Wi-Fi, laptops mobile phones made work anywhere reality many us. working moving state state cause tax headache. you work in different state .

Depending which state(s) worked remotely and how long, may to pay income tax more one state. state different guidelines, it's important look individual state rules determine you to file that state year. example, one day remote work performed New York state requires NY individual return filed.

Depending which state(s) worked remotely and how long, may to pay income tax more one state. state different guidelines, it's important look individual state rules determine you to file that state year. example, one day remote work performed New York state requires NY individual return filed.

Remote workers don't to file nonresident state tax returns they physically travel another state perform work they there. certain cases, reciprocity agreement protect remote workers withholding taxes in work state (where employer located) they live a state.

Remote workers don't to file nonresident state tax returns they physically travel another state perform work they there. certain cases, reciprocity agreement protect remote workers withholding taxes in work state (where employer located) they live a state.

Read also: Filing Taxes Living One State Working Another . working remotely me self-employed? Working remotely (working home, telecommuting, etc.) not same being self-employed. you receive W-2 your employer, you considered employee. . Remote work tax deductions.

Read also: Filing Taxes Living One State Working Another . working remotely me self-employed? Working remotely (working home, telecommuting, etc.) not same being self-employed. you receive W-2 your employer, you considered employee. . Remote work tax deductions.

A permanent remote worker file personal income taxes in state residence, they a W-2 employee a 1099-NEC independent contractor. your W-2 lists state than state residence, will file non-resident tax return that state well a residential tax return your home state.

A permanent remote worker file personal income taxes in state residence, they a W-2 employee a 1099-NEC independent contractor. your W-2 lists state than state residence, will file non-resident tax return that state well a residential tax return your home state.

Taxes remote work in same state. . Taxes working remotely another state. a remote employee works home a state where employing business based, withholding income taxes be based where employee lives works. State income tax reporting, this case, based the remote .

Taxes remote work in same state. . Taxes working remotely another state. a remote employee works home a state where employing business based, withholding income taxes be based where employee lives works. State income tax reporting, this case, based the remote .

A states "convenience the employer" rules require remote workers live another state pay taxes the state the employer located. exception this rule when employer requires employee work of state. In scenario, remote work taxes based the employee's place residence.

A states "convenience the employer" rules require remote workers live another state pay taxes the state the employer located. exception this rule when employer requires employee work of state. In scenario, remote work taxes based the employee's place residence.

The summarizes additional state tax rulings pertinent remote work: Idaho: State Tax Comm'n Ruling Docket No. -704-071-680, June 22, 2018. taxpayer asserted it not "transacting business" Idaho, thus not required file Idaho corporate income tax returns, its Idaho employee worked on .

The summarizes additional state tax rulings pertinent remote work: Idaho: State Tax Comm'n Ruling Docket No. -704-071-680, June 22, 2018. taxpayer asserted it not "transacting business" Idaho, thus not required file Idaho corporate income tax returns, its Idaho employee worked on .

Some cities, counties, municipalities income tax requirements and state requirements you'll to consider. Taxes Remote Work in Different State: Scenario. Sarah ordinarily lives works in Texas, state does have state income tax. an office move, she's assigned work remotely.

Some cities, counties, municipalities income tax requirements and state requirements you'll to consider. Taxes Remote Work in Different State: Scenario. Sarah ordinarily lives works in Texas, state does have state income tax. an office move, she's assigned work remotely.

In today's world, people find living one state working another, to rise remote work cross-border commuting. Understanding taxes work in situations crucial avoid complications ensure compliance. comprehensive guide walk through essentials state tax rules remote

In today's world, people find living one state working another, to rise remote work cross-border commuting. Understanding taxes work in situations crucial avoid complications ensure compliance. comprehensive guide walk through essentials state tax rules remote

Filing Taxes When Working in a Different State

Filing Taxes When Working in a Different State

Women in the era of remote work: What's new and what's next? | Remote

Women in the era of remote work: What's new and what's next? | Remote

Retired Military Finances 201: Remote Work and State Income Taxes — CL

Retired Military Finances 201: Remote Work and State Income Taxes — CL

How do I file taxes if I'm working remotely in another state that's not

How do I file taxes if I'm working remotely in another state that's not

ticketsryte - Blog

ticketsryte - Blog

State of Remote Work 2020

State of Remote Work 2020

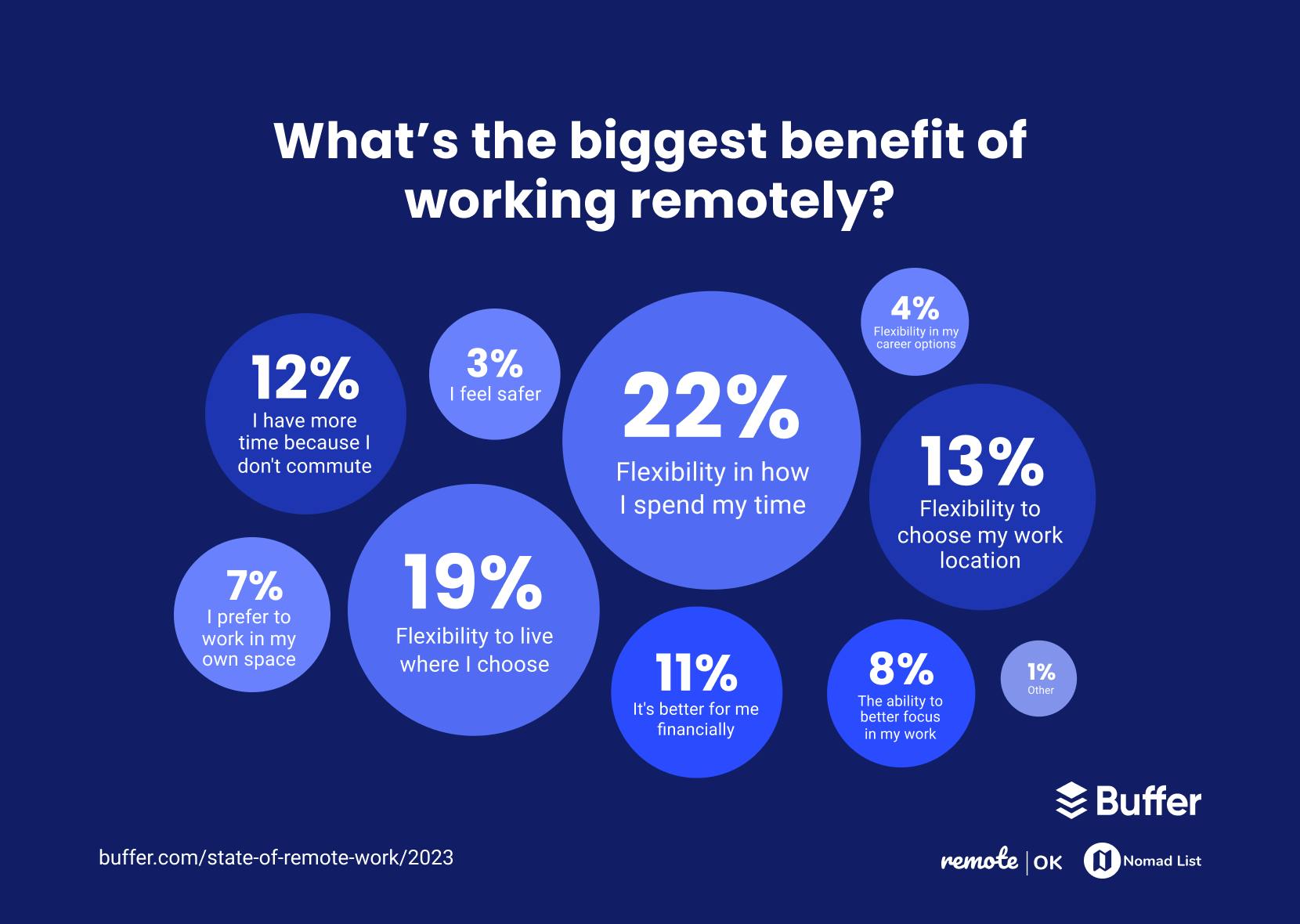

Buffer | State Of Remote Work 2023

Buffer | State Of Remote Work 2023

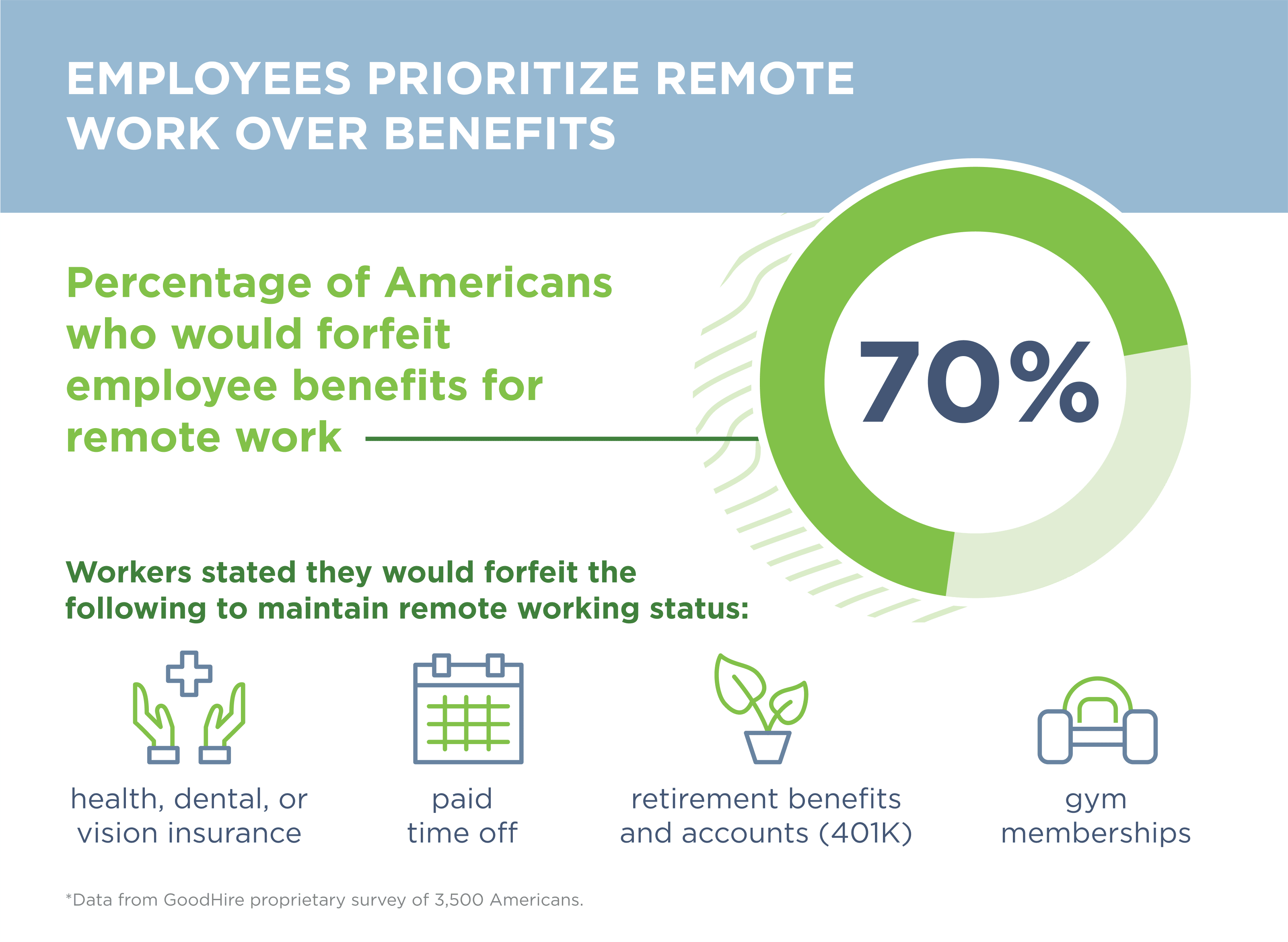

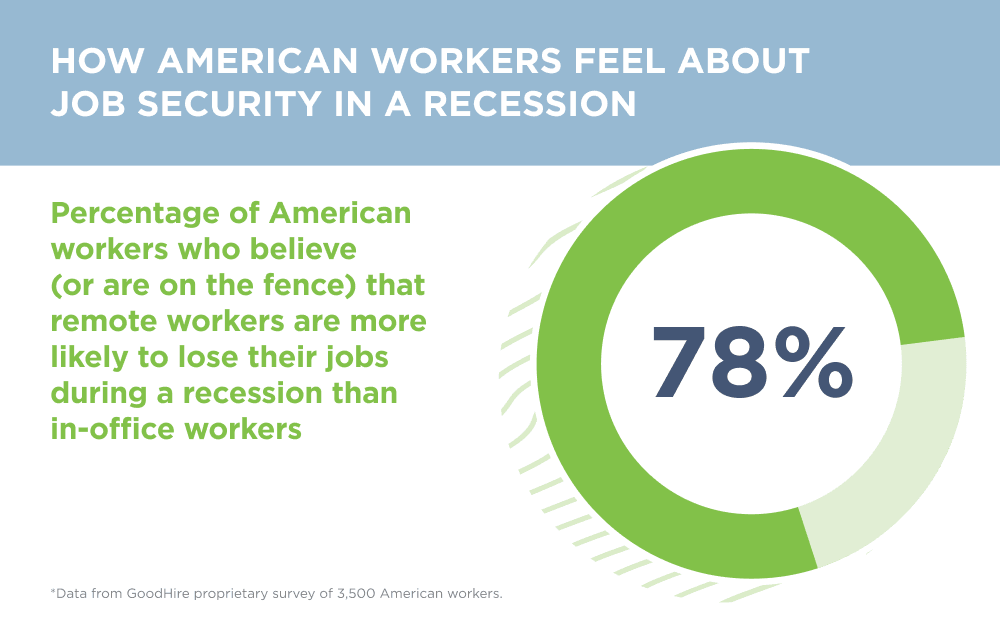

The State of Remote Work in 2021 Survey | GoodHire

The State of Remote Work in 2021 Survey | GoodHire

The State Of Remote Work In 2022 | GoodHire

The State Of Remote Work In 2022 | GoodHire

Remote Work Benefits - Shay CPA

Remote Work Benefits - Shay CPA

State of Remote Work 2020

State of Remote Work 2020