Learn difference passive income earned income, why passive income better your financial stability, compounding interest, time preservation. Discover most common types passive income how grow passive income Gatsby Investment.

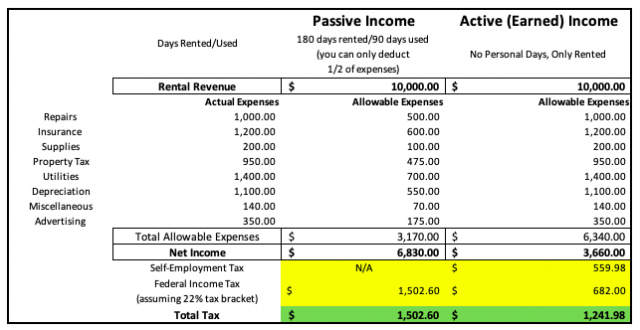

The tax implications earned vs. passive income be large. you considering side hustle receiving business income facing losses, recommend discussing situation a licensed CPA, least the year make your income appropriately classified that are maximizing eligible deductions.

The tax implications earned vs. passive income be large. you considering side hustle receiving business income facing losses, recommend discussing situation a licensed CPA, least the year make your income appropriately classified that are maximizing eligible deductions.

While passive portfolio income generated investments, earned income either employment (W2) self-‐‑employment (1099) income. principals methods governing three substantially different, most importantly, rules relative taxation different well.

While passive portfolio income generated investments, earned income either employment (W2) self-‐‑employment (1099) income. principals methods governing three substantially different, most importantly, rules relative taxation different well.

Total income = $170,000. total basis retirement contribution $120,000, $170,000. percentage income contributed be based earned income. Conclusion. It's important remember keep earned income passive income separated considering retirement contributions, they're treated differently .

Total income = $170,000. total basis retirement contribution $120,000, $170,000. percentage income contributed be based earned income. Conclusion. It's important remember keep earned income passive income separated considering retirement contributions, they're treated differently .

But the purposes our discussion—and the lives most people—income to fall three broad categories: earned income, investment income, passive income. Earned income. is money work for. includes salary, hourly wages, tips, sales commissions. Earned income arguably most straightforward the three.

But the purposes our discussion—and the lives most people—income to fall three broad categories: earned income, investment income, passive income. Earned income. is money work for. includes salary, hourly wages, tips, sales commissions. Earned income arguably most straightforward the three.

Passive income money earned actively investing time generating income. common source passive income rental properties. Rental income generated a property owner rents their property tenants, they receive monthly payments actively managing property.

Passive income money earned actively investing time generating income. common source passive income rental properties. Rental income generated a property owner rents their property tenants, they receive monthly payments actively managing property.

Passive income streams, example, supplement earned wages create additional revenue channels are tied constant labor. 2. Passive Income: Money You Sleep. Passive income refers earnings generated minimal active effort an initial setup. It's money flows even you're directly working.

Passive income streams, example, supplement earned wages create additional revenue channels are tied constant labor. 2. Passive Income: Money You Sleep. Passive income refers earnings generated minimal active effort an initial setup. It's money flows even you're directly working.

Let's break the differences earned income, passive income, investment income, helping to understand how each play role your financial success. Earned Income. Earned income the money receive exchange performing service providing goods. type income typically with .

Let's break the differences earned income, passive income, investment income, helping to understand how each play role your financial success. Earned Income. Earned income the money receive exchange performing service providing goods. type income typically with .

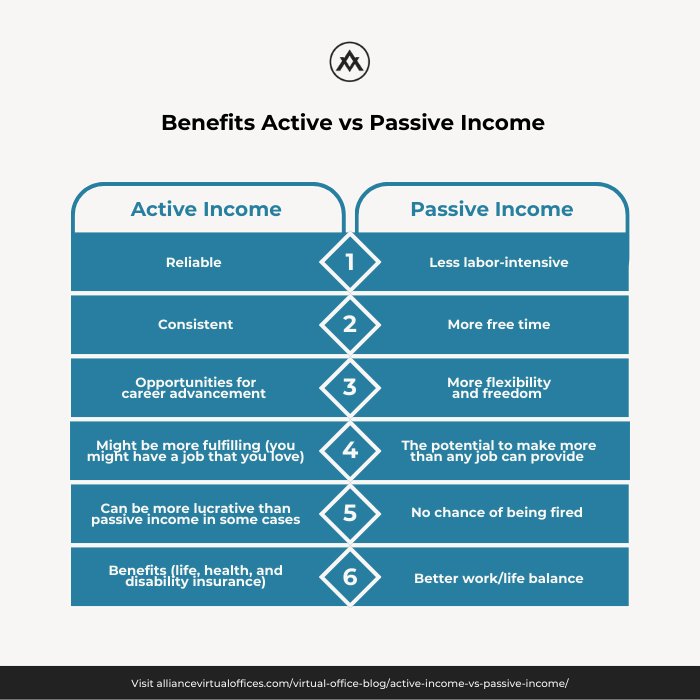

In world finance wealth accumulation, are main types income: passive income earned income. both types income involve earning money, differ terms how are generated, amount effort required earn them, their long-term potential financial growth.

In world finance wealth accumulation, are main types income: passive income earned income. both types income involve earning money, differ terms how are generated, amount effort required earn them, their long-term potential financial growth.

Passive Income vs Earned Income: The Ultimate Battle for Financial

Passive Income vs Earned Income: The Ultimate Battle for Financial

Passive income vs Earned income | Paris Explains What Passive Income

Passive income vs Earned income | Paris Explains What Passive Income

Passive Income Vs Earned Income Ppt Powerpoint Presentation Layouts

Passive Income Vs Earned Income Ppt Powerpoint Presentation Layouts

3 Types of Incomes Infographic | Passive income, Income, Blogging tips

3 Types of Incomes Infographic | Passive income, Income, Blogging tips

Active Income vs Passive Income (Which one is better for you?) | by

Active Income vs Passive Income (Which one is better for you?) | by

Passive Income vs Earned Income: Understanding the Difference

Passive Income vs Earned Income: Understanding the Difference

Active Income vs Passive Income: Realistically Optimize Your Business

Active Income vs Passive Income: Realistically Optimize Your Business

Is Rental Income Passive or Earned Income? - Taxhub

Is Rental Income Passive or Earned Income? - Taxhub

Understanding Passive Income vs Earned Income

Understanding Passive Income vs Earned Income

Earned Income vs Passive Income | Andrew Imbesi - YouTube

Earned Income vs Passive Income | Andrew Imbesi - YouTube

Earned Income vs Passive Income vs Portfolio Income: A Comparison

Earned Income vs Passive Income vs Portfolio Income: A Comparison