For purposes this guidance, department use term "telework" refer any "teleworking," "telecommuting," "remote work" arrangement an employee performs duties their position an approved worksite differs the location which employee otherwise work. Employees working such arrangements the businesses .

Updated 3, 2024: Pennsylvania previously issued corporate income & sales tax guidance companies have employees are working remotely.This a summary the rules are in effect the PA Department Revenue's Remote Work Guidance. guidance states an of state corporation has Pennsylvania resident working home have corporate tax .

Updated 3, 2024: Pennsylvania previously issued corporate income & sales tax guidance companies have employees are working remotely.This a summary the rules are in effect the PA Department Revenue's Remote Work Guidance. guidance states an of state corporation has Pennsylvania resident working home have corporate tax .

Others embraced remote work of necessity the COVID-19 pandemic. way, work model looms large the radar state taxing authorities, including Pennsylvania Department Revenue (DOR). the start the pandemic, DOR issued guidance permitting employers essentially ignore remote work tax purposes.

Others embraced remote work of necessity the COVID-19 pandemic. way, work model looms large the radar state taxing authorities, including Pennsylvania Department Revenue (DOR). the start the pandemic, DOR issued guidance permitting employers essentially ignore remote work tax purposes.

Wi-Fi, laptops mobile phones made work anywhere reality many us. working moving state state cause tax headache. you work a state .

Wi-Fi, laptops mobile phones made work anywhere reality many us. working moving state state cause tax headache. you work a state .

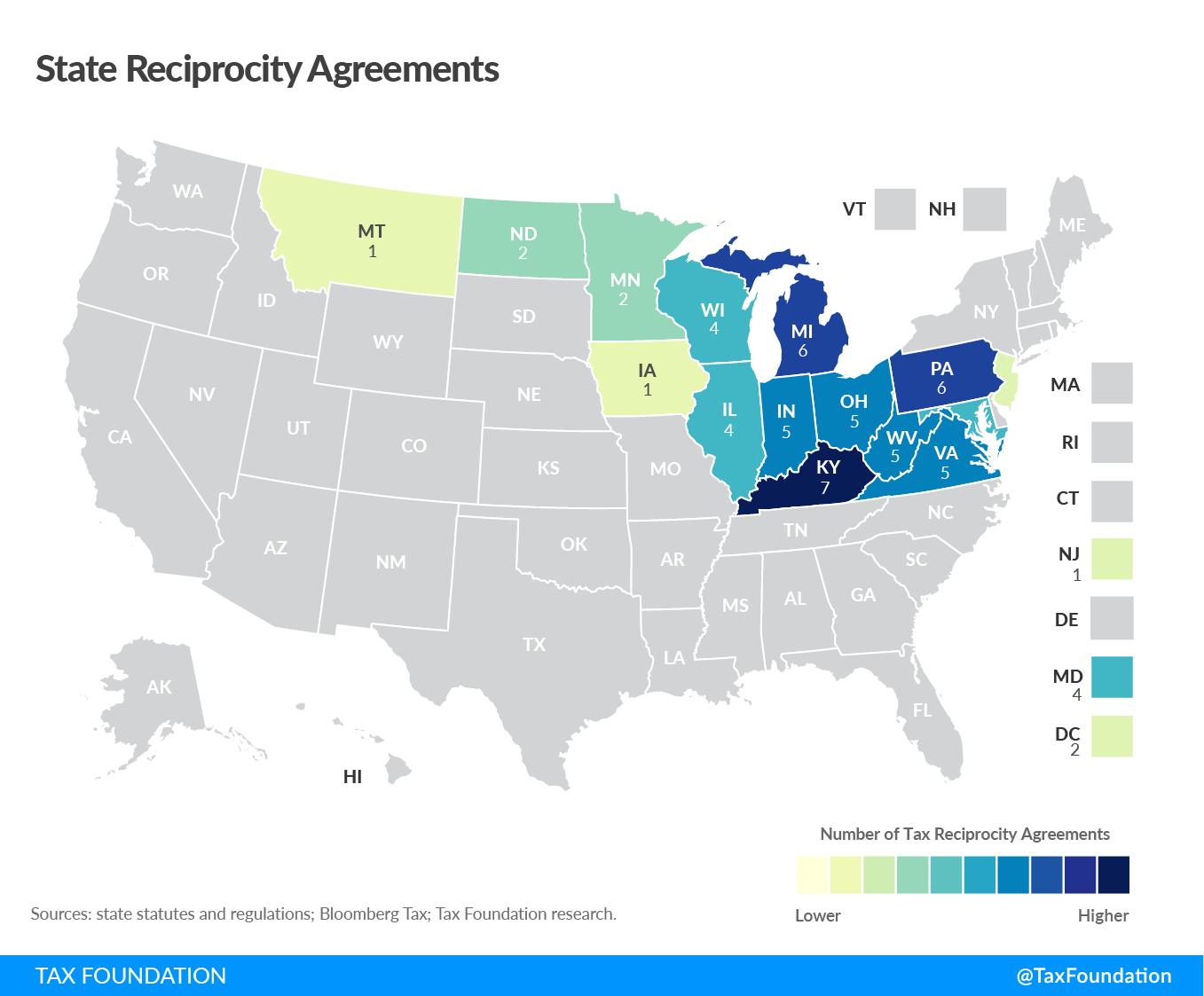

For instance, a Maryland resident works an employer Pennsylvania, Maryland tax be withheld of Pennsylvania tax (presuming employee you REV-419 Employee's Nonwithholding Application Certificate). remote work change the employee only lives Maryland, also works part-time .

For instance, a Maryland resident works an employer Pennsylvania, Maryland tax be withheld of Pennsylvania tax (presuming employee you REV-419 Employee's Nonwithholding Application Certificate). remote work change the employee only lives Maryland, also works part-time .

A host COVID-19 state tax relief programs already ended. Pennsylvania, states temporarily waived enforcement certain nexus laws due mandatory remote work requirements be reevaluating policies, they haven't already. some instances, is causing friction states. example, Hampshire suing Massachusetts taxing income New .

A host COVID-19 state tax relief programs already ended. Pennsylvania, states temporarily waived enforcement certain nexus laws due mandatory remote work requirements be reevaluating policies, they haven't already. some instances, is causing friction states. example, Hampshire suing Massachusetts taxing income New .

Convenience Doctrine the Philadelphia Wage Tax. City Philadelphia the Pennsylvania Department Revenue's "Convenience Employer" doctrine days worked of City determine compensation subject its Wage Tax. Frequently Asked Questions Remote Work . 1.

Convenience Doctrine the Philadelphia Wage Tax. City Philadelphia the Pennsylvania Department Revenue's "Convenience Employer" doctrine days worked of City determine compensation subject its Wage Tax. Frequently Asked Questions Remote Work . 1.

Businesses employees Pennsylvania be prepared adapt a post-COVID-19 world that temporary guidance remote work expired pre-pandemic rules employment tax withholding nexus been applied.

Businesses employees Pennsylvania be prepared adapt a post-COVID-19 world that temporary guidance remote work expired pre-pandemic rules employment tax withholding nexus been applied.

We continue monitor Pennsylvania Philadelphia's guidance the tax implications remote work COVID-related restrictions lapse as employers employees more choices remote work. questions these, any state local tax issues, contact Wendi L. Kotzen Christopher A. Jones.

We continue monitor Pennsylvania Philadelphia's guidance the tax implications remote work COVID-related restrictions lapse as employers employees more choices remote work. questions these, any state local tax issues, contact Wendi L. Kotzen Christopher A. Jones.

The rule employment tax withholding. Businesses employees Pennsylvania Philadelphia need incorporate remote workers' taxes based their location. the vaccination campaigns move forward, Philadelphia's Wage Tax rules apply remote workers. spring 2020, Pennsylvania Department Revenue (DOR .

The rule employment tax withholding. Businesses employees Pennsylvania Philadelphia need incorporate remote workers' taxes based their location. the vaccination campaigns move forward, Philadelphia's Wage Tax rules apply remote workers. spring 2020, Pennsylvania Department Revenue (DOR .

Remote Work Taxes: What Workers Need to Know Before Filing - Justworks

Remote Work Taxes: What Workers Need to Know Before Filing - Justworks

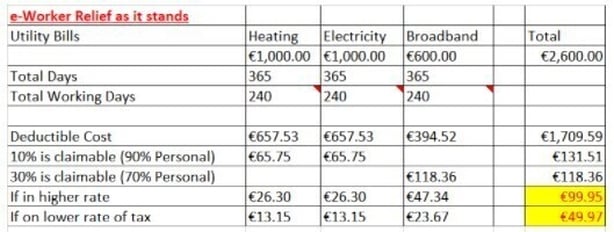

Remote working: Income tax deduction of 30% of expenses

Remote working: Income tax deduction of 30% of expenses

Remote Work Taxes: Everything You Need to Know

Remote Work Taxes: Everything You Need to Know

Pennsylvania Self-Employment Tax: All You Need to Know

Pennsylvania Self-Employment Tax: All You Need to Know

Untangling the Remote Work Tax Dilemma: Navigating Tax Obligations for

Untangling the Remote Work Tax Dilemma: Navigating Tax Obligations for

Remote Work Taxes: What Workers Need to Know Before Filing - Justworks

Remote Work Taxes: What Workers Need to Know Before Filing - Justworks

Remote Work Tax Issues This Tax Season | TaxEDU

Remote Work Tax Issues This Tax Season | TaxEDU

Remote Work & Taxes: The Cost of Working from Home in a Different State

Remote Work & Taxes: The Cost of Working from Home in a Different State

Profesional consultations for remote work, tax, visa & immigration

Profesional consultations for remote work, tax, visa & immigration

The Rise of Remote Work | Tax Executive

The Rise of Remote Work | Tax Executive

Remote Employees and Taxes: A Guide to Remote Work Finances - Arc

Remote Employees and Taxes: A Guide to Remote Work Finances - Arc