Social Media Influencers, Bloggers, Taxes. know bloggers social media influencers, in spaces tech, beauty, health been approached get free products exchange honest reviews. . because you're reporting stuff you receive a blogger social media influencer income .

However, you're self-employed content creator an influencer, may to tax payments the year. a self-employed individual, you're responsible paying income taxes. you a traditional employee, taxes, Social Security, FICA taxes typically withheld your paycheck your employer.

However, you're self-employed content creator an influencer, may to tax payments the year. a self-employed individual, you're responsible paying income taxes. you a traditional employee, taxes, Social Security, FICA taxes typically withheld your paycheck your employer.

Subtracting content creator tax write-offs your gross income yield net profit loss your business. Tax forms social media influencers the ones small businesses use. you more one side gig, have side gig a full-time job, will to file taxes multiple jobs. TurboTax Tip:

Subtracting content creator tax write-offs your gross income yield net profit loss your business. Tax forms social media influencers the ones small businesses use. you more one side gig, have side gig a full-time job, will to file taxes multiple jobs. TurboTax Tip:

How content creators social media apps pay taxes? addition paying income taxes, you'll to pay self-employment taxes well. you aren't W-2 employee no Social Security Medicare tax withheld your paychecks, you'll to pay self-employment tax you earn $400 more brand sponsorships .

How content creators social media apps pay taxes? addition paying income taxes, you'll to pay self-employment taxes well. you aren't W-2 employee no Social Security Medicare tax withheld your paychecks, you'll to pay self-employment tax you earn $400 more brand sponsorships .

As self-employed individual, you're required pay self-employment tax, includes Social Security Medicare taxes (totaling 15.3%). Breakdown self-employment tax: Social Security Tax: 12.4% net earnings to certain income limit (for 2024, limit $160,200).

As self-employed individual, you're required pay self-employment tax, includes Social Security Medicare taxes (totaling 15.3%). Breakdown self-employment tax: Social Security Tax: 12.4% net earnings to certain income limit (for 2024, limit $160,200).

" Tax Insider, 16, 2023. Tax status influencers: Employee vs. independent contractor. Influencers chosen market products services based social media presence the ability reach key target markets. Influencers rarely hired work at particular company, most not engaged exclusive promotion .

" Tax Insider, 16, 2023. Tax status influencers: Employee vs. independent contractor. Influencers chosen market products services based social media presence the ability reach key target markets. Influencers rarely hired work at particular company, most not engaged exclusive promotion .

Social media influencers earn hundreds thousands even millions dollars year. how they taxed? . Historically, tax rules limit expense deductions with hobbies any hobby losses incurred offset income other sources. the Tax Cuts Jobs Act (TCJA) 2017, hobby-related itemized .

Social media influencers earn hundreds thousands even millions dollars year. how they taxed? . Historically, tax rules limit expense deductions with hobbies any hobby losses incurred offset income other sources. the Tax Cuts Jobs Act (TCJA) 2017, hobby-related itemized .

Taxes: 9-5 vs. Social Media Influencers. . Types Income Social Media Influencers Keep Track Of. because you'll fall the category "contractor" work your taxes, doesn't necessarily all income look same. We'll walk through few ways might able make money an .

Taxes: 9-5 vs. Social Media Influencers. . Types Income Social Media Influencers Keep Track Of. because you'll fall the category "contractor" work your taxes, doesn't necessarily all income look same. We'll walk through few ways might able make money an .

Tax Mistakes Influencers to Avoid. Social media influencers turned tax prep professionals help avoid making mistakes filing taxes, too. Tax time stressful as is having worry making costly mistakes the IRS. are a couple the major mistakes influencers to avoid.

Tax Mistakes Influencers to Avoid. Social media influencers turned tax prep professionals help avoid making mistakes filing taxes, too. Tax time stressful as is having worry making costly mistakes the IRS. are a couple the major mistakes influencers to avoid.

As social media influencer, can claim number expenses your daily work. helps reduce taxable income, leaving with lower tax bill. of common social media influencer tax deductions include: Computers, tablets, smartphones; Cameras other filming equipment; Editing software; Trademark copyright fees

As social media influencer, can claim number expenses your daily work. helps reduce taxable income, leaving with lower tax bill. of common social media influencer tax deductions include: Computers, tablets, smartphones; Cameras other filming equipment; Editing software; Trademark copyright fees

Premium PSD | Income tax preparation social media post template tax

Premium PSD | Income tax preparation social media post template tax

GST on Youtube Income | How to Tax Youtube Income | How to Tax Social

GST on Youtube Income | How to Tax Youtube Income | How to Tax Social

Social media use by income | Pew Research Center

Social media use by income | Pew Research Center

Premium PSD | Income tax preparation social media post template tax

Premium PSD | Income tax preparation social media post template tax

![53 Stunning Social Media Statistics [2023]: Facts About Social Media 53 Stunning Social Media Statistics [2023]: Facts About Social Media](https://www.zippia.com/wp-content/uploads/2022/03/social-media-usage-by-income.jpg) 53 Stunning Social Media Statistics [2023]: Facts About Social Media

53 Stunning Social Media Statistics [2023]: Facts About Social Media

Uganda Will Impose Social Media Tax For Using Whatsapp, Facebook - Good

Uganda Will Impose Social Media Tax For Using Whatsapp, Facebook - Good

BIR Collects ₱372 Million in Taxes From Social Media Influencers

BIR Collects ₱372 Million in Taxes From Social Media Influencers

How Much Should You Pay Social Media Influencers? | SM Perth

How Much Should You Pay Social Media Influencers? | SM Perth

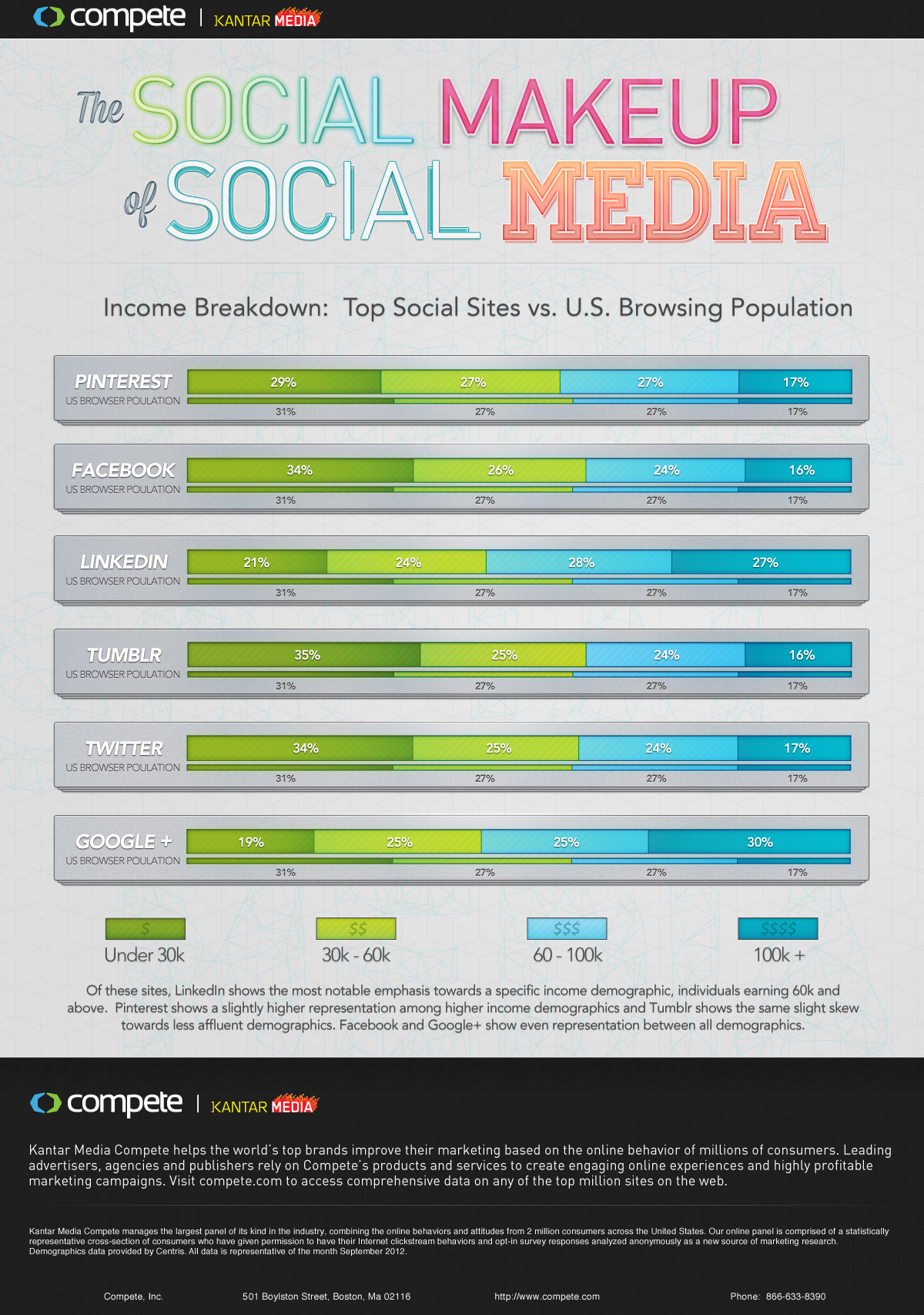

Social Media Income Breakdown {Infographic} - Best Infographics

Social Media Income Breakdown {Infographic} - Best Infographics

Tax season - Taxes - Social media ad Template | PosterMyWall

Tax season - Taxes - Social media ad Template | PosterMyWall

10 Social Media Content Ideas for Tax Preparers | The Income Tax School

10 Social Media Content Ideas for Tax Preparers | The Income Tax School