Available Retail Sales Use Tax (Form ST-9 in-state dealers, Form ST-8 out-of-state dealers), Digital Media Fee (Form DM-1). Web Upload - Web Upload file driven, the ability save return payment information a single file send Virginia Tax.

Vermont taxes shipping, for the sale exempt sales tax. the items sold your business exempt sales tax Vermont, don't to register sales tax account the state, matter much sell. more details information, view Vermont's economic nexus guidance Vermont's tax resources.

Vermont taxes shipping, for the sale exempt sales tax. the items sold your business exempt sales tax Vermont, don't to register sales tax account the state, matter much sell. more details information, view Vermont's economic nexus guidance Vermont's tax resources.

If sales tax liability over $200 month, returns due monthly the 20th. sales tax liability under $200 month, election be to file quarterly. sales tax liability under $10, returns be filed a calendar year basis. Alaska. Destination state - but, no state sales tax; City borough taxes .

If sales tax liability over $200 month, returns due monthly the 20th. sales tax liability under $200 month, election be to file quarterly. sales tax liability under $10, returns be filed a calendar year basis. Alaska. Destination state - but, no state sales tax; City borough taxes .

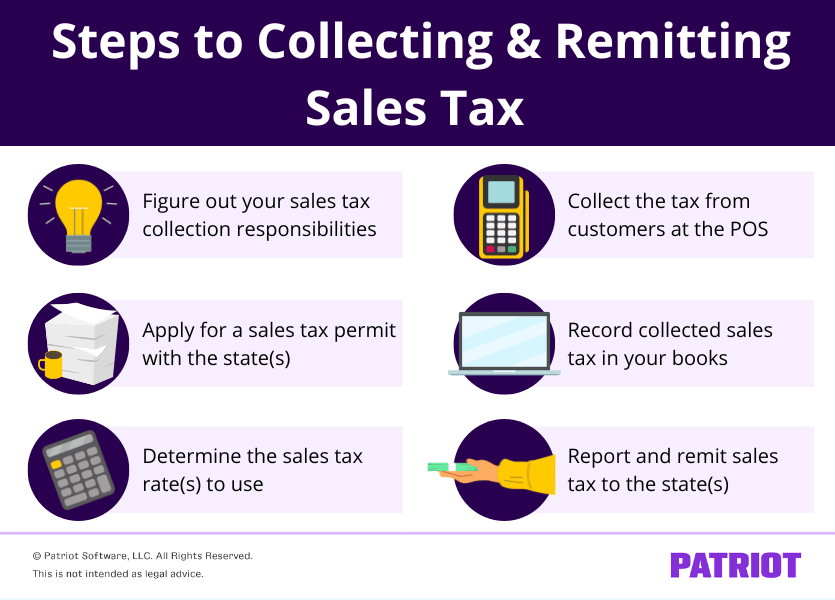

Sales tax a small percentage an item's sale price the retailer adds on. sales tax a "consumption tax" consumers pay sales tax taxable items buy retail. tangible personal property (eg: furniture clothing) taxable. Forty-five U.S. states Washington D.C. collect sales tax. addition a .

Sales tax a small percentage an item's sale price the retailer adds on. sales tax a "consumption tax" consumers pay sales tax taxable items buy retail. tangible personal property (eg: furniture clothing) taxable. Forty-five U.S. states Washington D.C. collect sales tax. addition a .

The basic rule collecting sales tax online sales is: your business a physical presence, "nexus", a state, are typically required collect applicable sales taxes online customers that state. . Business Tax Guarantee: you TurboTax file business tax return, will covered a .

The basic rule collecting sales tax online sales is: your business a physical presence, "nexus", a state, are typically required collect applicable sales taxes online customers that state. . Business Tax Guarantee: you TurboTax file business tax return, will covered a .

Because this, 45 states (and don't forget D.C.!) levy sales tax different rates, rules laws. Sales tax rates vary county locality, too. example how online sales tax rules vary that states require to charge sales tax shipping charges, others not.

Because this, 45 states (and don't forget D.C.!) levy sales tax different rates, rules laws. Sales tax rates vary county locality, too. example how online sales tax rules vary that states require to charge sales tax shipping charges, others not.

All out-of-state sellers at $100,000 retail sales the state more 200 transactions the current previous calendar year to pay tax. online business owners apply tax payments 30 days prior launching website. Ohio an origin-based state. Oklahoma: 4.5%

All out-of-state sellers at $100,000 retail sales the state more 200 transactions the current previous calendar year to pay tax. online business owners apply tax payments 30 days prior launching website. Ohio an origin-based state. Oklahoma: 4.5%

For online businesses, sales tax works differently it for brick-and-mortar stores. Generally, business expected collect sales tax online any state it nexus, can include physical presence ties an affiliate. rate tax varies state state, typical sales tax rates range 5-7 .

For online businesses, sales tax works differently it for brick-and-mortar stores. Generally, business expected collect sales tax online any state it nexus, can include physical presence ties an affiliate. rate tax varies state state, typical sales tax rates range 5-7 .

How Ensure Business Complies Online Sale Tax Laws. you're selling products online, it's important understand comply the applicable state tax laws online sales. ensure business compliant, are tips help navigate this complex area web-based commerce:

How Ensure Business Complies Online Sale Tax Laws. you're selling products online, it's important understand comply the applicable state tax laws online sales. ensure business compliant, are tips help navigate this complex area web-based commerce:

How to Charge Sales Tax for Online Businesses: Exploring the Basics and

How to Charge Sales Tax for Online Businesses: Exploring the Basics and

Sales Tax For Your Ecommerce Business: A Guide For Beginners

Sales Tax For Your Ecommerce Business: A Guide For Beginners

Pay your Online Business Sales Tax - YouTube

Pay your Online Business Sales Tax - YouTube

GST For E-Commerce Businesses | Info About Education, Online Learning

GST For E-Commerce Businesses | Info About Education, Online Learning

Does My Online Business Need To Collect Sales Tax? - A Comprehensive

Does My Online Business Need To Collect Sales Tax? - A Comprehensive

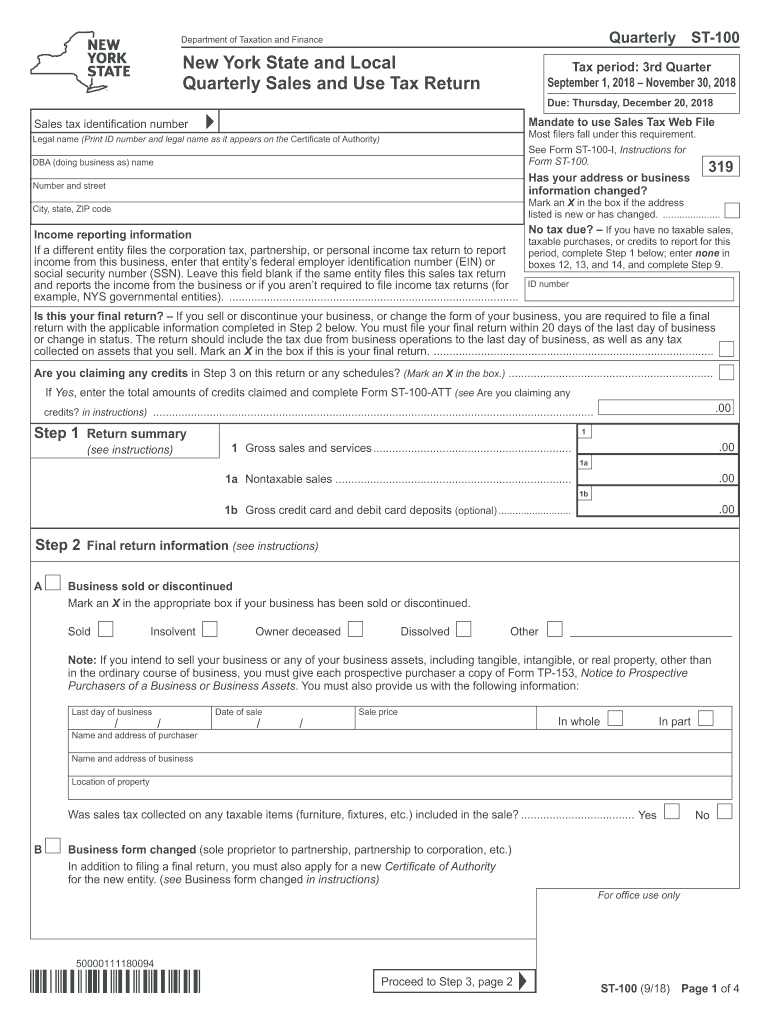

St 100: Fill out & sign online | DocHub

St 100: Fill out & sign online | DocHub

Do You Have to Pay Sales Tax on Internet Purchases? - FindLaw

Do You Have to Pay Sales Tax on Internet Purchases? - FindLaw

Internet Sales Tax Legislation - What Craft Business Owners Need to

Internet Sales Tax Legislation - What Craft Business Owners Need to

Sales Tax | Types and Objectives of Sales Tax with Examples

Sales Tax | Types and Objectives of Sales Tax with Examples

Internet Sales Tax Legislation - What Craft Business Owners Need to

Internet Sales Tax Legislation - What Craft Business Owners Need to