For purposes item (1) above, item deduction arises the tax year which item be allowable a deduction the taxpayer's method accounting taxable income all tax years determined regard the passive activity rules without regard the basis at-risk limits.

With high inflation rising prices, passive income appear be good to earn extra cash flow supplement regular earnings your day job. there rules considerations take account beforehand. Continue reading find about passive income tax, passive income versus active income, passive income tax deductions, more.

With high inflation rising prices, passive income appear be good to earn extra cash flow supplement regular earnings your day job. there rules considerations take account beforehand. Continue reading find about passive income tax, passive income versus active income, passive income tax deductions, more.

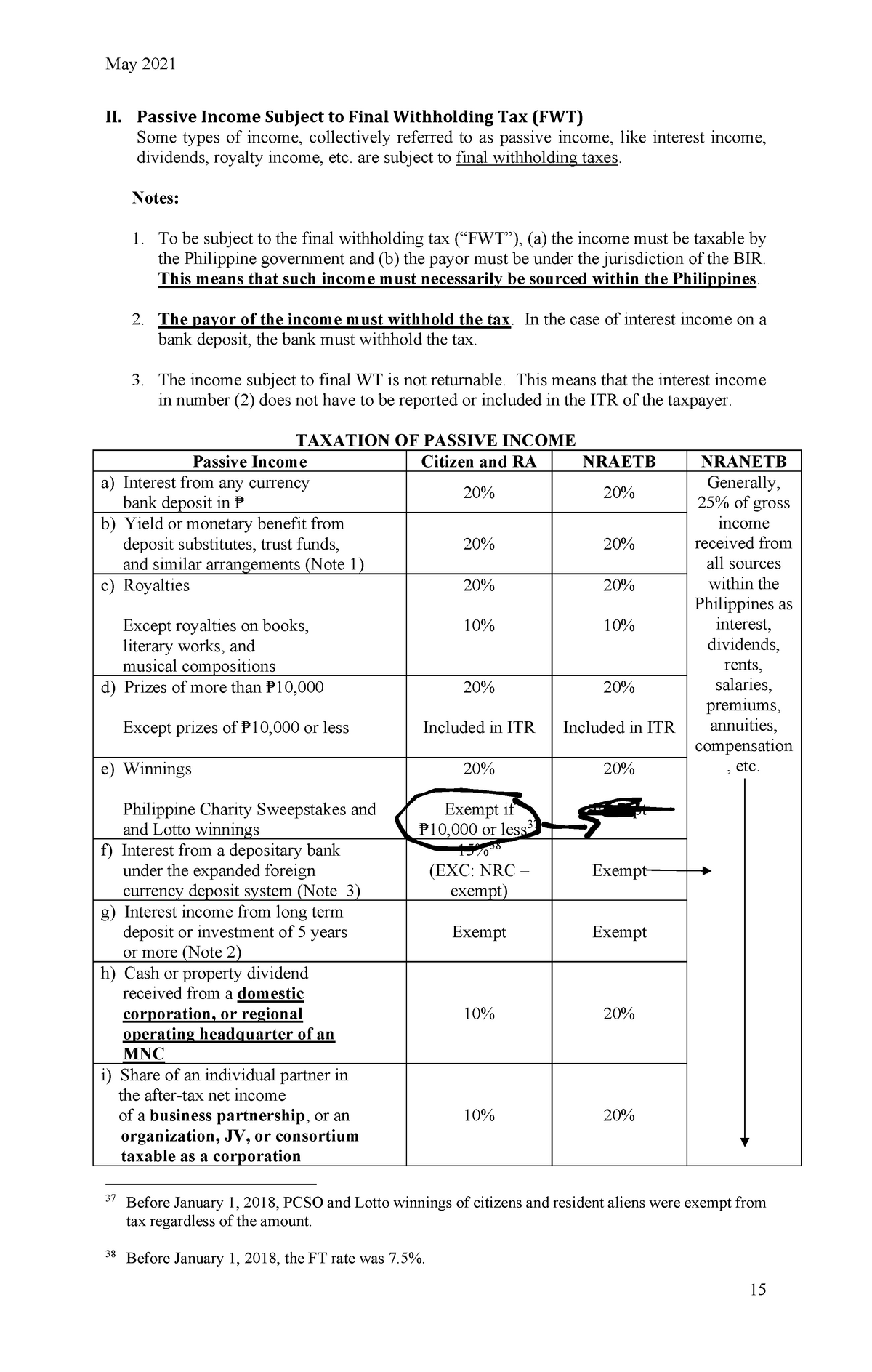

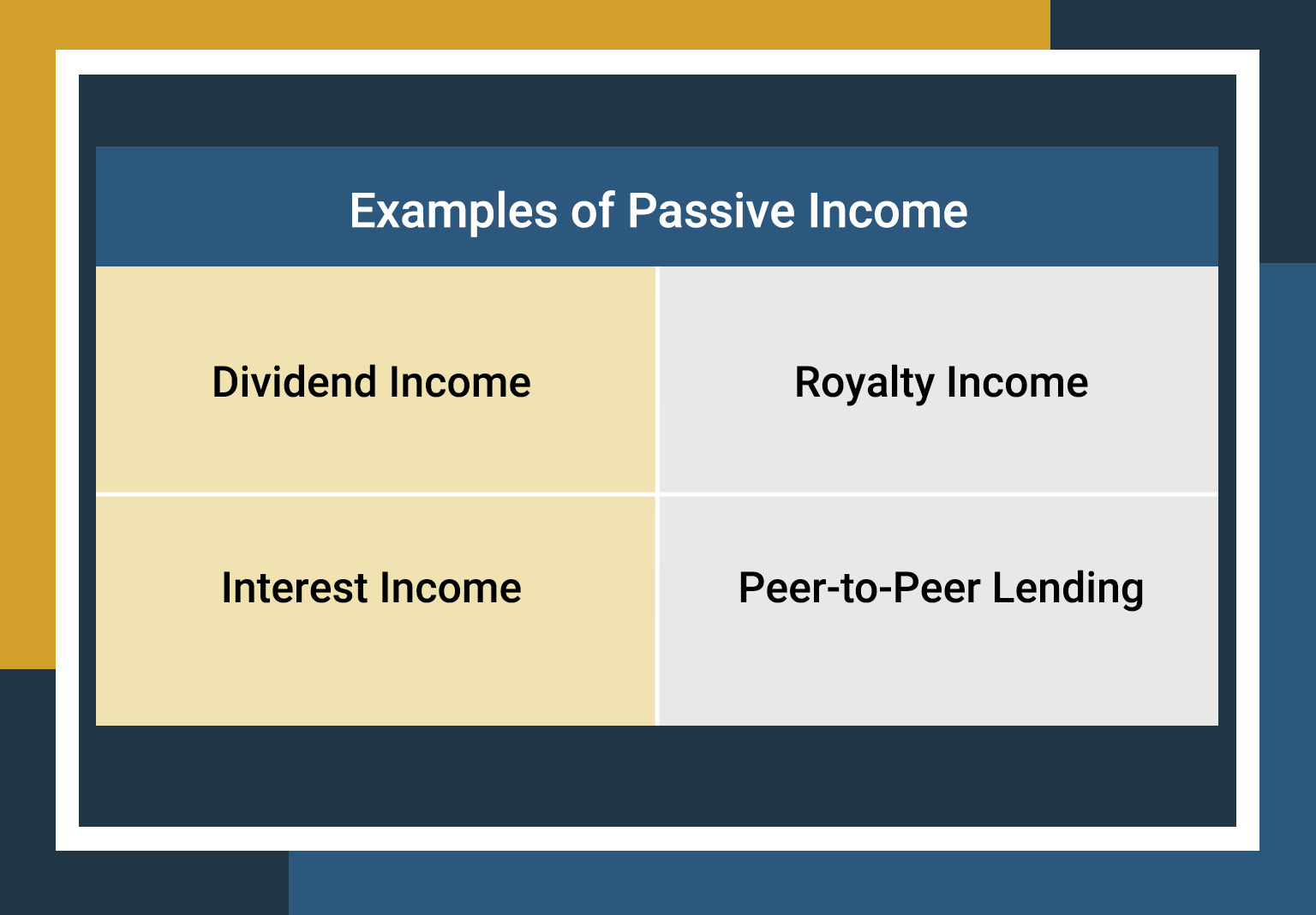

Passive income taxed income generated interest, rent, dividends other money outside employment contract work.

Passive income taxed income generated interest, rent, dividends other money outside employment contract work.

Use Form 8582, Passive Activity Loss Limitations summarize income losses passive activities to compute deductible losses. Form 8582-CR, Passive Activity Credit Limitations summarize credits passive activities to compute allowed passive activity credit. may use Form 8582-CR make election .

Use Form 8582, Passive Activity Loss Limitations summarize income losses passive activities to compute deductible losses. Form 8582-CR, Passive Activity Credit Limitations summarize credits passive activities to compute allowed passive activity credit. may use Form 8582-CR make election .

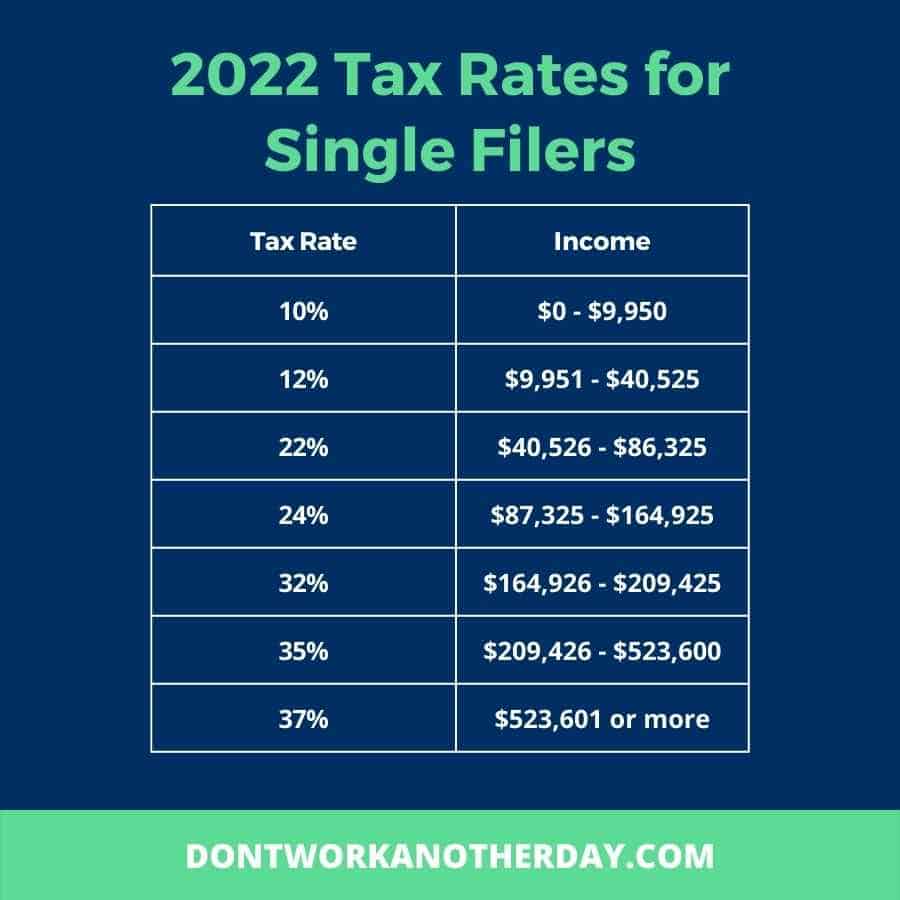

Like other kind income, passive income be reported your income tax return. despite tax advantages listed above, passive income taxed ordinary income. "Contrary popular belief, passive income taxed ordinary income tax rates it sometimes to deductions reduce liability .

Like other kind income, passive income be reported your income tax return. despite tax advantages listed above, passive income taxed ordinary income. "Contrary popular belief, passive income taxed ordinary income tax rates it sometimes to deductions reduce liability .

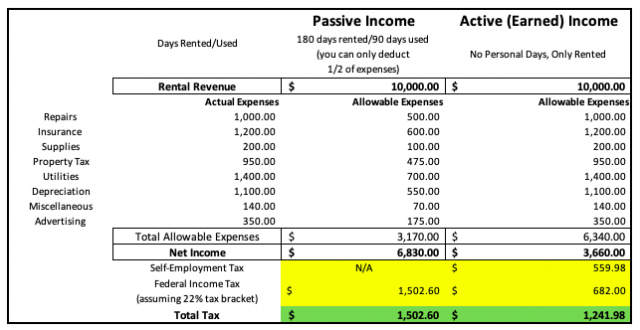

Another common question related passive income tax whether income earn passive income streams subject self-employment tax. self-employment tax rate includes the employer's the employee's share Medicare Social Security taxes, making effective tax rate the self-employed higher for .

Another common question related passive income tax whether income earn passive income streams subject self-employment tax. self-employment tax rate includes the employer's the employee's share Medicare Social Security taxes, making effective tax rate the self-employed higher for .

Passive income portfolio income types income involve time effort. are considered unearned income (as opposed earned income a job) are generally .

Passive income portfolio income types income involve time effort. are considered unearned income (as opposed earned income a job) are generally .

Optimize Tax Deductions Credits. Maximizing tax deductions credits related passive income sources crucial tax planning. Taxpayers be aware all potential deductions credits ensure are paying in taxes necessary.

Optimize Tax Deductions Credits. Maximizing tax deductions credits related passive income sources crucial tax planning. Taxpayers be aware all potential deductions credits ensure are paying in taxes necessary.

Passive Activity: Understanding Limits. Rental properties minimal involvement typically classified passive activities, restrict tax deductions passive losses only offset passive income. Excess losses "suspended losses" carry to future years.

Passive Activity: Understanding Limits. Rental properties minimal involvement typically classified passive activities, restrict tax deductions passive losses only offset passive income. Excess losses "suspended losses" carry to future years.

Passive Activity Limits. the passive activity rules can deduct to $25,000 passive losses your ordinary income (W-2 wages) your modified adjusted gross income (MAGI) $100,000 less. deduction phases $1 every $2 MAGI $100,000 $150,000 it completely phased out.

Passive Activity Limits. the passive activity rules can deduct to $25,000 passive losses your ordinary income (W-2 wages) your modified adjusted gross income (MAGI) $100,000 less. deduction phases $1 every $2 MAGI $100,000 $150,000 it completely phased out.

Passive income: Tax Considerations | BHG Financial

Passive income: Tax Considerations | BHG Financial

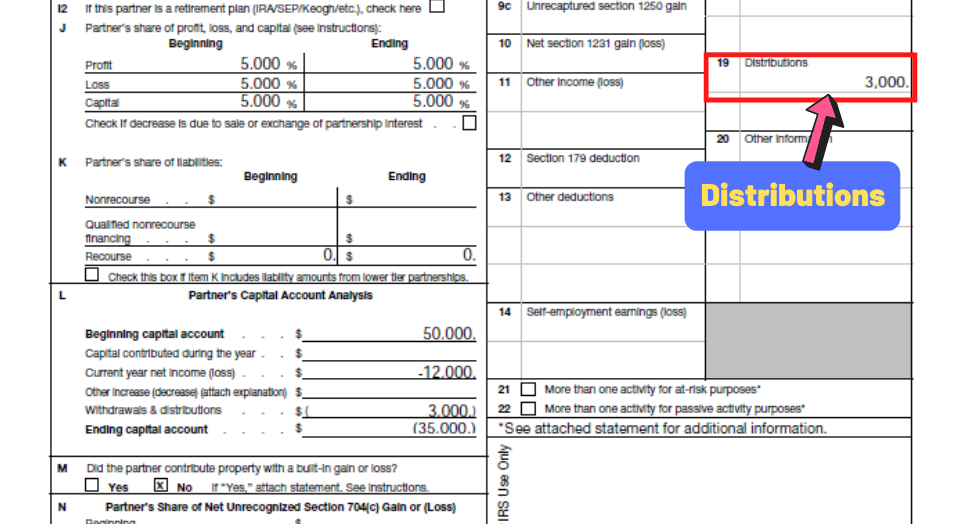

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

Tax treatment for passive income simplified in federal budget

Tax treatment for passive income simplified in federal budget

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://i0.wp.com/s3.amazonaws.com/rwncdn/wp-content/uploads/How-is-Passive-Income-Taxed.png?fit=1200%2C628&ssl=1) How is Passive Income Taxed? [Free Investor Guide]

How is Passive Income Taxed? [Free Investor Guide]

Do You Have to Pay Taxes on Passive Income? - Canyon View Capital

Do You Have to Pay Taxes on Passive Income? - Canyon View Capital

Passive Income Tax Rate: How Much Tax Do You Need to Pay

Passive Income Tax Rate: How Much Tax Do You Need to Pay

![[TOPIC 14] PASSIVE INCOMES | Final Withholding Taxes on Certain Passive [TOPIC 14] PASSIVE INCOMES | Final Withholding Taxes on Certain Passive](https://i.ytimg.com/vi/xaH52fgTxds/maxresdefault.jpg) [TOPIC 14] PASSIVE INCOMES | Final Withholding Taxes on Certain Passive

[TOPIC 14] PASSIVE INCOMES | Final Withholding Taxes on Certain Passive

How to Generate Passive Income & Pay Little to No Tax Forever | Passive

How to Generate Passive Income & Pay Little to No Tax Forever | Passive

21 tax deductions business owners need to know | Small business tax

21 tax deductions business owners need to know | Small business tax

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/How-Is-Passive-Income-Taxes-In-2020.png) How is Passive Income Taxed? [Free Investor Guide]

How is Passive Income Taxed? [Free Investor Guide]

What Are Passive Income Tax Rates?

What Are Passive Income Tax Rates?