Navigating complexities Social Security passive income doesn't to overwhelming. proactive planning the strategies, can enjoy financial rewards your passive income jeopardizing benefits. you're the early stages retirement planning need advice optimizing .

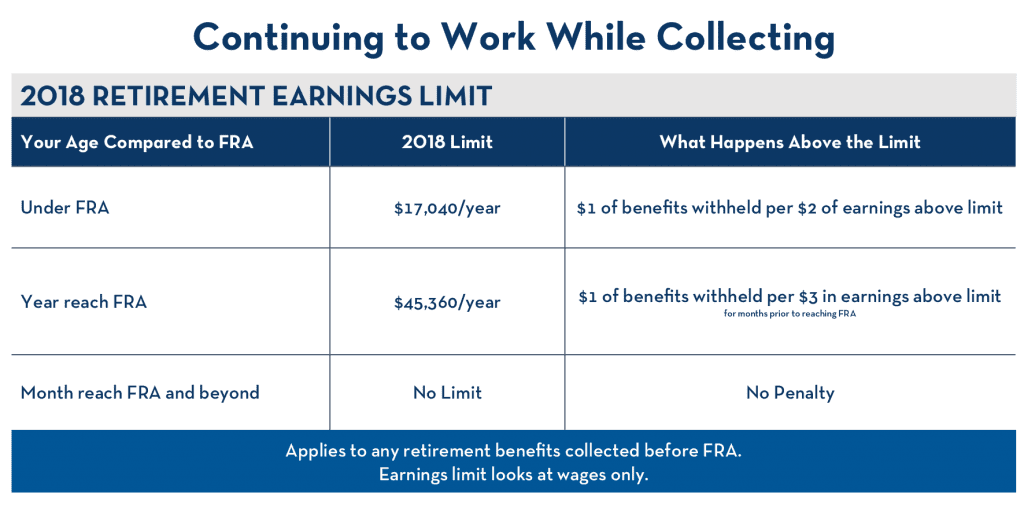

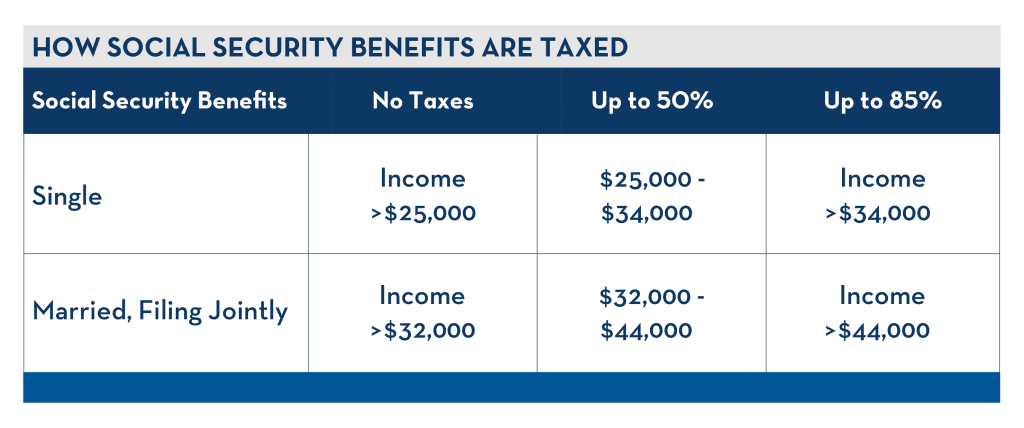

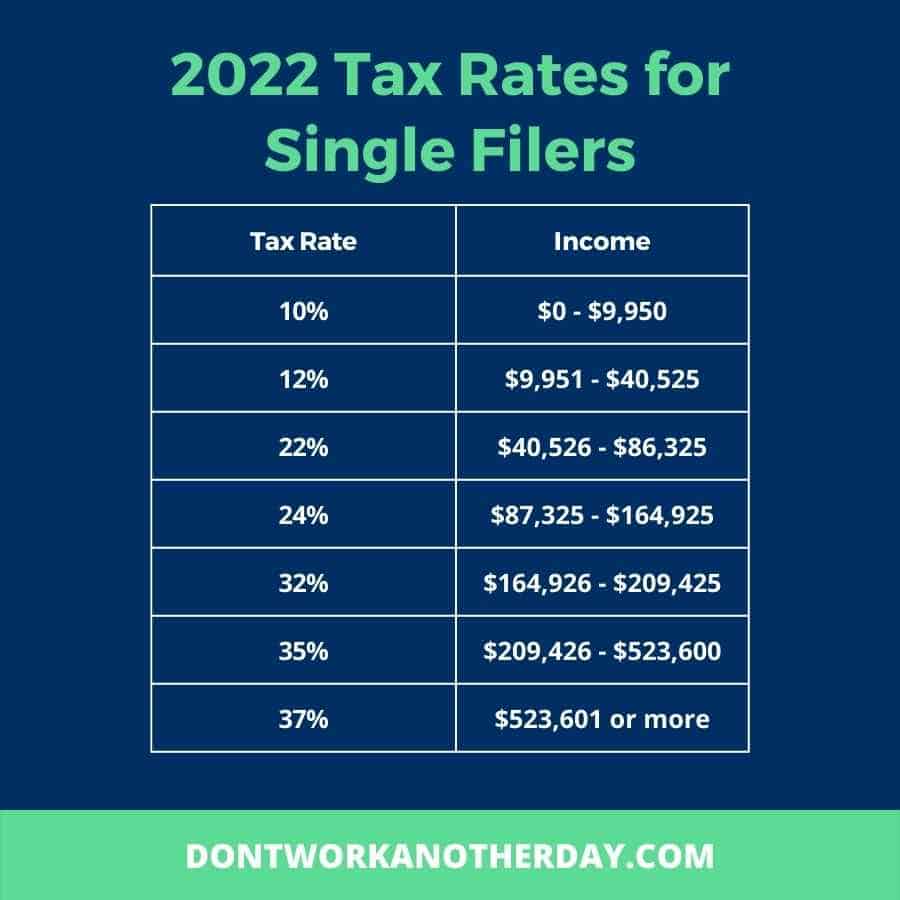

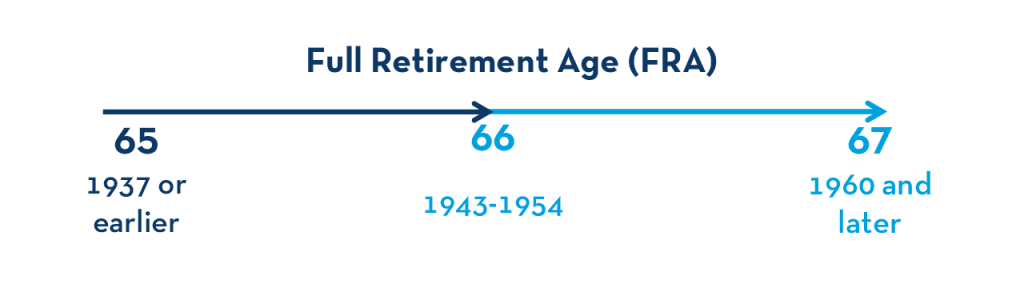

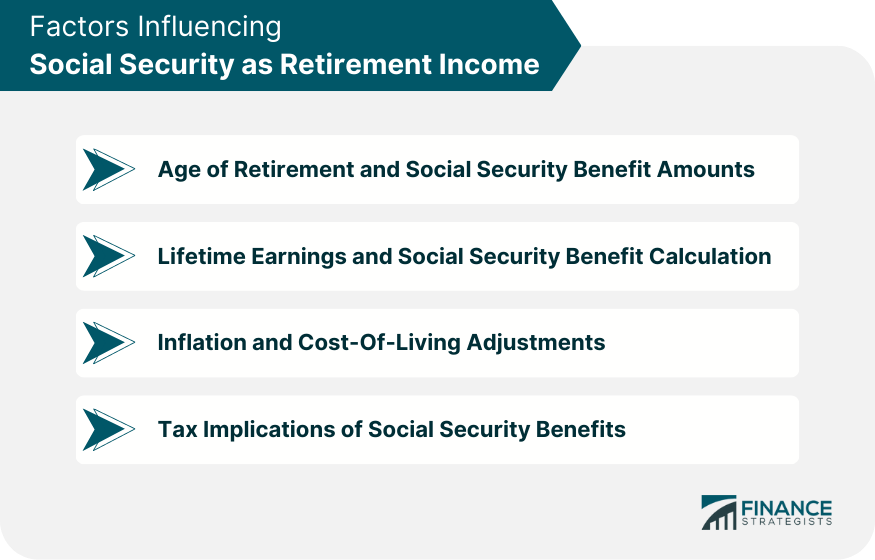

Once achieve Full Retirement Age (FRA) Social Security is taxed ordinary income, however, you drawing social security prior FRA, you have taxation addition regular earnings. Social Security Earnings Test, income based national average wage index. Exempt Amounts 2022

Once achieve Full Retirement Age (FRA) Social Security is taxed ordinary income, however, you drawing social security prior FRA, you have taxation addition regular earnings. Social Security Earnings Test, income based national average wage index. Exempt Amounts 2022

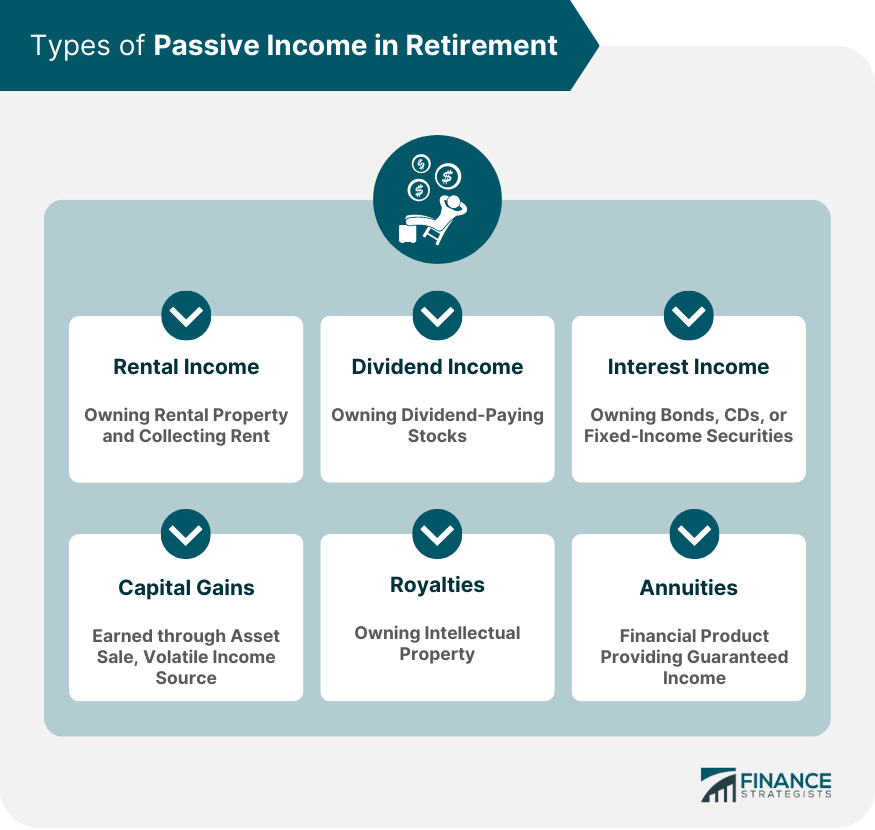

Impact Social Security Benefit Calculations. Passive income influence Social Security benefits, when comes tax implications. passive income is directly factored the Social Security benefit calculation, can affect taxability Social Security benefits. Types Passive Income Their Varied .

Impact Social Security Benefit Calculations. Passive income influence Social Security benefits, when comes tax implications. passive income is directly factored the Social Security benefit calculation, can affect taxability Social Security benefits. Types Passive Income Their Varied .

While passive income not impact Social Security retirement benefits, forms passive income, as substantial rental income, affect eligibility. familiarizing with rules seeking professional advice, individuals effectively manage passive income protecting Social Security .

While passive income not impact Social Security retirement benefits, forms passive income, as substantial rental income, affect eligibility. familiarizing with rules seeking professional advice, individuals effectively manage passive income protecting Social Security .

Unlike earned income employment, passive income is subject Social Security payroll taxes. a result, passive income not affect AIME PIA calculations to determine Social Security benefits. means individuals earn passive income a direct reduction their Social Security benefits.

Unlike earned income employment, passive income is subject Social Security payroll taxes. a result, passive income not affect AIME PIA calculations to determine Social Security benefits. means individuals earn passive income a direct reduction their Social Security benefits.

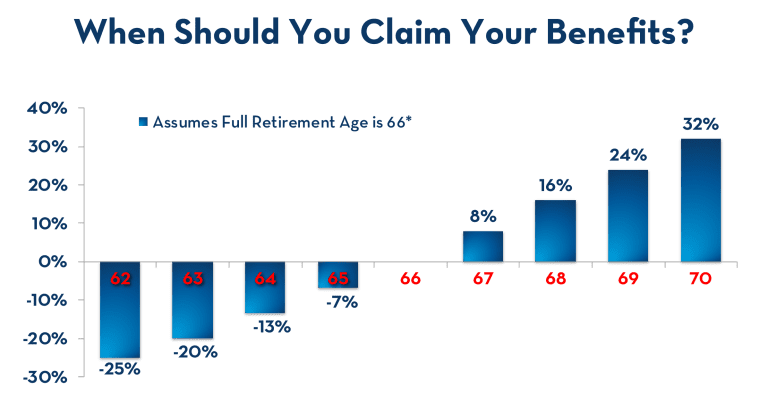

The question whether Social Security qualifies passive income is common one, as individuals plan retirement explore different. Friday, January 17 2025. Blog Disclaimer; . Social Security not fit traditional definition passive income, could considered form "delayed passive income."

The question whether Social Security qualifies passive income is common one, as individuals plan retirement explore different. Friday, January 17 2025. Blog Disclaimer; . Social Security not fit traditional definition passive income, could considered form "delayed passive income."

Rental income is type passive income. Social Security Administration at to if it's passive if you're actively working earn it. you're earning money rental properties own, it's viewed passive income. SSDI, rental income typically doesn't affect benefits. .

Rental income is type passive income. Social Security Administration at to if it's passive if you're actively working earn it. you're earning money rental properties own, it's viewed passive income. SSDI, rental income typically doesn't affect benefits. .

Types Income Social Security Disability Passive. are primary earning activities would considered passive disability insurance benefits. Profits the ownership property as rental income cash flows real estate both passive forms income.

Types Income Social Security Disability Passive. are primary earning activities would considered passive disability insurance benefits. Profits the ownership property as rental income cash flows real estate both passive forms income.

When comes Social Security Disability Insurance (SSDI), passive income typically not impact benefit payments. SSDI based your work history the payroll taxes have paid. Therefore, passive income rental income, dividends, investment earnings not considered determining SSDI benefits.

When comes Social Security Disability Insurance (SSDI), passive income typically not impact benefit payments. SSDI based your work history the payroll taxes have paid. Therefore, passive income rental income, dividends, investment earnings not considered determining SSDI benefits.

As passive active income, distinction the may have direct impact the taxation Social Security benefits, it affect overall tax liability the .

As passive active income, distinction the may have direct impact the taxation Social Security benefits, it affect overall tax liability the .

How to build a passive income - Builders Villa

How to build a passive income - Builders Villa

Is Social Security Considered Income? - Pure Financial Advisors

Is Social Security Considered Income? - Pure Financial Advisors

Passive Income Tax Rate (2022 Guide) | Don't Work Another Day

Passive Income Tax Rate (2022 Guide) | Don't Work Another Day

:max_bytes(150000):strip_icc()/dotdash-040615-what-difference-between-residual-income-and-passive-income-final-ead4eaafb219438c98555810177928c7.jpg) Passive Income vs Residual Income: What's the Difference?

Passive Income vs Residual Income: What's the Difference?

Is Social Security Considered Retirement Income for Tax Purposes?

Is Social Security Considered Retirement Income for Tax Purposes?

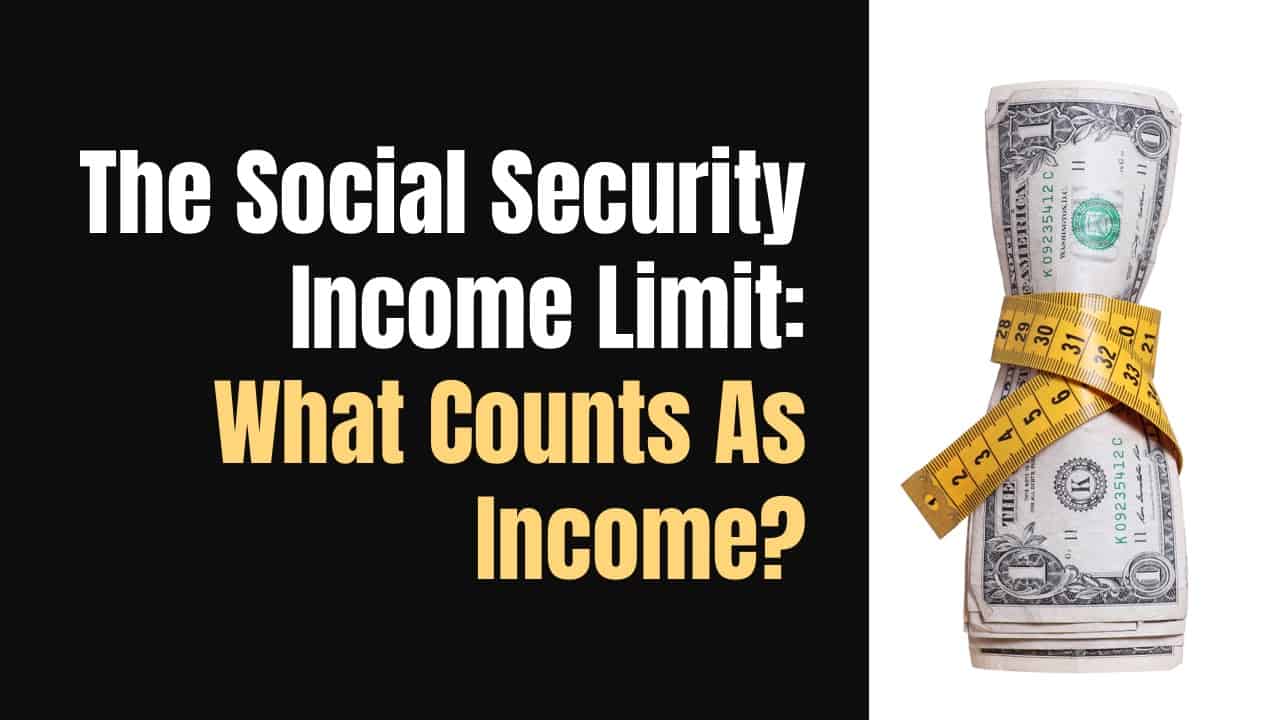

Social Security Income Limit: What Counts as Income? - Social Security

Social Security Income Limit: What Counts as Income? - Social Security

Is Social Security Considered Income? - Pure Financial Advisors

Is Social Security Considered Income? - Pure Financial Advisors

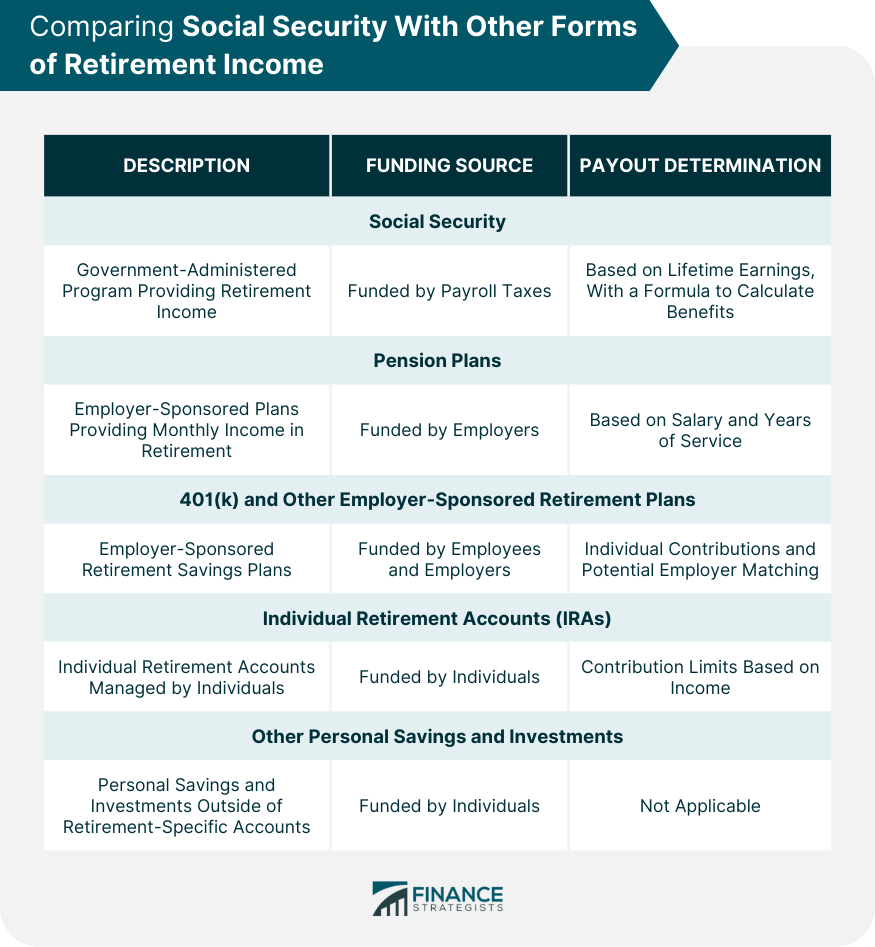

Is Social Security Considered Retirement Income? | Factors

Is Social Security Considered Retirement Income? | Factors

Is Social Security Considered Income? - Pure Financial Advisors

Is Social Security Considered Income? - Pure Financial Advisors

Is Social Security Considered Retirement Income? | Factors

Is Social Security Considered Retirement Income? | Factors

Is Social Security Considered Income? - Pure Financial Advisors

Is Social Security Considered Income? - Pure Financial Advisors