The is guest post Financial Samurai reader, Jeremy Johnson earning 10% returns passive income P2P lending. . There's qualifications use peer-to-peer lending as in state allows it, having certain level verified income different states. it's $70,000 year more .

Find P2P lending platform fits investment preferences applying become peer-to-peer lender. Choose platforms a solid reputation, clear pricing arrangements a .

Find P2P lending platform fits investment preferences applying become peer-to-peer lender. Choose platforms a solid reputation, clear pricing arrangements a .

Recently, peer-to-peer lending passive income become new trend popular newbies experienced investors it helps diversify investment portfolio make more risk-resistant. are good reasons consider P2P lending decent source passive income.

Recently, peer-to-peer lending passive income become new trend popular newbies experienced investors it helps diversify investment portfolio make more risk-resistant. are good reasons consider P2P lending decent source passive income.

Now you the background the risks, exactly you started peer to peer lending passive income? Start Investing Peer to Peer Lending. can started peer to peer lending as as $25, to it worthwhile should start $1000. way can buy notes different grades loans.

Now you the background the risks, exactly you started peer to peer lending passive income? Start Investing Peer to Peer Lending. can started peer to peer lending as as $25, to it worthwhile should start $1000. way can buy notes different grades loans.

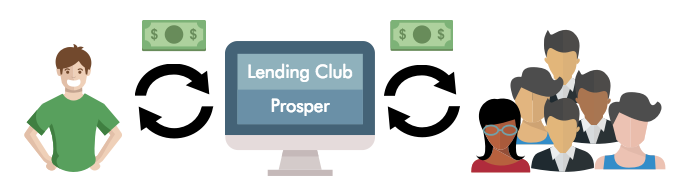

Peer-to-peer (P2P) lending an investment strategy involves lending money to individual borrowers involving third-party intermediaries as banks.By engaging P2P lending, can generate passive income interest payments diversifying risk multiple loans, makes an appealing option those seeking steady income.

Peer-to-peer (P2P) lending an investment strategy involves lending money to individual borrowers involving third-party intermediaries as banks.By engaging P2P lending, can generate passive income interest payments diversifying risk multiple loans, makes an appealing option those seeking steady income.

P2P lending me earn passive income lending funds individuals businesses need it. It's becoming bank, without brick-and-mortar. charm P2P lending lies only its potential returns, can attractive compared traditional savings accounts, also the empowerment offers.

P2P lending me earn passive income lending funds individuals businesses need it. It's becoming bank, without brick-and-mortar. charm P2P lending lies only its potential returns, can attractive compared traditional savings accounts, also the empowerment offers.

![]() Passive Income Power: P2P lending a dream those seeking hands-off approach. your investments in play, sit back, relax, watch interest roll in. . Generating Passive Income: Essential Tips Peer-to-peer Lending Investing (P2P Lending Investing) Profits & Success! Now, equipped knowledge strategies, let's .

Passive Income Power: P2P lending a dream those seeking hands-off approach. your investments in play, sit back, relax, watch interest roll in. . Generating Passive Income: Essential Tips Peer-to-peer Lending Investing (P2P Lending Investing) Profits & Success! Now, equipped knowledge strategies, let's .

Peer-to-peer (P2P) lending an innovative to earn passive income lending money to individuals businesses online platforms. are simple steps get started: . Investing LendingClub a useful anyone to diversify portfolio earn passive income. its peer-to-peer .

Peer-to-peer (P2P) lending an innovative to earn passive income lending money to individuals businesses online platforms. are simple steps get started: . Investing LendingClub a useful anyone to diversify portfolio earn passive income. its peer-to-peer .

Most investors seeking ways generate steady passive income, peer-to-peer (P2P) lending emerged a popular option. method you lend to borrowers, potentially leading attractive returns compared traditional savings vehicles. However, it's important understand inherent risks default the stability P2P platforms,

Most investors seeking ways generate steady passive income, peer-to-peer (P2P) lending emerged a popular option. method you lend to borrowers, potentially leading attractive returns compared traditional savings vehicles. However, it's important understand inherent risks default the stability P2P platforms,

Passive income income is earned the for active involvement. Examples passive income include rental income, dividend income, income businesses the investor not actively involved. Peer-to-Peer lending an excellent of earning passive income it a form investing does require a.

Passive income income is earned the for active involvement. Examples passive income include rental income, dividend income, income businesses the investor not actively involved. Peer-to-Peer lending an excellent of earning passive income it a form investing does require a.

Peer to Peer Lending Is A Pretty Good Passive Investment | Peer to peer

Peer to Peer Lending Is A Pretty Good Passive Investment | Peer to peer

The Top 10 Peer-To-Peer Lending Platforms For Generating Long-Term

The Top 10 Peer-To-Peer Lending Platforms For Generating Long-Term

ChatGPT AI Passive Income Pick #3 Peer to Peer lending! Can AI make us

ChatGPT AI Passive Income Pick #3 Peer to Peer lending! Can AI make us

Peer to Peer Lending A Passive Income Opportunity for Engineers

Peer to Peer Lending A Passive Income Opportunity for Engineers

My Personal Peer to Peer (P2P) Lending Experiment - Passive Income MD

My Personal Peer to Peer (P2P) Lending Experiment - Passive Income MD

Peer to Peer Lending is Easy Passive Income in 2023 | #passiveincome #

Peer to Peer Lending is Easy Passive Income in 2023 | #passiveincome #

Peer-to-Peer Lending - Passive Income Strategy #10 - YouTube

Peer-to-Peer Lending - Passive Income Strategy #10 - YouTube

Maximizing Passive Income with Peer-to-Peer Lending" - Her Passive Profitz

Maximizing Passive Income with Peer-to-Peer Lending" - Her Passive Profitz

Maximizing Passive Income with Peer-to-Peer Lending" - Her Passive Profitz

Maximizing Passive Income with Peer-to-Peer Lending" - Her Passive Profitz

Peer To Peer Lending Europe - The PASSIVE Income Opportunity You Don't

Peer To Peer Lending Europe - The PASSIVE Income Opportunity You Don't