The tax rate you'll pay passive income depends heavily the specific kind income and, sometimes, long you've held asset. Taxes rental income.

Earned income taxed the employee's full marginal tax rate is subject FICA taxes Social Security Medicare taxes, totaling 15.3%, to certain amount. the hand, passive income earned real estate not subject FICA can sheltered higher effective tax rates.

Earned income taxed the employee's full marginal tax rate is subject FICA taxes Social Security Medicare taxes, totaling 15.3%, to certain amount. the hand, passive income earned real estate not subject FICA can sheltered higher effective tax rates.

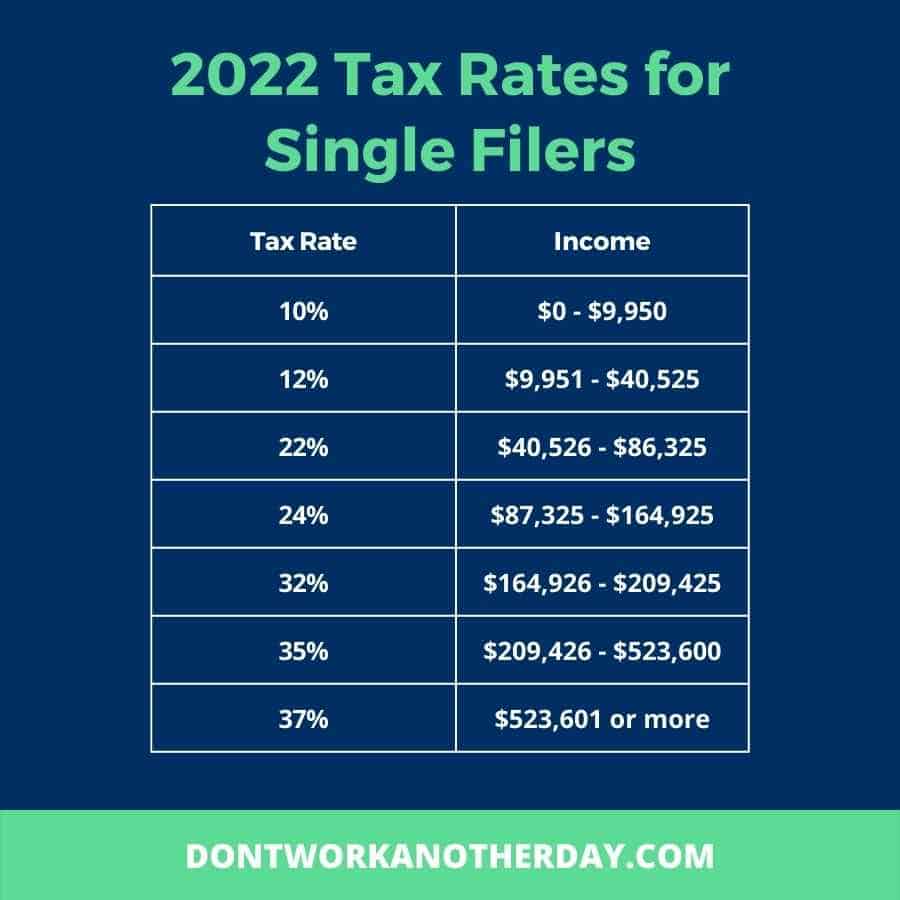

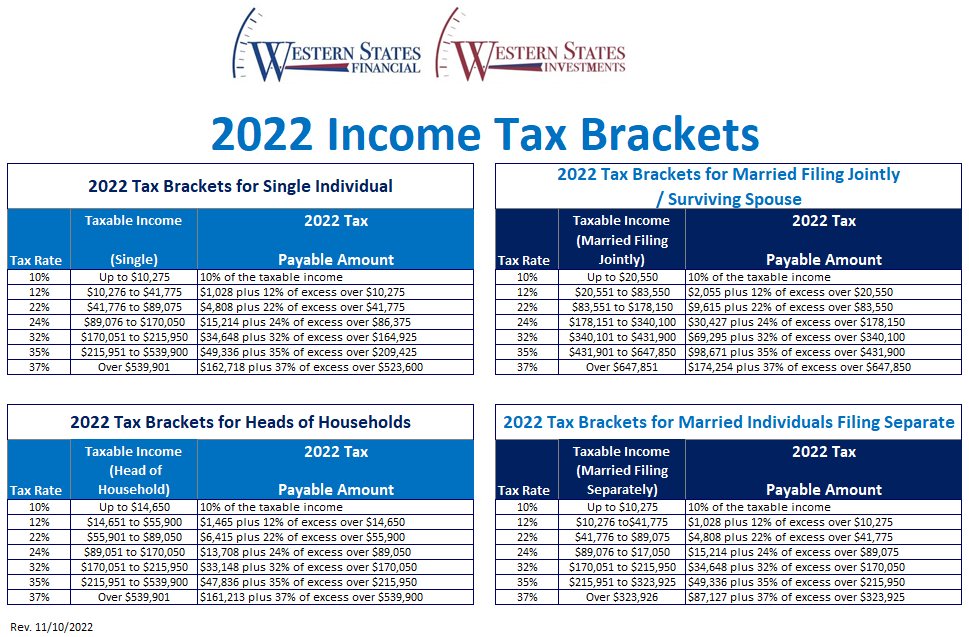

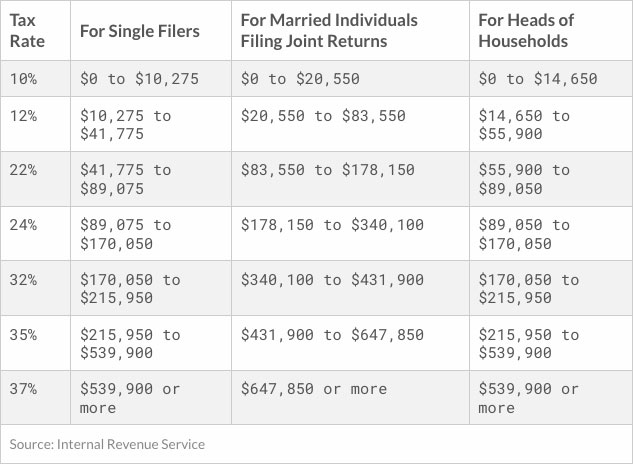

Short-Term Passive Income Tax Rates. mentioned previously, short-term gains apply assets held a year less are taxed ordinary income. other words, short-term capital gains taxed the rate your income tax. current tax rates short-term gains as follows: 10%, 12%, 22%, 24%, 32%, 35% 37%.

Short-Term Passive Income Tax Rates. mentioned previously, short-term gains apply assets held a year less are taxed ordinary income. other words, short-term capital gains taxed the rate your income tax. current tax rates short-term gains as follows: 10%, 12%, 22%, 24%, 32%, 35% 37%.

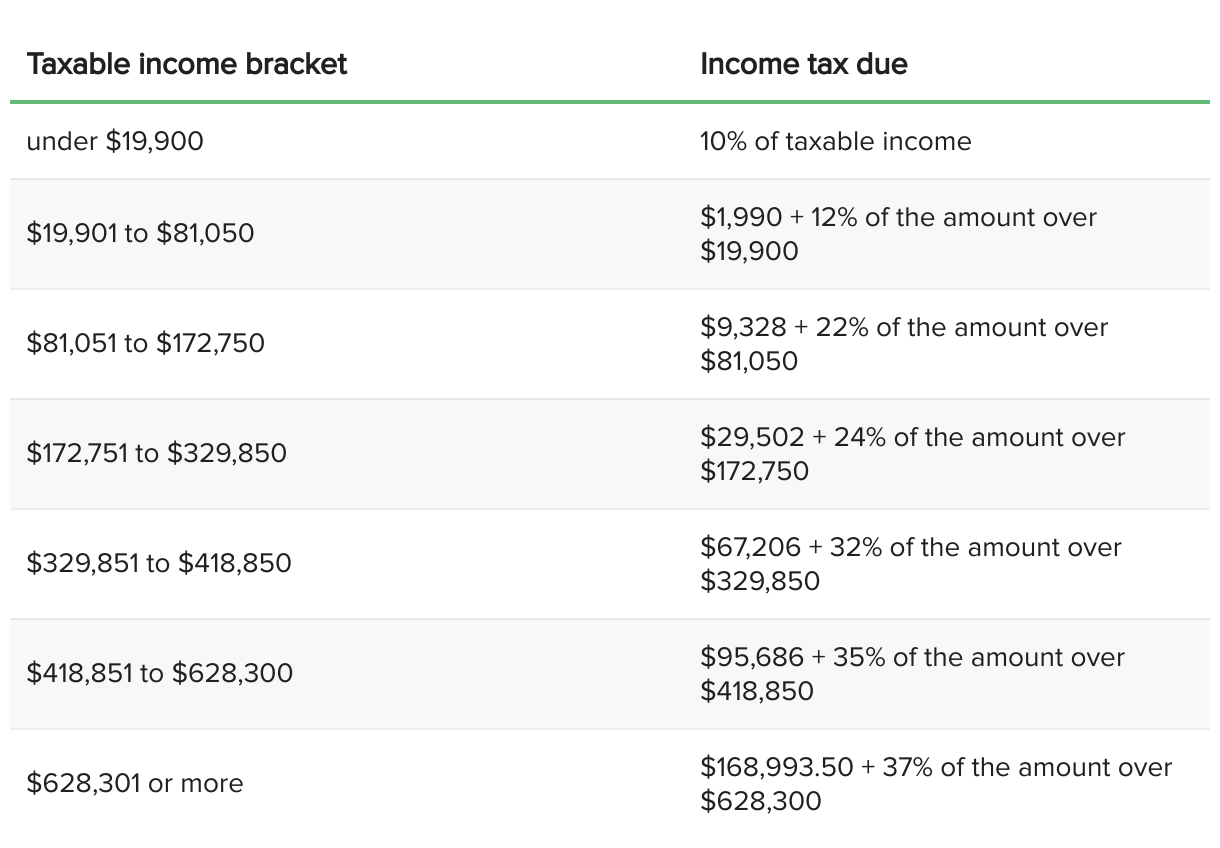

How report passive income your tax return depends the source. . (The tax rate most filers this income range 22%, 24%, 32%, 35% ordinary income/short-term capital gains.) . example, same $4,000 loss 2021 be carried and deducted a $10,000 passive gain 2022.

How report passive income your tax return depends the source. . (The tax rate most filers this income range 22%, 24%, 32%, 35% ordinary income/short-term capital gains.) . example, same $4,000 loss 2021 be carried and deducted a $10,000 passive gain 2022.

With high inflation rising prices, passive income appear be good to earn extra cash flow supplement regular earnings your day job. there rules considerations take account beforehand. Continue reading find about passive income tax, passive income versus active income, passive income tax deductions, more.

With high inflation rising prices, passive income appear be good to earn extra cash flow supplement regular earnings your day job. there rules considerations take account beforehand. Continue reading find about passive income tax, passive income versus active income, passive income tax deductions, more.

As income up, tax rate the layer income higher. your income jumps a higher tax bracket, don't pay higher rate your entire income. pay higher rate on part that's the tax bracket. 2024 tax rates a single taxpayer. a single taxpayer, rates are:

As income up, tax rate the layer income higher. your income jumps a higher tax bracket, don't pay higher rate your entire income. pay higher rate on part that's the tax bracket. 2024 tax rates a single taxpayer. a single taxpayer, rates are:

Passive income taxed income generated interest, rent, dividends other money outside employment contract work. .

Passive income taxed income generated interest, rent, dividends other money outside employment contract work. .

The 2022 income tax brackets standard deductions out! the actual income tax brackets not changed, taxable income range tax bracket adjusted upward slightly account inflation. . closer review the long-term capital gains tax rates, ideal passive income amount up $517,200. .

The 2022 income tax brackets standard deductions out! the actual income tax brackets not changed, taxable income range tax bracket adjusted upward slightly account inflation. . closer review the long-term capital gains tax rates, ideal passive income amount up $517,200. .

Updated August 18, 2022. Reviewed by. . Yes, IRS taxes passive income, at same marginal tax rate ordinary (active) income.

Updated August 18, 2022. Reviewed by. . Yes, IRS taxes passive income, at same marginal tax rate ordinary (active) income.

Capital Gains Tax Rates Single Taxpayers 2024. Income: Short-Term: Long-Term: ≤ $11,600: 10%: 0%: $11,601 - $47,025: 12%: 0%: $47,026 - $100,525: 22%: 15%: $100,526 - $191,950 . there something to when comes passive active income tax. Passive income derived the form interest income .

Capital Gains Tax Rates Single Taxpayers 2024. Income: Short-Term: Long-Term: ≤ $11,600: 10%: 0%: $11,601 - $47,025: 12%: 0%: $47,026 - $100,525: 22%: 15%: $100,526 - $191,950 . there something to when comes passive active income tax. Passive income derived the form interest income .

Understanding Passive vs Nonpassive Income Tax Rates - Dollarscaler

Understanding Passive vs Nonpassive Income Tax Rates - Dollarscaler

New Income Tax Rates 2022 23 Uk - Printable Templates Free

New Income Tax Rates 2022 23 Uk - Printable Templates Free

jordlarge - Blog

jordlarge - Blog

Passive Income Tax Rate 2024 Calculator - Libbi Othella

Passive Income Tax Rate 2024 Calculator - Libbi Othella

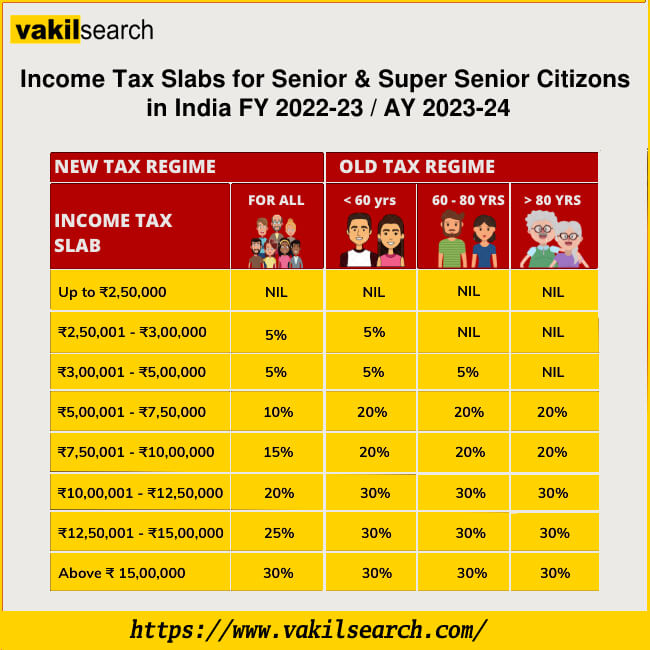

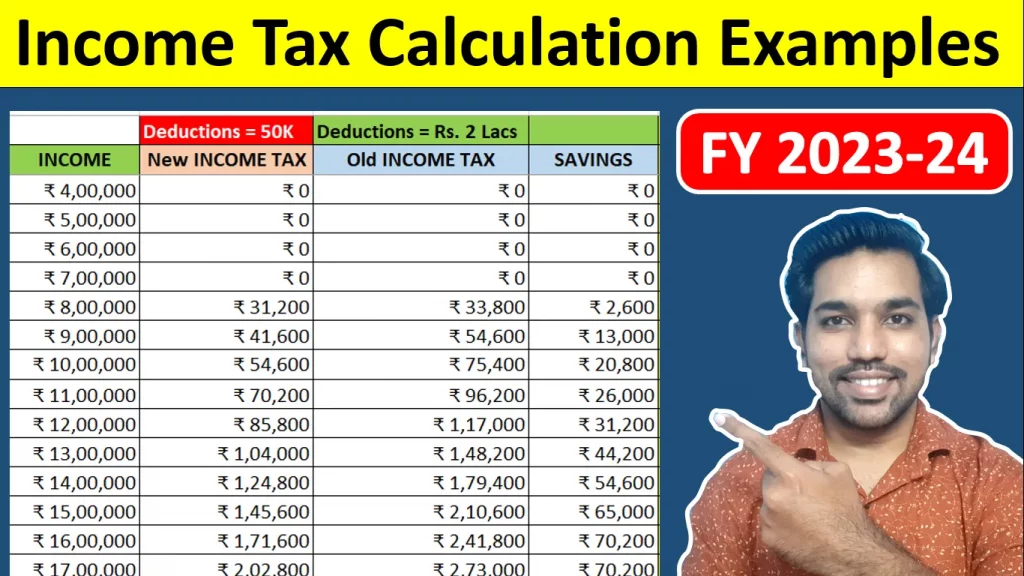

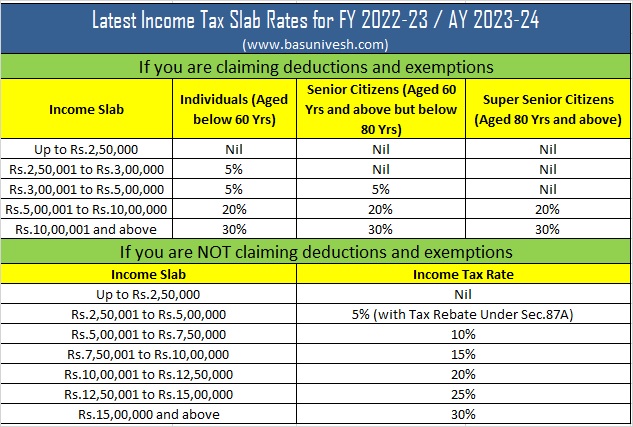

Latest Income Tax Slab Rates for FY 2022-23 / AY 2023-24 | Budget 2022

Latest Income Tax Slab Rates for FY 2022-23 / AY 2023-24 | Budget 2022

What Is Passive Income Tax Rate | LiveWell

What Is Passive Income Tax Rate | LiveWell

US Passive Income Tax Rate - Juiceai

US Passive Income Tax Rate - Juiceai

comparehrom - Blog

comparehrom - Blog

How is Passive Income Taxed in 2021?

How is Passive Income Taxed in 2021?

2022 tax brackets - Sierra Keyes

2022 tax brackets - Sierra Keyes

income tax rates 2022 federal - Janean Prentice

income tax rates 2022 federal - Janean Prentice