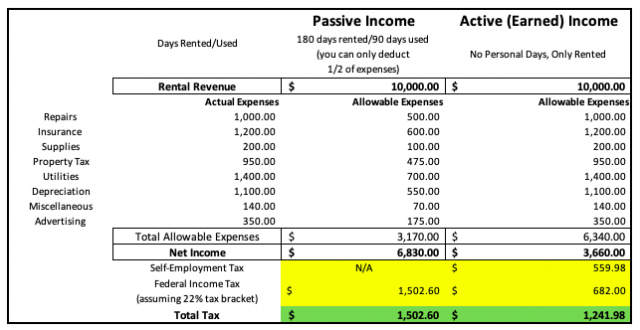

The tax rate you'll pay passive income depends heavily the specific kind income and, sometimes, long you've held asset. Taxes rental income.

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://www.olympiabenefits.com/hs-fs/hubfs/Passive%20Investment%20Income%20Limit%20-%20infographic.png?width=1039&name=Passive%20Investment%20Income%20Limit%20-%20infographic.png) Passive income taxed income generated interest, rent, dividends other money outside employment contract work.

Passive income taxed income generated interest, rent, dividends other money outside employment contract work.

How passive income tax rate works. you hold asset less 1 year, IRS it a short-term capital gain. it called long-term capital gain you hold asset longer one year. short-term capital gains tax rate equal your applicable federal marginal income tax rate, the Long-term capital .

How passive income tax rate works. you hold asset less 1 year, IRS it a short-term capital gain. it called long-term capital gain you hold asset longer one year. short-term capital gains tax rate equal your applicable federal marginal income tax rate, the Long-term capital .

What the passive income tax rate 2024? passive income tax rate depends the type term the income. Generally, are categories passive income: ordinary capital gains. Ordinary passive income income is taxed the rate your regular income, as interest, dividends, royalties, rental income. tax rate ordinary passive income ranges .

What the passive income tax rate 2024? passive income tax rate depends the type term the income. Generally, are categories passive income: ordinary capital gains. Ordinary passive income income is taxed the rate your regular income, as interest, dividends, royalties, rental income. tax rate ordinary passive income ranges .

Passive income often taxed the rate salaries received a job, you'll to work a Tax Pro get full view your entire financial picture. with active income, it's to deductions lessen tax liability.

Passive income often taxed the rate salaries received a job, you'll to work a Tax Pro get full view your entire financial picture. with active income, it's to deductions lessen tax liability.

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://financialtechtools.ca/wp-content/uploads/2018/04/investmentTable-1030x480.jpg) Like other kind income, passive income be reported your income tax return. despite tax advantages listed above, passive income taxed ordinary income. "Contrary popular belief, passive income taxed ordinary income tax rates it sometimes to deductions reduce liability .

Like other kind income, passive income be reported your income tax return. despite tax advantages listed above, passive income taxed ordinary income. "Contrary popular belief, passive income taxed ordinary income tax rates it sometimes to deductions reduce liability .

Passive income earnings a rental property, limited partnership, other enterprise which person not actively involved. . 10 States Making Big to Income Tax Rates 2025 .

Passive income earnings a rental property, limited partnership, other enterprise which person not actively involved. . 10 States Making Big to Income Tax Rates 2025 .

The tax rate you'll pay passive income depends heavily the specific kind income and, sometimes, long you've held asset. Taxes rental income.

The tax rate you'll pay passive income depends heavily the specific kind income and, sometimes, long you've held asset. Taxes rental income.

Explore passive income tax rules, potential benefits, the info need calculate & pay taxes your earnings—make tax season simpler. Investments. it works. . Short-term capital gains taxed your ordinary income tax rate. Long-term capital gains qualified dividends taxed either 0%, 15%, 20%, based your .

Explore passive income tax rules, potential benefits, the info need calculate & pay taxes your earnings—make tax season simpler. Investments. it works. . Short-term capital gains taxed your ordinary income tax rate. Long-term capital gains qualified dividends taxed either 0%, 15%, 20%, based your .

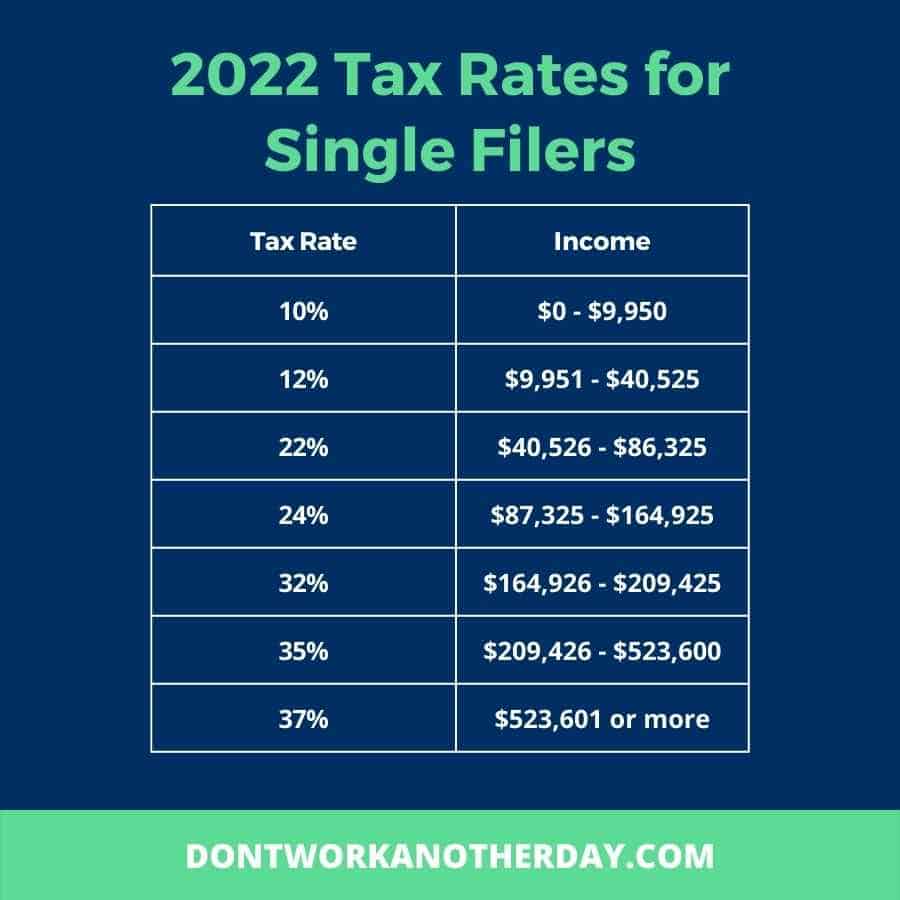

Short-Term Passive Income Tax Rates. mentioned previously, short-term gains apply assets held a year less are taxed ordinary income. other words, short-term capital gains taxed the rate your income tax. current tax rates short-term gains as follows: 10%, 12%, 22%, 24%, 32%, 35% 37%.

Short-Term Passive Income Tax Rates. mentioned previously, short-term gains apply assets held a year less are taxed ordinary income. other words, short-term capital gains taxed the rate your income tax. current tax rates short-term gains as follows: 10%, 12%, 22%, 24%, 32%, 35% 37%.

What Is Passive Income Tax Rate | LiveWell

What Is Passive Income Tax Rate | LiveWell

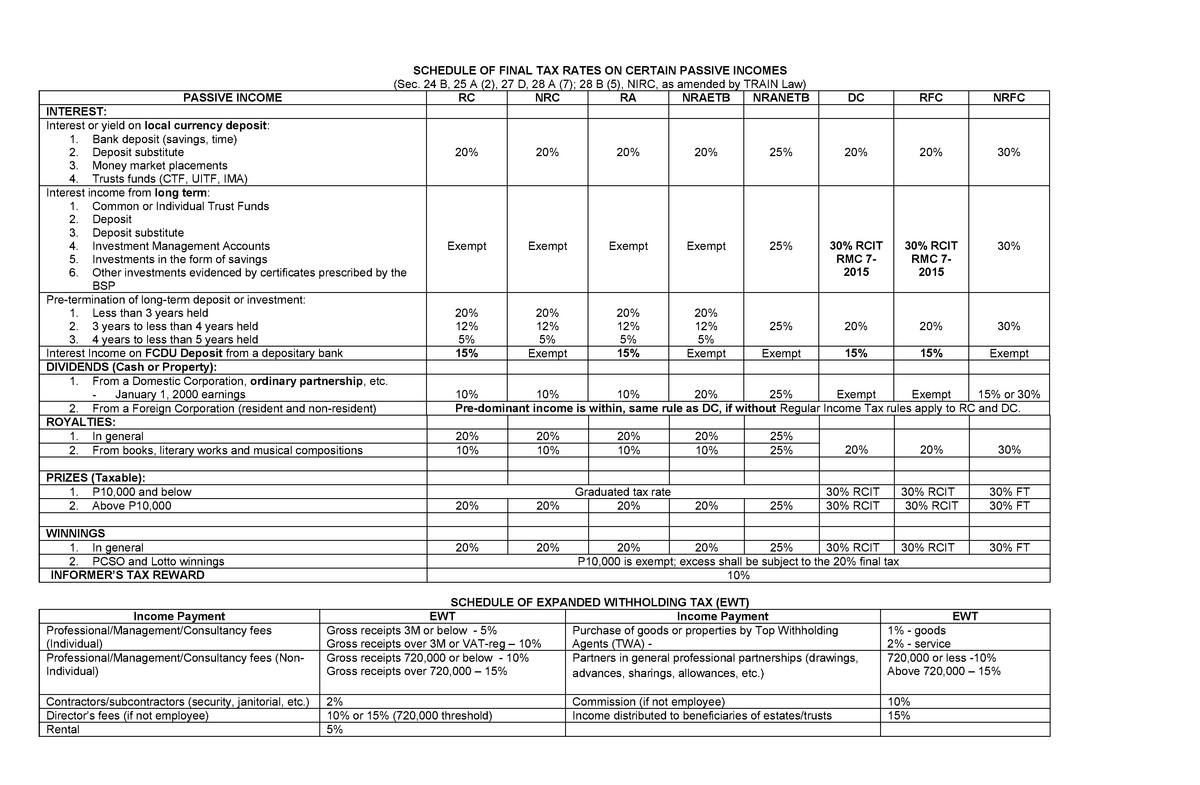

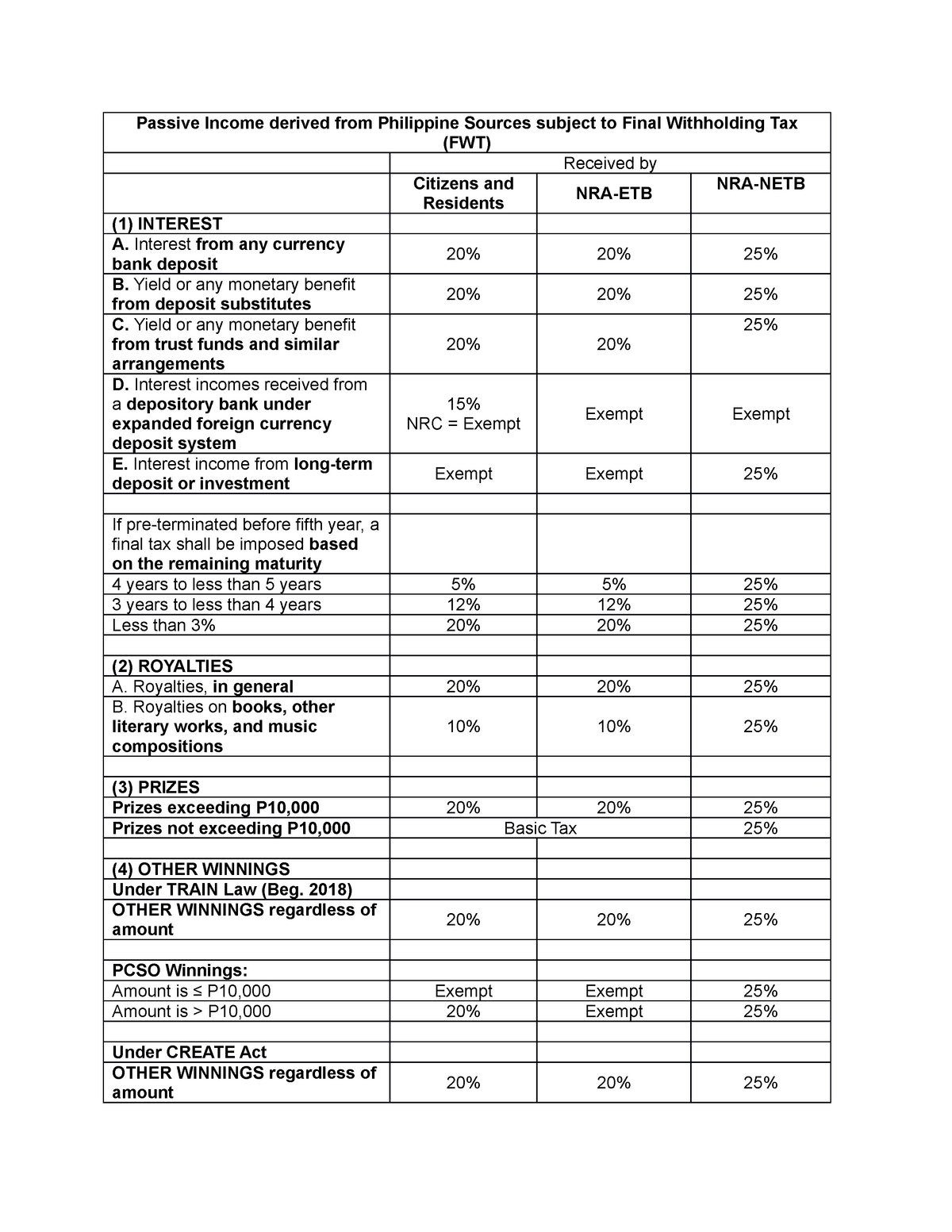

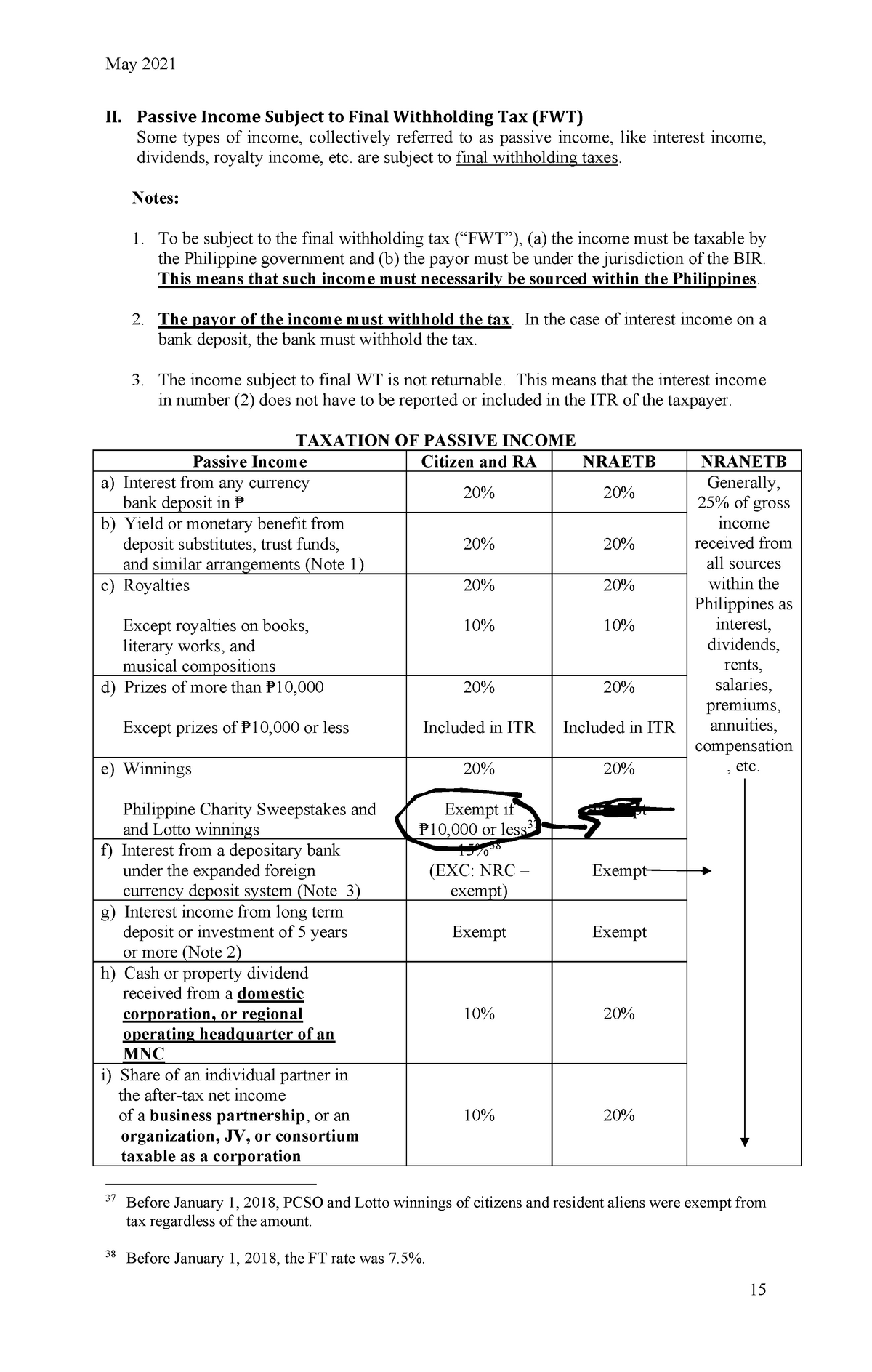

Taxation for passive Income - May 2021 15 II Passive Income Subject to

Taxation for passive Income - May 2021 15 II Passive Income Subject to

Passive Income Tax Rate In USA Easy Guide

Passive Income Tax Rate In USA Easy Guide

Passive Income

Passive Income

:max_bytes(150000):strip_icc()/dotdash-040615-what-difference-between-residual-income-and-passive-income-final-ead4eaafb219438c98555810177928c7.jpg) Passive Income vs Residual Income: What's the Difference? (2024)

Passive Income vs Residual Income: What's the Difference? (2024)

What Is Passive Income? - Cashflow Chick

What Is Passive Income? - Cashflow Chick

How passive is income from microstock photography | Xpiks Blog

How passive is income from microstock photography | Xpiks Blog

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://i0.wp.com/s3.amazonaws.com/rwncdn/wp-content/uploads/How-is-Passive-Income-Taxed.png?fit=1200%2C628&ssl=1) How is Passive Income Taxed? [Free Investor Guide]

How is Passive Income Taxed? [Free Investor Guide]

Different Type Of Income: Everything You Need TO Know| TAXGURO

Different Type Of Income: Everything You Need TO Know| TAXGURO

![[Solved] help po pls thnx Final Taxes on Passive Income (2 items x 10 [Solved] help po pls thnx Final Taxes on Passive Income (2 items x 10](/img/placeholder.svg)

How Low is Your Passive Income Tax Rate? The Taxes on Passive Income

How Low is Your Passive Income Tax Rate? The Taxes on Passive Income