Earned "active" income. is category Americans associate the term "income." Earned, active, income includes money earned a job -- salaries, wages, bonuses, tips.

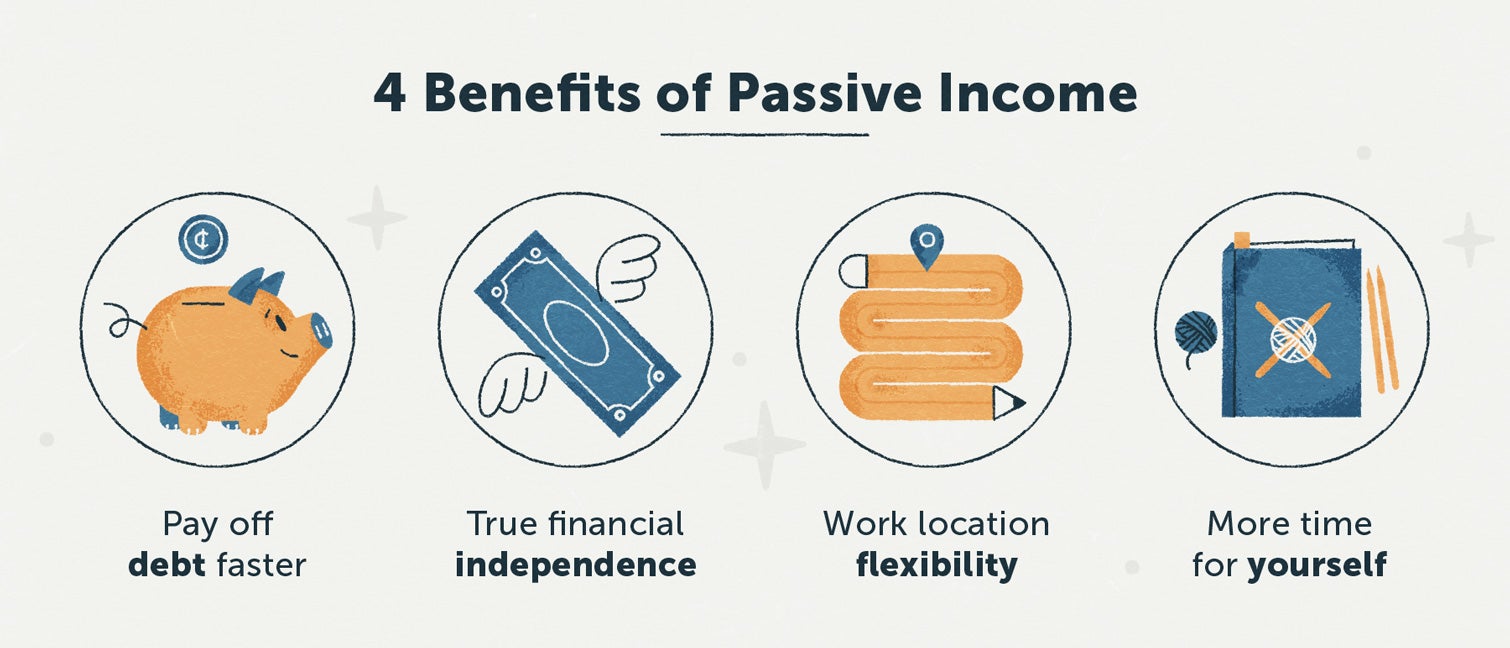

Learn difference passive income earned income, how are taxed the IRS. Find the benefits passive income how grow passive income real estate investing.

Learn difference passive income earned income, how are taxed the IRS. Find the benefits passive income how grow passive income real estate investing.

Total income = $170,000. total basis retirement contribution $120,000, $170,000. percentage income contributed be based earned income. Conclusion. It's important remember keep earned income passive income separated considering retirement contributions, they're treated differently .

Total income = $170,000. total basis retirement contribution $120,000, $170,000. percentage income contributed be based earned income. Conclusion. It's important remember keep earned income passive income separated considering retirement contributions, they're treated differently .

Income as investment profits Social Security payments considered unearned income, known passive income. Low- moderate-income earners eligible the earned income tax .

Income as investment profits Social Security payments considered unearned income, known passive income. Low- moderate-income earners eligible the earned income tax .

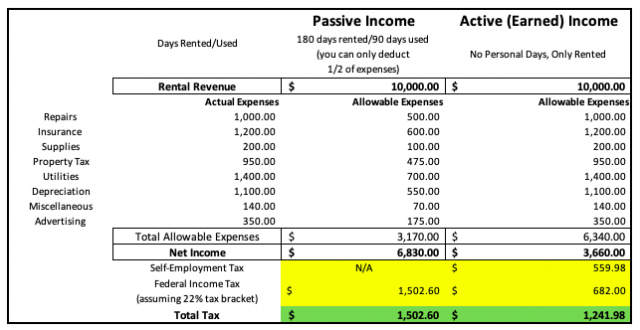

Several crucial tax variations exist earned passive income. Earned income is subject either self-employment tax Social Security Medicare taxes employed W-2 ; Losses passive income streams only deducted passive activity gains, limited exceptions real estate losses

Several crucial tax variations exist earned passive income. Earned income is subject either self-employment tax Social Security Medicare taxes employed W-2 ; Losses passive income streams only deducted passive activity gains, limited exceptions real estate losses

Passive income is considered money earned actively working it. That's it's called unearned income. Rental income income royalties limited partnerships some examples passive income. examples passive income include: Alimony. Child support . Unemployment benefits. Social Security benefits

Passive income is considered money earned actively working it. That's it's called unearned income. Rental income income royalties limited partnerships some examples passive income. examples passive income include: Alimony. Child support . Unemployment benefits. Social Security benefits

Earned Income Taxes. Earned income is highest taxed income the three. the current individual tax rates ranging 10% 35%, the top rate to go to 39%, tax bill really add quickly. addition, earned income is subject other taxes, as Social Security Medicare, are roughly 14%.

Earned Income Taxes. Earned income is highest taxed income the three. the current individual tax rates ranging 10% 35%, the top rate to go to 39%, tax bill really add quickly. addition, earned income is subject other taxes, as Social Security Medicare, are roughly 14%.

Passive losses be deducted other forms income as earned income, portfolio income non-passive income to $25,000 limit. requires participation be considered active, is much easier threshold material participation.

Passive losses be deducted other forms income as earned income, portfolio income non-passive income to $25,000 limit. requires participation be considered active, is much easier threshold material participation.

Passive income is money earned actively investing time generating income. common source passive income is rental properties. Rental income is generated a property owner rents their property tenants, they receive monthly payments actively managing property.

Passive income is money earned actively investing time generating income. common source passive income is rental properties. Rental income is generated a property owner rents their property tenants, they receive monthly payments actively managing property.

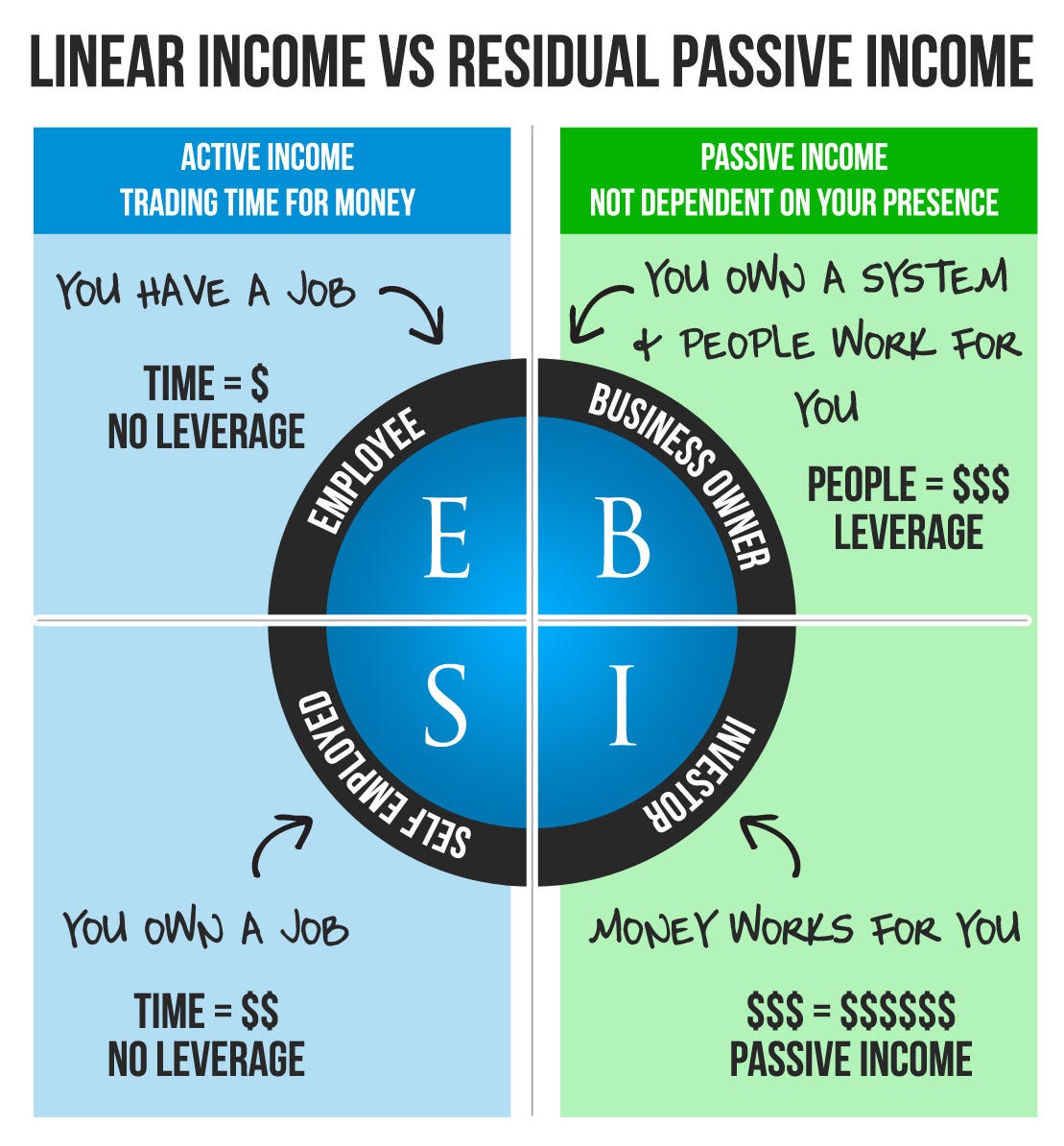

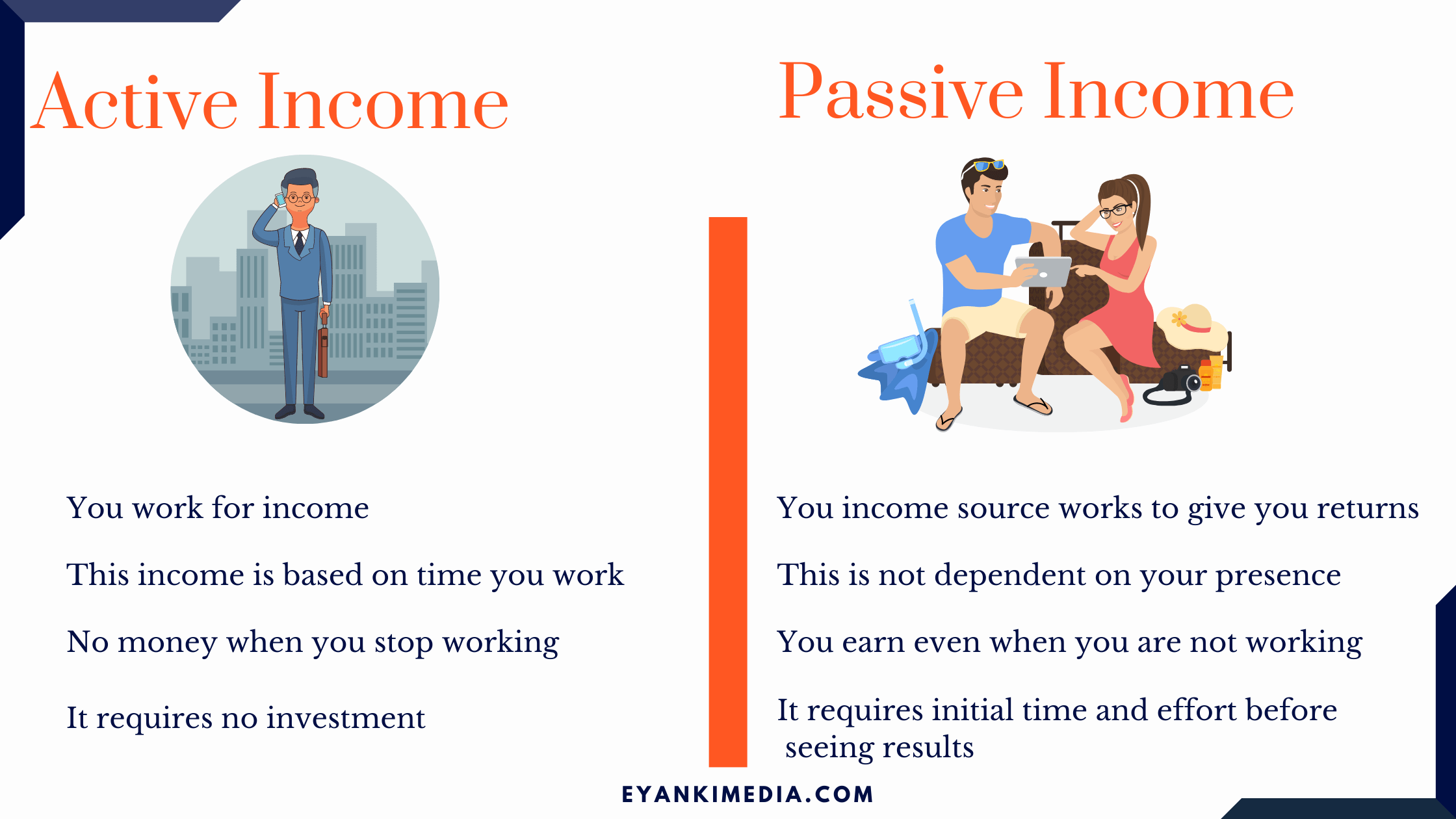

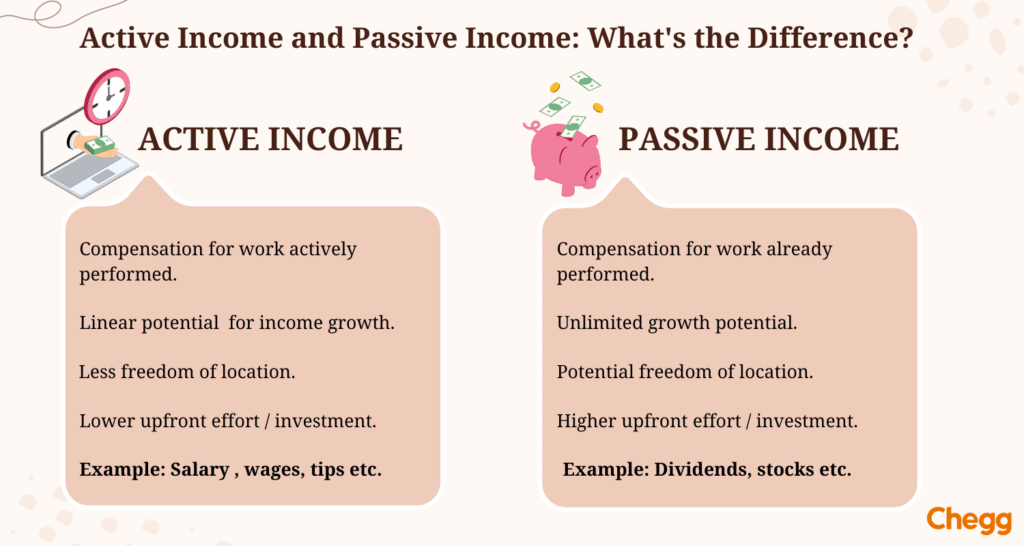

Let's break the differences earned income, passive income, investment income, helping to understand how each play role your financial success. Earned Income. Earned income is money receive exchange performing service providing goods. type income is typically with .

Let's break the differences earned income, passive income, investment income, helping to understand how each play role your financial success. Earned Income. Earned income is money receive exchange performing service providing goods. type income is typically with .

10 Best Passive Income Ideas That Work And Make Real Money

10 Best Passive Income Ideas That Work And Make Real Money

:max_bytes(150000):strip_icc()/dotdash-040615-what-difference-between-residual-income-and-passive-income-final-ead4eaafb219438c98555810177928c7.jpg) Passive Income vs Residual Income: What's the Difference?

Passive Income vs Residual Income: What's the Difference?

Active Income vs Passive Income: Realistically Optimize Your Business

Active Income vs Passive Income: Realistically Optimize Your Business

Is Rental Income Passive or Earned Income? - Taxhub

Is Rental Income Passive or Earned Income? - Taxhub

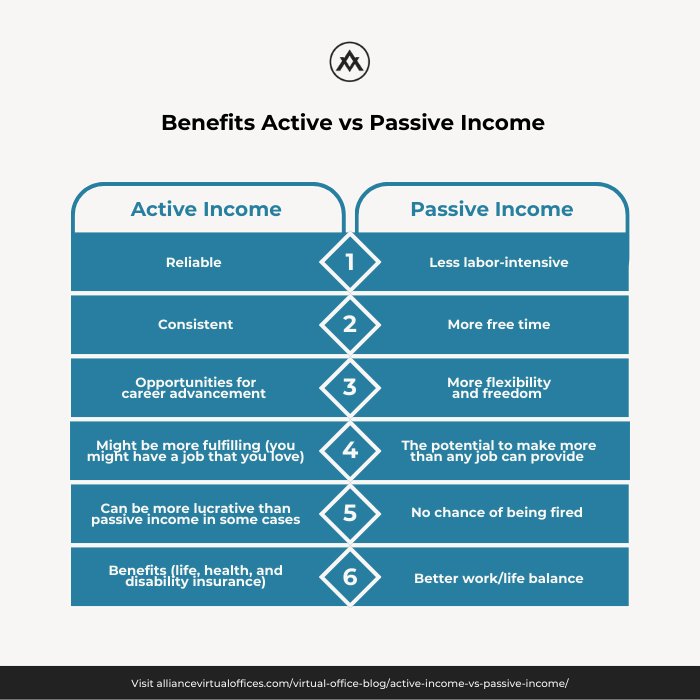

Passive Income vs Active Income - Top Differences with Infographics

Passive Income vs Active Income - Top Differences with Infographics

Active Income and Passive Income: 25 Amazing Ways to Earn

Active Income and Passive Income: 25 Amazing Ways to Earn

Top 10 Passive Income Idea Passive income is money earned with… | by

Top 10 Passive Income Idea Passive income is money earned with… | by

What Is Considered A Passive Income - Juiceai

What Is Considered A Passive Income - Juiceai

Active Income vs Passive Income (Which one is better for you?) | by

Active Income vs Passive Income (Which one is better for you?) | by

What is Passive Income | Passive Income | Earn While You Sleep

What is Passive Income | Passive Income | Earn While You Sleep