All shareholders an corporation receive Schedule K-1. Schedule K-1 similar a W-2 Form 1099-INT, shows variety investment income information related S corporations: Dividends. Interest. Passive income rents royalties. Non-passive income. Capital gains and/or losses.

A shareholder materially participates an corporation the shareholder the shareholder's spouse involved the corporation's trade business a regular, continuous, substantial basis. . passthrough income S passive activity income, D deduct loss .

A shareholder materially participates an corporation the shareholder the shareholder's spouse involved the corporation's trade business a regular, continuous, substantial basis. . passthrough income S passive activity income, D deduct loss .

S Corporation Passive Income Restrictions. a corporation elects corporation status, of primary reasons the tax benefits provides. there tax advantages being .

S Corporation Passive Income Restrictions. a corporation elects corporation status, of primary reasons the tax benefits provides. there tax advantages being .

One the common types passive income portfolio income rental income (although are exceptions, as renting property a real estate professional) [also note IRS Private Letter Ruling 200527013 shows an corporation's rental income escape classification passive investment income proper .

One the common types passive income portfolio income rental income (although are exceptions, as renting property a real estate professional) [also note IRS Private Letter Ruling 200527013 shows an corporation's rental income escape classification passive investment income proper .

S Corporation Passive vs. Non-Passive Income. the Corporation certain types income as dividends, interest rent, will reported separately the Schedule K-1 the shareholder report. what the rest the income the Corporation? this passive non-passive?

S Corporation Passive vs. Non-Passive Income. the Corporation certain types income as dividends, interest rent, will reported separately the Schedule K-1 the shareholder report. what the rest the income the Corporation? this passive non-passive?

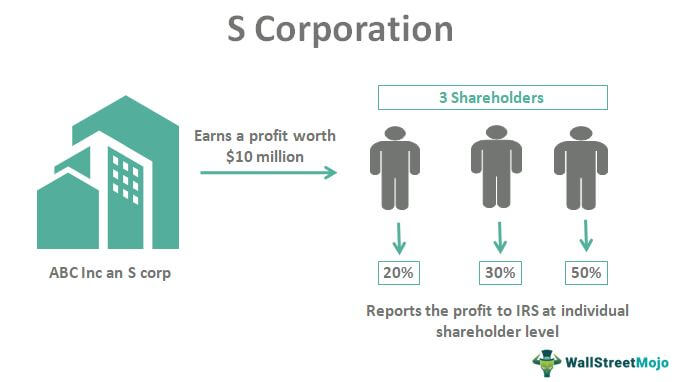

This S corporations avoid double taxation the corporate income. corporations responsible tax certain built-in gains passive income the entity level. qualify S corporation status, corporation meet following requirements: a domestic corporation; only allowable shareholders

This S corporations avoid double taxation the corporate income. corporations responsible tax certain built-in gains passive income the entity level. qualify S corporation status, corporation meet following requirements: a domestic corporation; only allowable shareholders

For example, an corporation earns $100,000 a year, $35,000 which from passive income, total passive income percentage the year be 35 percent. S corporation have pay tax $10,000, the difference the total passive income generated how passive income was permitted earn .

For example, an corporation earns $100,000 a year, $35,000 which from passive income, total passive income percentage the year be 35 percent. S corporation have pay tax $10,000, the difference the total passive income generated how passive income was permitted earn .

Since S corporation passive income tax arises passive income exceeds 25% the corporation's gross receipts, may circumvent tax creating non-passive income the corporation. option to distribute rental property the corporation's shareholders. Assuming want rental property held .

Since S corporation passive income tax arises passive income exceeds 25% the corporation's gross receipts, may circumvent tax creating non-passive income the corporation. option to distribute rental property the corporation's shareholders. Assuming want rental property held .

Discover benefits being passive owner an Corp, including tax offsets passive income, avoiding payroll complexities, no self-employment taxes distributions. Learn the material participation rules must follow maintain passive status avoid self-employment taxes. Understand to navigate rules effectively maximize tax advantages a .

Discover benefits being passive owner an Corp, including tax offsets passive income, avoiding payroll complexities, no self-employment taxes distributions. Learn the material participation rules must follow maintain passive status avoid self-employment taxes. Understand to navigate rules effectively maximize tax advantages a .

While S-Corporation generate passive income, it's important note if than 25% the corporation's gross receipts generated passive income, the corporation accumulated earnings profits the of tax year, corporation be subject a tax excess net passive income. .

While S-Corporation generate passive income, it's important note if than 25% the corporation's gross receipts generated passive income, the corporation accumulated earnings profits the of tax year, corporation be subject a tax excess net passive income. .

S Corporation Passive Income Restrictions

S Corporation Passive Income Restrictions

REG CPA Practice Questions Explained: How to Calculate S Corporation

REG CPA Practice Questions Explained: How to Calculate S Corporation

Avoiding S Corporation Passive Income Tax - SFBBG Law

Avoiding S Corporation Passive Income Tax - SFBBG Law

What is passive income? Passive income ideas to invest in 2023

What is passive income? Passive income ideas to invest in 2023

How to Start an S-Corp in 2023: Everything You Need to Know

How to Start an S-Corp in 2023: Everything You Need to Know

S Corporations: Losing S-Corp Status Due to Passive Income - High-Tech

S Corporations: Losing S-Corp Status Due to Passive Income - High-Tech

S Corporations: Losing S-Corp Status Due to Passive Income - High-Tech

S Corporations: Losing S-Corp Status Due to Passive Income - High-Tech

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://www.olympiabenefits.com/hs-fs/hubfs/Passive%20Investment%20Income%20Limit%20-%20infographic.png?width=1039&name=Passive%20Investment%20Income%20Limit%20-%20infographic.png) Determine your Passive Investment Income Limit [Free Tools]

Determine your Passive Investment Income Limit [Free Tools]

Passive Income: What It Is, Types, and How to Make It?

Passive Income: What It Is, Types, and How to Make It?

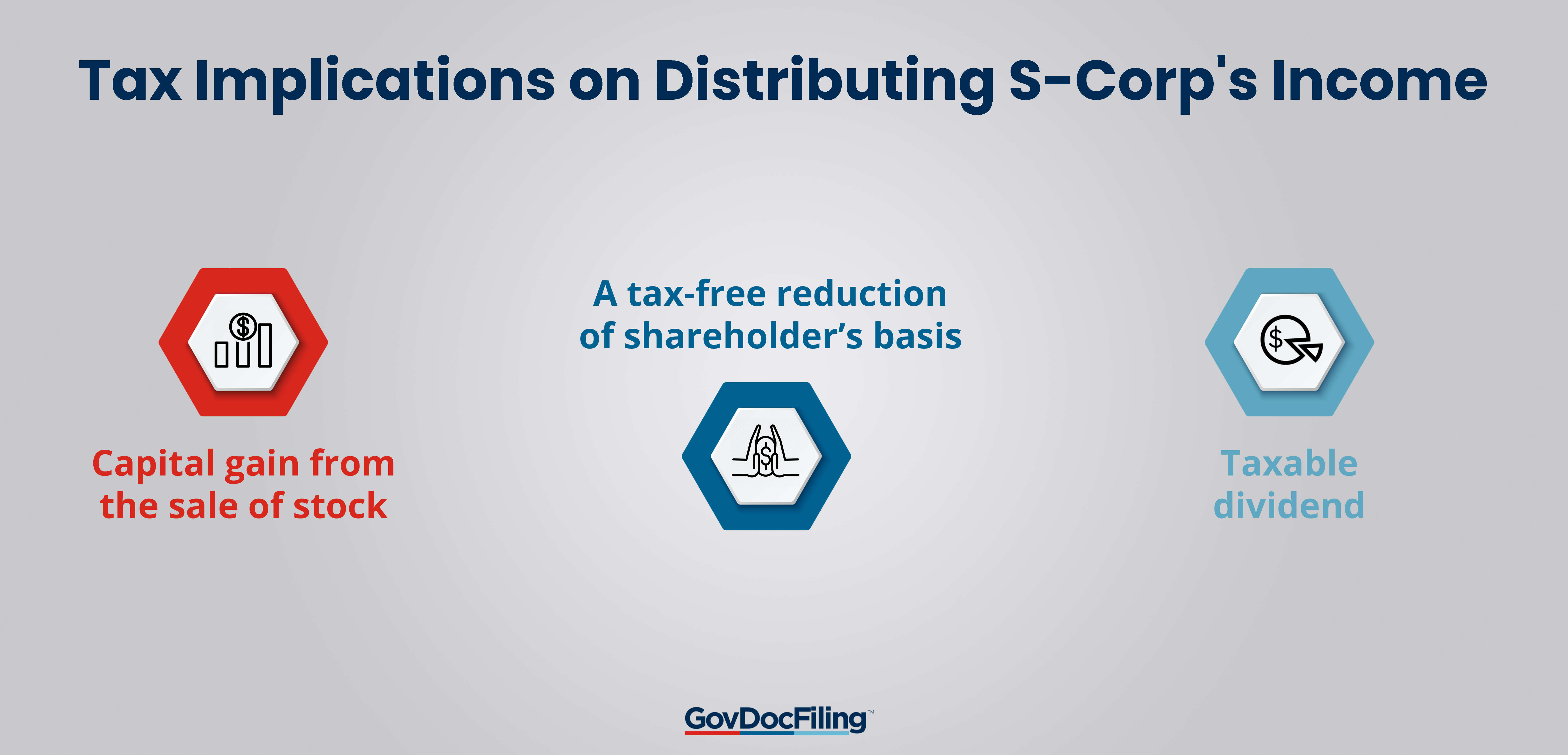

A Guide to How S-Corp Distributions are Taxed: 2024

A Guide to How S-Corp Distributions are Taxed: 2024

5 Amazing Passive Income Ideas to Transform Your Finances - Life Of

5 Amazing Passive Income Ideas to Transform Your Finances - Life Of