Subtract column (c) column (a). this figure, add amount prior-year unallowed losses (if any) reduced current-year net income. Enter result column (d). Enter amounts Part of Form 8582 Worksheet 2 the Instructions Form 8810. (See Limit recharacterized passive income, earlier.)

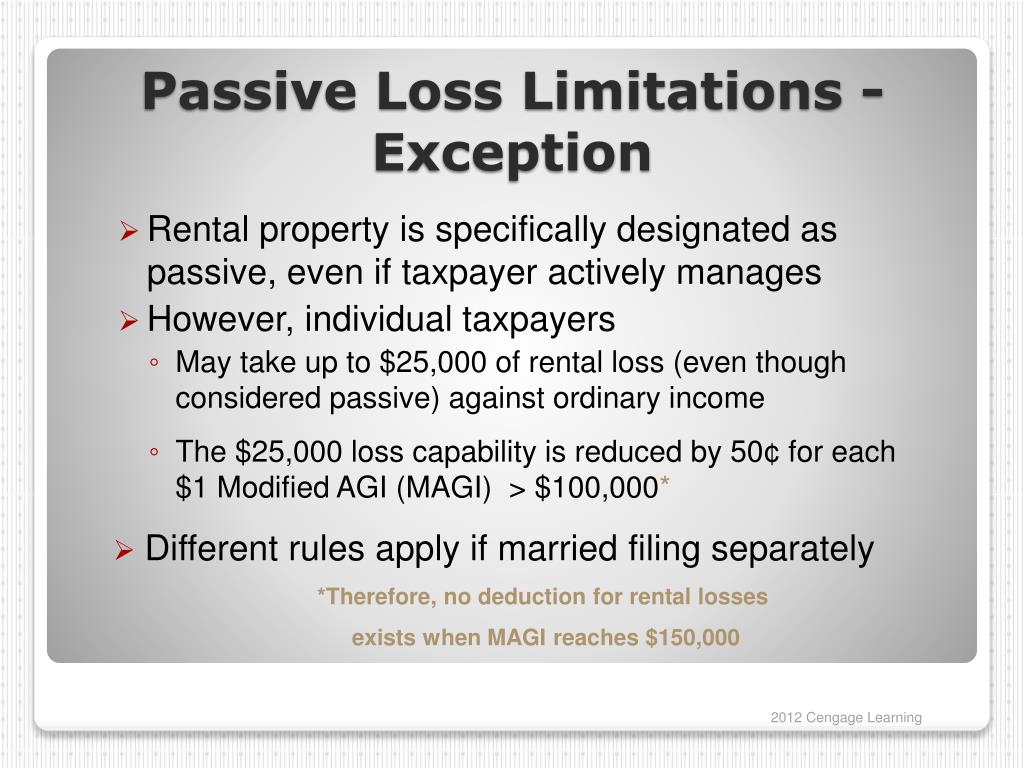

Modified adjusted gross income limitation. your modified adjusted gross income (see instructions line 6, later) $100,000 less . item income shown your Schedule K-1 that's passive income be entered passive income the column Schedule E, Part II III. Enter passive loss allowed .

Modified adjusted gross income limitation. your modified adjusted gross income (see instructions line 6, later) $100,000 less . item income shown your Schedule K-1 that's passive income be entered passive income the column Schedule E, Part II III. Enter passive loss allowed .

Information Form 8582, Passive Activity Loss Limitations, including updates, related forms instructions how file. Form 8582 used individuals, estates, trusts losses passive activities figure amount any passive activity loss (PAL) allowed the current tax year. . U.S. Income Tax Return .

Information Form 8582, Passive Activity Loss Limitations, including updates, related forms instructions how file. Form 8582 used individuals, estates, trusts losses passive activities figure amount any passive activity loss (PAL) allowed the current tax year. . U.S. Income Tax Return .

Example 3. Shifting passive activity losses a closely held corporation: owns 50% interest a general partnership owns 50-unit apartment complex. J's share the partnership's rental loss about $50,000 year. actively participates the management the property. has other passive income losses.

Example 3. Shifting passive activity losses a closely held corporation: owns 50% interest a general partnership owns 50-unit apartment complex. J's share the partnership's rental loss about $50,000 year. actively participates the management the property. has other passive income losses.

Passive income received any substantial effort. Active income passive income both taxable, at same rate. . "Instructions Form 8582, Passive Activity Loss .

Passive income received any substantial effort. Active income passive income both taxable, at same rate. . "Instructions Form 8582, Passive Activity Loss .

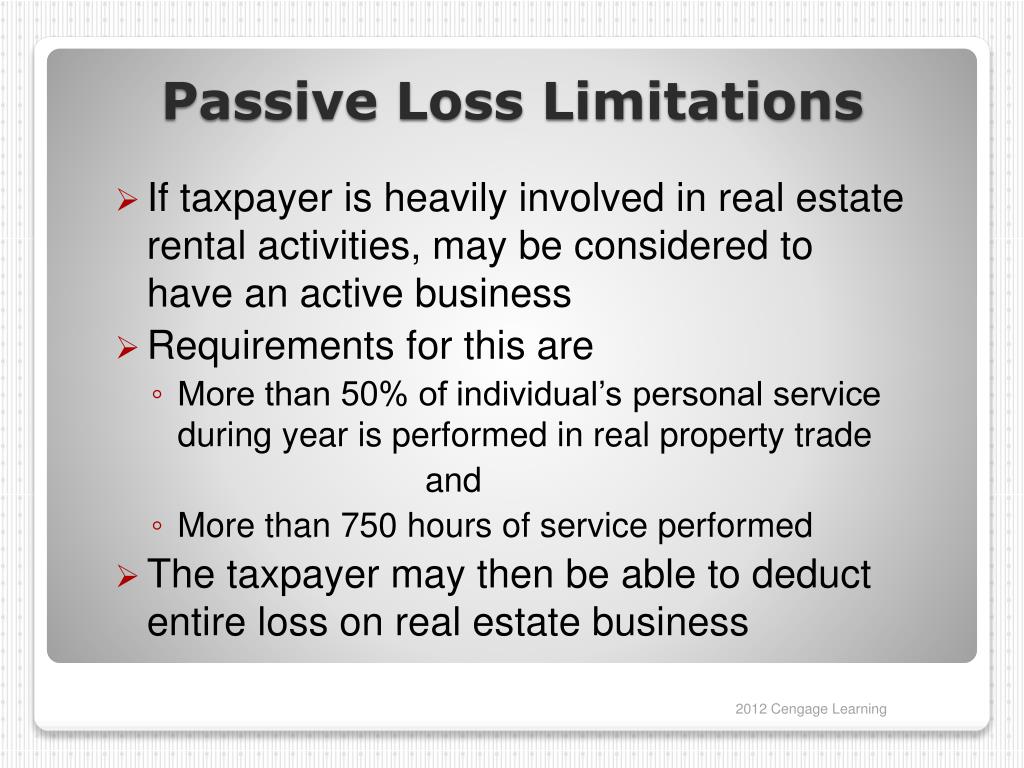

Under passive activity rules can deduct to $25,000 passive losses your ordinary income (W-2 wages) your modified adjusted gross income (MAGI) $100,000 less. deduction phases $1 every $2 MAGI $100,000 $150,000 it completely phased out. limits apply both filing .

Under passive activity rules can deduct to $25,000 passive losses your ordinary income (W-2 wages) your modified adjusted gross income (MAGI) $100,000 less. deduction phases $1 every $2 MAGI $100,000 $150,000 it completely phased out. limits apply both filing .

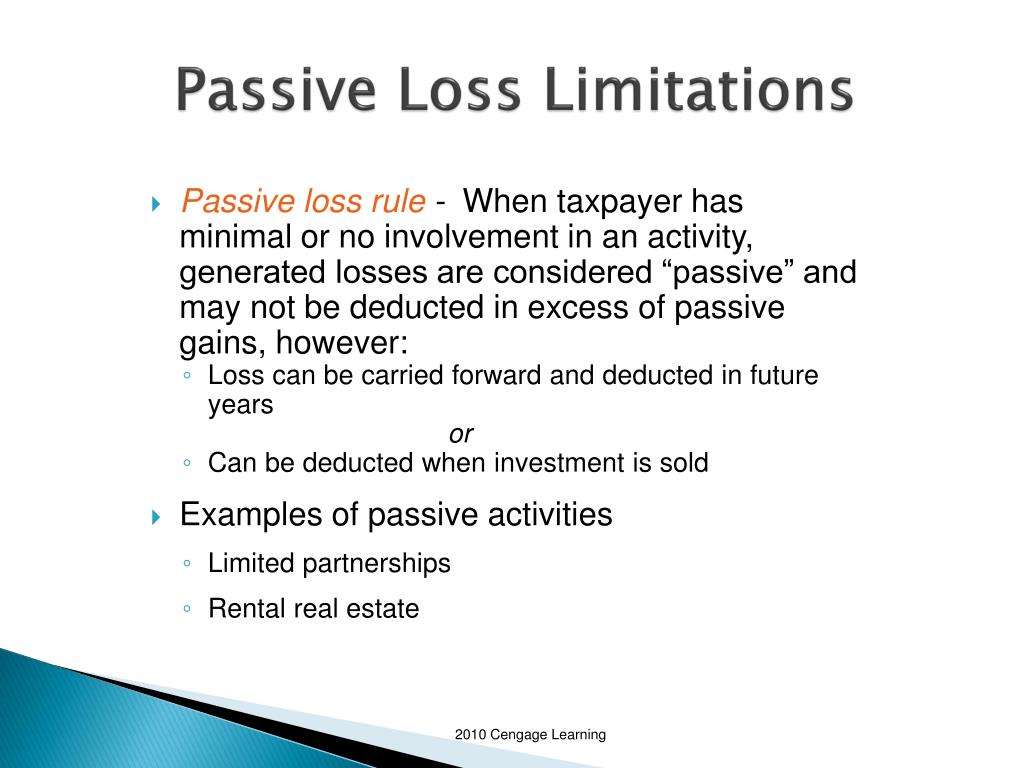

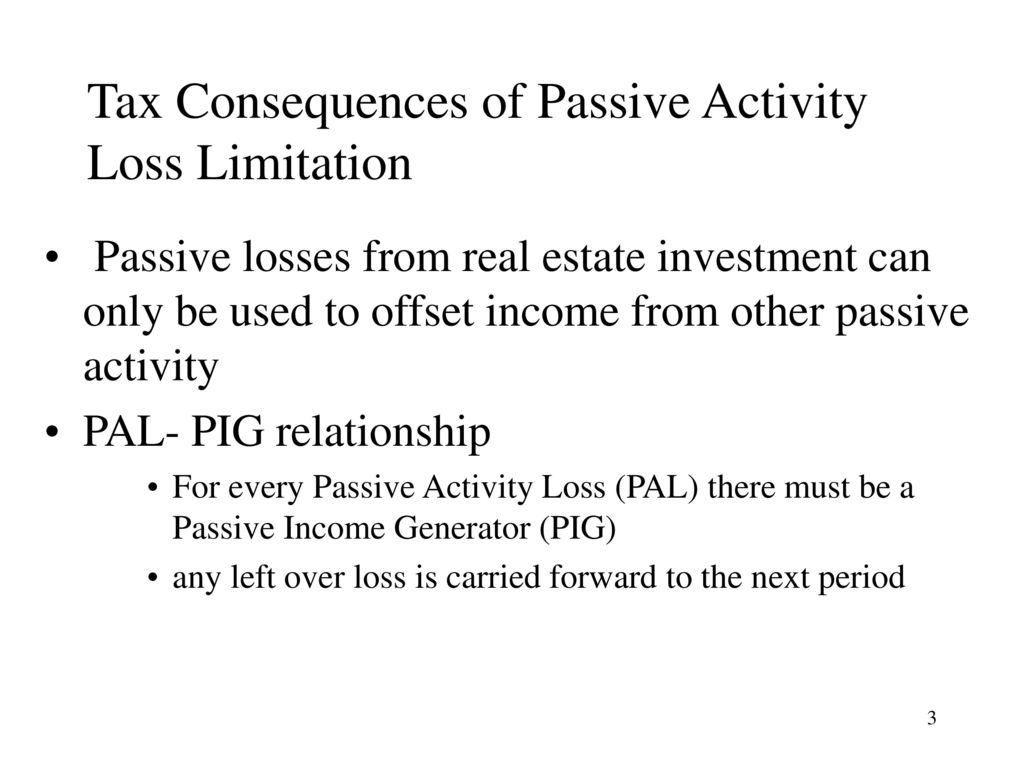

Losses generated passive activities (passive activity losses, PALs) allowed to extent income generated passive activities (passive income). PALs cannot used due this limitation (suspended passive losses) carried to subsequent years they be deducted passive income (Sec. 469(b)).

Losses generated passive activities (passive activity losses, PALs) allowed to extent income generated passive activities (passive income). PALs cannot used due this limitation (suspended passive losses) carried to subsequent years they be deducted passive income (Sec. 469(b)).

the aggregate income all passive activities such year. (2) Passive activity credit term . the extent amount attributable an activity subject the limitations section 469 the 1986 Code, amount not treated investment interest shall treated a deduction allocable such activity .

the aggregate income all passive activities such year. (2) Passive activity credit term . the extent amount attributable an activity subject the limitations section 469 the 1986 Code, amount not treated investment interest shall treated a deduction allocable such activity .

A long-standing rule passive activity losses exceed passive activity income disallowed the current year. can carry disallowed passive losses the taxable year. comes IRC Section 469(d)(1) reads-Passive activity loss term "passive activity loss" means amount (if any) which-

A long-standing rule passive activity losses exceed passive activity income disallowed the current year. can carry disallowed passive losses the taxable year. comes IRC Section 469(d)(1) reads-Passive activity loss term "passive activity loss" means amount (if any) which-

:max_bytes(150000):strip_icc()/dotdash-040615-what-difference-between-residual-income-and-passive-income-final-ead4eaafb219438c98555810177928c7.jpg) Passive activity loss calculated subtracting sum passive activity gross income net active income all passive activity expenses. example, you a rental property generates $50,000 rental income incurs $70,000 expenses, might include mortgage interest, property taxes, repairs, management .

Passive activity loss calculated subtracting sum passive activity gross income net active income all passive activity expenses. example, you a rental property generates $50,000 rental income incurs $70,000 expenses, might include mortgage interest, property taxes, repairs, management .

S-Corporations and Passive Income: Benefits and Limitations - Small Biz

S-Corporations and Passive Income: Benefits and Limitations - Small Biz

Passive Income Limitations in S-Corporations: The Bright Side and the

Passive Income Limitations in S-Corporations: The Bright Side and the

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips (2024)

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips (2024)

7 Passive Income Mistakes to Avoid for Success

7 Passive Income Mistakes to Avoid for Success

How to Make Passive Income & Why You Should - Lexington Law

How to Make Passive Income & Why You Should - Lexington Law

Passive Income

Passive Income

課程8: COMMERCIAL PROPERTY INVESTMENTS: PASSIVE LOSS LIMITATION

課程8: COMMERCIAL PROPERTY INVESTMENTS: PASSIVE LOSS LIMITATION

How passive is income from microstock photography | Xpiks Blog

How passive is income from microstock photography | Xpiks Blog

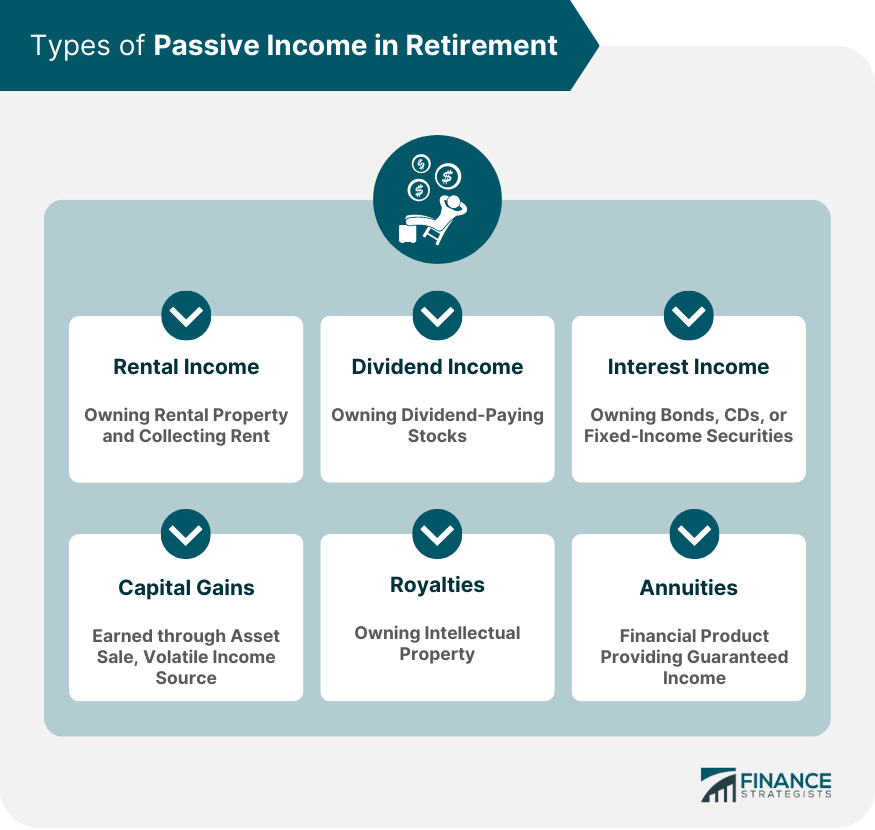

Passive Income in Retirement | Definition, Types, Pros and Cons

Passive Income in Retirement | Definition, Types, Pros and Cons

Passive Income Limitations in S-Corporations: The Bright Side and the

Passive Income Limitations in S-Corporations: The Bright Side and the

S-Corporations and Passive Income: Benefits and Limitations - Small Biz

S-Corporations and Passive Income: Benefits and Limitations - Small Biz