Capital gains assets held less a year taxed short-term gains ordinary income rates. Capital gains assets held more a year taxed long-term gains enjoy .

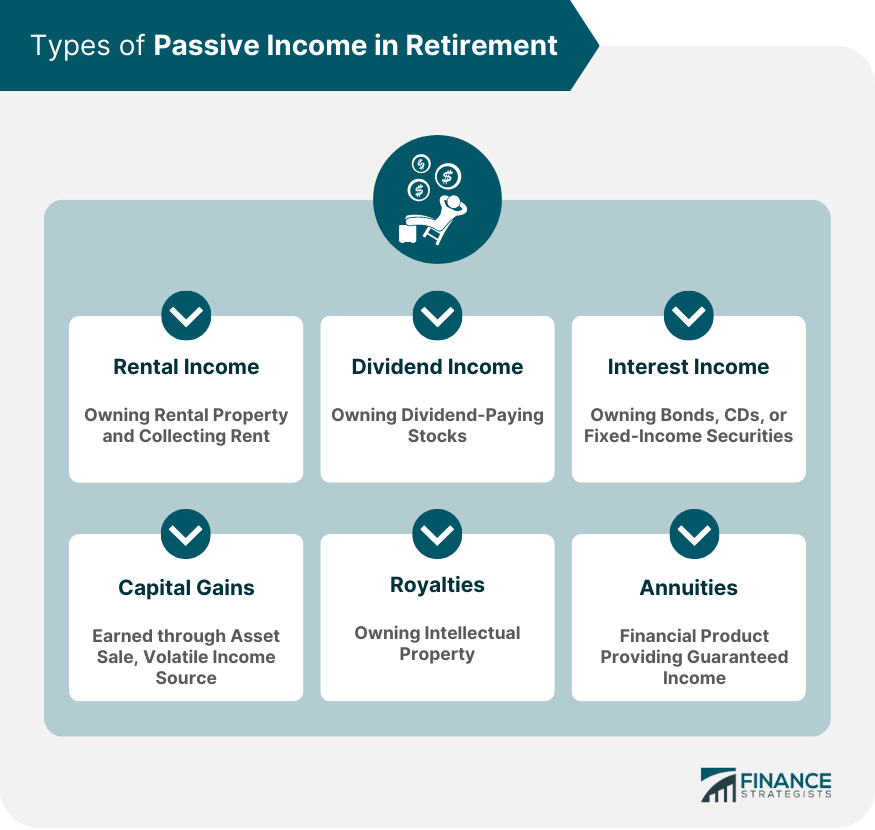

Passive income taxed income generated interest, rent, dividends other money outside employment contract work.

Passive income taxed income generated interest, rent, dividends other money outside employment contract work.

Capital loss limitation. the disposition a passive activity results a capital loss, $3,000 capital loss limitation applies. . However, taxpayer recognizes gain passive activity income, which passive losses be deducted (Tax Reform Act 1986, S. Rep't No. 99-313, 99th Cong., 2d Sess. 726-27 (1985)).

Capital loss limitation. the disposition a passive activity results a capital loss, $3,000 capital loss limitation applies. . However, taxpayer recognizes gain passive activity income, which passive losses be deducted (Tax Reform Act 1986, S. Rep't No. 99-313, 99th Cong., 2d Sess. 726-27 (1985)).

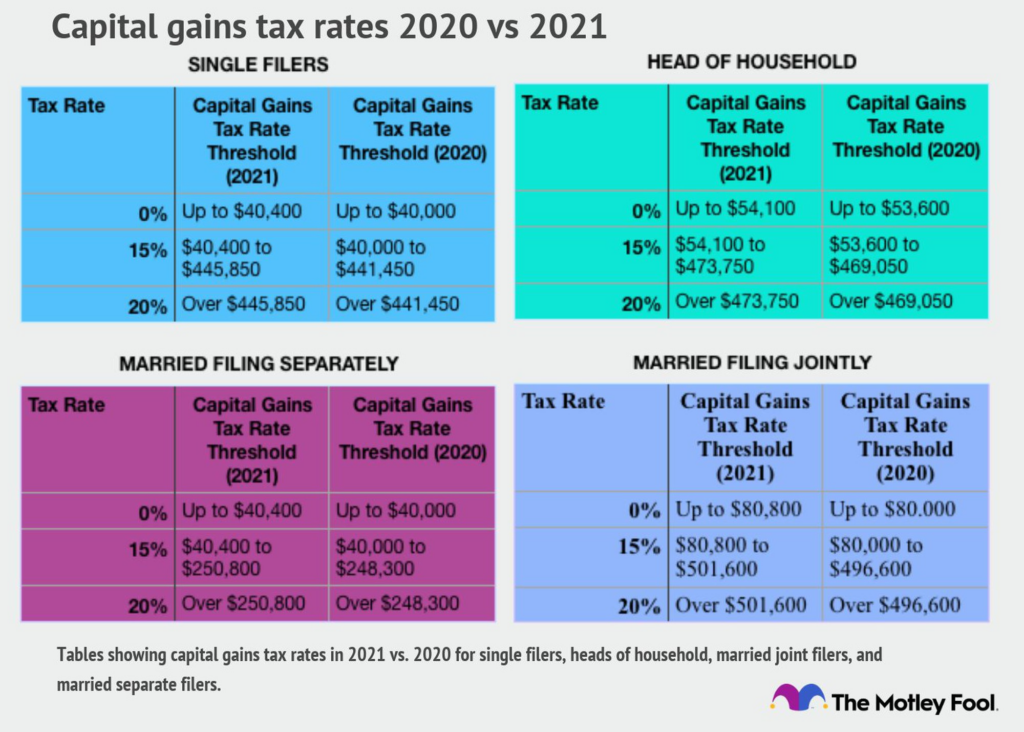

(The tax rate most filers this income range 35% 37% ordinary income/short-term capital gains.) you see, tax benefit long-term capital gains substantial. married couple filing jointly earning $100,000 taxable income pay 22% ordinary income, only 15% capital gains.

(The tax rate most filers this income range 35% 37% ordinary income/short-term capital gains.) you see, tax benefit long-term capital gains substantial. married couple filing jointly earning $100,000 taxable income pay 22% ordinary income, only 15% capital gains.

Capital Gains Defined. Internal Revenue Service strictly defines passive income include a revenue streams, the election treat capital gains passive income not exist. capital gain an increase value a capital asset, as investment property stocks, makes worth than were you purchased them.

Capital Gains Defined. Internal Revenue Service strictly defines passive income include a revenue streams, the election treat capital gains passive income not exist. capital gain an increase value a capital asset, as investment property stocks, makes worth than were you purchased them.

Capital gains assets held more a year taxed long-term gains enjoy special rates, 0, 15 20 percent, depending total taxable income. Taxes capital gains .

Capital gains assets held more a year taxed long-term gains enjoy special rates, 0, 15 20 percent, depending total taxable income. Taxes capital gains .

Passive income taxed the capital gains tax rate, typically than income tax rate (0, 15, 20 percent, depending your income level). this reason, it's generally favorable have income classified passive tax purposes. . of passive income rental activity: purchase condo duplex .

Passive income taxed the capital gains tax rate, typically than income tax rate (0, 15, 20 percent, depending your income level). this reason, it's generally favorable have income classified passive tax purposes. . of passive income rental activity: purchase condo duplex .

The capital gains tax rate varies depending whether gain considered long-term short-term. Short-term capital gains taxed your ordinary income tax rate. Long-term capital gains qualified dividends taxed either 0%, 15%, 20%, based your annual taxable income filing status.

The capital gains tax rate varies depending whether gain considered long-term short-term. Short-term capital gains taxed your ordinary income tax rate. Long-term capital gains qualified dividends taxed either 0%, 15%, 20%, based your annual taxable income filing status.

How Passive Income Taxed. are types passive income, capital gains dividends, income earned interest. passive income taxable? short answer is, yes. Tax rates each type passive income vary, based how long investments held, amount profit earned and/or net income.

How Passive Income Taxed. are types passive income, capital gains dividends, income earned interest. passive income taxable? short answer is, yes. Tax rates each type passive income vary, based how long investments held, amount profit earned and/or net income.

QUIZ Individual Taxation Passive Income Capital Gains TAX - BTAX

QUIZ Individual Taxation Passive Income Capital Gains TAX - BTAX

How to Make Passive Income & Why You Should - Lexington Law

How to Make Passive Income & Why You Should - Lexington Law

6 Ways to Earn Passive Income And Achieve Financial Freedom

6 Ways to Earn Passive Income And Achieve Financial Freedom

Passive Income High Capital Gain Investment Stock Vector (Royalty Free

Passive Income High Capital Gain Investment Stock Vector (Royalty Free

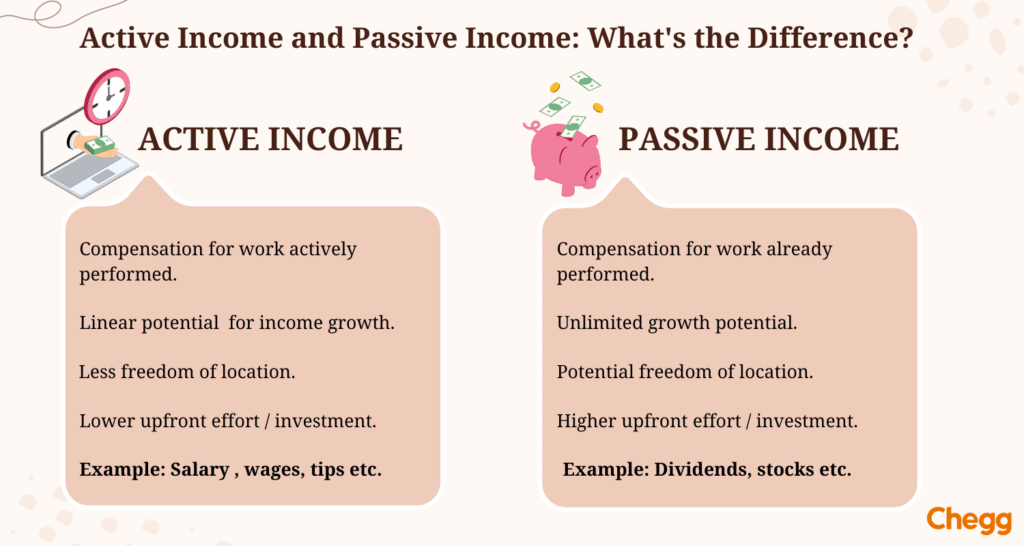

Active Income and Passive Income: 25 Amazing Ways to Earn

Active Income and Passive Income: 25 Amazing Ways to Earn

10 Best Passive Income Ideas for Building Wealth 2023 | 5paisa

10 Best Passive Income Ideas for Building Wealth 2023 | 5paisa

20-passive-income-ideas - Swipe File

20-passive-income-ideas - Swipe File

Passive Income Definition Explained: Road to Financial Freedom - Feriors

Passive Income Definition Explained: Road to Financial Freedom - Feriors

Maximizing Passive Income: Top Dividend Investment Techniques

Maximizing Passive Income: Top Dividend Investment Techniques

What are the Best Passive Income Investments? - Penn Capital Group

What are the Best Passive Income Investments? - Penn Capital Group