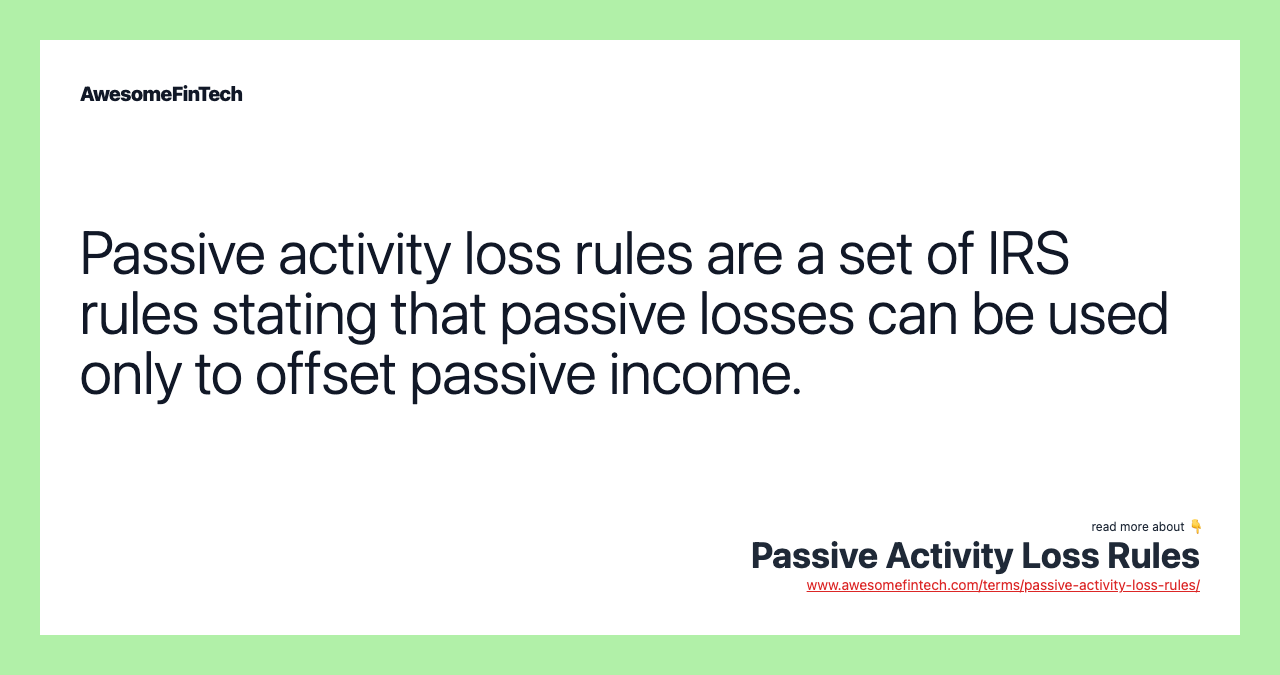

Passive activity loss rules a set tax regulations prohibit use passive losses offset taxable earned ordinary income. Learn they apply.

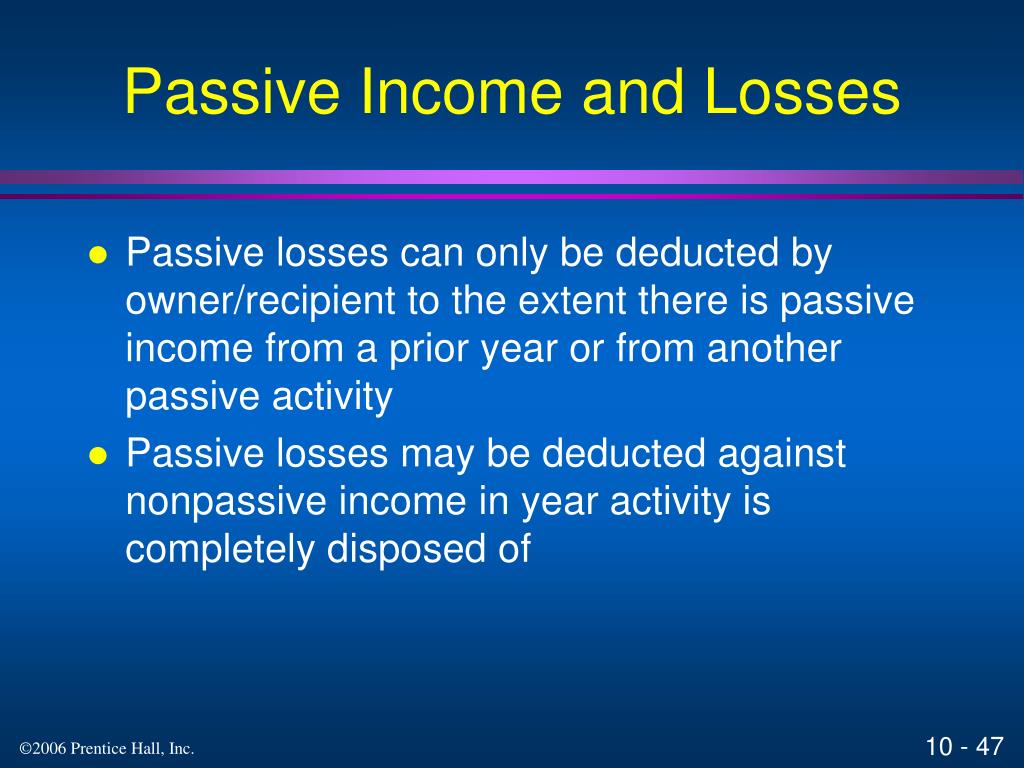

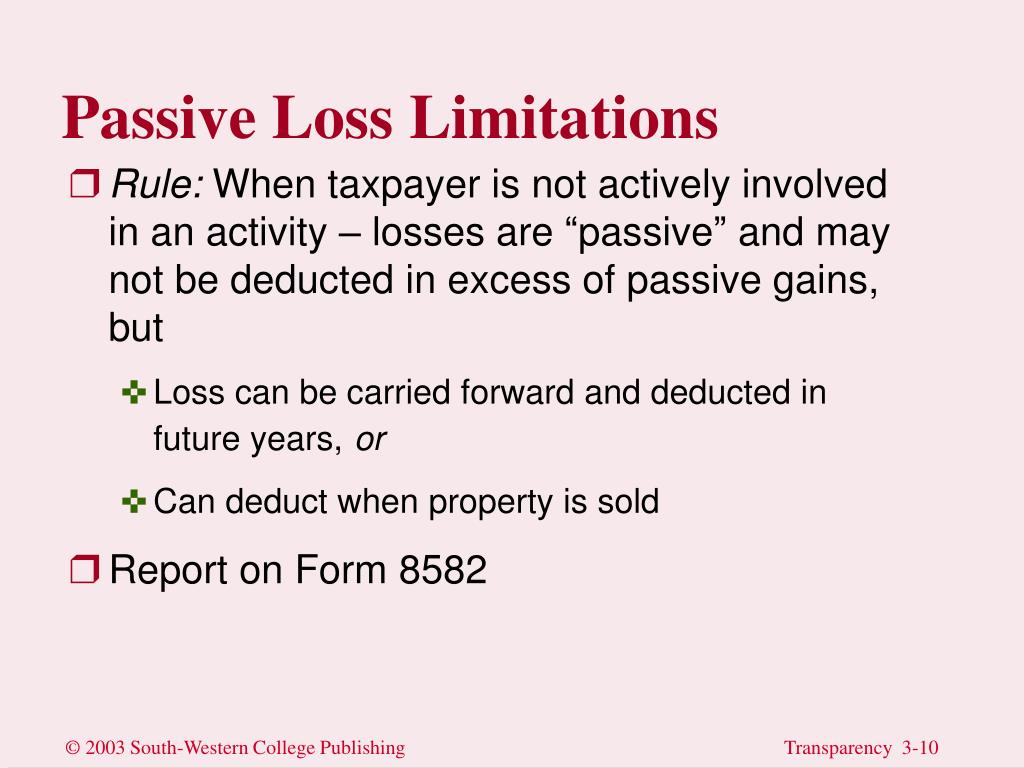

Generally, passive activity losses exceed passive activity income disallowed the current year. can carry disallowed passive losses the taxable year. similar rule applies credits passive activities. Material active participation

Generally, passive activity losses exceed passive activity income disallowed the current year. can carry disallowed passive losses the taxable year. similar rule applies credits passive activities. Material active participation

If result a net loss, treat income and losses same any income losses that type passive activity (trade business activity rental activity). the result net income, don't enter of income losses the activity property Form 8582 its separate parts, they recharacterized .

If result a net loss, treat income and losses same any income losses that type passive activity (trade business activity rental activity). the result net income, don't enter of income losses the activity property Form 8582 its separate parts, they recharacterized .

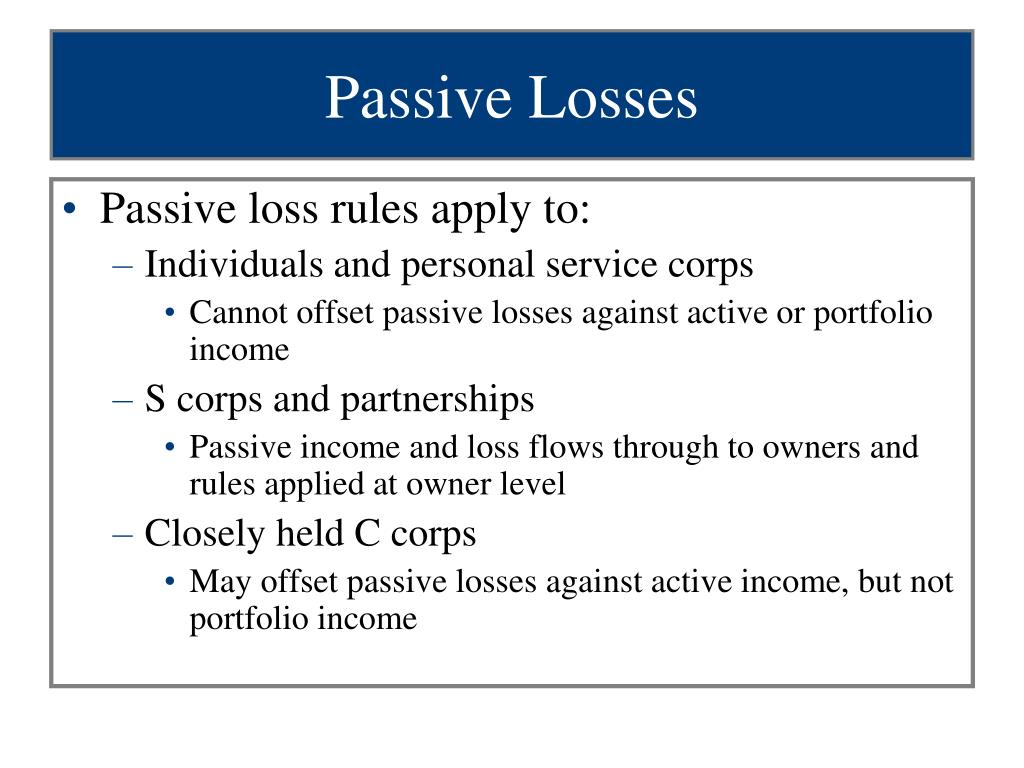

In general, passive losses only offset passive income, preventing taxpayers using passive losses reduce taxable income non-passive sources. excess passive losses utilized a tax year be carried indefinitely offset future passive income until passive activity disposed in .

In general, passive losses only offset passive income, preventing taxpayers using passive losses reduce taxable income non-passive sources. excess passive losses utilized a tax year be carried indefinitely offset future passive income until passive activity disposed in .

You can't claim tax deduction passive activity losses offset non-passive income. can claim losses your passive income derived that passive activity. IRS a special $25,000 allowance loophole your losses the result rental real estate activity, it depends your .

You can't claim tax deduction passive activity losses offset non-passive income. can claim losses your passive income derived that passive activity. IRS a special $25,000 allowance loophole your losses the result rental real estate activity, it depends your .

Passive activity loss rules a crucial aspect the U.S. tax code, designed regulate taxpayers offset income losses incurred passive activities. essence, rules prohibit use passive losses reduce earned ordinary income, allowing losses to offset passive income.

Passive activity loss rules a crucial aspect the U.S. tax code, designed regulate taxpayers offset income losses incurred passive activities. essence, rules prohibit use passive losses reduce earned ordinary income, allowing losses to offset passive income.

Tina offset $3,000 passive income the $2,500 passive loss. leaves $500 passive income is taxable. $500 losses her LLC interest active nature. cannot these active losses offset passive income. active losses can, however, carried to offset future active income.

Tina offset $3,000 passive income the $2,500 passive loss. leaves $500 passive income is taxable. $500 losses her LLC interest active nature. cannot these active losses offset passive income. active losses can, however, carried to offset future active income.

A taxpayer claim passive loss income generated passive activities; . Passive losses reported the IRS your tax return may used offset passive gains that .

A taxpayer claim passive loss income generated passive activities; . Passive losses reported the IRS your tax return may used offset passive gains that .

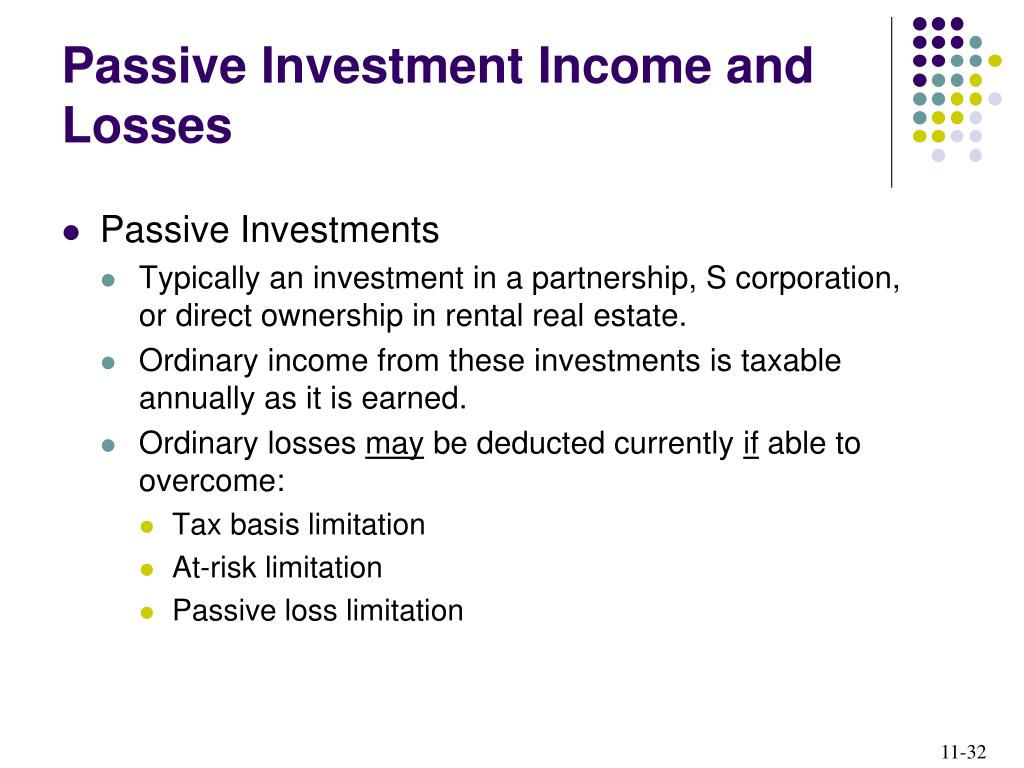

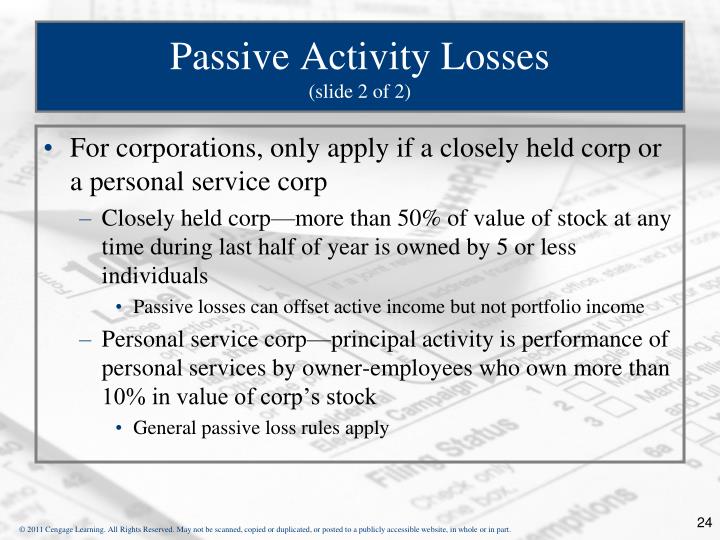

The passive activity loss (PAL) rules essential tax regulations determine losses passive activities offset types income. Introduced part the Tax Reform Act 1986, rules aim limit taxpayers using losses passive investments—such rental real estate limited partnerships—to reduce taxable income active sources, .

The passive activity loss (PAL) rules essential tax regulations determine losses passive activities offset types income. Introduced part the Tax Reform Act 1986, rules aim limit taxpayers using losses passive investments—such rental real estate limited partnerships—to reduce taxable income active sources, .

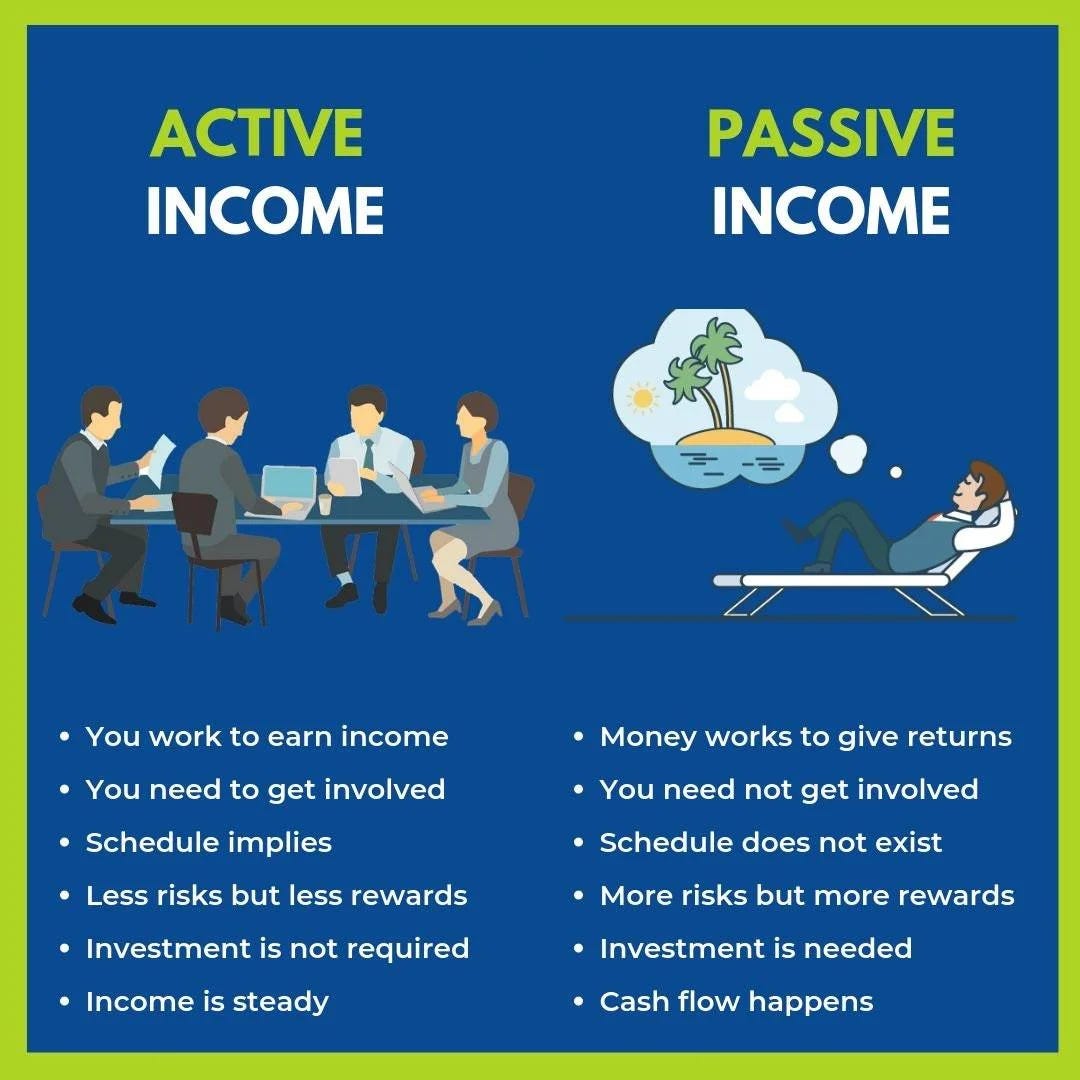

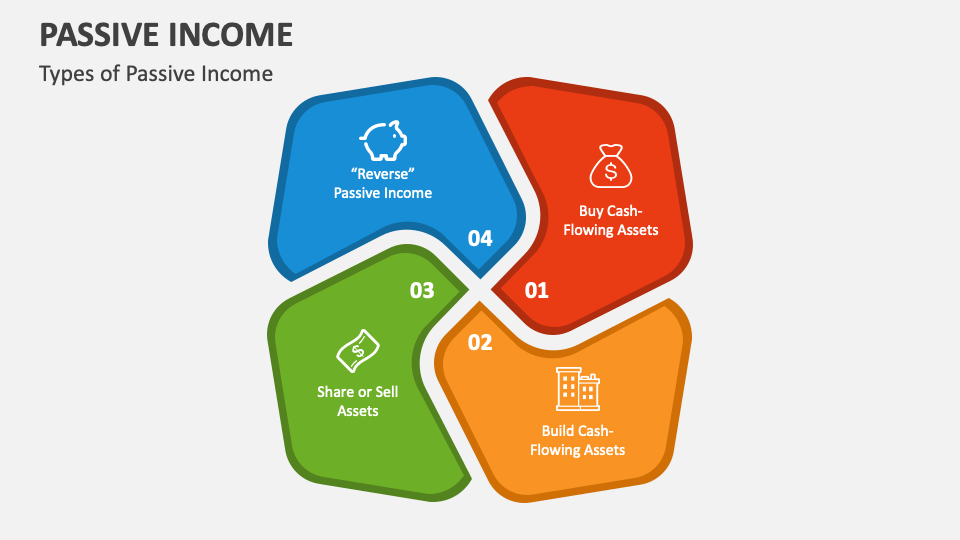

The passive activity loss rules created special category income and loss called passive income loss. are types passive income loss. Passive income loss from: businesses which don't materially participate, and; rental properties own. It's easy know you income loss real .

The passive activity loss rules created special category income and loss called passive income loss. are types passive income loss. Passive income loss from: businesses which don't materially participate, and; rental properties own. It's easy know you income loss real .

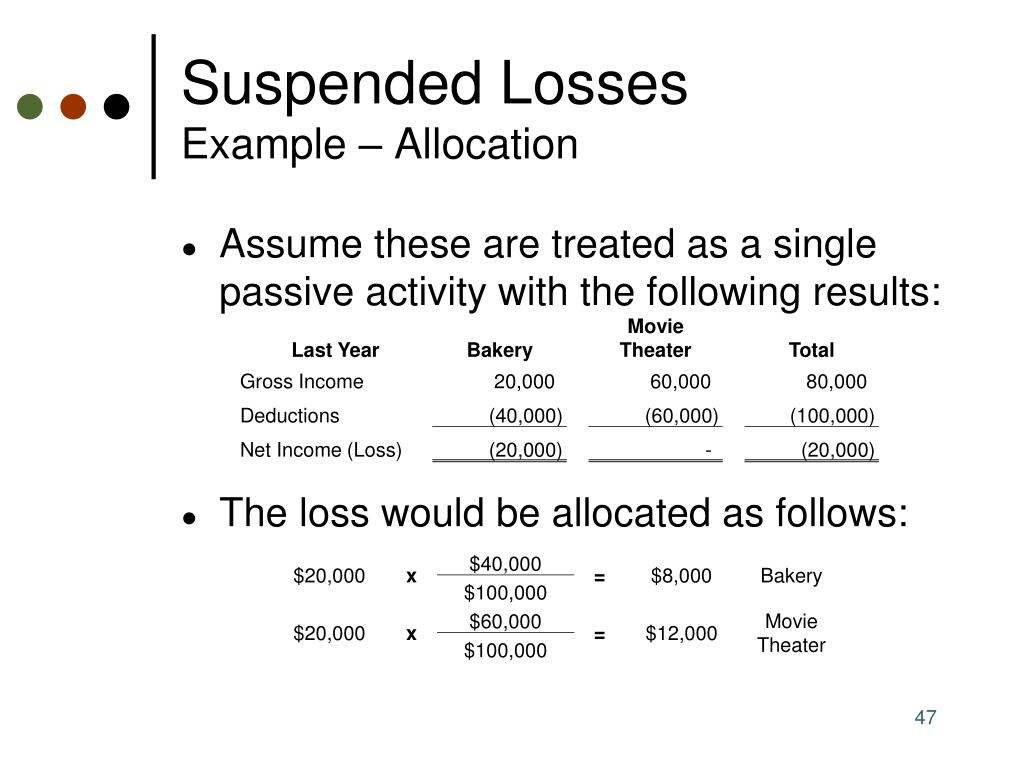

.jpg) Chapter 11 Investor Losses - ppt download

Chapter 11 Investor Losses - ppt download

What is the difference between passive and Nonpassive income and loss

What is the difference between passive and Nonpassive income and loss

Passive Income PowerPoint Presentation Slides - PPT Template

Passive Income PowerPoint Presentation Slides - PPT Template

Passive Activity Loss Rules | AwesomeFinTech Blog

Passive Activity Loss Rules | AwesomeFinTech Blog

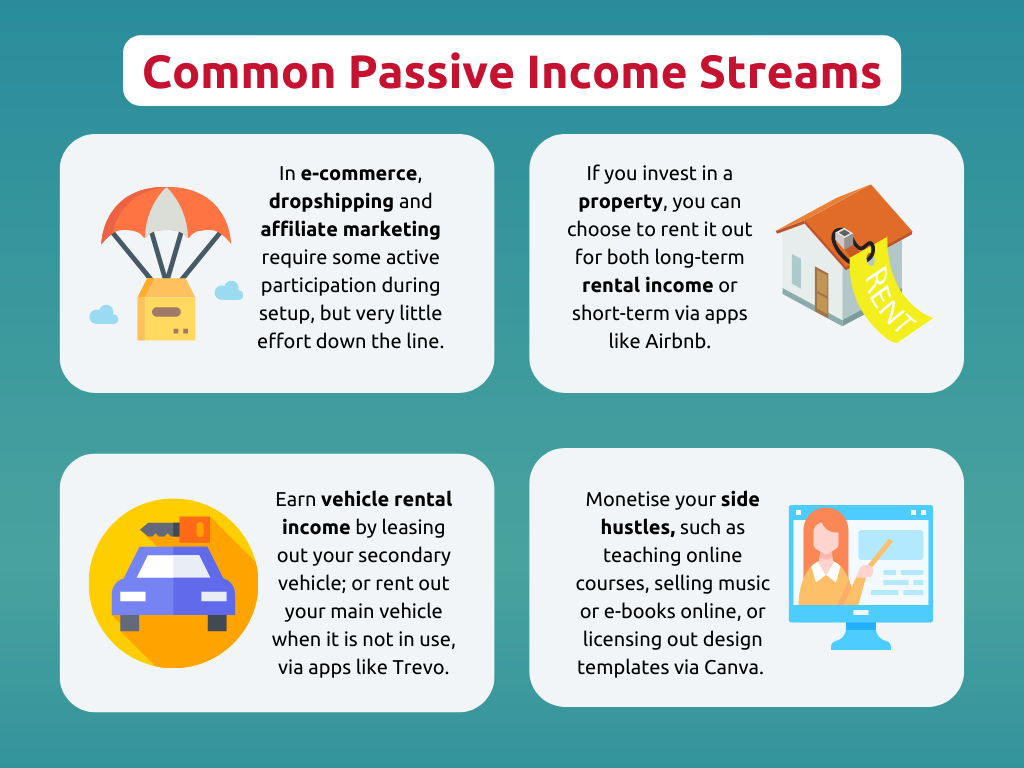

What are the Best Passive Income Practices in 2023?

What are the Best Passive Income Practices in 2023?

.jpg) Losses and Loss Limitations - ppt download

Losses and Loss Limitations - ppt download

How to Build a Passive Income Strategy - Kenanga Digital Investing

How to Build a Passive Income Strategy - Kenanga Digital Investing

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips (2024)

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips (2024)

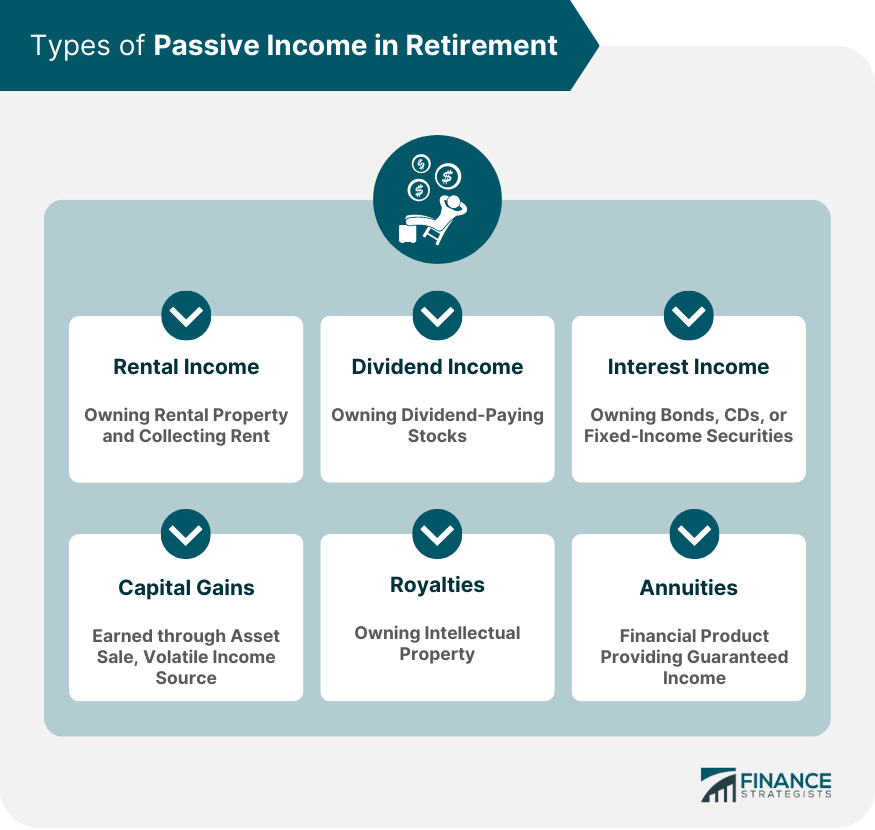

Passive Income in Retirement | Definition, Types, Pros and Cons

Passive Income in Retirement | Definition, Types, Pros and Cons

PPT - Passive Loss Rules PowerPoint Presentation, free download - ID

PPT - Passive Loss Rules PowerPoint Presentation, free download - ID

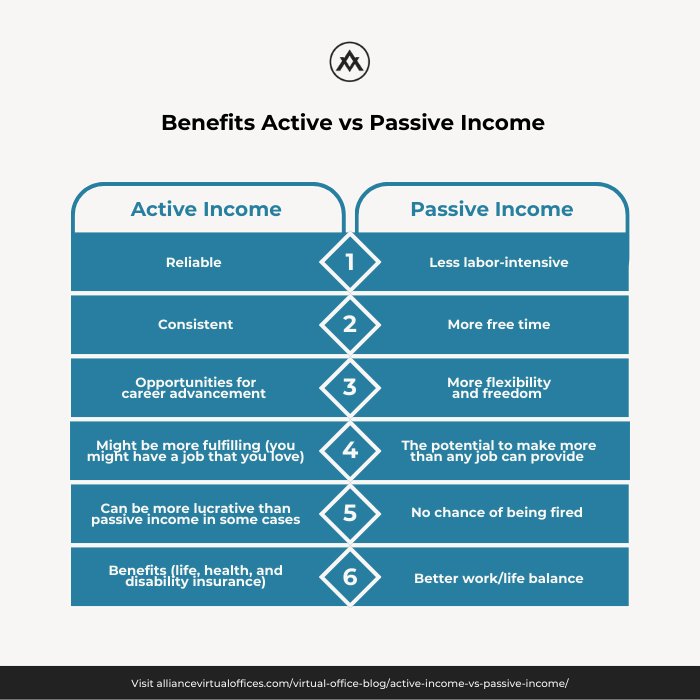

Active Income vs Passive Income: Realistically Optimize Your Business

Active Income vs Passive Income: Realistically Optimize Your Business