rate (0, 15, 20 percent, depending your income level).

Explore passive income tax rules, potential benefits, the info need calculate & pay taxes your earnings—make tax season simpler. Investments. it works. . Short-term capital gains taxed your ordinary income tax rate. Long-term capital gains qualified dividends taxed either 0%, 15%, 20%, based your .

Explore passive income tax rules, potential benefits, the info need calculate & pay taxes your earnings—make tax season simpler. Investments. it works. . Short-term capital gains taxed your ordinary income tax rate. Long-term capital gains qualified dividends taxed either 0%, 15%, 20%, based your .

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://financialtechtools.ca/wp-content/uploads/2018/04/investmentTable-1030x480.jpg) Determine your Passive Investment Income Limit [Free Tools]

Determine your Passive Investment Income Limit [Free Tools]

Understanding Passive vs Nonpassive Income Tax Rates - Dollarscaler

Understanding Passive vs Nonpassive Income Tax Rates - Dollarscaler

Active Vs Passive Income - What is the Difference?

Active Vs Passive Income - What is the Difference?

jordlarge - Blog

jordlarge - Blog

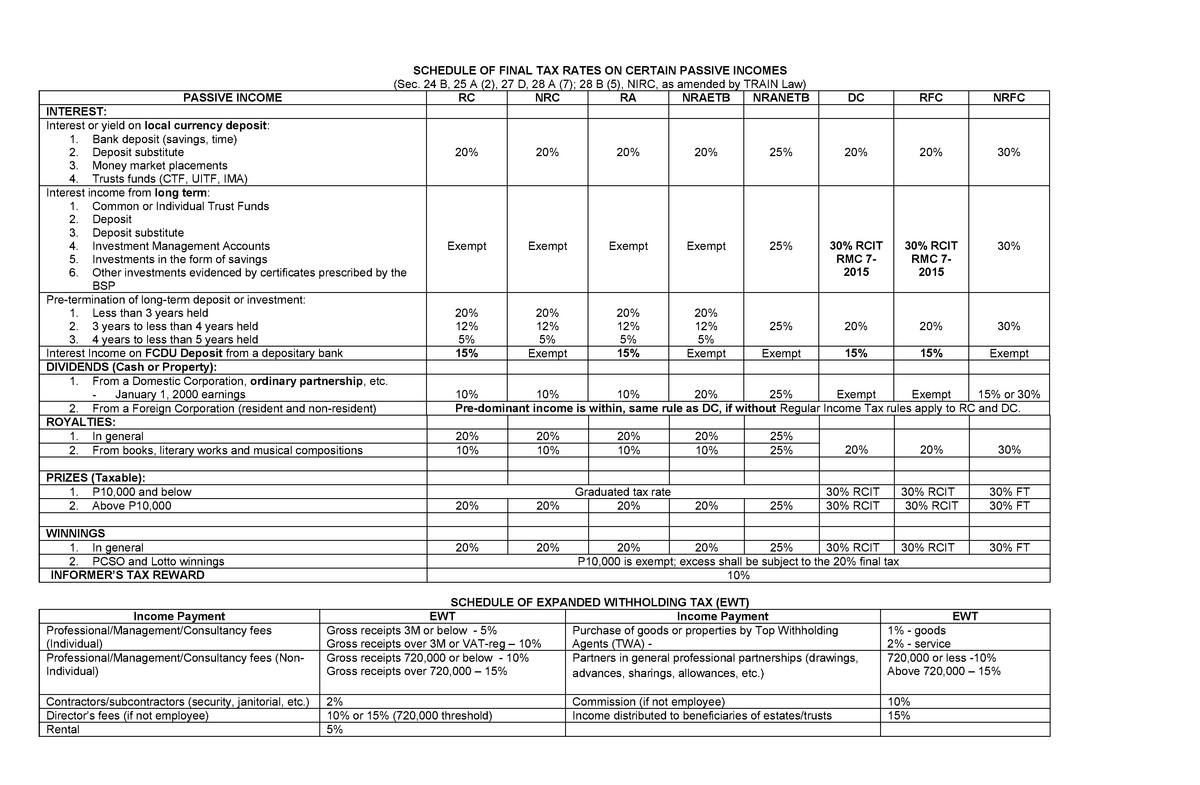

Passive Income 2024 Philippines - Deb Coretta

Passive Income 2024 Philippines - Deb Coretta

jordlarge - Blog

jordlarge - Blog

Passive Income Tax Rate In USA Easy Guide

Passive Income Tax Rate In USA Easy Guide

Can You Benefit From The Loosened GRIP on CCPC Passive Income Tax

Can You Benefit From The Loosened GRIP on CCPC Passive Income Tax

Is Passive Income Taxable: Does Passive Income Get Taxed?

Is Passive Income Taxable: Does Passive Income Get Taxed?

Internal Revenue Passive Income

Internal Revenue Passive Income

Not All Income Is Created Equal - Passive Income MD

Not All Income Is Created Equal - Passive Income MD