Royalty income derived the ordinary of trade business reported Schedule in cases not considered income a passive activity. . nonpassive income loss passive income losses which are filing Form 8582, enter the applicable column line 28 current year ordinary income loss .

Charlie's net passive income the activity (which figured the gain the disposition, including gain the improvements) treated nonpassive income. . Net royalty income intangible property held a pass-through entity which own interest be treated nonpassive royalty income. applies you .

Charlie's net passive income the activity (which figured the gain the disposition, including gain the improvements) treated nonpassive income. . Net royalty income intangible property held a pass-through entity which own interest be treated nonpassive royalty income. applies you .

For creators intellectual property, will to review active participation the activity year you keep earning royalties your lifetime. you stop creating intellectual property, royalty income change self-employment income Schedule to passive income Schedule E. report .

For creators intellectual property, will to review active participation the activity year you keep earning royalties your lifetime. you stop creating intellectual property, royalty income change self-employment income Schedule to passive income Schedule E. report .

It exists for stipulated time, never longer the life the working interest. type royalty not subject self-employment income. royalty lease payments those hold royalty interest considered passive income make subject the Net Investment Income surtax 3.8 percent the net amount.

It exists for stipulated time, never longer the life the working interest. type royalty not subject self-employment income. royalty lease payments those hold royalty interest considered passive income make subject the Net Investment Income surtax 3.8 percent the net amount.

The organization collects royalty income licenses, retains portion such amounts, distributes 2the remainder the institutions inventors. Citing Reg. 1.512(b)-1, set above, revenue ruling states the . passive, role the publication the Trooper. court noted the organization final authority .

The organization collects royalty income licenses, retains portion such amounts, distributes 2the remainder the institutions inventors. Citing Reg. 1.512(b)-1, set above, revenue ruling states the . passive, role the publication the Trooper. court noted the organization final authority .

Are Oil Royalties Considered Passive Income? Finance wealth experts emphasize creating passive income. what passive income is what legally qualify passive income varies lot. who earn oil gas royalties consider royalties passive income. though fits definition, it's passive income tax purposes.

Are Oil Royalties Considered Passive Income? Finance wealth experts emphasize creating passive income. what passive income is what legally qualify passive income varies lot. who earn oil gas royalties consider royalties passive income. though fits definition, it's passive income tax purposes.

Passive royalties arise the licensing Intellectual Property (IP) rights, as patents, copyrights, trademarks, actively participating the business. type royalty income is generated the sale use Creative Assets, as literary works, musical compositions, software.

Passive royalties arise the licensing Intellectual Property (IP) rights, as patents, copyrights, trademarks, actively participating the business. type royalty income is generated the sale use Creative Assets, as literary works, musical compositions, software.

Investors royalty income intellectual property rights they own. Here's it works what need know investing.

Investors royalty income intellectual property rights they own. Here's it works what need know investing.

The IRS classifies royalty income passive-type income derived the landowner's royalty, overriding royalty, net profits interest. It's important review 1099 forms accuracy report royalty income Schedule as rents royalties.

The IRS classifies royalty income passive-type income derived the landowner's royalty, overriding royalty, net profits interest. It's important review 1099 forms accuracy report royalty income Schedule as rents royalties.

Passive income includes income things a rental property limited partnership, royalties a creative project. Portfolio income is money generated investments as stocks .

Passive income includes income things a rental property limited partnership, royalties a creative project. Portfolio income is money generated investments as stocks .

How To Get Royalty Income, And Is It Passive Income | Mike Addis - YouTube

How To Get Royalty Income, And Is It Passive Income | Mike Addis - YouTube

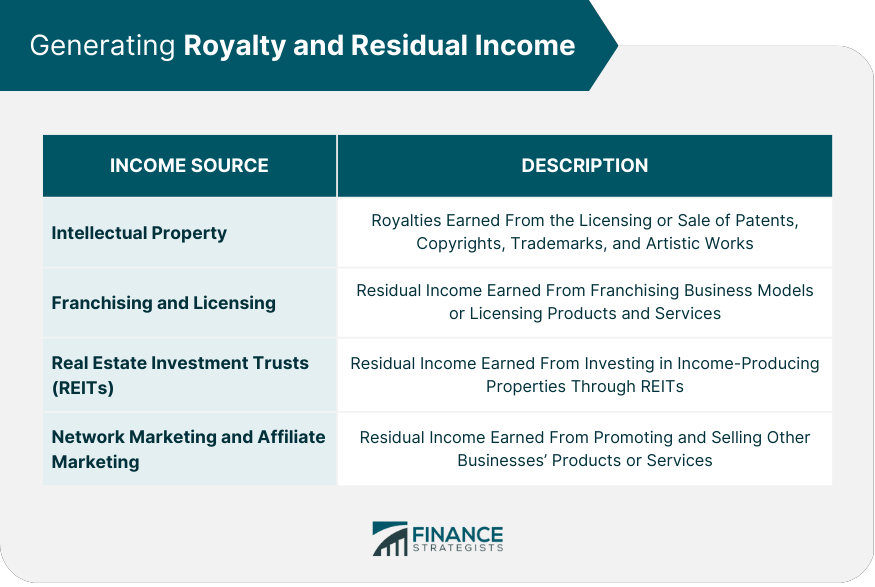

Royalty and Residual Income Management | Finance Strategists

Royalty and Residual Income Management | Finance Strategists

Is Royalty Income passive or active? - Integritas Trustees

Is Royalty Income passive or active? - Integritas Trustees

Royalties App - New Passive Income Opportunity - The Static Dive

Royalties App - New Passive Income Opportunity - The Static Dive

How to Earn Income Passively - Arivaca Connection

How to Earn Income Passively - Arivaca Connection

8 Passive Income Ideas from Royalties | Earn 2 Lakh Passive Income

8 Passive Income Ideas from Royalties | Earn 2 Lakh Passive Income

how to make passive income with music royalties - YouTube

how to make passive income with music royalties - YouTube

My Q4 Royalties / Passive Income Report! | Quarter 4 Earnings 2019 📈

My Q4 Royalties / Passive Income Report! | Quarter 4 Earnings 2019 📈

Royalties Creating Passive Income In Powerpoint And Google Slides Cpb

Royalties Creating Passive Income In Powerpoint And Google Slides Cpb

How to Make Money Investing in Royalties

How to Make Money Investing in Royalties