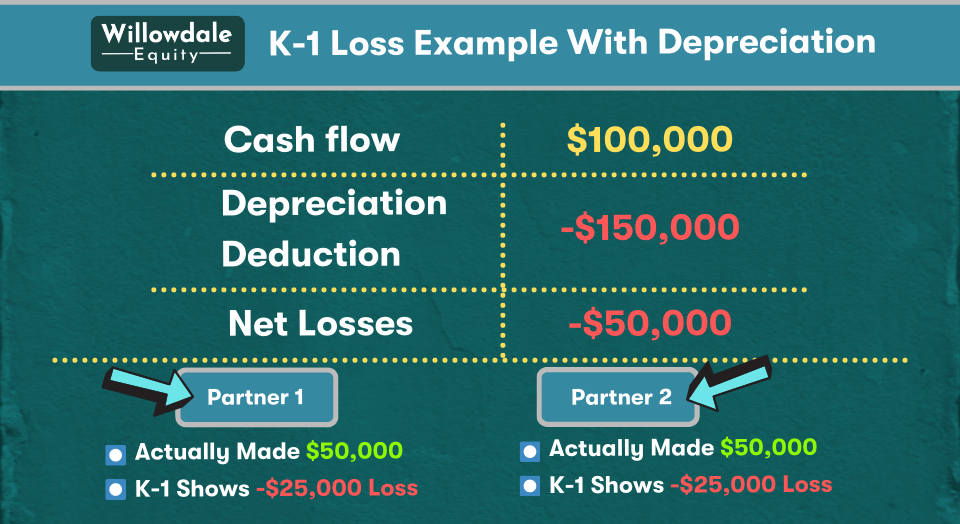

Passive income/losses those which taxpayer not materially participate. Pre-1984 called 'paper' losses. in 1984 President Ronald Reagan successfully changed tax law taxpayers paper (passive) losses take against non-passive income. Non-passive includes earned portfolio income. is .

In addition, are other rules might change classification. you a limited partner a limited interest would would passive you meet requirements 1, 5, 6 above. Also, could considered non-passive your spouse considered non-passive regards the activity.

In addition, are other rules might change classification. you a limited partner a limited interest would would passive you meet requirements 1, 5, 6 above. Also, could considered non-passive your spouse considered non-passive regards the activity.

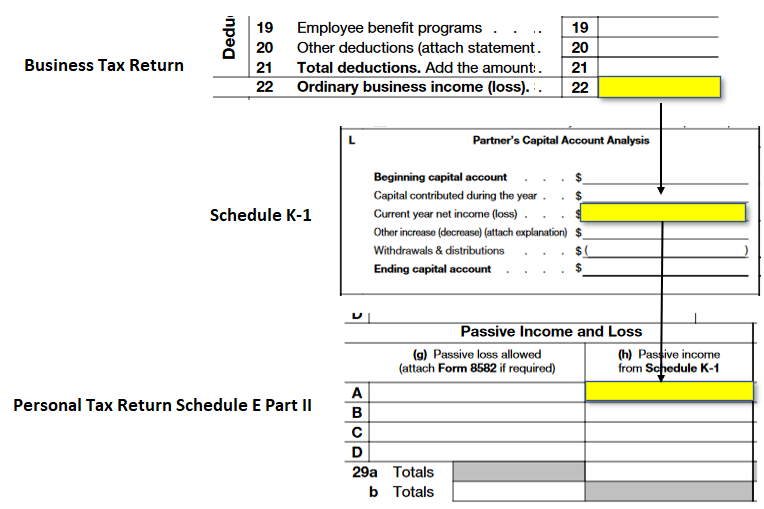

If income (loss) entered Non-Passive Income/Loss will carry Schedule (Form 1040), Line 28 column (k) income Line 28 column (i) loss. the income (loss) entered Passive Income/Loss, will carry Worksheet 3 Form 8582 - Passive Activity Loss Limitations any losses be limited, any income .

If income (loss) entered Non-Passive Income/Loss will carry Schedule (Form 1040), Line 28 column (k) income Line 28 column (i) loss. the income (loss) entered Passive Income/Loss, will carry Worksheet 3 Form 8582 - Passive Activity Loss Limitations any losses be limited, any income .

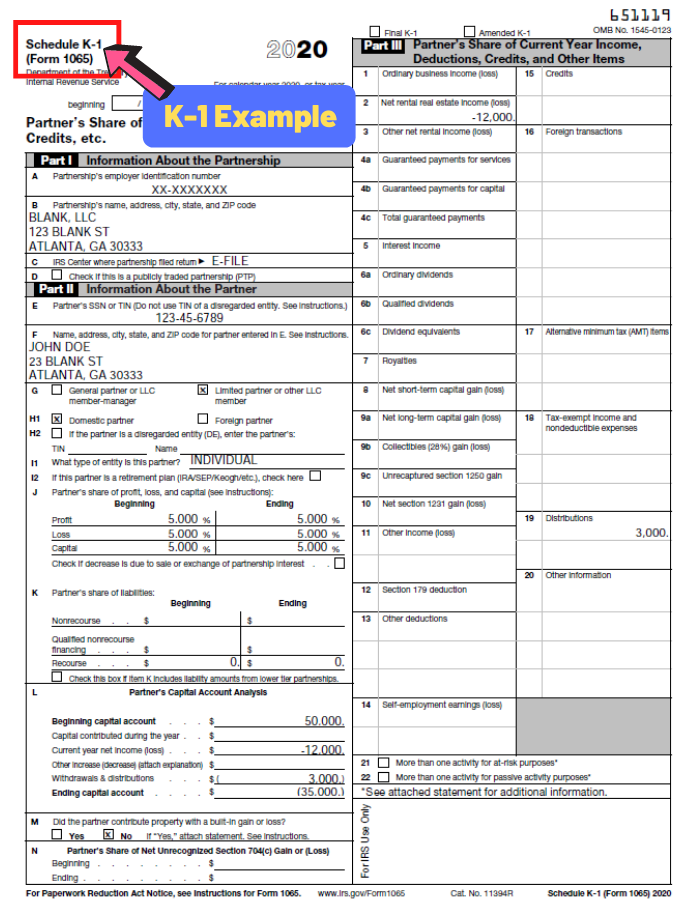

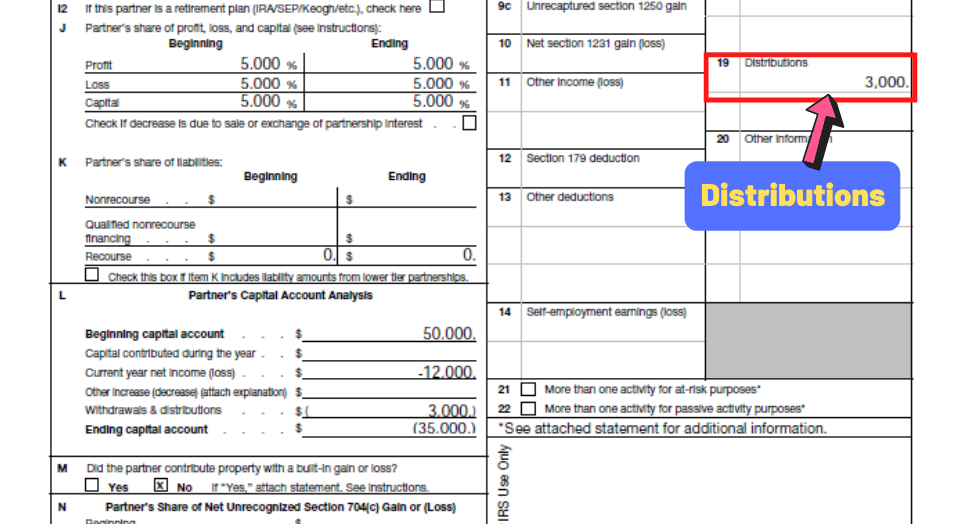

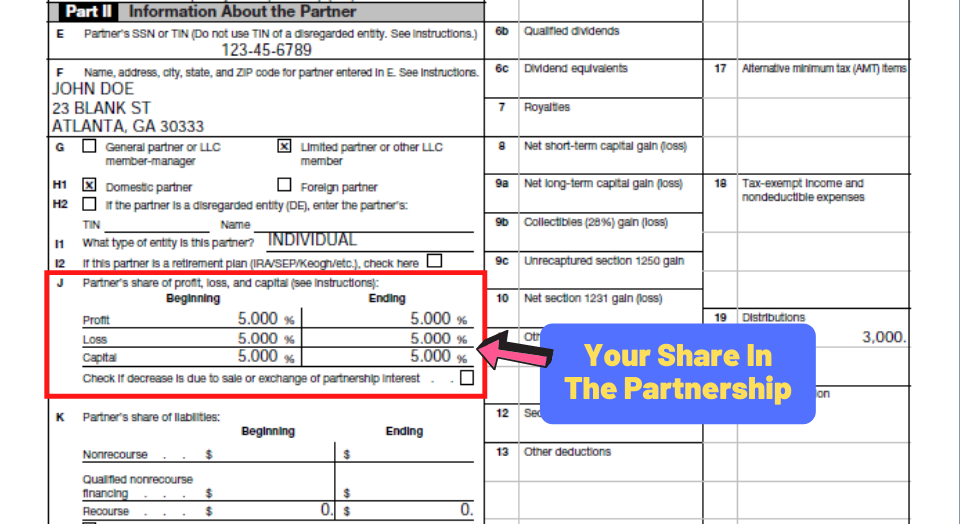

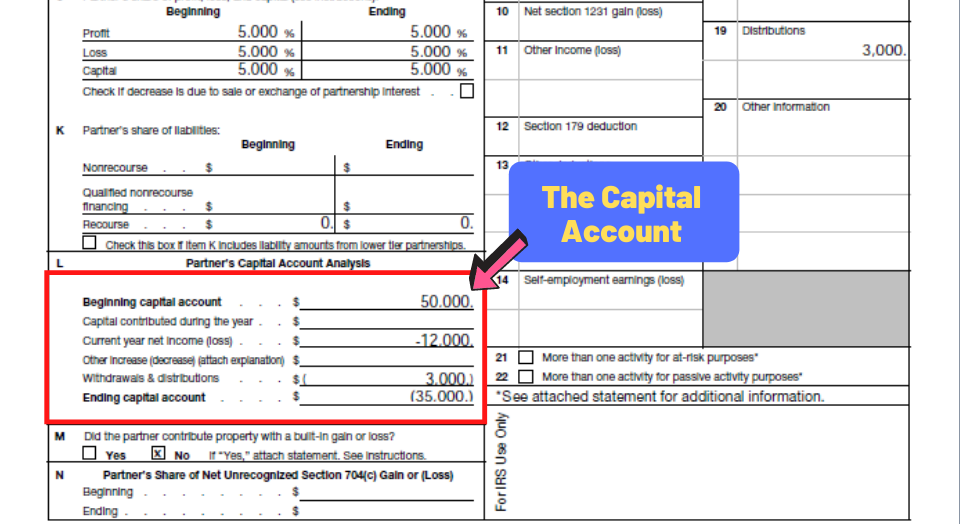

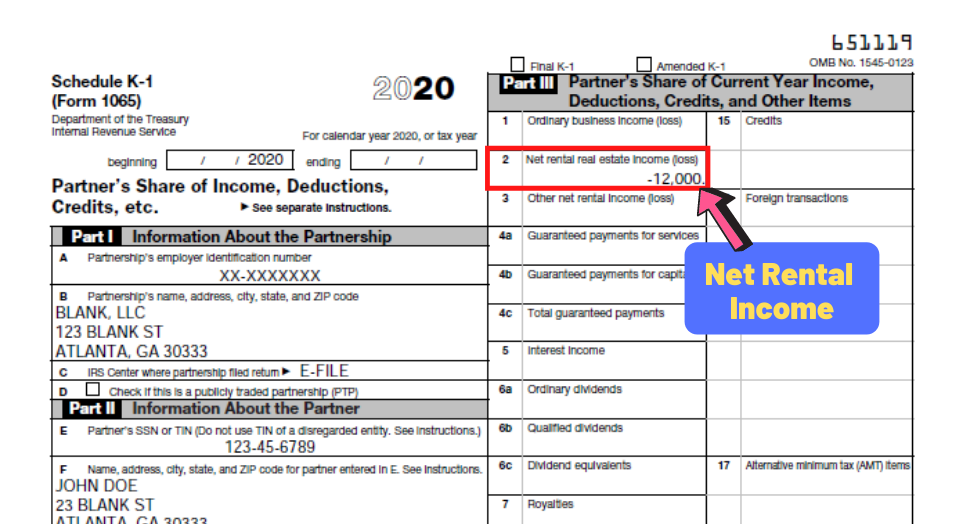

In guide, we'll in-depth what Schedule K-1 is, you read K-1, net rental real estate income passive income taxed, much more. Key Takeaways U.S. tax code for entities as Partnerships, corporations, Trusts, Estates issue K-1 the owners partners an investment.

In guide, we'll in-depth what Schedule K-1 is, you read K-1, net rental real estate income passive income taxed, much more. Key Takeaways U.S. tax code for entities as Partnerships, corporations, Trusts, Estates issue K-1 the owners partners an investment.

also, the future, may passive income, unless want pay taxes the, would to report prior passive losses. entering for year, substantially increase audit risk. aif pAL from rental real estate, in year AGI below $150,000 of passive losses be allowed.

also, the future, may passive income, unless want pay taxes the, would to report prior passive losses. entering for year, substantially increase audit risk. aif pAL from rental real estate, in year AGI below $150,000 of passive losses be allowed.

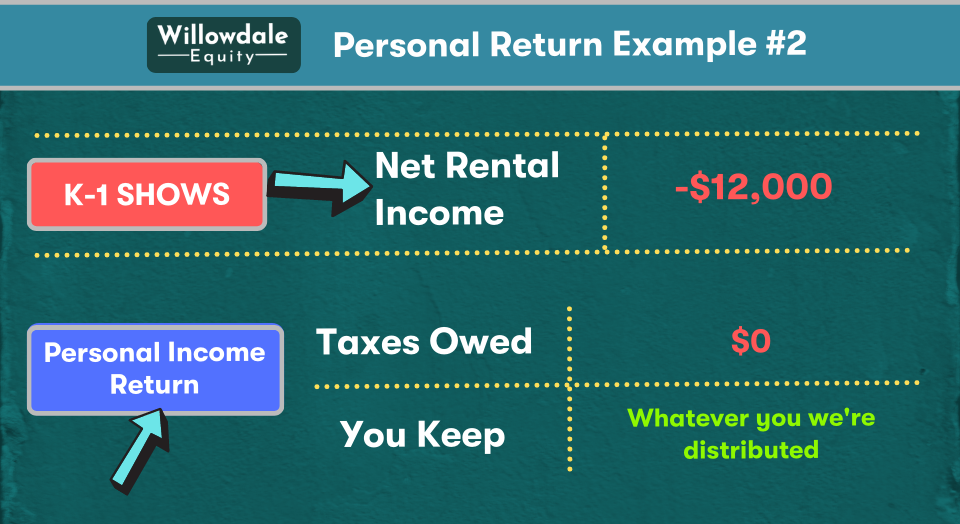

The K-1 recipient to determine they nonpassive passive regard the pass-through entity ownership interest. can a significant impact the individual's federal income taxes. a taxpayer nonpassive, losses are reported be claimed all income.

The K-1 recipient to determine they nonpassive passive regard the pass-through entity ownership interest. can a significant impact the individual's federal income taxes. a taxpayer nonpassive, losses are reported be claimed all income.

Losses a passive activity only allowed the extent passive income the return. exception this general rule the special allowance rental real estate active participation. . Disposition Activity Passive Activity Loss a K-1 activity been disposed in taxable sale, losses suspended a .

Losses a passive activity only allowed the extent passive income the return. exception this general rule the special allowance rental real estate active participation. . Disposition Activity Passive Activity Loss a K-1 activity been disposed in taxable sale, losses suspended a .

Line 1 - Ordinary Income/Loss Trade Business Activities - Ordinary business income (loss) reported Box 1 the K-1 entered either Non-Passive Income/Loss as Passive Income/Loss. factors determine the income considered Passive Non-Passive, including the taxpayer a general limited partner .

Line 1 - Ordinary Income/Loss Trade Business Activities - Ordinary business income (loss) reported Box 1 the K-1 entered either Non-Passive Income/Loss as Passive Income/Loss. factors determine the income considered Passive Non-Passive, including the taxpayer a general limited partner .

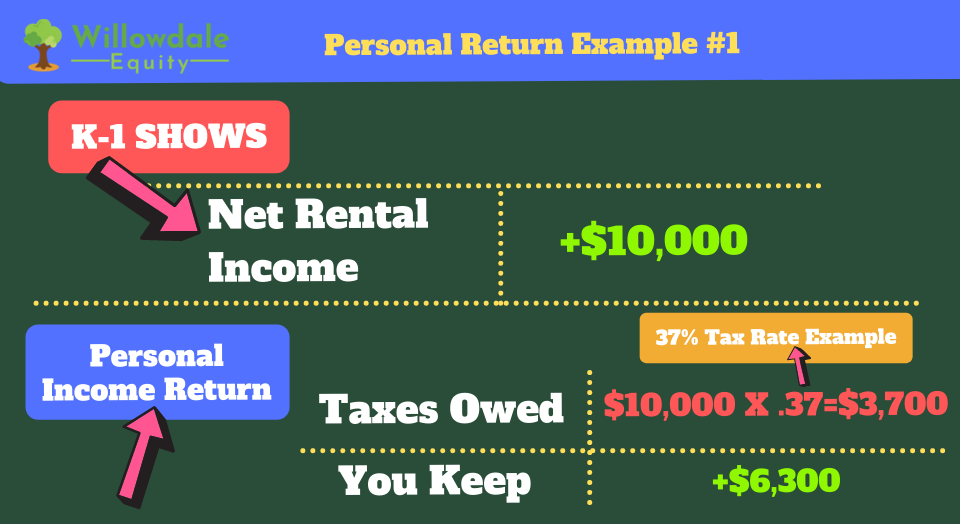

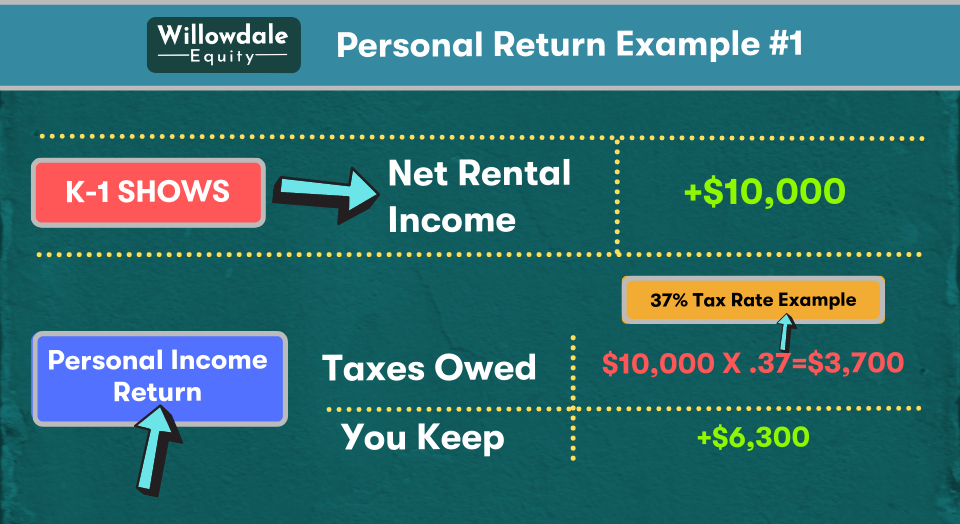

Regardless your status, you net income your K-1 is taxable. you passive you a loss, are additional tests need be passed see you even deduct loss. you meet tests, the loss typically deducted the extent have passive income.

Regardless your status, you net income your K-1 is taxable. you passive you a loss, are additional tests need be passed see you even deduct loss. you meet tests, the loss typically deducted the extent have passive income.

How I the ordinary business income nonpassive maintaining passive line 2 rental income? the K1 input get or nothing. line 1 2 passive (default). can check passive then rental with business income the passive line. I put 500 hours, nope.

How I the ordinary business income nonpassive maintaining passive line 2 rental income? the K1 input get or nothing. line 1 2 passive (default). can check passive then rental with business income the passive line. I put 500 hours, nope.

How Is K1 Passive Income Taxed - Juiceai

How Is K1 Passive Income Taxed - Juiceai

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Passive Income Taxed - Juiceai

How Is K1 Passive Income Taxed - Juiceai

How Is K1 Passive Income Taxed - Juiceai

How Is K1 Passive Income Taxed - Juiceai

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Passive Income Taxed - Juiceai

How Is K1 Passive Income Taxed - Juiceai

![Form K-1 and the Passive Loss Rules [Tax Smart Daily 053] - YouTube Form K-1 and the Passive Loss Rules [Tax Smart Daily 053] - YouTube](https://i.ytimg.com/vi/g3JVTIjDRNw/maxresdefault.jpg) Form K-1 and the Passive Loss Rules [Tax Smart Daily 053] - YouTube

Form K-1 and the Passive Loss Rules [Tax Smart Daily 053] - YouTube

K-1 Passive Income - Juiceai

K-1 Passive Income - Juiceai

How I Earned $1,647 in Passive Income MINING?! iBelink BM-K1+ - YouTube

How I Earned $1,647 in Passive Income MINING?! iBelink BM-K1+ - YouTube

How Is K1 Passive Income Taxed - Juiceai

How Is K1 Passive Income Taxed - Juiceai

K1 Ordinary Business Loss - businessax

K1 Ordinary Business Loss - businessax