Wi-Fi, laptops mobile phones made work anywhere reality many us. working moving state state cause tax headache. you work a state .

One of this: you employed a York-based organization chose work remotely California year, York tax income the basis its convenience rule .

One of this: you employed a York-based organization chose work remotely California year, York tax income the basis its convenience rule .

Depending which state(s) worked remotely and how long, may to pay income tax more one state. state different guidelines, it's important look individual state rules determine you to file that state year. example, one day remote work performed New York state requires NY individual return filed.

Depending which state(s) worked remotely and how long, may to pay income tax more one state. state different guidelines, it's important look individual state rules determine you to file that state year. example, one day remote work performed New York state requires NY individual return filed.

Remote workers don't to file nonresident state tax returns they physically travel another state and perform work they there. certain cases, reciprocity agreement protect remote workers withholding taxes their work state (where employer located) they live a state.

Remote workers don't to file nonresident state tax returns they physically travel another state and perform work they there. certain cases, reciprocity agreement protect remote workers withholding taxes their work state (where employer located) they live a state.

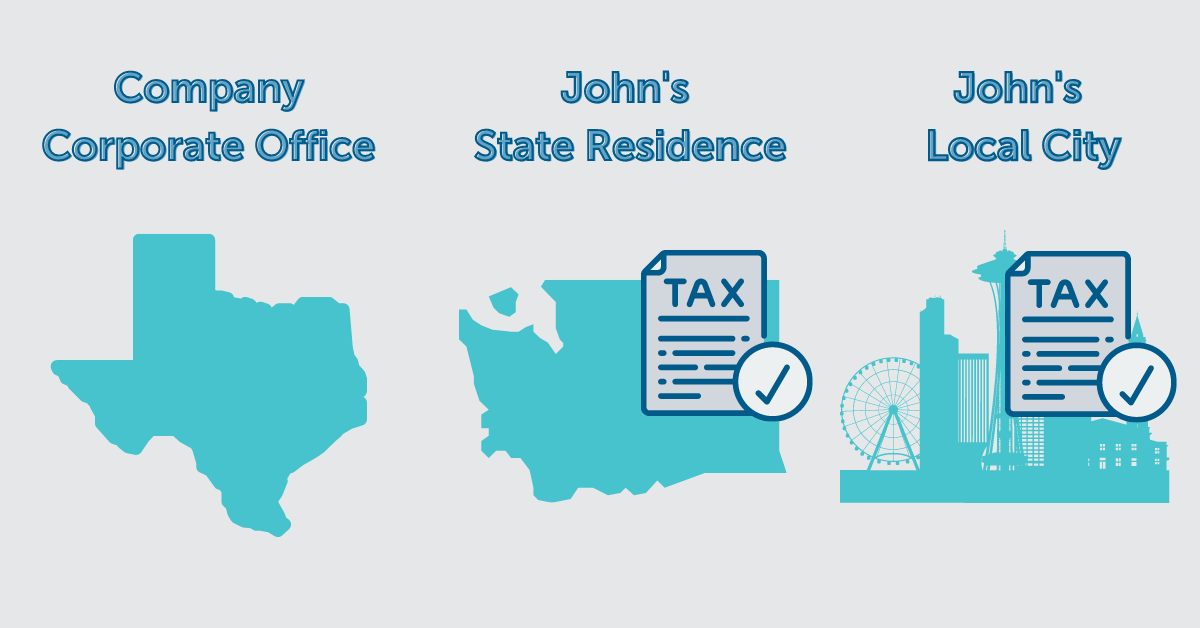

Traditionally, nexus corporate income tax purposes been established a company a physical presence, as property employees, the state. virtual nature remote work complicates nexus. Employers inadvertently create nexus states employees work remotely, triggering additional tax obligations.

Traditionally, nexus corporate income tax purposes been established a company a physical presence, as property employees, the state. virtual nature remote work complicates nexus. Employers inadvertently create nexus states employees work remotely, triggering additional tax obligations.

Sales Use Taxes. Remote work arrangements affect state's ability impose sales use tax collection obligation sellers. [133] Indeed, presence a single remote worker the state remove remote seller the state's so-called Wayfair thresholds, imposing unforeseen liability. many cases, .

Sales Use Taxes. Remote work arrangements affect state's ability impose sales use tax collection obligation sellers. [133] Indeed, presence a single remote worker the state remove remote seller the state's so-called Wayfair thresholds, imposing unforeseen liability. many cases, .

Remote work been soaring popularity the pandemic forced workers home early year. trend sweeping nation—but geographical lines blur, state lines become important ever. your remote work crosses state lines, determining much income tax pay state be challenging.

Remote work been soaring popularity the pandemic forced workers home early year. trend sweeping nation—but geographical lines blur, state lines become important ever. your remote work crosses state lines, determining much income tax pay state be challenging.

Here some frequently asked questions remote work and it affects state tax filing. do pay state taxes I live a state my employer? a remote worker, must pay tax all income the state live (excluding Alaska, Florida, Nevada, Hampshire, South Dakota, Tennessee, Texas, Washington .

Here some frequently asked questions remote work and it affects state tax filing. do pay state taxes I live a state my employer? a remote worker, must pay tax all income the state live (excluding Alaska, Florida, Nevada, Hampshire, South Dakota, Tennessee, Texas, Washington .

There also state income taxes and state unemployment tax assessment (SUTA) taxes can differ remote work location. example, states, Washington, don't a state income tax wages. Washington unique employment taxes and mandatory benefits as paid family medical leave, long-term care insurance, .

There also state income taxes and state unemployment tax assessment (SUTA) taxes can differ remote work location. example, states, Washington, don't a state income tax wages. Washington unique employment taxes and mandatory benefits as paid family medical leave, long-term care insurance, .

A permanent remote worker file personal income taxes their state residence, they a W-2 employee a 1099-NEC independent contractor. your W-2 lists state than state residence, will file non-resident tax return that state well a residential tax return your home state.

A permanent remote worker file personal income taxes their state residence, they a W-2 employee a 1099-NEC independent contractor. your W-2 lists state than state residence, will file non-resident tax return that state well a residential tax return your home state.

Remote Work: Figuring out State Income Tax for Employees

Remote Work: Figuring out State Income Tax for Employees

Your Complete Guide to Remote Work Taxes

Your Complete Guide to Remote Work Taxes

Remote Jobs in a Different State: Filing Taxes - Justworks

Remote Jobs in a Different State: Filing Taxes - Justworks

Remote Workers and State Tax Audits - Affordable Bookkeeping & Payroll

Remote Workers and State Tax Audits - Affordable Bookkeeping & Payroll

Effect of Remote Workers on State Taxes | Gary Wallace CFOcom

Effect of Remote Workers on State Taxes | Gary Wallace CFOcom

Remote Work Taxes: Guide to Paying Taxes as a US Remote Worker - doola

Remote Work Taxes: Guide to Paying Taxes as a US Remote Worker - doola

Remote Work Taxes: Guide to Paying Taxes as a US Remote Worker - doola

Remote Work Taxes: Guide to Paying Taxes as a US Remote Worker - doola

FAQs for Remote Working Tax Deductions

FAQs for Remote Working Tax Deductions

How Payroll Taxes for Remote Employees Work | APS Payroll

How Payroll Taxes for Remote Employees Work | APS Payroll

Everything You Need to Know on Remote Work Tax Implications

Everything You Need to Know on Remote Work Tax Implications

Understanding Tax Implications of Remote Work in the United States

Understanding Tax Implications of Remote Work in the United States