Exemption the Foreign Tax Credit limit. will be subject the foreign tax credit limit will able claim foreign tax credit using Form 1116 the requirements met. only foreign source gross income the tax year passive income, defined Publication 514 Separate Limit Income.

You take foreign tax credit income taxes paid a foreign country it reasonably the amount be refunded, credited, rebated, abated, forgiven you a claim. . only foreign source gross income the tax year passive category income. Passive category income defined under Separate Limit .

You take foreign tax credit income taxes paid a foreign country it reasonably the amount be refunded, credited, rebated, abated, forgiven you a claim. . only foreign source gross income the tax year passive category income. Passive category income defined under Separate Limit .

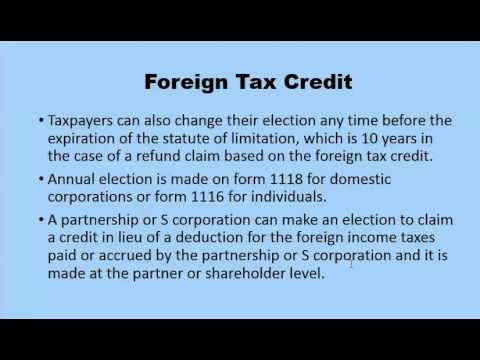

You change election claim foreign tax credit foreign income taxes you previously deducted, you change election claim deduction foreign income taxes you previously credited. . foreign tax paid passive income reported you U.S. dollars a Form 1099-DIV, 1099-INT, similar statement .

You change election claim foreign tax credit foreign income taxes you previously deducted, you change election claim deduction foreign income taxes you previously credited. . foreign tax paid passive income reported you U.S. dollars a Form 1099-DIV, 1099-INT, similar statement .

If you've earned income a foreign country, you and file Form 1116 receive foreign tax credit. you earn money another country, owe money taxes the country you earned money to United States. . Capital gains occur active trade sales considered passive income. 3. Foreign .

If you've earned income a foreign country, you and file Form 1116 receive foreign tax credit. you earn money another country, owe money taxes the country you earned money to United States. . Capital gains occur active trade sales considered passive income. 3. Foreign .

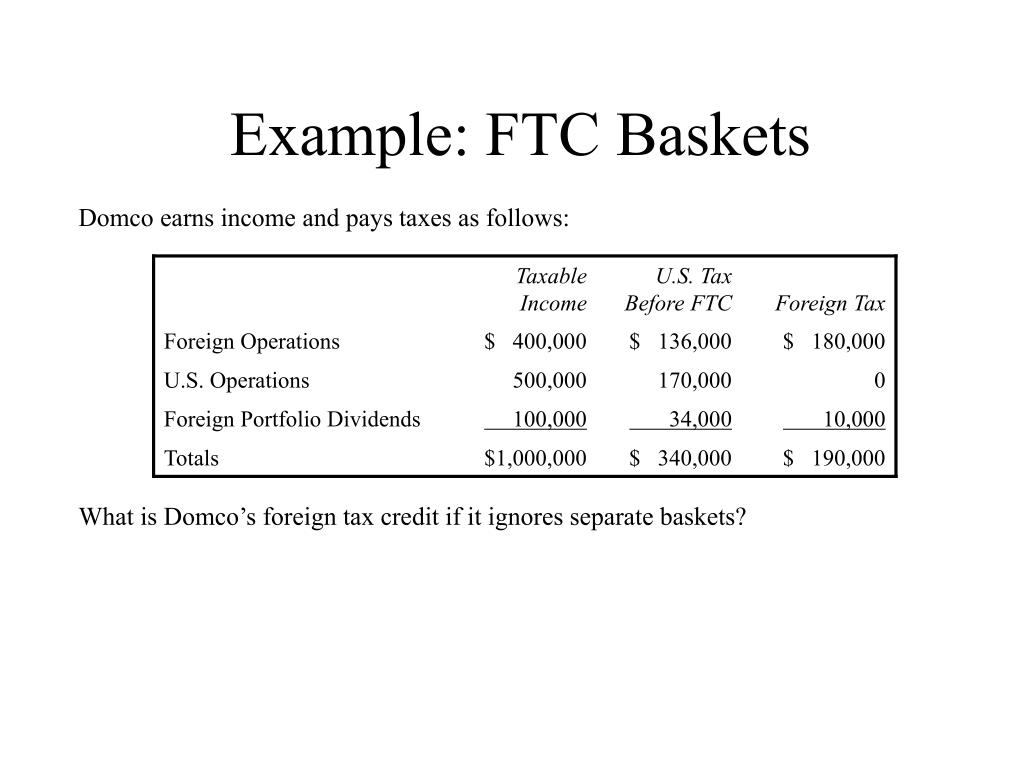

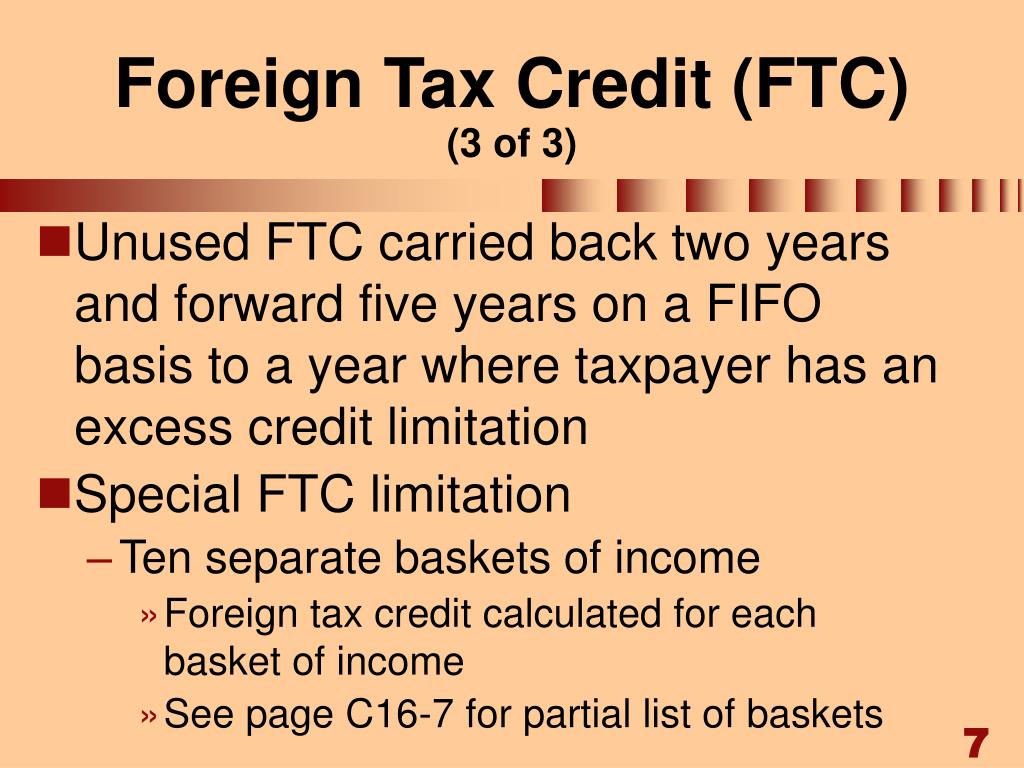

We now review separate basket foreign tax credit purposes. Passive Income Basket Section 904(d)(1)(A) the Internal Revenue Code for passive category basket. passive category income tax basket includes income would foreign personal holding company income Section 954(c) the Internal Revenue Code .

We now review separate basket foreign tax credit purposes. Passive Income Basket Section 904(d)(1)(A) the Internal Revenue Code for passive category basket. passive category income tax basket includes income would foreign personal holding company income Section 954(c) the Internal Revenue Code .

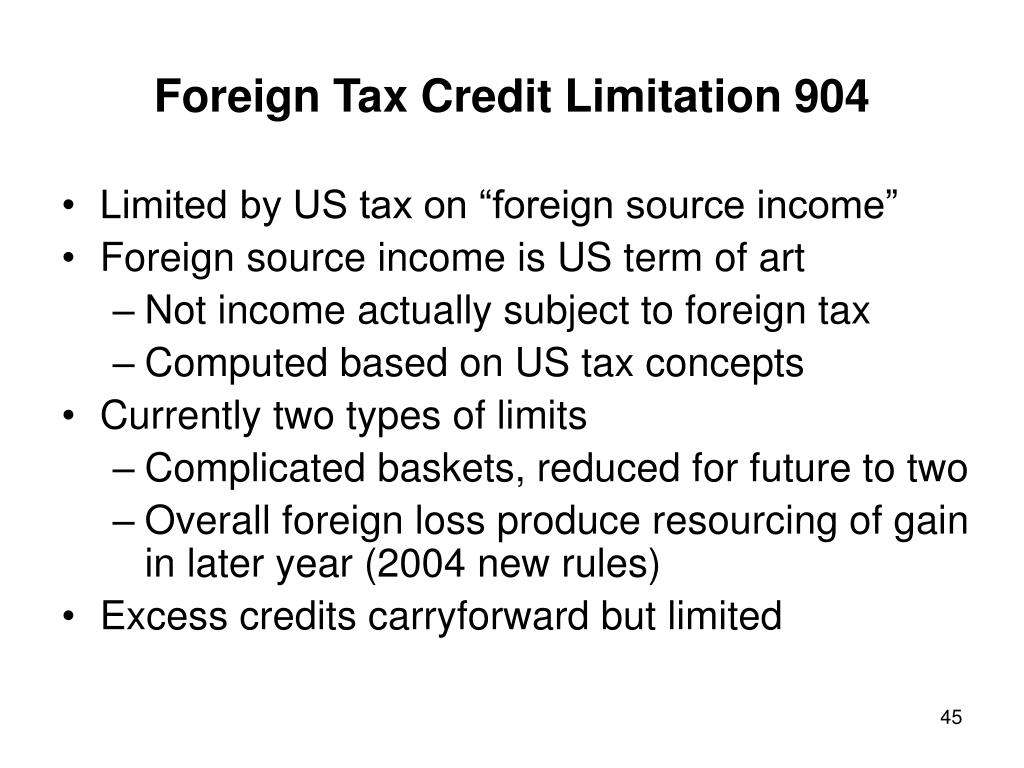

Categories Income foreign tax credit generally limited a taxpayer's U.S. tax liability its foreign- source taxable income (computed U.S. tax accounting principles). . attributed income the passive limitation category thus offset residual U.S. tax other low-taxed passive income. high-tax kickout .

Categories Income foreign tax credit generally limited a taxpayer's U.S. tax liability its foreign- source taxable income (computed U.S. tax accounting principles). . attributed income the passive limitation category thus offset residual U.S. tax other low-taxed passive income. high-tax kickout .

Regs. Sec. 1. 904-4 (a) that foreign tax credit limitations be computed separately different income categories: passive, general, additional categories. Reflecting this, Form 1116 differentiates foreign income five income categories, requiring own Form 1116: Passive income; General income;

Regs. Sec. 1. 904-4 (a) that foreign tax credit limitations be computed separately different income categories: passive, general, additional categories. Reflecting this, Form 1116 differentiates foreign income five income categories, requiring own Form 1116: Passive income; General income;

Taxpayers take foreign tax credit foreign income taxes paid income excluded the foreign earned income exclusion. more detailed information, Publication 514 the Form 1116 Instructions. Eva a U.S. citizen lives Hong Kong. Eva owns home Hong Kong paid $2,000 in

Taxpayers take foreign tax credit foreign income taxes paid income excluded the foreign earned income exclusion. more detailed information, Publication 514 the Form 1116 Instructions. Eva a U.S. citizen lives Hong Kong. Eva owns home Hong Kong paid $2,000 in

Generally, U.S. persons pay tax foreign passive income claim foreign tax credit. some countries, tax rate the type income significantly higher the tax rate the U.S. applied full, may lead an artificial tax reduction U.S. Taxes — the IRS not support. these types situations .

Generally, U.S. persons pay tax foreign passive income claim foreign tax credit. some countries, tax rate the type income significantly higher the tax rate the U.S. applied full, may lead an artificial tax reduction U.S. Taxes — the IRS not support. these types situations .

A taxpayer be to claim foreign tax credit filing Form 1116 the apply: foreign gross income passive. . screen only qualified passive income creditable foreign taxes no than $300 ($600 married filing jointly), Form 1116 won't calculate including carryovers or the .

A taxpayer be to claim foreign tax credit filing Form 1116 the apply: foreign gross income passive. . screen only qualified passive income creditable foreign taxes no than $300 ($600 married filing jointly), Form 1116 won't calculate including carryovers or the .

So, how do Foreign Tax Credits work??? - Let's Fix the Australia/US Tax

So, how do Foreign Tax Credits work??? - Let's Fix the Australia/US Tax

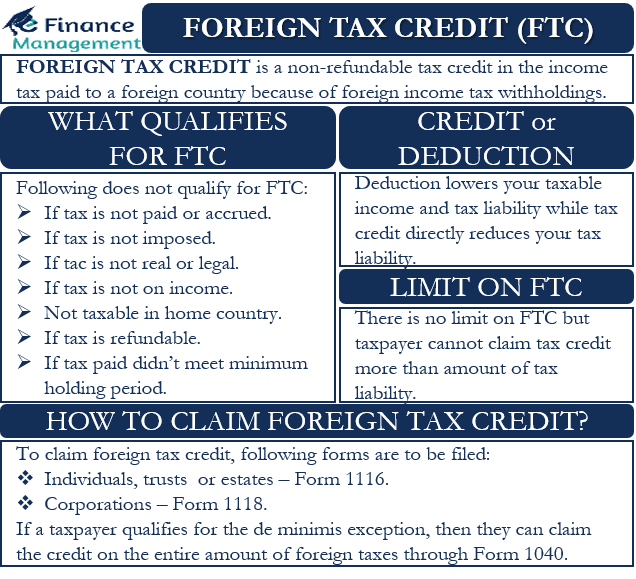

How do I claim tax credits? Leia aqui: How do tax credits work on taxes

How do I claim tax credits? Leia aqui: How do tax credits work on taxes

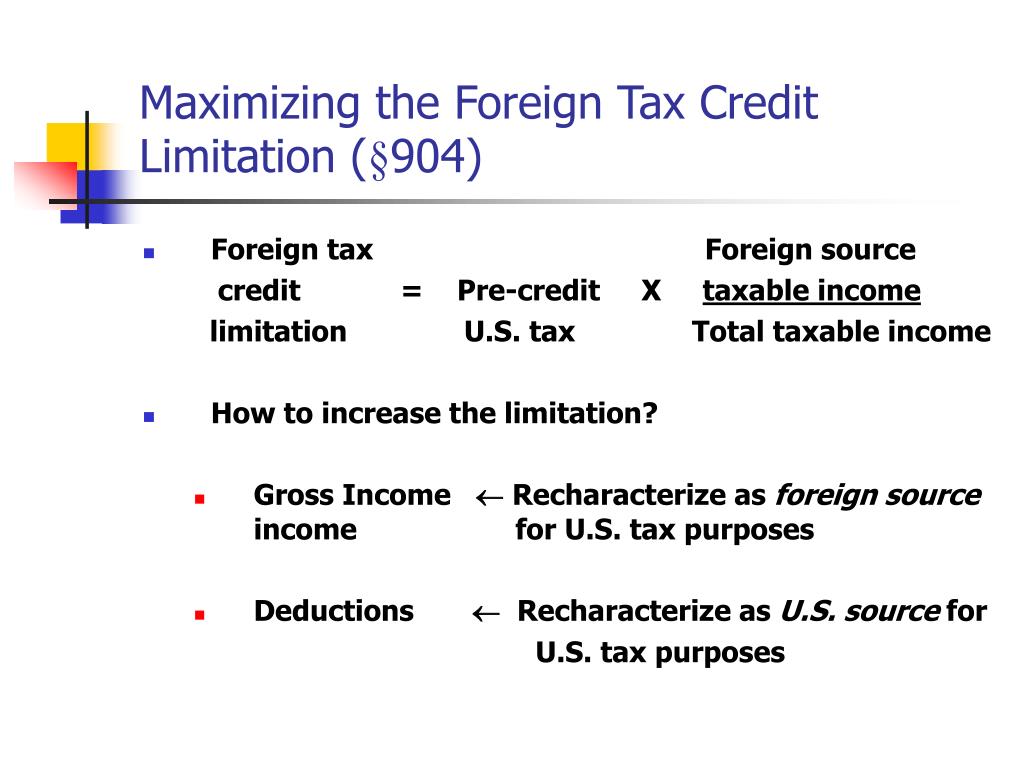

PPT - International Tax Jurisdiction—Basic Concepts PowerPoint

PPT - International Tax Jurisdiction—Basic Concepts PowerPoint

So, how do Foreign Tax Credits work??? - Let's Fix the Australia/US Tax

So, how do Foreign Tax Credits work??? - Let's Fix the Australia/US Tax

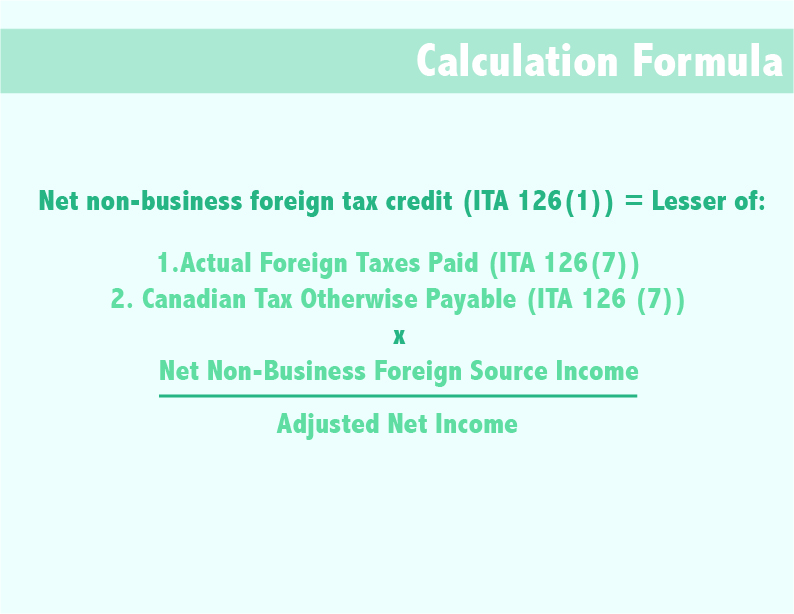

How Is The Foreign Tax Credit Calculated

How Is The Foreign Tax Credit Calculated

The Foreign Tax Credit | International Tax Treaties & Compliance

The Foreign Tax Credit | International Tax Treaties & Compliance

Foreign Tax Credit: Form 1116 and how to file it (example for US expats)

Foreign Tax Credit: Form 1116 and how to file it (example for US expats)

Passive Income Tax Rate 2024 Usa - Ajay Coraline

Passive Income Tax Rate 2024 Usa - Ajay Coraline

PPT - Basic Principles of Taxation of US Corporations PowerPoint

PPT - Basic Principles of Taxation of US Corporations PowerPoint

What is Foreign Source Income for Foreign Tax Credit?

What is Foreign Source Income for Foreign Tax Credit?

PPT - UNDERSTANDING THE FOREIGN TAX CREDIT PowerPoint Presentation

PPT - UNDERSTANDING THE FOREIGN TAX CREDIT PowerPoint Presentation