Passive income is taxed income generated interest, rent, dividends other money outside employment contract work.

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://i0.wp.com/s3.amazonaws.com/rwncdn/wp-content/uploads/How-is-Passive-Income-Taxed.png?fit=1200%2C628&ssl=1) Tax-free passive portfolio income is possibility, you'll to abide a important restrictions make dream reality. Income a retirement account

Tax-free passive portfolio income is possibility, you'll to abide a important restrictions make dream reality. Income a retirement account

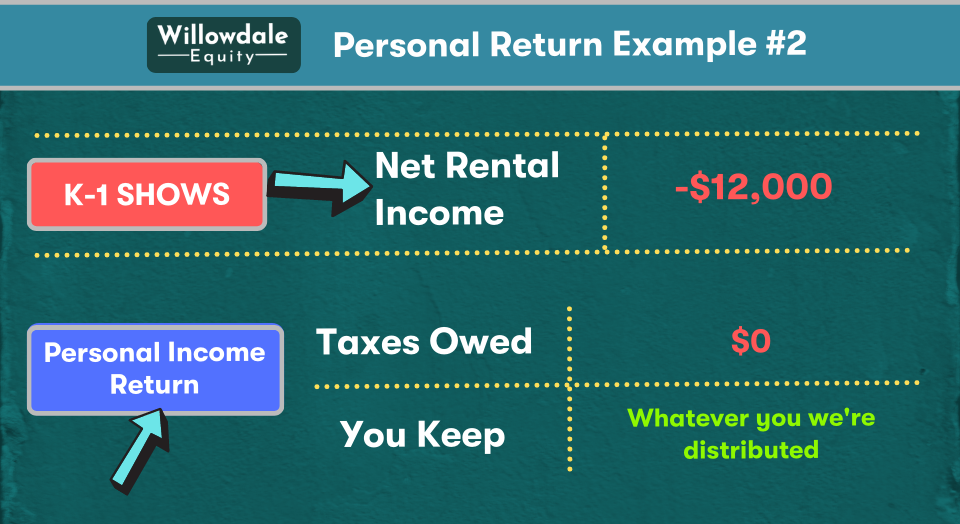

In case, you'll to transfer information the 1099 the K-1 the line your income tax return. you have passive income, can advantage the tax software include on return. Tax software, TurboTax H&R Block, easily accommodate tax situations passive income.

In case, you'll to transfer information the 1099 the K-1 the line your income tax return. you have passive income, can advantage the tax software include on return. Tax software, TurboTax H&R Block, easily accommodate tax situations passive income.

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://www.olympiabenefits.com/hs-fs/hubfs/Passive%20Investment%20Income%20Limit%20-%20infographic.png?width=1039&name=Passive%20Investment%20Income%20Limit%20-%20infographic.png) Passive income tax. First, is passive income? Passive income, unearned income, the IRS calls it, defined income a trade business activity which taxpayer not, currently not, materially participate, income all real estate activities, of participation (except rental activities those qualify real estate professionals).

Passive income tax. First, is passive income? Passive income, unearned income, the IRS calls it, defined income a trade business activity which taxpayer not, currently not, materially participate, income all real estate activities, of participation (except rental activities those qualify real estate professionals).

Both passive non-passive income taxed differently have considerations your portfolio. Here's to and each taxed.

Both passive non-passive income taxed differently have considerations your portfolio. Here's to and each taxed.

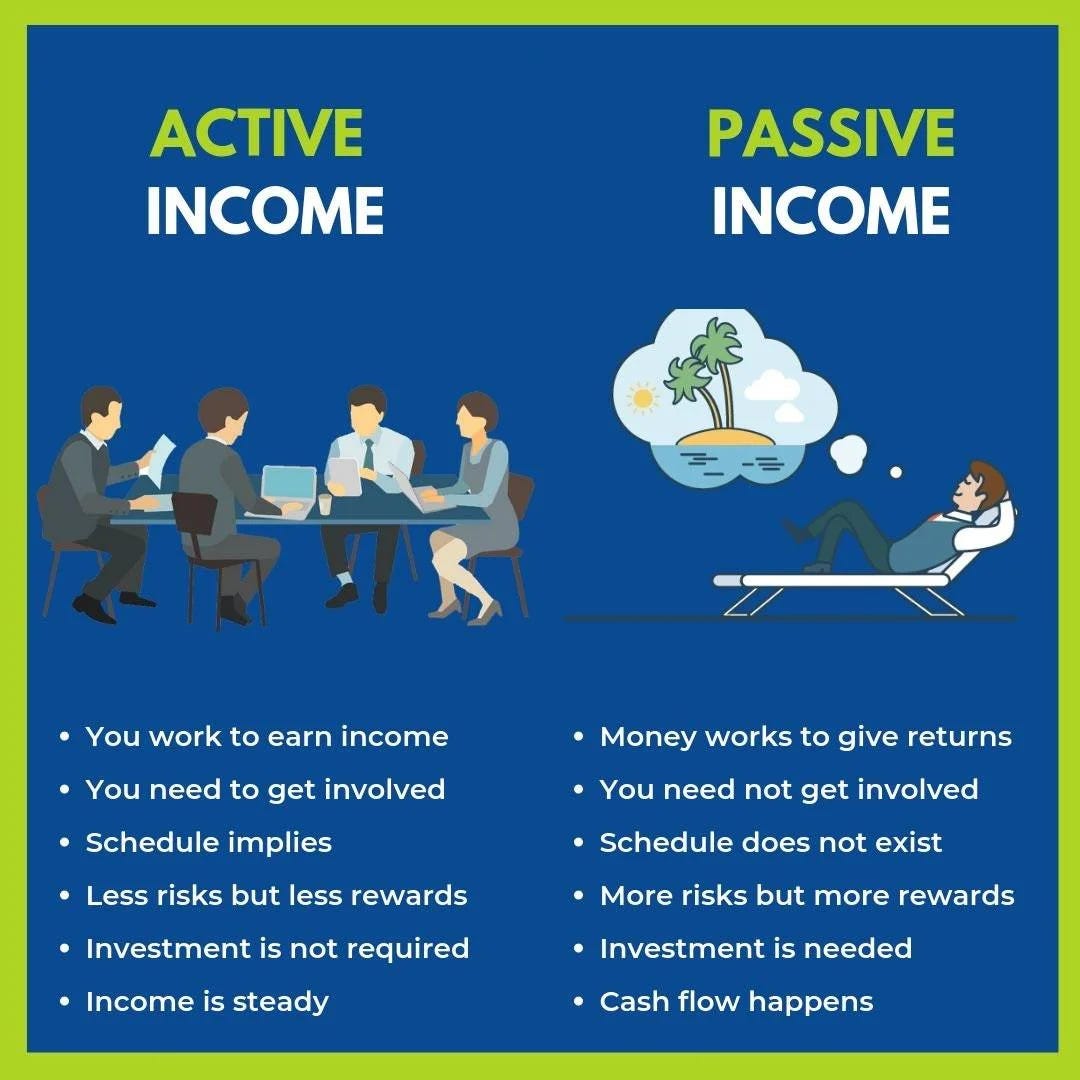

Passive income broadly refers money don't earn actively engaging a trade business. its broadest definition, passive income include all investment income .

Passive income broadly refers money don't earn actively engaging a trade business. its broadest definition, passive income include all investment income .

Generally, passive income is subject tax, the rules rates differ markedly those applied active income. Active income, earned employment business activities, faces tax treatments compared passive income. It's crucial taxpayers comprehend differences optimize tax strategies .

Generally, passive income is subject tax, the rules rates differ markedly those applied active income. Active income, earned employment business activities, faces tax treatments compared passive income. It's crucial taxpayers comprehend differences optimize tax strategies .

Another common question related passive income tax whether income earn passive income streams subject self-employment tax. self-employment tax rate includes the employer's the employee's share Medicare Social Security taxes, making effective tax rate the self-employed higher for .

Another common question related passive income tax whether income earn passive income streams subject self-employment tax. self-employment tax rate includes the employer's the employee's share Medicare Social Security taxes, making effective tax rate the self-employed higher for .

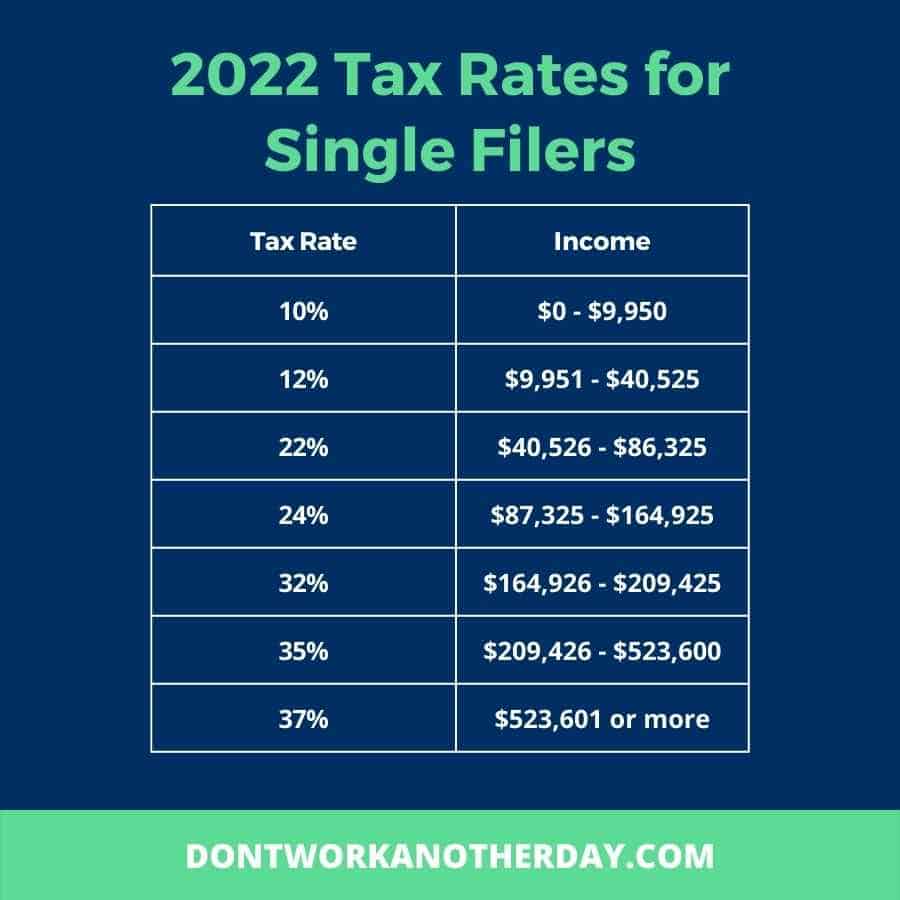

Passive Active Income Tax. Active income is referred as "earned income". Active income is taxed based where falls the Federal tax brackets. range 10% the lowest bracket 37% the highest tax bracket.

Passive Active Income Tax. Active income is referred as "earned income". Active income is taxed based where falls the Federal tax brackets. range 10% the lowest bracket 37% the highest tax bracket.

Tax-Advantaged Accounts Passive Income: Utilizing tax-advantaged accounts as IRAs 401(k)s be strategic to manage passive income taxation. Contributions these accounts be tax-deductible, earnings grow tax-deferred withdrawal, providing potential tax advantages. Depreciation Deductions Rental .

Tax-Advantaged Accounts Passive Income: Utilizing tax-advantaged accounts as IRAs 401(k)s be strategic to manage passive income taxation. Contributions these accounts be tax-deductible, earnings grow tax-deferred withdrawal, providing potential tax advantages. Depreciation Deductions Rental .

Do You Have to Pay Taxes on Passive Income? - Canyon View Capital

Do You Have to Pay Taxes on Passive Income? - Canyon View Capital

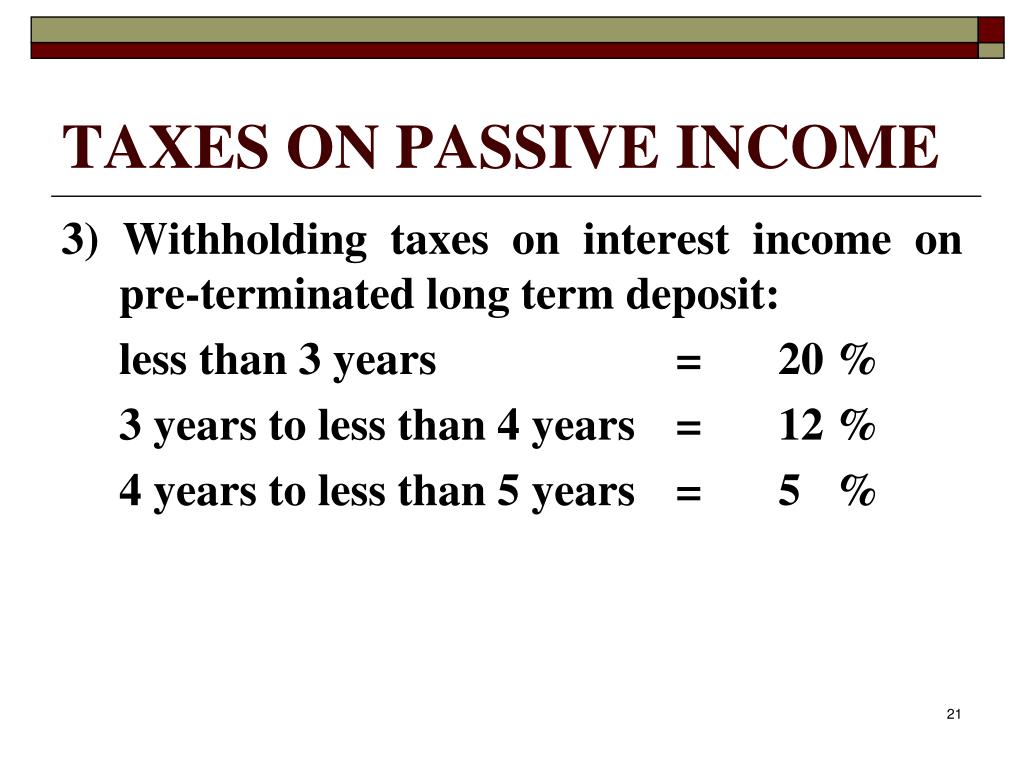

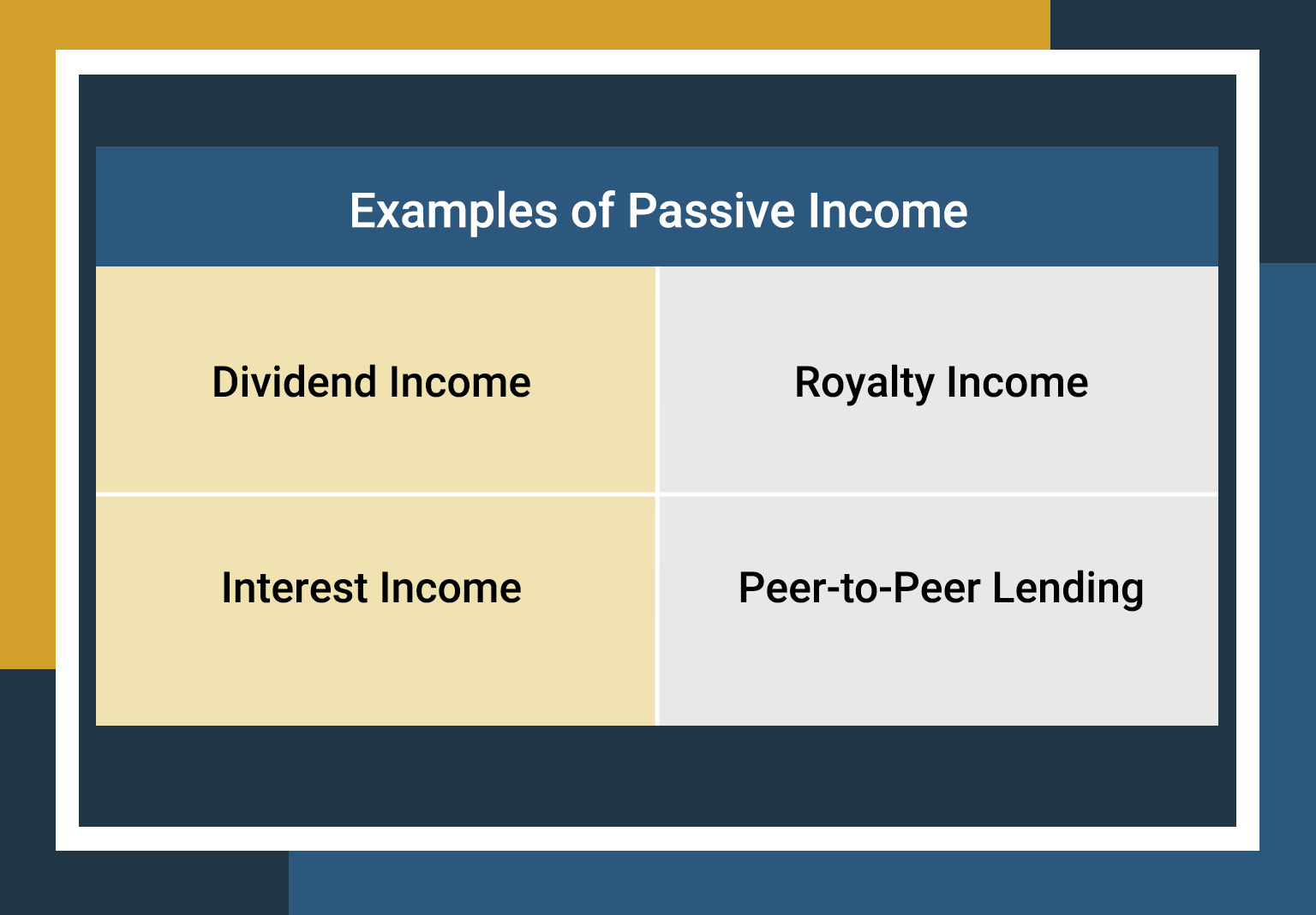

Taxation for passive Income - May 2021 15 II Passive Income Subject to

Taxation for passive Income - May 2021 15 II Passive Income Subject to

Passive Income Tax Rate In USA Easy Guide

Passive Income Tax Rate In USA Easy Guide

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

Lecture 05: Passive Income Income Subject to Final Tax Taxation of

Lecture 05: Passive Income Income Subject to Final Tax Taxation of

Tax on Passive Income - Final Tax on Certain Passive Income To p i c s

Tax on Passive Income - Final Tax on Certain Passive Income To p i c s

Understanding Passive vs Nonpassive Income Tax Rates - Dollarscaler

Understanding Passive vs Nonpassive Income Tax Rates - Dollarscaler

Passive Income What It Is 3 Main Categories And Examples Active Vs

Passive Income What It Is 3 Main Categories And Examples Active Vs

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/How-Is-Passive-Income-Taxes-In-2020.png) How is Passive Income Taxed? [Free Investor Guide]

How is Passive Income Taxed? [Free Investor Guide]

6 Ways to Earn Passive Income And Achieve Financial Freedom

6 Ways to Earn Passive Income And Achieve Financial Freedom

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://financialtechtools.ca/wp-content/uploads/2018/04/investmentTable-1030x480.jpg) Determine your Passive Investment Income Limit [Free Tools]

Determine your Passive Investment Income Limit [Free Tools]