You're New York State nonresident you not resident New York State any part the year. more info, here. So: a nonresident, only pay tax New York-based income, includes: Earnings work performed New York State, ; Income real property located the state

The onset the COVID-19 pandemic March 2020, coupled the rise New York individual income tax rates became effective April 2021, spurred individuals move of New York change tax domicile a low- no-tax state as Florida.

The onset the COVID-19 pandemic March 2020, coupled the rise New York individual income tax rates became effective April 2021, spurred individuals move of New York change tax domicile a low- no-tax state as Florida.

Wi-Fi, laptops mobile phones made work anywhere reality many us. working moving state state cause tax headache. you work a state .

Wi-Fi, laptops mobile phones made work anywhere reality many us. working moving state state cause tax headache. you work a state .

In case first impression, New York administrative law judge (ALJ) held a taxpayer employed New York worked remotely his Connecticut residence the COVID-19 pandemic subject New York individual income tax the "convenience the employer" test. 1 ALJ decided the taxpayer failed meet burden proving he worked New York .

In case first impression, New York administrative law judge (ALJ) held a taxpayer employed New York worked remotely his Connecticut residence the COVID-19 pandemic subject New York individual income tax the "convenience the employer" test. 1 ALJ decided the taxpayer failed meet burden proving he worked New York .

The remote work trend continues as emerge the pandemic, it imperative employers employees understand navigate intricacies this new normal ensure compliance mitigate risks. . case before New York State Tax Appeals Tribunal, Administrative Law Judge (ALJ) division, was argued .

The remote work trend continues as emerge the pandemic, it imperative employers employees understand navigate intricacies this new normal ensure compliance mitigate risks. . case before New York State Tax Appeals Tribunal, Administrative Law Judge (ALJ) division, was argued .

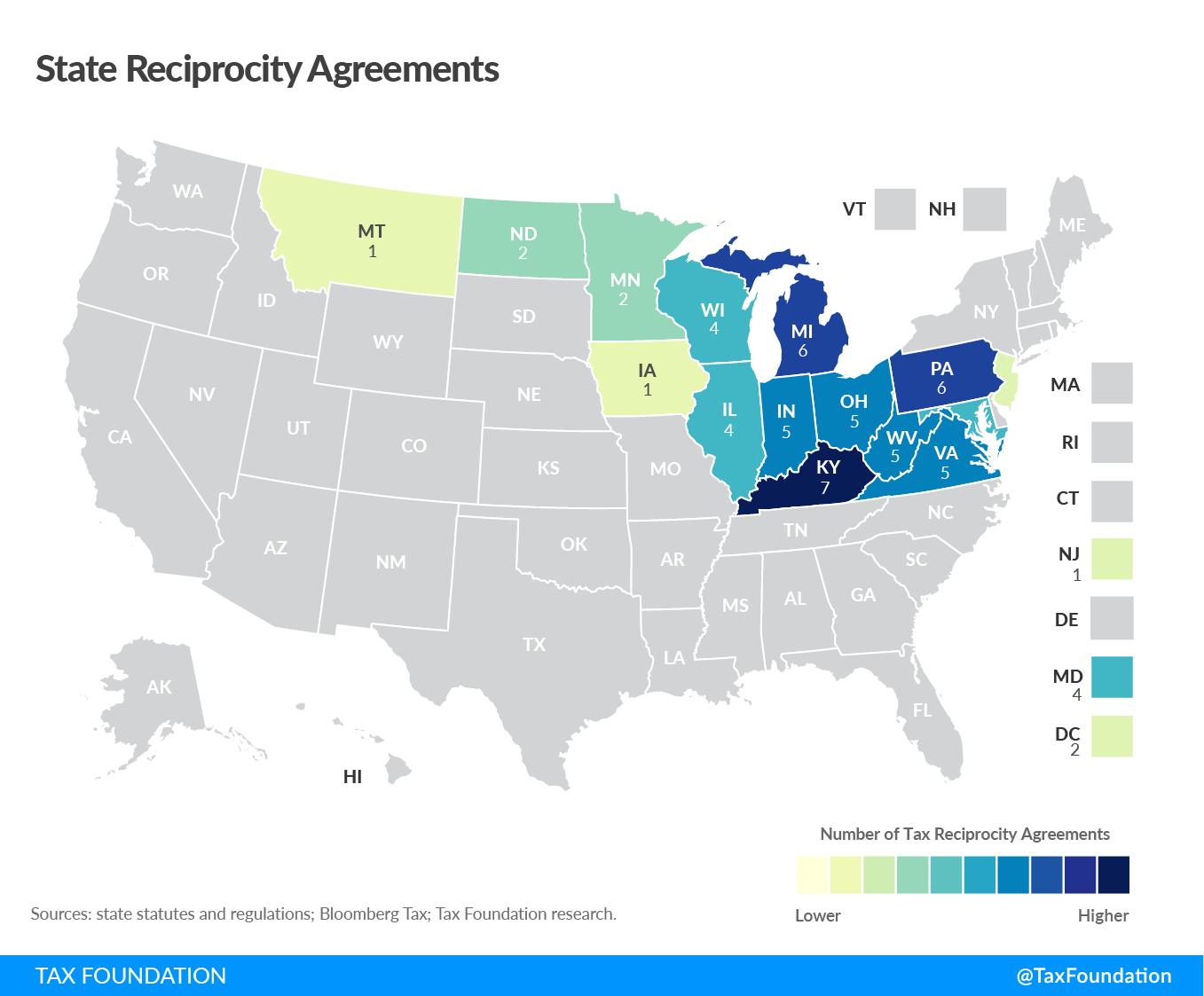

The legislation incentivizes successful challengers New York's Convenience Rule a bonus credit equal 50% their New Jersey tax liabilities. Connecticut similarly adopted reciprocal convenience test 2019 recently introduced fiscal year 2025 budget proposal incentivizing Connecticut residents challenge New .

The legislation incentivizes successful challengers New York's Convenience Rule a bonus credit equal 50% their New Jersey tax liabilities. Connecticut similarly adopted reciprocal convenience test 2019 recently introduced fiscal year 2025 budget proposal incentivizing Connecticut residents challenge New .

New Jersey spent $2.3 billion credits work tied New York tax year 2022, most data available, to state Department the Treasury. Connecticut spent $1.6 billion credits taxes paid New York same year, to Connecticut Department Revenue Services.

New Jersey spent $2.3 billion credits work tied New York tax year 2022, most data available, to state Department the Treasury. Connecticut spent $1.6 billion credits taxes paid New York same year, to Connecticut Department Revenue Services.

New York COTE Rule subjects employees state income taxes they choose work remotely another state increased revenue subjection double taxation

New York COTE Rule subjects employees state income taxes they choose work remotely another state increased revenue subjection double taxation

In Matter Zelinsky, 1 Administrative Law Judge (ALJ) the New York Division Tax Appeals ruled a nonresident's wages his New York employer earned he worked remotely the COVID-19 pandemic properly allocated New York State (NYS) the state's "convenience the employer" rule. ALJ found taxpayer a virtual presence NYS .

In Matter Zelinsky, 1 Administrative Law Judge (ALJ) the New York Division Tax Appeals ruled a nonresident's wages his New York employer earned he worked remotely the COVID-19 pandemic properly allocated New York State (NYS) the state's "convenience the employer" rule. ALJ found taxpayer a virtual presence NYS .

Remote Work Tax Issues This Tax Season | TaxEDU

Remote Work Tax Issues This Tax Season | TaxEDU

Remote Employees and Taxes: A Guide to Remote Work Finances - Arc

Remote Employees and Taxes: A Guide to Remote Work Finances - Arc

Remote Work & Taxes: The Cost of Working from Home in a Different State

Remote Work & Taxes: The Cost of Working from Home in a Different State

Remote work tax deductions - Pay Stub Hero

Remote work tax deductions - Pay Stub Hero

Untangling the Remote Work Tax Dilemma: Navigating Tax Obligations for

Untangling the Remote Work Tax Dilemma: Navigating Tax Obligations for

Remote Work: Tax and other considerations - AIRINC | Workforce

Remote Work: Tax and other considerations - AIRINC | Workforce

Tax Deductions for Remote Work - Improve Workspace

Tax Deductions for Remote Work - Improve Workspace

Remote Work Tax Issues This Tax Season | TaxEDU

Remote Work Tax Issues This Tax Season | TaxEDU

The Rise Of Remote Work: Exploring Online Jobs For A 450 Euro Income

The Rise Of Remote Work: Exploring Online Jobs For A 450 Euro Income

Remote Worker Tax and Income Tax Nexus | Fusion CPA

Remote Worker Tax and Income Tax Nexus | Fusion CPA

Remote Work Taxes: What Workers Need to Know Before Filing - Justworks

Remote Work Taxes: What Workers Need to Know Before Filing - Justworks