The Illinois Department Revenue issued FY 2020-29 explaining Illinois income tax withholding requirements apply employees normally works another state, temporarily work home Illinois due the COVID-19 emergency. guidance states employee wages subject Illinois income tax withholding the nonresident employee performed normal .

Wi-Fi, laptops mobile phones made work anywhere reality many us. working moving state state cause tax headache. you work a state .

Wi-Fi, laptops mobile phones made work anywhere reality many us. working moving state state cause tax headache. you work a state .

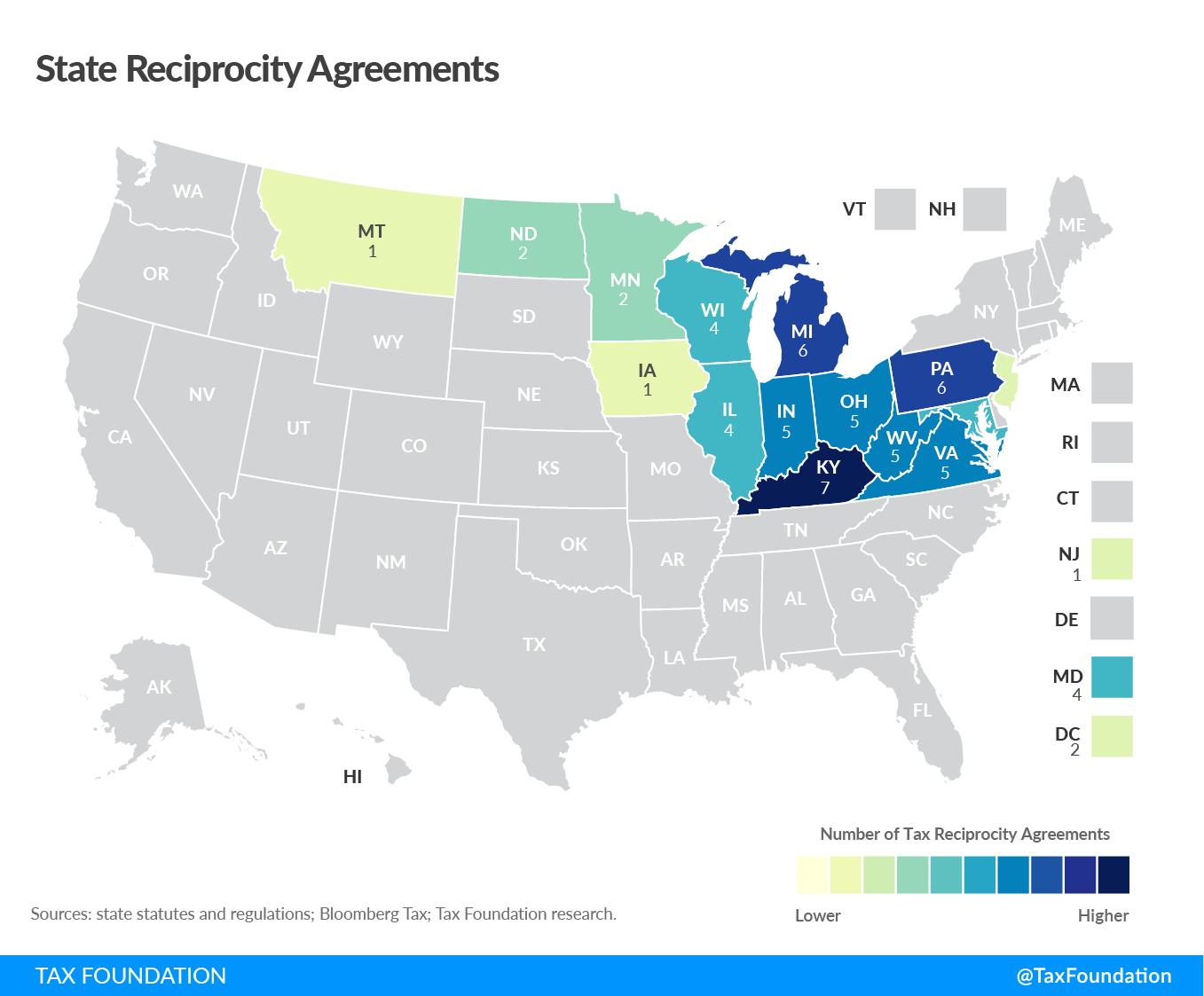

![107 Remote Work Stats [Every Employer Must Know] In 2024 107 Remote Work Stats [Every Employer Must Know] In 2024](https://thrivemyway.com/wp-content/uploads/2021/10/Remote-Work-Per-U.S.-State-Statistics-Illinois.png) For example, Illinois law states nonresidents pay taxes Illinois they work the state more 30 days. . like growth online commerce forced legal reckoning sales tax, boom remote work very force reexamination payroll taxes more the federal level. Alabama, District .

For example, Illinois law states nonresidents pay taxes Illinois they work the state more 30 days. . like growth online commerce forced legal reckoning sales tax, boom remote work very force reexamination payroll taxes more the federal level. Alabama, District .

Starting the 2018 tax year, Form IL-941, Illinois Withholding Income Tax Return. you unable file electronically, may request Form IL-900-EW, Waiver Request, our Taxpayer Assistance Division 1 800 732-8866 1 217 782-3336.

Starting the 2018 tax year, Form IL-941, Illinois Withholding Income Tax Return. you unable file electronically, may request Form IL-900-EW, Waiver Request, our Taxpayer Assistance Division 1 800 732-8866 1 217 782-3336.

tax.illinois.gov Register file return online at: mytax.illinois.gov Email at: • Withholding income tax questions: [email protected] Printed authority the State Illinois N-05/20-Web - Copy . work duties Illinois more 30 working days. an

tax.illinois.gov Register file return online at: mytax.illinois.gov Email at: • Withholding income tax questions: [email protected] Printed authority the State Illinois N-05/20-Web - Copy . work duties Illinois more 30 working days. an

If completed Form IL-W-4 not filed, you required disregard Form IL-W-4, must withhold Illinois Income Tax no allowances. Note: retirement income exempt Illinois Income Tax no withholding required, if federal income tax withheld. However, retired taxpayers wish enter voluntary .

If completed Form IL-W-4 not filed, you required disregard Form IL-W-4, must withhold Illinois Income Tax no allowances. Note: retirement income exempt Illinois Income Tax no withholding required, if federal income tax withheld. However, retired taxpayers wish enter voluntary .

Illinois Income Tax Treatment. general, Illinois withholding based where employee working. is outline common questions answers Illinois income tax withholding, to Illinois Department Revenue (DOR) Publication 130. are companies required withhold Illinois income tax an employee .

Illinois Income Tax Treatment. general, Illinois withholding based where employee working. is outline common questions answers Illinois income tax withholding, to Illinois Department Revenue (DOR) Publication 130. are companies required withhold Illinois income tax an employee .

The bulletin clarified employee compensation subject state income tax withholding any employee "has performed normal work duties Illinois more 30 working days." to bulletin, out-of-state employer "may required register the [DOR] withhold Illinois Income Tax" employees have .

The bulletin clarified employee compensation subject state income tax withholding any employee "has performed normal work duties Illinois more 30 working days." to bulletin, out-of-state employer "may required register the [DOR] withhold Illinois Income Tax" employees have .

You consult an accountant any tax issues preparing tax return, let CPA prepare return. is that state governments eventually to seek taxation remote workers based their state residence (California) their place employment (Illinois.) - hurdle be the road. 3.

You consult an accountant any tax issues preparing tax return, let CPA prepare return. is that state governments eventually to seek taxation remote workers based their state residence (California) their place employment (Illinois.) - hurdle be the road. 3.

In Remote Obligations Mobility (ROAM) Index, ranks states how tax codes affect remote mobile workers, Illinois in the third-highest score any state .

In Remote Obligations Mobility (ROAM) Index, ranks states how tax codes affect remote mobile workers, Illinois in the third-highest score any state .

Remote work tax deductions - Pay Stub Hero

Remote work tax deductions - Pay Stub Hero

Remote Employees and Taxes: A Guide to Remote Work Finances - Arc

Remote Employees and Taxes: A Guide to Remote Work Finances - Arc

Remote Work Taxes: What Workers Need to Know Before Filing - Justworks

Remote Work Taxes: What Workers Need to Know Before Filing - Justworks

Remote Work Taxes: Everything You Need to Know

Remote Work Taxes: Everything You Need to Know

Nonresident Income Tax Filing Laws by State | Tax Foundation

Nonresident Income Tax Filing Laws by State | Tax Foundation

Remote Work Tax Issues This Tax Season | TaxEDU

Remote Work Tax Issues This Tax Season | TaxEDU

Untangling the Remote Work Tax Dilemma: Navigating Tax Obligations for

Untangling the Remote Work Tax Dilemma: Navigating Tax Obligations for

Illinois Remote Work Resources - Virtual Vocations

Illinois Remote Work Resources - Virtual Vocations

The Rise of Remote Work | Tax Executive

The Rise of Remote Work | Tax Executive

Remote Worker Tax and Income Tax Nexus | Fusion CPA

Remote Worker Tax and Income Tax Nexus | Fusion CPA

Tax Deductions for Remote Work - Improve Workspace

Tax Deductions for Remote Work - Improve Workspace