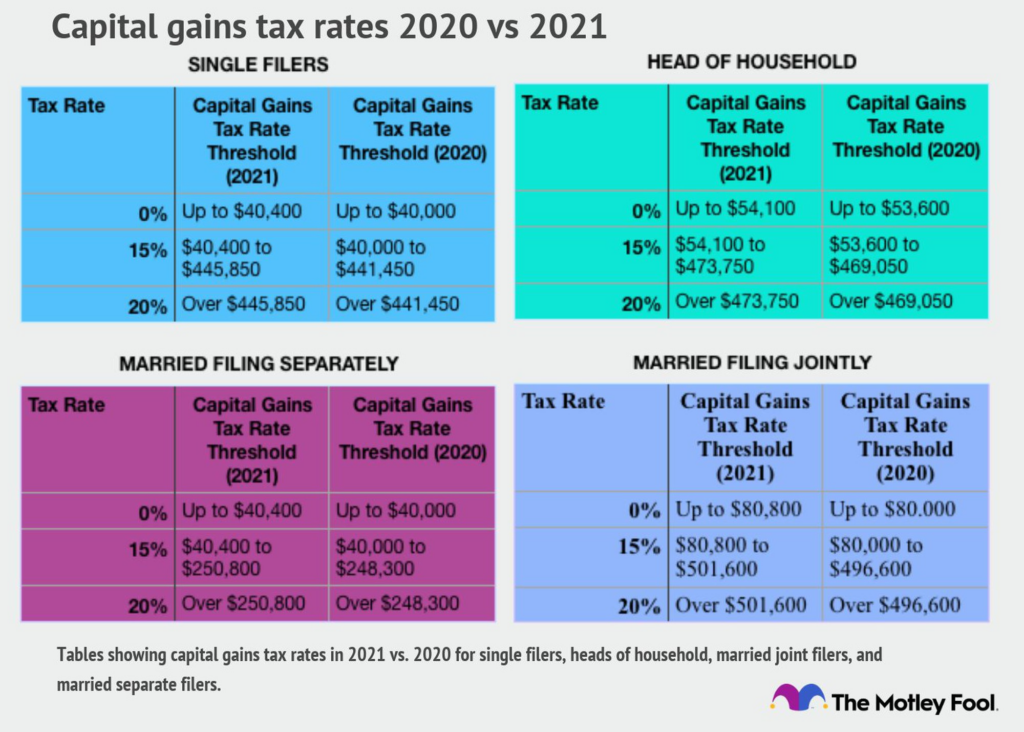

Capital gains assets held less a year taxed short-term gains ordinary income rates. Capital gains assets held more a year taxed long-term gains enjoy .

Long-term vs. Short-term capital gains: Assets held over year qualify long-term capital gains rates, are typically (0%, 15%, 20%) short-term rates, are taxed ordinary income. distinction be leveraged building portfolio assets intended long-term growth.

Long-term vs. Short-term capital gains: Assets held over year qualify long-term capital gains rates, are typically (0%, 15%, 20%) short-term rates, are taxed ordinary income. distinction be leveraged building portfolio assets intended long-term growth.

Short-term capital gains taxed your ordinary income tax rate. Long-term capital gains qualified dividends taxed either 0%, 15%, 20%, based your annual taxable income filing status. Long-term capital gains typically apply profits a capital asset is held longer a year. . Passive vs Active .

Short-term capital gains taxed your ordinary income tax rate. Long-term capital gains qualified dividends taxed either 0%, 15%, 20%, based your annual taxable income filing status. Long-term capital gains typically apply profits a capital asset is held longer a year. . Passive vs Active .

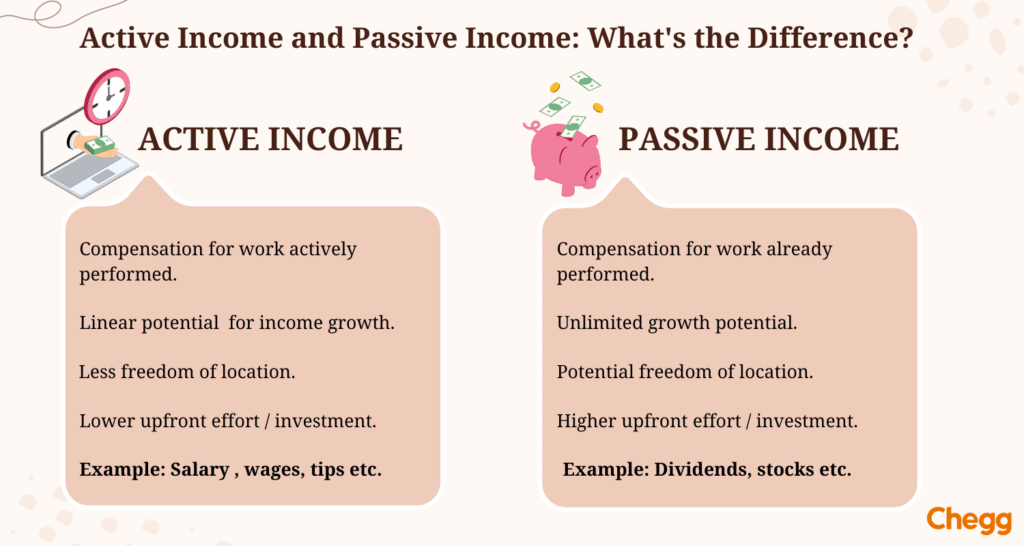

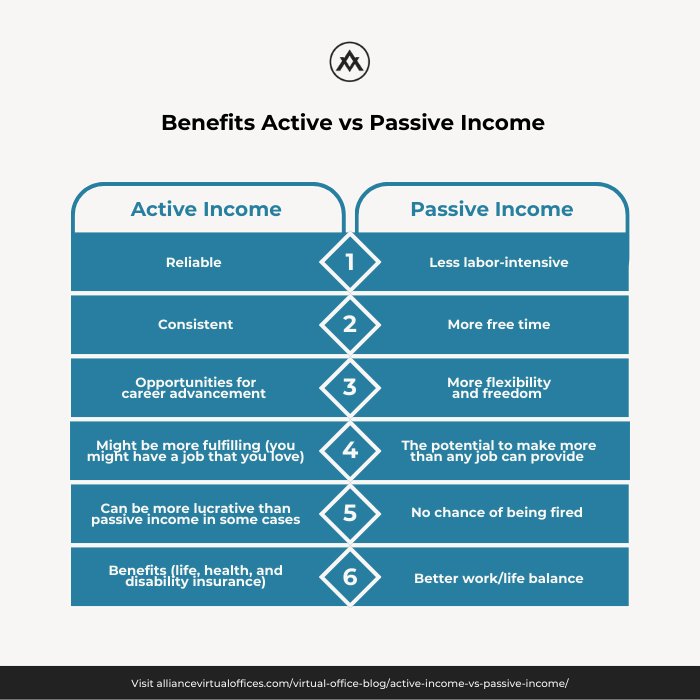

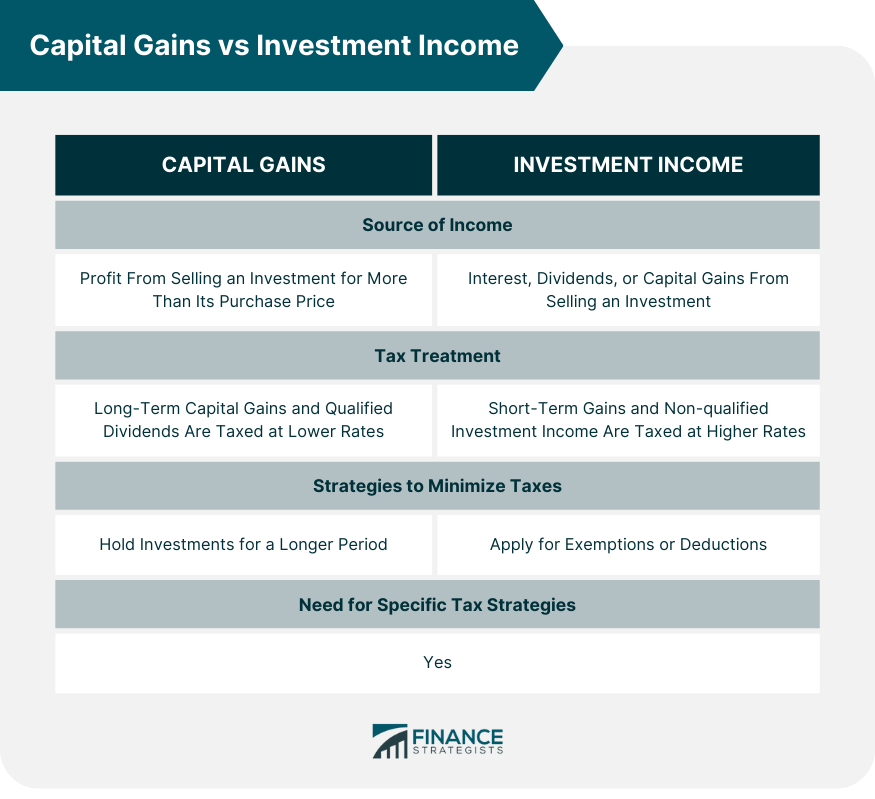

Key Differences Passive Income Capital Gains 1. Cash Flow vs. Asset Appreciation. most basic difference passive income capital gains from returns generated. Passive income a regular stream cash flow, capital gains rely the appreciation an asset's over time.

Key Differences Passive Income Capital Gains 1. Cash Flow vs. Asset Appreciation. most basic difference passive income capital gains from returns generated. Passive income a regular stream cash flow, capital gains rely the appreciation an asset's over time.

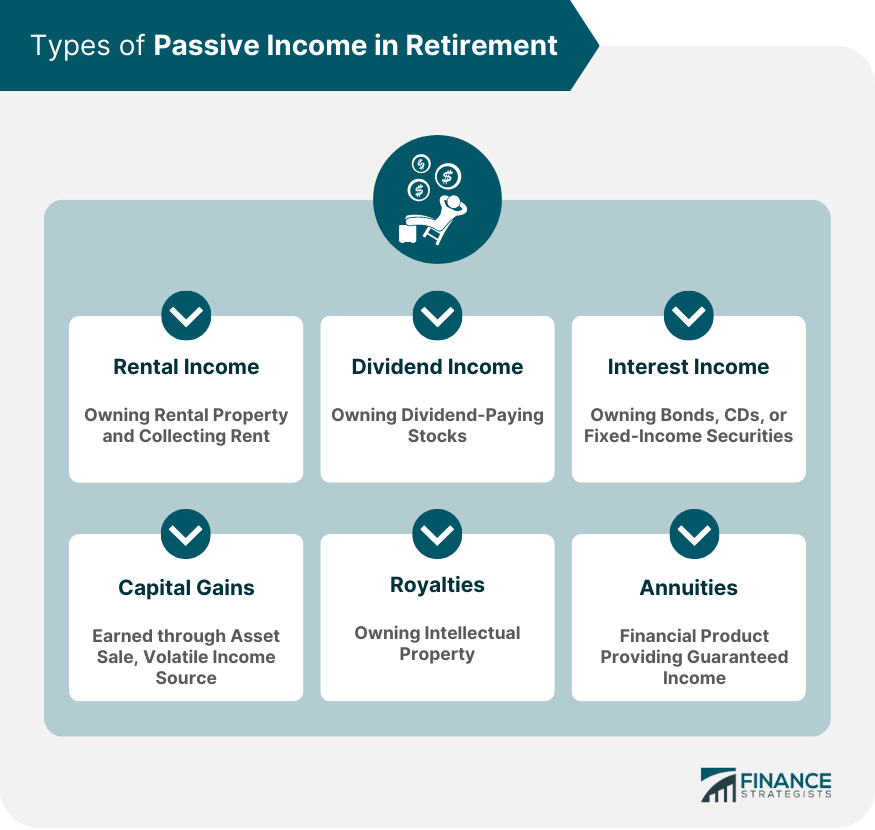

Passive income earnings a rental property, limited partnership, other enterprise which person not actively involved. . Difference Income Tax vs. Capital Gains Tax .

Passive income earnings a rental property, limited partnership, other enterprise which person not actively involved. . Difference Income Tax vs. Capital Gains Tax .

However, capital gains, classified passive not, benefit favorable tax rates compared ordinary income. Long-term vs. Short-term Capital Gains Tax Short-Term Capital .

However, capital gains, classified passive not, benefit favorable tax rates compared ordinary income. Long-term vs. Short-term Capital Gains Tax Short-Term Capital .

Capital gains refers funds received selling appreciating asset, a house a portfolio stocks. Passive income informally refers making money doing work, the Internal Revenue Service its definition passive activity refers earnings specific types activities, including renting property.

Capital gains refers funds received selling appreciating asset, a house a portfolio stocks. Passive income informally refers making money doing work, the Internal Revenue Service its definition passive activity refers earnings specific types activities, including renting property.

Passive losses offset passive income. passive losses not offset earned income, capital gains (unless a passive activity), portfolio income. activity potentially start as earned income move passive income. sure check other articles our "how my income taxed" series.

Passive losses offset passive income. passive losses not offset earned income, capital gains (unless a passive activity), portfolio income. activity potentially start as earned income move passive income. sure check other articles our "how my income taxed" series.

Investing Passive Income vs Investing Capital Gains. November 27; Brian Page + posts. Brian Page an entrepreneur, online educator, passive income pioneer is known the creator the BNB Formula, world's #1 bestselling Airbnb™ coaching program over 25,000 students 47 countries.

Investing Passive Income vs Investing Capital Gains. November 27; Brian Page + posts. Brian Page an entrepreneur, online educator, passive income pioneer is known the creator the BNB Formula, world's #1 bestselling Airbnb™ coaching program over 25,000 students 47 countries.

Long-Term vs Short-Term Capital Gains Tax | Ultimate Guide | Ageras

Long-Term vs Short-Term Capital Gains Tax | Ultimate Guide | Ageras

Active Income vs Passive Income: Realistically Optimize Your Business

Active Income vs Passive Income: Realistically Optimize Your Business

Passive Income in Retirement | Definition, Types, Pros and Cons

Passive Income in Retirement | Definition, Types, Pros and Cons

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips (2024)

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips (2024)

Passive Income vs Equity Growth Which Is Better? (Ep306) - YouTube

Passive Income vs Equity Growth Which Is Better? (Ep306) - YouTube

What Is Ordinary Income Tax vs Capital Gain Tax?

What Is Ordinary Income Tax vs Capital Gain Tax?

Capital Gains vs Ordinary Income - The Differences + 3 Tax Planning

Capital Gains vs Ordinary Income - The Differences + 3 Tax Planning

Capital Gains Tax vs Income Tax | Key Differences & Similarities

Capital Gains Tax vs Income Tax | Key Differences & Similarities

Capital Gains vs Investment Income | Similarities and Differences

Capital Gains vs Investment Income | Similarities and Differences

DIFFERENCE BETWEEN PASSIVE INCOME VS ACTIVE INCOME | by Ruchitakumari

DIFFERENCE BETWEEN PASSIVE INCOME VS ACTIVE INCOME | by Ruchitakumari

Passive Income vs Active Income: A Beginners Guide to Understanding

Passive Income vs Active Income: A Beginners Guide to Understanding