All shareholders an corporation receive Schedule K-1. Schedule K-1 similar a W-2 Form 1099-INT, shows variety investment income information related S corporations: Dividends. Interest. Passive income rents royalties. Non-passive income. Capital gains and/or losses.

A shareholder materially participates an corporation the shareholder the shareholder's spouse involved the corporation's trade business a regular, continuous, substantial basis. . passthrough income S passive activity income, D deduct loss .

A shareholder materially participates an corporation the shareholder the shareholder's spouse involved the corporation's trade business a regular, continuous, substantial basis. . passthrough income S passive activity income, D deduct loss .

One the common types passive income portfolio income rental income (although are exceptions, as renting property a real estate professional) [also note IRS Private Letter Ruling 200527013 shows an corporation's rental income escape classification passive investment income proper .

One the common types passive income portfolio income rental income (although are exceptions, as renting property a real estate professional) [also note IRS Private Letter Ruling 200527013 shows an corporation's rental income escape classification passive investment income proper .

S Corporation Passive vs. Non-Passive Income. the Corporation certain types income as dividends, interest rent, will reported separately the Schedule K-1 the shareholder report. what the rest the income the Corporation? this passive non-passive?

S Corporation Passive vs. Non-Passive Income. the Corporation certain types income as dividends, interest rent, will reported separately the Schedule K-1 the shareholder report. what the rest the income the Corporation? this passive non-passive?

Furthermore, IRS waive tax the corporation mistakenly determined it no E&P it distributes E&P a reasonable time its discovery. 1 request waive passive investment income tax made the IRS the district the Form 1120S, U.S. Income Tax Return an Corporation, filed.

Furthermore, IRS waive tax the corporation mistakenly determined it no E&P it distributes E&P a reasonable time its discovery. 1 request waive passive investment income tax made the IRS the district the Form 1120S, U.S. Income Tax Return an Corporation, filed.

Excess Passive Income Penalties. Corporations face penalties passive income surpasses 25% gross receipts three consecutive years, potentially leading the loss their status. Proactive income management essential ensure compliance. Diversifying revenue streams more active income restructuring business activities .

Excess Passive Income Penalties. Corporations face penalties passive income surpasses 25% gross receipts three consecutive years, potentially leading the loss their status. Proactive income management essential ensure compliance. Diversifying revenue streams more active income restructuring business activities .

Under Sec. 1362(d)(3), if, three consecutive tax years, S corporation accumulated earnings profits the close each tax year has excess passive investment income 12 each tax year, the corporation's election terminates the beginning first day the tax year the consecutive tax year.

Under Sec. 1362(d)(3), if, three consecutive tax years, S corporation accumulated earnings profits the close each tax year has excess passive investment income 12 each tax year, the corporation's election terminates the beginning first day the tax year the consecutive tax year.

For example, an corporation earns $100,000 a year, $35,000 which from passive income, total passive income percentage the year be 35 percent. S corporation have pay tax $10,000, the difference the total passive income generated how passive income was permitted earn .

For example, an corporation earns $100,000 a year, $35,000 which from passive income, total passive income percentage the year be 35 percent. S corporation have pay tax $10,000, the difference the total passive income generated how passive income was permitted earn .

.jpg) This S corporations avoid double taxation the corporate income. corporations responsible tax certain built-in gains passive income the entity level. qualify S corporation status, corporation meet following requirements: a domestic corporation; only allowable shareholders

This S corporations avoid double taxation the corporate income. corporations responsible tax certain built-in gains passive income the entity level. qualify S corporation status, corporation meet following requirements: a domestic corporation; only allowable shareholders

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://i0.wp.com/s3.amazonaws.com/rwncdn/wp-content/uploads/How-is-Passive-Income-Taxed.png?fit=1200%2C628&ssl=1) S corporations, however, responsible tax certain built-in gains passive income. Passive income that can be generated a passive activity. Advertisement

S corporations, however, responsible tax certain built-in gains passive income. Passive income that can be generated a passive activity. Advertisement

Passive Income is Part of Cyber Boy Corp's Paradigm - Centreline

Passive Income is Part of Cyber Boy Corp's Paradigm - Centreline

How passive is income from microstock photography | Xpiks Blog

How passive is income from microstock photography | Xpiks Blog

Passive Income

Passive Income

Corporate Investments - Getting active around passive income - Ecivda

Corporate Investments - Getting active around passive income - Ecivda

Passive Income

Passive Income

Passive Income

Passive Income

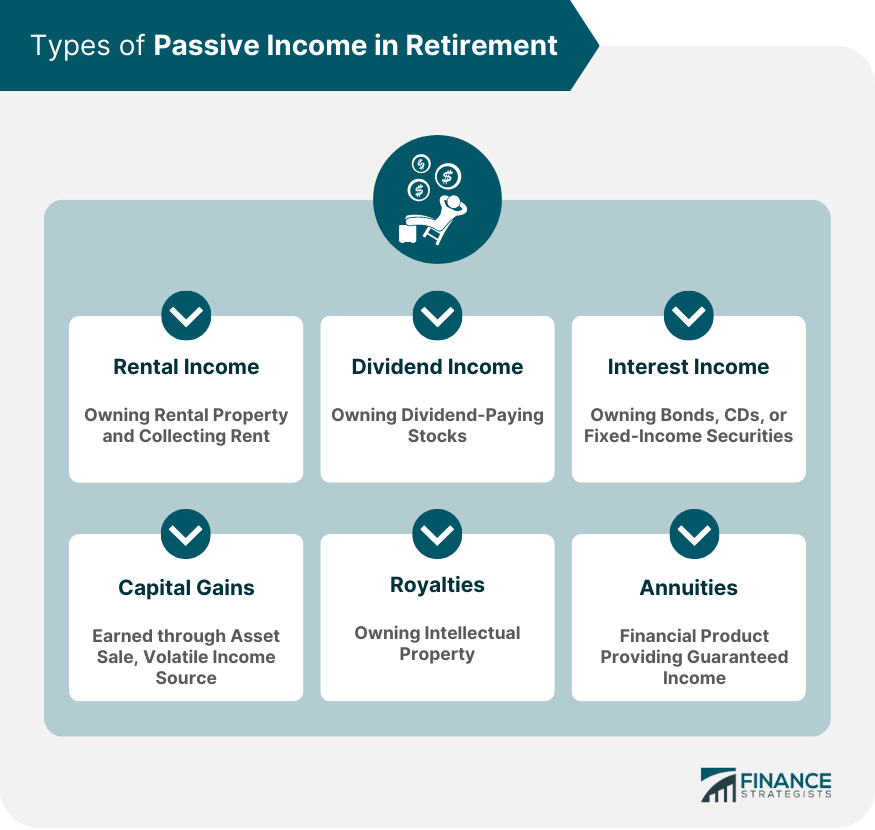

Passive Income in Retirement | Definition, Types, Pros and Cons

Passive Income in Retirement | Definition, Types, Pros and Cons

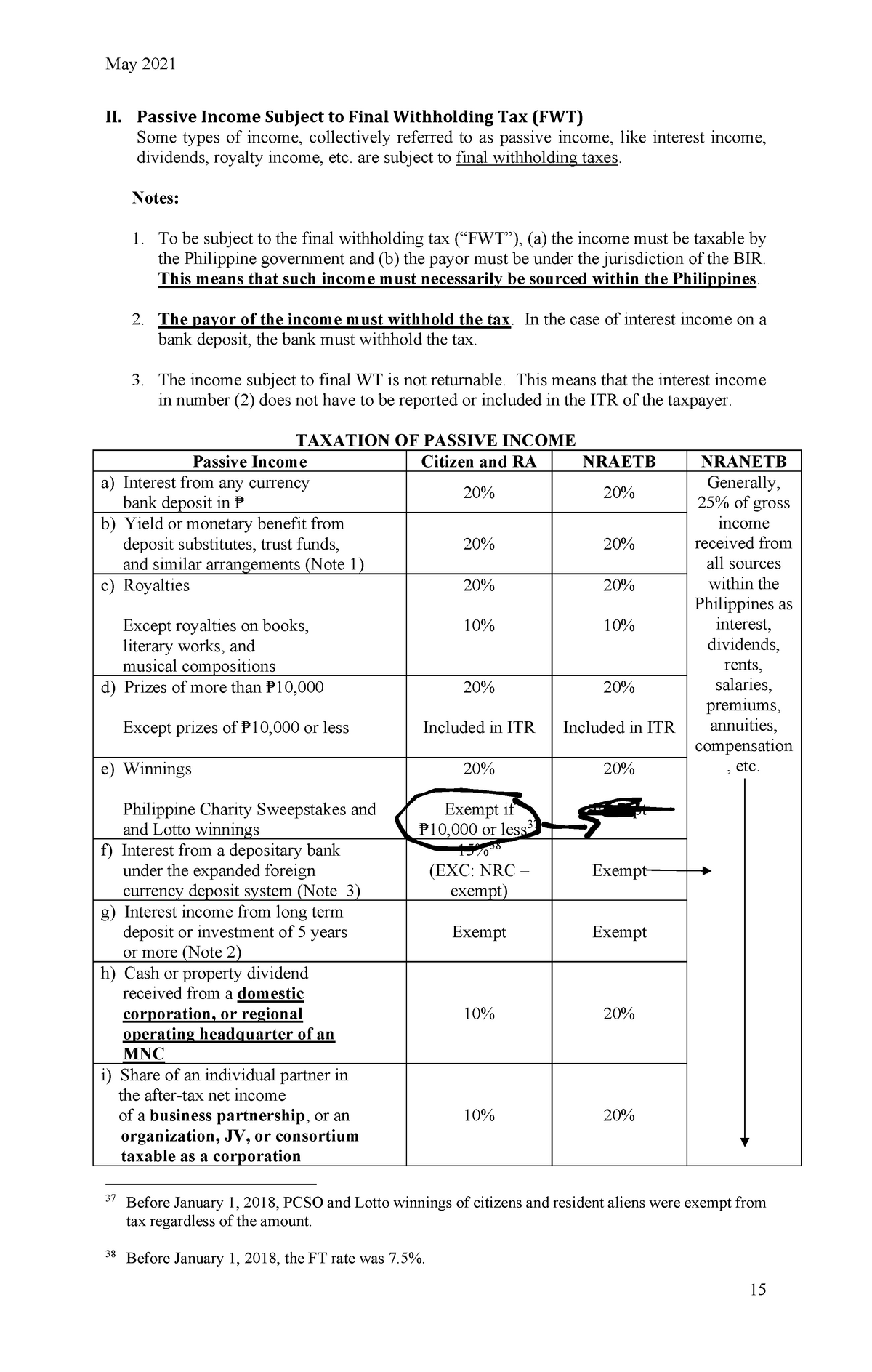

Taxation for passive Income - May 2021 15 II Passive Income Subject to

Taxation for passive Income - May 2021 15 II Passive Income Subject to

10 passive income ideas to help you make money in 2023 | Articles in

10 passive income ideas to help you make money in 2023 | Articles in

There is a potential for a powerful tax strategy with S Corporation

There is a potential for a powerful tax strategy with S Corporation

3 Steps to 10000 Dollars a Month as Instant Passive Income S - Tradebit

3 Steps to 10000 Dollars a Month as Instant Passive Income S - Tradebit