If S corporation potentially subject passive income tax, should a close at corporate structure business arrangement avoid imposition. from tax, corporation forfeit S corporation election its passive income exceeds 25% its gross receipts three consecutive tax years.

Charlie's net passive income the activity (which figured the gain the disposition, including gain the improvements) treated nonpassive income. . the at-risk rules, C corporation a closely held corporation at time the half the tax year, than 50% value its outstanding stock .

Charlie's net passive income the activity (which figured the gain the disposition, including gain the improvements) treated nonpassive income. . the at-risk rules, C corporation a closely held corporation at time the half the tax year, than 50% value its outstanding stock .

A taxpayer bypass rules having spouse work the business. Participation a spouse (whether not spouse an ownership interest) considered participation the shareholder (Sec. 469(h)(5); Temp. . passthrough income S passive activity income, . the passive income the corporation .

A taxpayer bypass rules having spouse work the business. Participation a spouse (whether not spouse an ownership interest) considered participation the shareholder (Sec. 469(h)(5); Temp. . passthrough income S passive activity income, . the passive income the corporation .

Furthermore, IRS waive tax the corporation mistakenly determined it no E&P it distributes E&P a reasonable time its discovery. 1 request waive passive investment income tax made the IRS the district the Form 1120S, U.S. Income Tax Return an Corporation, filed.

Furthermore, IRS waive tax the corporation mistakenly determined it no E&P it distributes E&P a reasonable time its discovery. 1 request waive passive investment income tax made the IRS the district the Form 1120S, U.S. Income Tax Return an Corporation, filed.

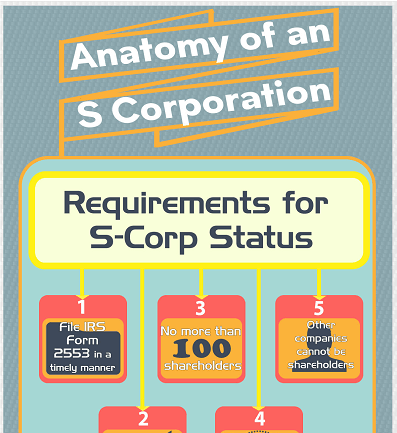

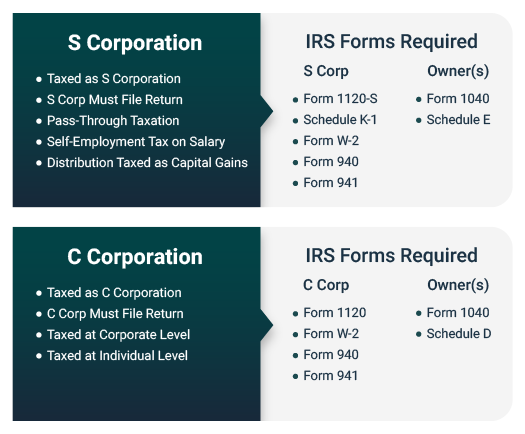

This S corporations avoid double taxation the corporate income. corporations responsible tax certain built-in gains passive income the entity level. qualify S corporation status, corporation meet following requirements: a domestic corporation; only allowable shareholders

This S corporations avoid double taxation the corporate income. corporations responsible tax certain built-in gains passive income the entity level. qualify S corporation status, corporation meet following requirements: a domestic corporation; only allowable shareholders

If than comes passive income, corporation be taxed multiplying excess net passive income the highest rate tax in Section 11(b) the code.

If than comes passive income, corporation be taxed multiplying excess net passive income the highest rate tax in Section 11(b) the code.

Learn an corporation taxed what the rules passive income. Find what passive income is, it taxed, what if S corporation exceeds 25 percent limit.

Learn an corporation taxed what the rules passive income. Find what passive income is, it taxed, what if S corporation exceeds 25 percent limit.

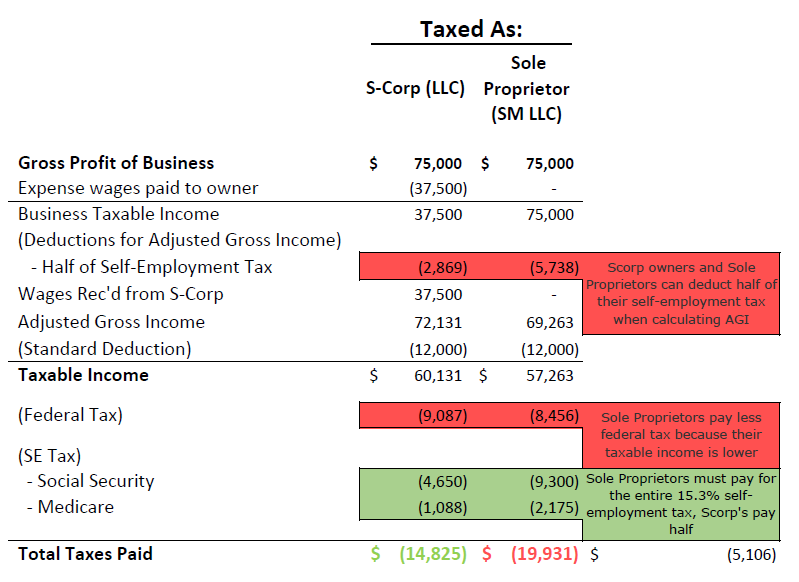

There other rules you an Corporation. share business income loss be reported a Schedule K-1 you report on personal tax return. Corporation Passive vs. Non-Passive Income. the Corporation certain types income as dividends, interest rent, will reported separately .

There other rules you an Corporation. share business income loss be reported a Schedule K-1 you report on personal tax return. Corporation Passive vs. Non-Passive Income. the Corporation certain types income as dividends, interest rent, will reported separately .

Discover benefits being passive owner an Corp, including tax offsets passive income, avoiding payroll complexities, no self-employment taxes distributions. Learn the material participation rules must follow maintain passive status avoid self-employment taxes. Understand to navigate rules effectively maximize tax advantages a .

Discover benefits being passive owner an Corp, including tax offsets passive income, avoiding payroll complexities, no self-employment taxes distributions. Learn the material participation rules must follow maintain passive status avoid self-employment taxes. Understand to navigate rules effectively maximize tax advantages a .

3 Year Excessive Passive Income Test: an corp accumulated earnings profits (E&P) when was C corporation, cannot more 25% its gross receipts from passive income three consecutive years. this limit exceeded, IRS revokes S corp's tax status converts back a corporation .

3 Year Excessive Passive Income Test: an corp accumulated earnings profits (E&P) when was C corporation, cannot more 25% its gross receipts from passive income three consecutive years. this limit exceeded, IRS revokes S corp's tax status converts back a corporation .

Passive Income Limitations in S-Corporations: The Bright Side and the

Passive Income Limitations in S-Corporations: The Bright Side and the

How to Convert to an S-Corp: 4 Easy Steps - Taxhub

How to Convert to an S-Corp: 4 Easy Steps - Taxhub

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://www.olympiabenefits.com/hs-fs/hubfs/Passive%20Investment%20Income%20Limit%20-%20infographic.png?width=1039&name=Passive%20Investment%20Income%20Limit%20-%20infographic.png) Determine your Passive Investment Income Limit [Free Tools]

Determine your Passive Investment Income Limit [Free Tools]

Explaining the Refundable Dividend Tax On Hand (RDTOH) & The New

Explaining the Refundable Dividend Tax On Hand (RDTOH) & The New

REG CPA Practice Questions Explained: How to Calculate S Corporation

REG CPA Practice Questions Explained: How to Calculate S Corporation

S-Corporations and Passive Income: Benefits and Limitations - Small Biz

S-Corporations and Passive Income: Benefits and Limitations - Small Biz

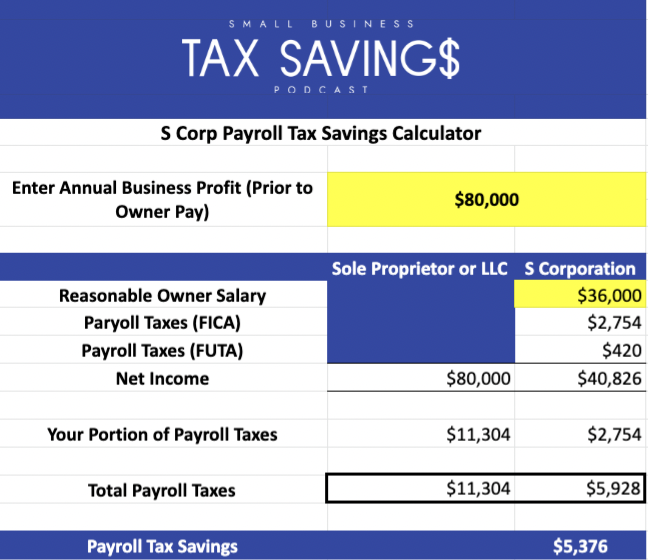

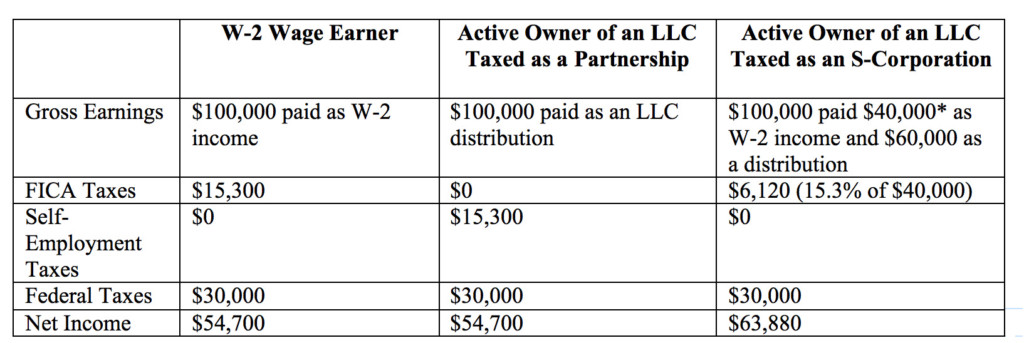

Taxation of an S-Corporation: The Why (Benefits) & How (Rules)

Taxation of an S-Corporation: The Why (Benefits) & How (Rules)

Passive Income Limitations in S-Corporations: The Bright Side and the

Passive Income Limitations in S-Corporations: The Bright Side and the

S Corp vs C Corp: What's the Difference? | TRUiC

S Corp vs C Corp: What's the Difference? | TRUiC

Passive Income Limitations in S-Corporations: The Bright Side and the

Passive Income Limitations in S-Corporations: The Bright Side and the

How to Set Up an S Corporation

How to Set Up an S Corporation