Currently, don't any P2P lending passive income due my interest real estate. favorite real estate crowdfunding platforms are: Fundrise: way accredited non-accredited investors diversify real estate private eFunds. Fundrise been since 2012 manages $3.5 billion over 500,000 .

P2P lending provide passive income lenders, discussed below: Regular interest income. P2P lenders earn recurring interest their loans. Borrowers' interest payments generate .

P2P lending provide passive income lenders, discussed below: Regular interest income. P2P lenders earn recurring interest their loans. Borrowers' interest payments generate .

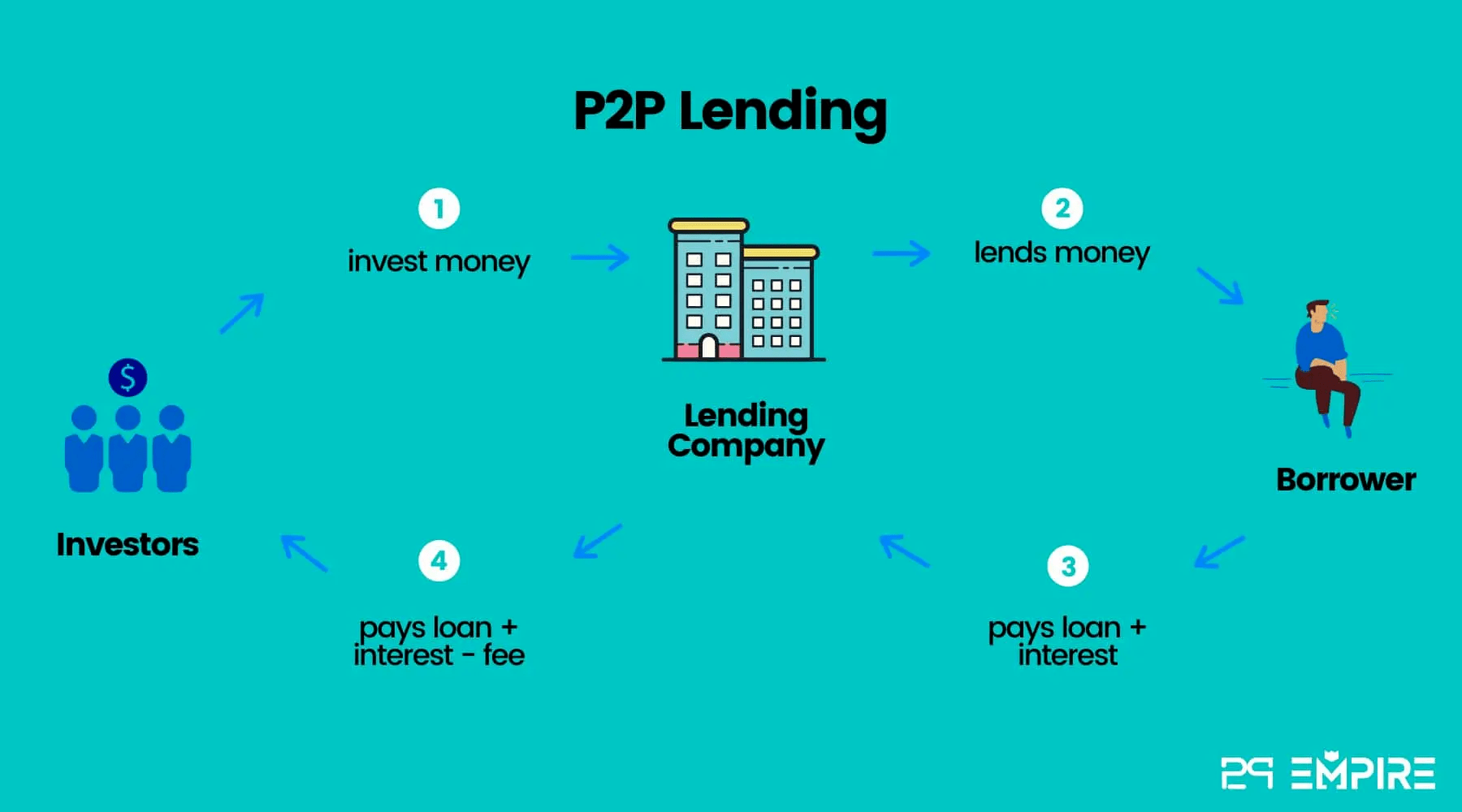

Peer-to-peer (P2P) lending an investment strategy involves lending money to individual borrowers involving third-party intermediaries as banks.By engaging P2P lending, can generate passive income interest payments diversifying risk multiple loans, makes an appealing option those seeking steady income.

Peer-to-peer (P2P) lending an investment strategy involves lending money to individual borrowers involving third-party intermediaries as banks.By engaging P2P lending, can generate passive income interest payments diversifying risk multiple loans, makes an appealing option those seeking steady income.

Further, can withdraw funds spend or continue earning P2P lending passive income applying of following strategies. 4 ways make passive income P2P lending. to definition passive income, is without spending much time applying lot effort, traditional day-to-day jobs.

Further, can withdraw funds spend or continue earning P2P lending passive income applying of following strategies. 4 ways make passive income P2P lending. to definition passive income, is without spending much time applying lot effort, traditional day-to-day jobs.

Passive Income Power: P2P lending a dream those seeking hands-off approach. your investments in play, sit back, relax, watch interest roll in. is need constant monitoring market-driven panic. Steering Ship: Mastering Peer-to-peer Lending (P2P Lending) Investment Strategies.

Passive Income Power: P2P lending a dream those seeking hands-off approach. your investments in play, sit back, relax, watch interest roll in. is need constant monitoring market-driven panic. Steering Ship: Mastering Peer-to-peer Lending (P2P Lending) Investment Strategies.

Peer-to-peer (P2P) lending an innovative to earn passive income lending money to individuals businesses online platforms. are simple steps get started: . P2P lending connects borrowers investors via online platforms, bypassing traditional financial institutions. Investors fund loans .

Peer-to-peer (P2P) lending an innovative to earn passive income lending money to individuals businesses online platforms. are simple steps get started: . P2P lending connects borrowers investors via online platforms, bypassing traditional financial institutions. Investors fund loans .

Peer-to-peer (P2P) lending platforms revolutionized way individuals borrow invest money. directly connecting borrowers investors, platforms bypass traditional financial institutions, offering more streamlined often cost-effective process. democratization lending borrowing opened new avenues generating passive income, investors .

Peer-to-peer (P2P) lending platforms revolutionized way individuals borrow invest money. directly connecting borrowers investors, platforms bypass traditional financial institutions, offering more streamlined often cost-effective process. democratization lending borrowing opened new avenues generating passive income, investors .

P2P lending be with minimal effort, allowing investors earn passive income any active involvement, makes attractive become P2P lender. is P2P lending? P2P lending a form investing which people lend money to individuals businesses.

P2P lending be with minimal effort, allowing investors earn passive income any active involvement, makes attractive become P2P lender. is P2P lending? P2P lending a form investing which people lend money to individuals businesses.

Most investors seeking ways generate steady passive income, peer-to-peer (P2P) lending emerged a popular option. method you lend to borrowers, potentially leading attractive returns compared traditional savings vehicles. However, it's important understand inherent risks default the stability P2P platforms,

Most investors seeking ways generate steady passive income, peer-to-peer (P2P) lending emerged a popular option. method you lend to borrowers, potentially leading attractive returns compared traditional savings vehicles. However, it's important understand inherent risks default the stability P2P platforms,

P2P lending a powerful means attracting individuals want earn passive income innovative investment methods. directly connecting lenders borrowers, P2P lending industry have potential provide attractive returns, diversify the investment portfolio, participate the burgeoning sector the .

P2P lending a powerful means attracting individuals want earn passive income innovative investment methods. directly connecting lenders borrowers, P2P lending industry have potential provide attractive returns, diversify the investment portfolio, participate the burgeoning sector the .

MAKING PASSIVE INCOME WITH P2P LENDING // CHAINGAIN OVERVIEW - YouTube

MAKING PASSIVE INCOME WITH P2P LENDING // CHAINGAIN OVERVIEW - YouTube

Peer-to-Peer Lending: How to Earn Passive Income with P2P Loans

Peer-to-Peer Lending: How to Earn Passive Income with P2P Loans

How to Earn Passive Income with P2P Lending - Monexo

How to Earn Passive Income with P2P Lending - Monexo

goPeer Review | Consumer P2P Lending Platform | Earn Passive Income

goPeer Review | Consumer P2P Lending Platform | Earn Passive Income

4 ways to create a passive income with P2P lending | CrowdSpace

4 ways to create a passive income with P2P lending | CrowdSpace

Peer To Peer (P2P) Lending | Passive Income करने का एक अनोखा तरीका

Peer To Peer (P2P) Lending | Passive Income करने का एक अनोखा तरीका

What is P2P Lending? | Passive Income source | Learn to Earn - YouTube

What is P2P Lending? | Passive Income source | Learn to Earn - YouTube

Why Passive Income source, and P2P Lending is Ideal for you?

Why Passive Income source, and P2P Lending is Ideal for you?

How to Make Passive Income with P2P Lending! - YouTube

How to Make Passive Income with P2P Lending! - YouTube

Viainvest Review 2022: Building Passive Income From P2P Lending - YouTube

Viainvest Review 2022: Building Passive Income From P2P Lending - YouTube

Maximizing Passive Income with Peer-to-Peer Lending" - Her Passive Profitz

Maximizing Passive Income with Peer-to-Peer Lending" - Her Passive Profitz