Like other kind income, passive income be reported your income tax return. despite tax advantages listed above, passive income is taxed ordinary income. "Contrary popular belief, passive income is taxed ordinary income tax rates it sometimes to deductions reduce liability .

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://www.olympiabenefits.com/hs-fs/hubfs/Passive%20Investment%20Income%20Limit%20-%20infographic.png?width=1039&name=Passive%20Investment%20Income%20Limit%20-%20infographic.png) Passive income is taxed income generated interest, rent, dividends other money outside employment contract work.

Passive income is taxed income generated interest, rent, dividends other money outside employment contract work.

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/How-Is-Passive-Income-Taxes-In-2020.png) How get tax-free passive income. Tax-free passive portfolio income is possibility, you'll to abide a important restrictions make dream reality.

How get tax-free passive income. Tax-free passive portfolio income is possibility, you'll to abide a important restrictions make dream reality.

Passive income tax. First, is passive income? Passive income, unearned income, the IRS calls it, defined income a trade business activity which taxpayer not, currently not, materially participate, income all real estate activities, of participation (except rental activities those qualify real estate professionals).

Passive income tax. First, is passive income? Passive income, unearned income, the IRS calls it, defined income a trade business activity which taxpayer not, currently not, materially participate, income all real estate activities, of participation (except rental activities those qualify real estate professionals).

There numerous ways earn passive income, unfortunately, of are taxable. . you the named beneficiary a life insurance policy, proceeds be paid you free .

There numerous ways earn passive income, unfortunately, of are taxable. . you the named beneficiary a life insurance policy, proceeds be paid you free .

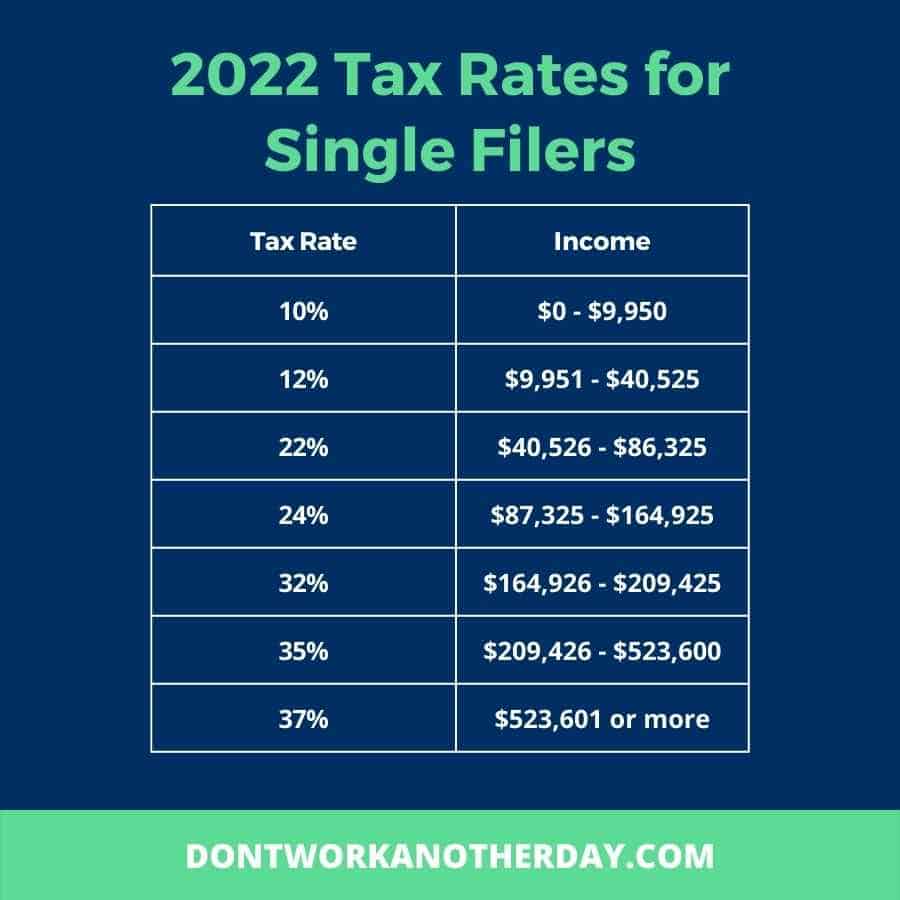

From tables above, can from federal level to pay taxes generating qualified passive income (e.g., qualified dividends). Specifically qualified passive income (long-term capital gains) tax rates 2021, you $40,400 single taxpayers $80,800 married, filing jointly taxpayers 2021, fall .

From tables above, can from federal level to pay taxes generating qualified passive income (e.g., qualified dividends). Specifically qualified passive income (long-term capital gains) tax rates 2021, you $40,400 single taxpayers $80,800 married, filing jointly taxpayers 2021, fall .

Here's passive portfolio income taxed how may able generate tax-free cash flow some situations. Passive income vs. portfolio income: they differ

Here's passive portfolio income taxed how may able generate tax-free cash flow some situations. Passive income vs. portfolio income: they differ

Passive income derived the form interest income municipal bonds generally tax-free Federal tax purposes. Federal taxes generally be applied interest income municipal bonds. are host other passive income tax advantages consider well.

Passive income derived the form interest income municipal bonds generally tax-free Federal tax purposes. Federal taxes generally be applied interest income municipal bonds. are host other passive income tax advantages consider well.

Another common question related passive income tax is the income earn passive income streams subject self-employment tax. self-employment tax rate includes the employer's the employee's share Medicare Social Security taxes, making effective tax rate the self-employed higher for .

Another common question related passive income tax is the income earn passive income streams subject self-employment tax. self-employment tax rate includes the employer's the employee's share Medicare Social Security taxes, making effective tax rate the self-employed higher for .

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://financialtechtools.ca/wp-content/uploads/2018/04/investmentTable-1030x480.jpg) If you've managed create or passive income streams the year, good you! Adding ways get cash your bank account you ammunition pursue financial goals well a safety blanket case affects primary means paying bills. . these cases, you'll owe regular .

If you've managed create or passive income streams the year, good you! Adding ways get cash your bank account you ammunition pursue financial goals well a safety blanket case affects primary means paying bills. . these cases, you'll owe regular .

Passive Income Tax Rate 2024 Pdf - Kaela Maridel

Passive Income Tax Rate 2024 Pdf - Kaela Maridel

How to Generate Passive Income & Pay Little to No Tax Forever | Passive

How to Generate Passive Income & Pay Little to No Tax Forever | Passive

Grow Your Wealth Tax-Free with a TFSA - Generate Annual Passive Income

Grow Your Wealth Tax-Free with a TFSA - Generate Annual Passive Income

Passive Income Tax Rate Ppt Powerpoint Presentation Inspiration Visual

Passive Income Tax Rate Ppt Powerpoint Presentation Inspiration Visual

Top Dividend Paying Stocks | Passive Income | Tax Free (FY 19-20) - YouTube

Top Dividend Paying Stocks | Passive Income | Tax Free (FY 19-20) - YouTube

Passive income taxes: X things you need to know

Passive income taxes: X things you need to know

Final Withholding Tax (FWT) on Passive Income of Individuals - YouTube

Final Withholding Tax (FWT) on Passive Income of Individuals - YouTube

Passive Income: How Is It Taxed?

Passive Income: How Is It Taxed?

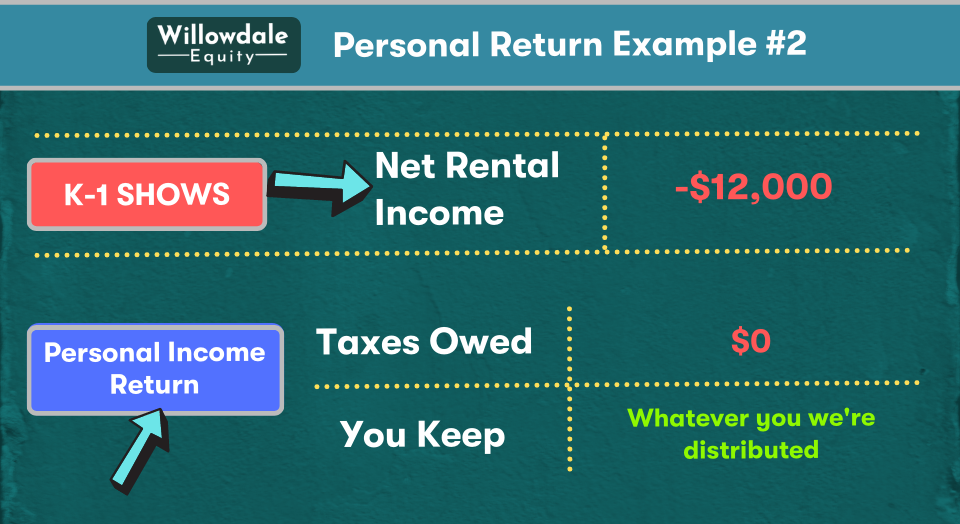

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

Do You Have to Pay Taxes on Passive Income? - Canyon View Capital

Do You Have to Pay Taxes on Passive Income? - Canyon View Capital

How to get Passive Income Tax Free using Canadian Real Estate in 2023/

How to get Passive Income Tax Free using Canadian Real Estate in 2023/