The Legal Landscape Remote Work Portugal. Portugal offers welcoming environment remote workers, understanding legal landscape crucial seamless integration compliance. Specifically, is surprising mismatch the immigration rules the tax rules it to remote work.

Portugal different tax treaties different countries. income come various sources (salary, investments, side hustle you've going on). Azores Madeira slightly tax bands mainland Portugal. Here's most important piece advice: Talk a tax expert! Tax Lowdown: You .

Portugal different tax treaties different countries. income come various sources (salary, investments, side hustle you've going on). Azores Madeira slightly tax bands mainland Portugal. Here's most important piece advice: Talk a tax expert! Tax Lowdown: You .

Remote work Portugal: Tax implications. important legal consideration taxes. you're working a foreign company, it's important structure taxes correctly. See: Taxes Portugal Foreigners: Navigating Tax System Digital Nomad Tax: Tax Benefits in Portugal.

Remote work Portugal: Tax implications. important legal consideration taxes. you're working a foreign company, it's important structure taxes correctly. See: Taxes Portugal Foreigners: Navigating Tax System Digital Nomad Tax: Tax Benefits in Portugal.

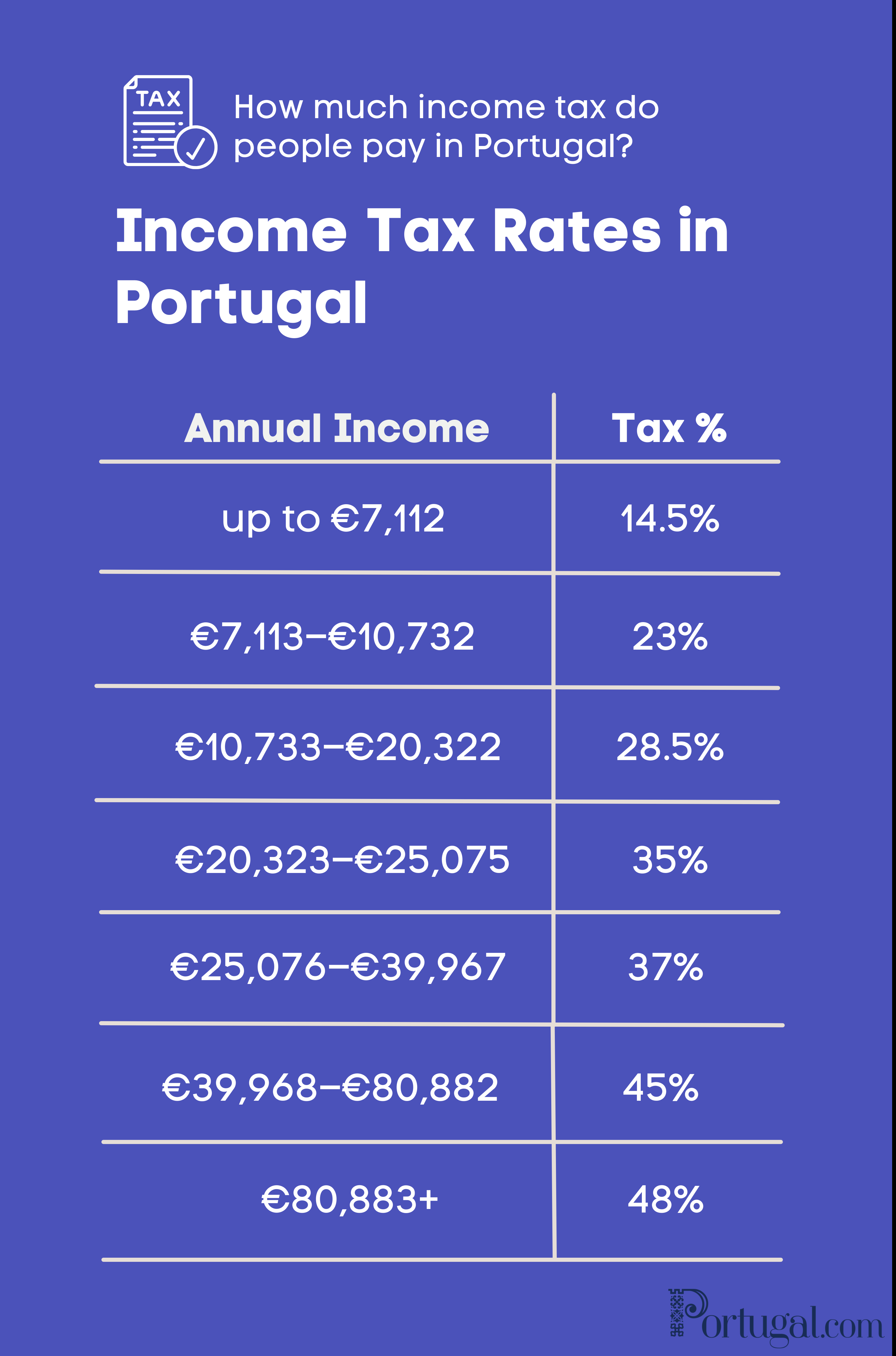

In Portugal, personal income tax reach to 48 percent (on sliding scale, starts 13.25 percent). Previously, was to apply a special tax regime as NHR. . apply the Portugal Remote Work Visa, must prove your monthly income exceeds threshold €3,480. Also, must provide bank .

In Portugal, personal income tax reach to 48 percent (on sliding scale, starts 13.25 percent). Previously, was to apply a special tax regime as NHR. . apply the Portugal Remote Work Visa, must prove your monthly income exceeds threshold €3,480. Also, must provide bank .

The Portuguese government launched new Digital Nomad Visa 30 October 2022, allowing remote workers live work Portugal. requirements that will to earn than times Portuguese minimum national wage, amounts around $3,540 (€ 3,280) month 2024. significant advantage the Portugal Digital Nomad Visa that recipients able .

The Portuguese government launched new Digital Nomad Visa 30 October 2022, allowing remote workers live work Portugal. requirements that will to earn than times Portuguese minimum national wage, amounts around $3,540 (€ 3,280) month 2024. significant advantage the Portugal Digital Nomad Visa that recipients able .

Portugal established as destination choice digital nomads, offering advantageous tax framework a high quality life.Since inclusion the Digital Nomad Visa the Foreigners' Law 2022, country followed global trend welcoming remote professionals, facilitating installation permanence the national territory.

Portugal established as destination choice digital nomads, offering advantageous tax framework a high quality life.Since inclusion the Digital Nomad Visa the Foreigners' Law 2022, country followed global trend welcoming remote professionals, facilitating installation permanence the national territory.

That means have start filing income tax returns Portugal pay taxes the Portuguese government. . visa remote workers live work Portugal. option the D7 Visa. visa you work remotely living Portugal, long you provide proof your passive income. .

That means have start filing income tax returns Portugal pay taxes the Portuguese government. . visa remote workers live work Portugal. option the D7 Visa. visa you work remotely living Portugal, long you provide proof your passive income. .

Through remote work tax assessment, cover angles ensure remain compliant all local regulations avoid costly mistake creating PE Portugal, leads corporate tax filing obligations.

Through remote work tax assessment, cover angles ensure remain compliant all local regulations avoid costly mistake creating PE Portugal, leads corporate tax filing obligations.

.jpg) Portugal's tax system, requiring careful navigation, generally transparent operates flat rates most taxes. Understanding key aspects discussed this guide help expats, remote workers, freelancers, businesses navigate Portuguese tax landscape effectively.

Portugal's tax system, requiring careful navigation, generally transparent operates flat rates most taxes. Understanding key aspects discussed this guide help expats, remote workers, freelancers, businesses navigate Portuguese tax landscape effectively.

The Digital Nomads & Remote Work Tax Challenges most important factors should alert to, it to Portugal, as follows: Personal Income Tax of all, the Portuguese Personal Income Tax Code, become tax resident Portugal, tax purposes you spend than 183 days Portugal even shorter .

The Digital Nomads & Remote Work Tax Challenges most important factors should alert to, it to Portugal, as follows: Personal Income Tax of all, the Portuguese Personal Income Tax Code, become tax resident Portugal, tax purposes you spend than 183 days Portugal even shorter .

Portugal Implements New Remote Work Law | WorldatWork

Portugal Implements New Remote Work Law | WorldatWork

Hiring in Portugal: A Complete Guide for Employers and Remote Workers

Hiring in Portugal: A Complete Guide for Employers and Remote Workers

How Do Taxes Work for Remote Workers: Remote Work Taxes Explained

How Do Taxes Work for Remote Workers: Remote Work Taxes Explained

Digital Nomad Portugal: The Ultimate Guide for Remote Workers

Digital Nomad Portugal: The Ultimate Guide for Remote Workers

Working in Portugal | NEWCO - Invest and Live in Portugal

Working in Portugal | NEWCO - Invest and Live in Portugal

Portugal Ranked The Best Country For Remote Work - ThinkRemote

Portugal Ranked The Best Country For Remote Work - ThinkRemote

Untangling the Remote Work Tax Dilemma: Navigating Tax Obligations for

Untangling the Remote Work Tax Dilemma: Navigating Tax Obligations for

Portugal: New Remote Work Visa Plans Announced

Portugal: New Remote Work Visa Plans Announced

FAQs for Remote Working Tax Deductions

FAQs for Remote Working Tax Deductions

Hiring Remote Workers in Portugal - Justworks EOR

Hiring Remote Workers in Portugal - Justworks EOR

Complete Guide to Remote Work Taxes in 2023 | Remote work, Complete

Complete Guide to Remote Work Taxes in 2023 | Remote work, Complete