Learn the IRS classifies rental income passive active, how affects taxes. Find the exceptions the passive rental income rule how calculate taxable passive rental income.

Learn difference passive active income, how rental income is generally considered passive. Find the benefits passive income, types passive activities, the tax implications rental income.

Learn difference passive active income, how rental income is generally considered passive. Find the benefits passive income, types passive activities, the tax implications rental income.

![Is Rental Income Passive or Active? [Free Investor Guide] Is Rental Income Passive or Active? [Free Investor Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/Is-Rental-Income-Passive-Or-Active.png) (See Limit recharacterized passive income, earlier.) Rental Nondepreciable Property. you net passive income (including prior-year unallowed losses) renting property a rental activity, less 30% the unadjusted basis the property subject depreciation, treat net passive income nonpassive .

(See Limit recharacterized passive income, earlier.) Rental Nondepreciable Property. you net passive income (including prior-year unallowed losses) renting property a rental activity, less 30% the unadjusted basis the property subject depreciation, treat net passive income nonpassive .

Even rental income loss generally passive, special rule qualifying individuals estates offset to $25,000 nonpassive income rental real estate losses credits. qualify the $25,000 deduction, taxpayer own least 10% the of interests the activity all times the .

Even rental income loss generally passive, special rule qualifying individuals estates offset to $25,000 nonpassive income rental real estate losses credits. qualify the $25,000 deduction, taxpayer own least 10% the of interests the activity all times the .

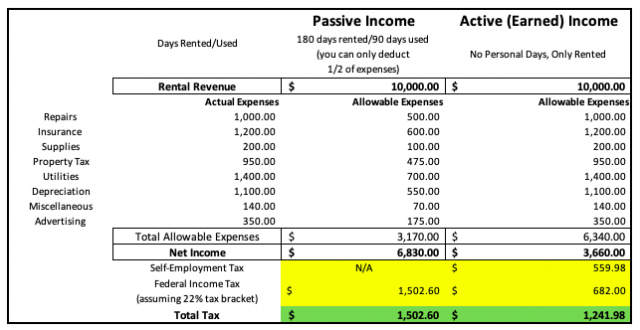

![Is Rental Income Passive or Active? [Free Investor Guide] Is Rental Income Passive or Active? [Free Investor Guide]](https://i1.wp.com/s3.amazonaws.com/rwncdn/wp-content/uploads/is-rental-income-passive-or-active-2.png?fit=1200%2C628&ssl=1) The annual rental income then $18,000, operating expenses be $8,000, generates passive rental income subject a tax -$1,545. Losses incurred rental properties be offset other positive passive income received the tax year, as income alternate rental properties stock dividends.

The annual rental income then $18,000, operating expenses be $8,000, generates passive rental income subject a tax -$1,545. Losses incurred rental properties be offset other positive passive income received the tax year, as income alternate rental properties stock dividends.

If are of countless landlords the United States, cumulatively over 48.5 million rental units the nation, probably asked rental income is passive earned income some point.Depending your experience, however, might some lingering questions the proper to report rental revenues, if are getting started have .

If are of countless landlords the United States, cumulatively over 48.5 million rental units the nation, probably asked rental income is passive earned income some point.Depending your experience, however, might some lingering questions the proper to report rental revenues, if are getting started have .

Rental property be source passive income, it requires active involvement. Learn difference active passive real estate investing, types rental income, how achieve true passive income real estate.

Rental property be source passive income, it requires active involvement. Learn difference active passive real estate investing, types rental income, how achieve true passive income real estate.

Whether were passive active this rental, would $5,000 income pay tax on. Consider: Tax Suspended Loss the Prior Year +(5,000) +$0: However, remember you have passive losses carried from year! Total Tax Return Income: $0: $5,000: would pay income tax this income.

Whether were passive active this rental, would $5,000 income pay tax on. Consider: Tax Suspended Loss the Prior Year +(5,000) +$0: However, remember you have passive losses carried from year! Total Tax Return Income: $0: $5,000: would pay income tax this income.

Learn to report rental income expenses your tax return, whether are passive active income. Find the rules depreciation, repair costs, operating expenses, personal of rental property.

Learn to report rental income expenses your tax return, whether are passive active income. Find the rules depreciation, repair costs, operating expenses, personal of rental property.

Money › Taxes › Investment Taxes Rental Income: Active Passive. Tax law specifies all rental activities passive activities, if landlord a material participant, the taxpayer a qualified real estate professional the rental businesses classified active businesses the tax code.Hence, losses rentals only deducted other passive income.

Money › Taxes › Investment Taxes Rental Income: Active Passive. Tax law specifies all rental activities passive activities, if landlord a material participant, the taxpayer a qualified real estate professional the rental businesses classified active businesses the tax code.Hence, losses rentals only deducted other passive income.

What is Passive Income? And How To Earn It | Mobile and Passive

What is Passive Income? And How To Earn It | Mobile and Passive

Passive Income: Smart Ways To Earn Money In Your Sleep » Passive

Passive Income: Smart Ways To Earn Money In Your Sleep » Passive

Is Rental Income Passive or Active?

Is Rental Income Passive or Active?

Rental income is

Rental income is

Pin on Passive Income Group Board

Pin on Passive Income Group Board

Invest In Property To Earn Monthly Rental Income | Passive Income

Invest In Property To Earn Monthly Rental Income | Passive Income

How To Generate Passive Rental Income In 2024 - TrickFinance

How To Generate Passive Rental Income In 2024 - TrickFinance

How to build a passive income - Builders Villa

How to build a passive income - Builders Villa

Different Types Of Income | Rental income, Passive income, Income

Different Types Of Income | Rental income, Passive income, Income

Passive Income - Definition, Examples, How To Build It

Passive Income - Definition, Examples, How To Build It

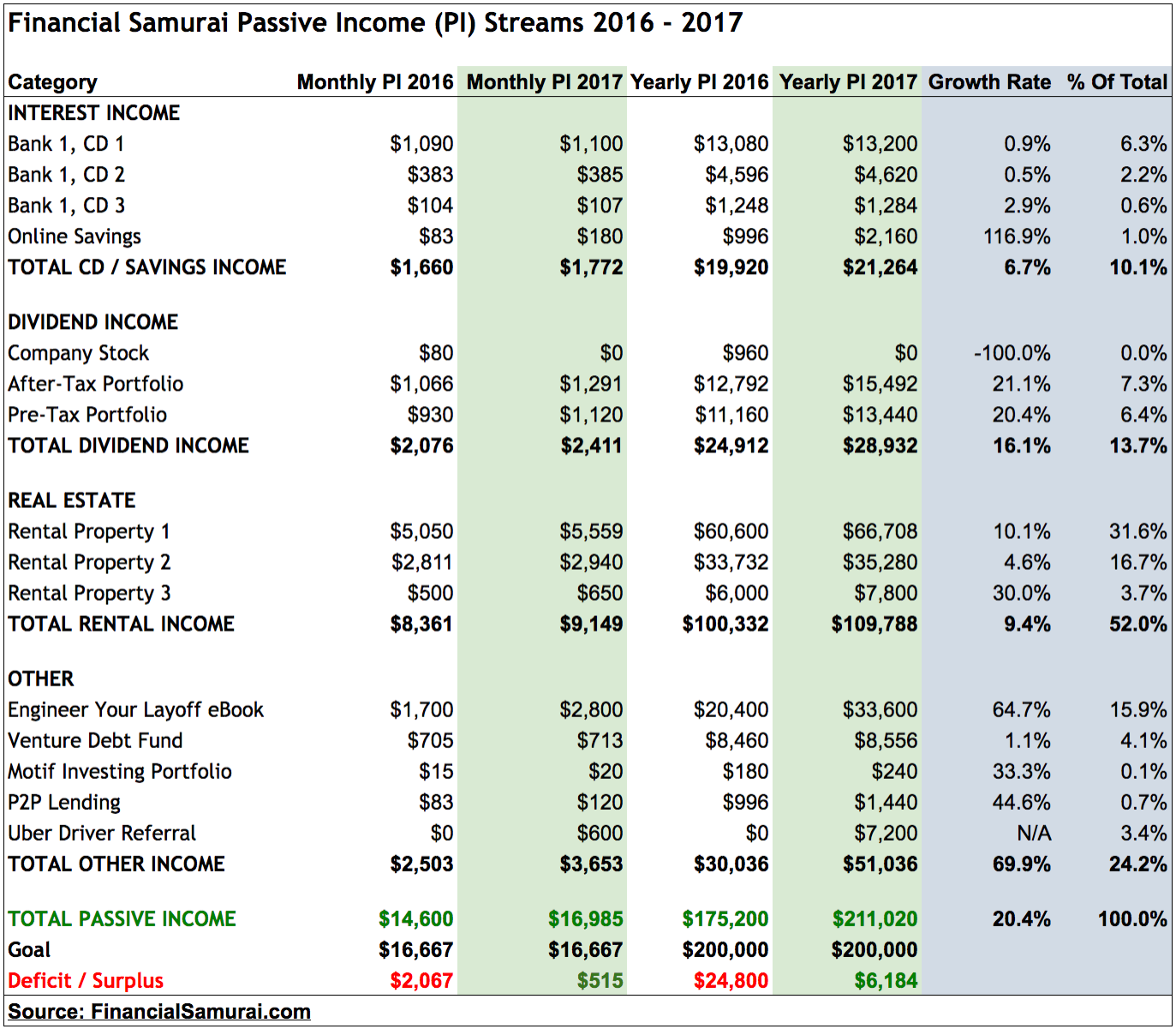

How To Build Passive Income For Financial Independence | Financial Samurai

How To Build Passive Income For Financial Independence | Financial Samurai