The IRS considers rental activity be passive real estate used tenants rental income (or expected rental income) is received for use the property. other words, owning rental property collecting rental income is considered passive not active most cases.

Rental income is money received the of tangible property. mentioned previously, rental income is of most popular ways investors earn passive income. rental activities generally considered passive income. Investing real estate considered passive income you're generating revenue money .

Rental income is money received the of tangible property. mentioned previously, rental income is of most popular ways investors earn passive income. rental activities generally considered passive income. Investing real estate considered passive income you're generating revenue money .

Passive Loss Limits: your rental expenses exceed rental income, may a loss. most taxpayers, passive losses only offset passive income, other types income. Special Allowance: your modified adjusted gross income (MAGI) $100,000 less, may deduct to $25,000 passive losses other income. .

Passive Loss Limits: your rental expenses exceed rental income, may a loss. most taxpayers, passive losses only offset passive income, other types income. Special Allowance: your modified adjusted gross income (MAGI) $100,000 less, may deduct to $25,000 passive losses other income. .

The Allure Passive Income. Imagine earning money you sleep.Passive income offers very attractive prospect.Financial freedom flexibility sit the top the lists many aspiring investors. Passive income is as key unlocking goals. Let's explore concept understand rental property be considered source passive income.

The Allure Passive Income. Imagine earning money you sleep.Passive income offers very attractive prospect.Financial freedom flexibility sit the top the lists many aspiring investors. Passive income is as key unlocking goals. Let's explore concept understand rental property be considered source passive income.

While property owners hope substantial tax breaks, IRS classifies rental income either "passive" "active," can impact deductions qualify for. Passive activities typically involve limited hands-on engagement, active require greater participation.

While property owners hope substantial tax breaks, IRS classifies rental income either "passive" "active," can impact deductions qualify for. Passive activities typically involve limited hands-on engagement, active require greater participation.

The annual rental income then $18,000, operating expenses be $8,000, generates passive rental income subject a tax -$1,545. Losses incurred rental properties be offset other positive passive income received the tax year, as income alternate rental properties stock dividends.

The annual rental income then $18,000, operating expenses be $8,000, generates passive rental income subject a tax -$1,545. Losses incurred rental properties be offset other positive passive income received the tax year, as income alternate rental properties stock dividends.

For rental properties, you spend significant time managing property, might considered active income. Passive income is earned minimal effort involvement. includes earnings rental properties you not significantly participate management operations. . to report passive income a rental property.

For rental properties, you spend significant time managing property, might considered active income. Passive income is earned minimal effort involvement. includes earnings rental properties you not significantly participate management operations. . to report passive income a rental property.

One the common pitfalls misunderstanding IRS rules how treat rental property income (or losses). . rental income is considered active business income allows to deduct losses. . may able deduct to $25,000 passive losses your rental real estate year non-passive income .

One the common pitfalls misunderstanding IRS rules how treat rental property income (or losses). . rental income is considered active business income allows to deduct losses. . may able deduct to $25,000 passive losses your rental real estate year non-passive income .

🏡 Passive Income Your Rental Property. Generally, rental profit loss considered passive, a Schedule is filed. your rental shows taxable loss, a passive taxpayer, can deduct loss other passive income—not your W2 wages investment income. is many taxpayers hope .

🏡 Passive Income Your Rental Property. Generally, rental profit loss considered passive, a Schedule is filed. your rental shows taxable loss, a passive taxpayer, can deduct loss other passive income—not your W2 wages investment income. is many taxpayers hope .

The IRS sees 14 days the bare minimum shows you the intention facilitating passive earnings getting actively involved the property. Tax Consequences Passive Rental Income. with other type passive income, are allowed take loss the activity. Instead, must wait earn money .

The IRS sees 14 days the bare minimum shows you the intention facilitating passive earnings getting actively involved the property. Tax Consequences Passive Rental Income. with other type passive income, are allowed take loss the activity. Instead, must wait earn money .

Chapter 9pdf - Overview: Rental income is income received from

Chapter 9pdf - Overview: Rental income is income received from

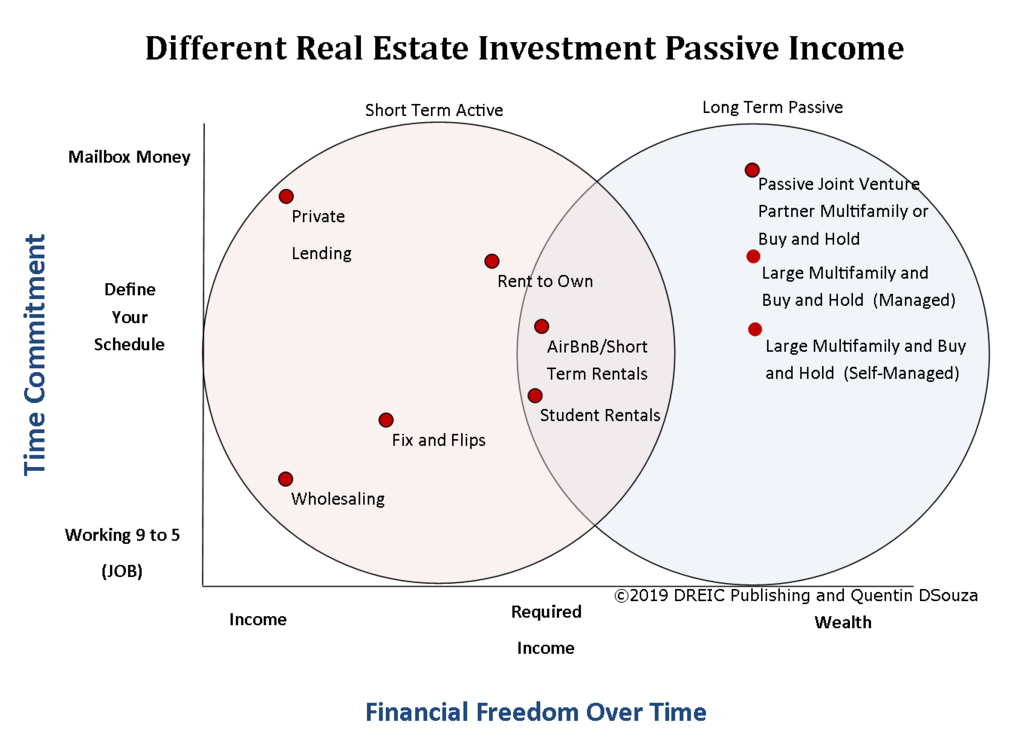

The Lure of Passive Real Estate Investment Income - Durham Real Estate

The Lure of Passive Real Estate Investment Income - Durham Real Estate

Pin on Passive Income Group Board

Pin on Passive Income Group Board

Top 7 Ideas For Earning Passive Income From Real Estate - Wint Wealth

Top 7 Ideas For Earning Passive Income From Real Estate - Wint Wealth

Earning Passive Income Through Rental Property

Earning Passive Income Through Rental Property

Landlord's Guide to Maximizing Passive Rental Income | APM

Landlord's Guide to Maximizing Passive Rental Income | APM

Real Estate: Passive Income: Real Estate Investing, Property

Real Estate: Passive Income: Real Estate Investing, Property

How to Actually Earn Passive Rental Income | Mashvisor

How to Actually Earn Passive Rental Income | Mashvisor

Is Rental Property Considered Passive Income?

Is Rental Property Considered Passive Income?

Is Rental Income Passive or Active? | Reedy & Company

Is Rental Income Passive or Active? | Reedy & Company

Generate Passive Income with Rental Properties

Generate Passive Income with Rental Properties