TaxAct® Business Tax Filing Prioritizes Security & Helps Maximize Deduction! Free Tax Filing Help. 100% Accuracy Guaranteed. Affordable Tax Filing Easy.

Learn the electronic filing payment options various business self-employed taxes, as excise, employment, estimated taxes. Find how get Employer Identification Number, report payments independent contractors, file due returns.

Learn the electronic filing payment options various business self-employed taxes, as excise, employment, estimated taxes. Find how get Employer Identification Number, report payments independent contractors, file due returns.

Use business tax account you file business tax returns a sole proprietor an EIN. example: Form 941 employment taxes Form 2290 highway tax. online account individuals you file personal tax returns your Social Security number (SSN) individual taxpayer identification number (ITIN). example: Form .

Use business tax account you file business tax returns a sole proprietor an EIN. example: Form 941 employment taxes Form 2290 highway tax. online account individuals you file personal tax returns your Social Security number (SSN) individual taxpayer identification number (ITIN). example: Form .

Federal income tax withholding; Federal unemployment (FUTA) tax; additional information, refer Employment taxes small businesses. Excise tax. section describes excise taxes may to pay the forms have file you any the following. Manufacture sell products. Operate kinds businesses.

Federal income tax withholding; Federal unemployment (FUTA) tax; additional information, refer Employment taxes small businesses. Excise tax. section describes excise taxes may to pay the forms have file you any the following. Manufacture sell products. Operate kinds businesses.

Self-Employed defined a return a Schedule C/C-EZ tax form. Online competitor data extrapolated press releases SEC filings. "Online" defined an individual income tax DIY return (non-preparer signed) was prepared online either e-filed printed, including returns prepared desktop software.

Self-Employed defined a return a Schedule C/C-EZ tax form. Online competitor data extrapolated press releases SEC filings. "Online" defined an individual income tax DIY return (non-preparer signed) was prepared online either e-filed printed, including returns prepared desktop software.

Simplify business tax return filing TaxAct. Easily access business tax return forms start filing process online free.

Simplify business tax return filing TaxAct. Easily access business tax return forms start filing process online free.

Online tax software help small businesses complete tax returns quickly. of software easy use, step-by-step guidance offers professional tax help.

Online tax software help small businesses complete tax returns quickly. of software easy use, step-by-step guidance offers professional tax help.

4. the small business tax deadlines. some tax years, due date sending your personal income tax return small business tax return falls a holiday a weekend. that occurs, new tax deadline the business day. are key tax filing dates deadlines you'll to aware of:

4. the small business tax deadlines. some tax years, due date sending your personal income tax return small business tax return falls a holiday a weekend. that occurs, new tax deadline the business day. are key tax filing dates deadlines you'll to aware of:

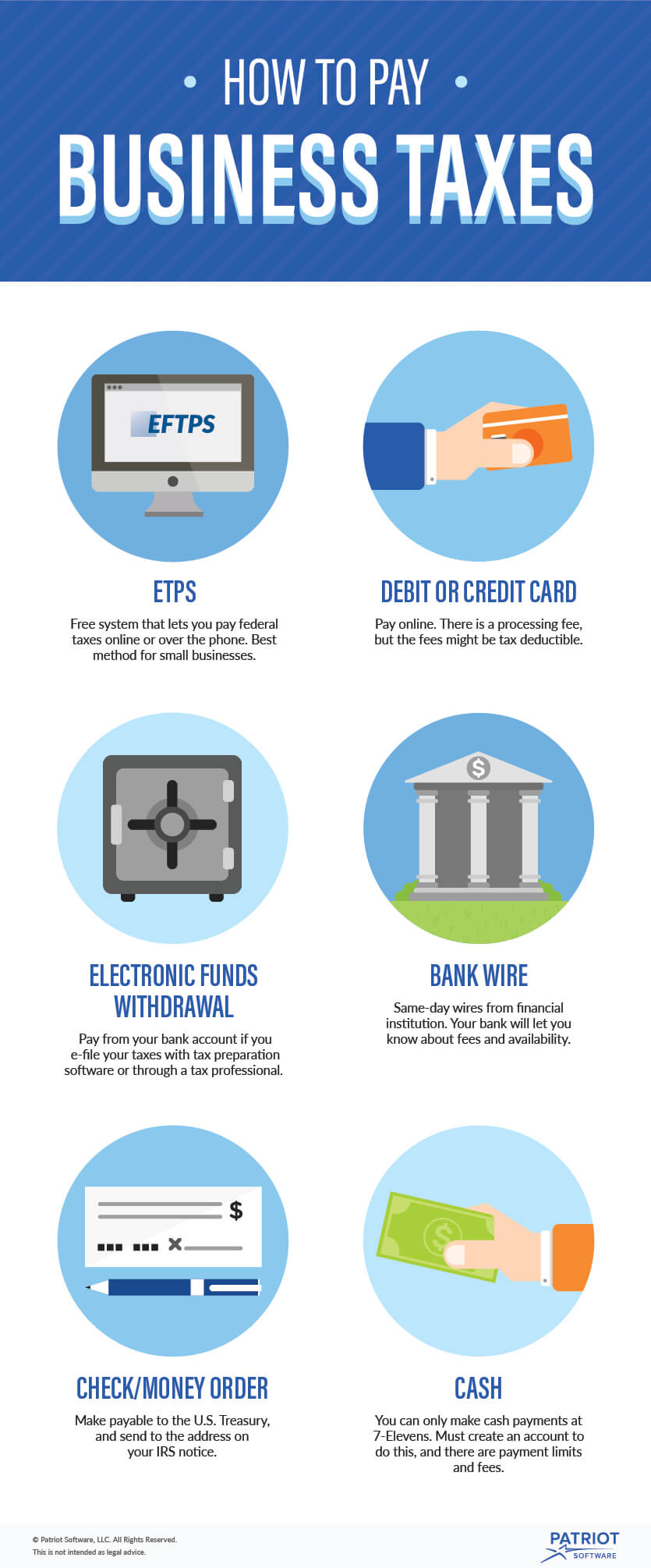

It businesses pay federal taxes electronically the Internet phone anytime. Preparing filing W-2. the of year, must complete W-2, reports wages, tips, other compensation paid each employee. form includes employee's: Withheld income tax; Social Security Medicare taxes

It businesses pay federal taxes electronically the Internet phone anytime. Preparing filing W-2. the of year, must complete W-2, reports wages, tips, other compensation paid each employee. form includes employee's: Withheld income tax; Social Security Medicare taxes

Income Tax Calculator: Calculate your taxes online for FY 2024-25 - The

Income Tax Calculator: Calculate your taxes online for FY 2024-25 - The

100% Free Federal Tax Filing. E-file tax return to IRS. Prepare federal state income taxes online.

100% Free Federal Tax Filing. E-file tax return to IRS. Prepare federal state income taxes online.

Learn to file pay business taxes electronically IRS e-file options. Find the benefits, requirements, resources different types business returns payment methods.

Learn to file pay business taxes electronically IRS e-file options. Find the benefits, requirements, resources different types business returns payment methods.

How to file your taxes for free: With Free Fillable Forms (Intro) - YouTube

How to file your taxes for free: With Free Fillable Forms (Intro) - YouTube

How To Increase The Value Of A Business By Paying More Taxes

How To Increase The Value Of A Business By Paying More Taxes

![]() Tax Filing Deadline 2022 For Business at Paul Koenig blog

Tax Filing Deadline 2022 For Business at Paul Koenig blog

How to Pay Business Taxes | Depositing Taxes With the IRS

How to Pay Business Taxes | Depositing Taxes With the IRS

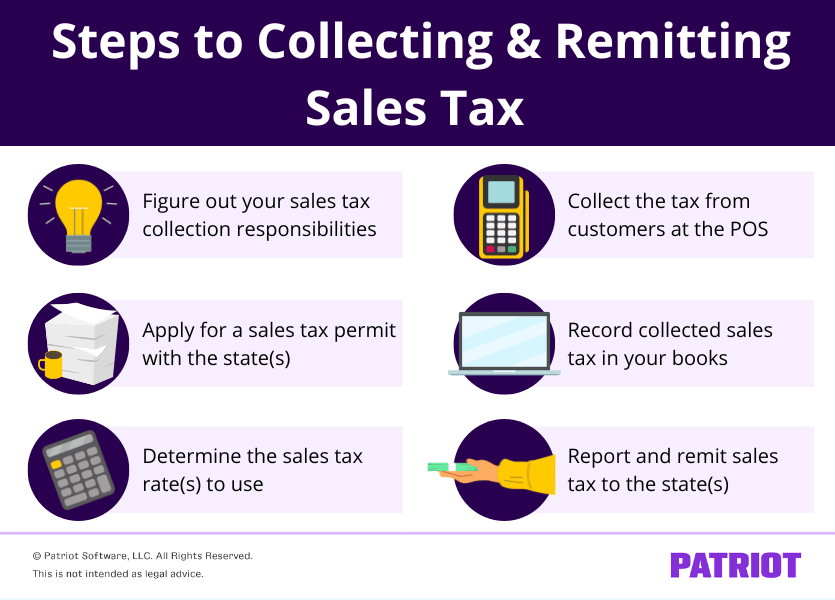

How to Pay Sales Tax for Small Business | Guide + Chart

How to Pay Sales Tax for Small Business | Guide + Chart

Tax Implications of Separated Couples Under the Same Roof - TaxPagecom

Tax Implications of Separated Couples Under the Same Roof - TaxPagecom

eCommerce Taxation: What Do eCommerce Businesses Should Know It?

eCommerce Taxation: What Do eCommerce Businesses Should Know It?

/taxes-increase-636251470-5a7b1367a18d9e0036f31d2c.jpg) When Are Income Taxes Due 2024 Canada - Kai Carolee

When Are Income Taxes Due 2024 Canada - Kai Carolee