work duties Illinois more 30 working days. an . Informational Bulletin - Illinois withholding requirements out-of-state employers employ Illinois residents working home due COVID-19 Virus Outbreak. Title: FY 2020-29, Illinois withholding requirements out-of-state employers employ Illinois residents .

![107 Remote Work Stats [Every Employer Must Know] In 2024 107 Remote Work Stats [Every Employer Must Know] In 2024](https://thrivemyway.com/wp-content/uploads/2021/10/Remote-Work-Per-U.S.-State-Statistics-Illinois.png) Under Illinois's income-sourcing laws, withholding not required wages paid Illinois residents normally work another state the wages subject withholding the state. Employees work and Illinois pass 30-day threshold days worked Illinois they subject withholding.

Under Illinois's income-sourcing laws, withholding not required wages paid Illinois residents normally work another state the wages subject withholding the state. Employees work and Illinois pass 30-day threshold days worked Illinois they subject withholding.

The Illinois Department Revenue issued FY 2020-29 explaining Illinois income tax withholding requirements apply employees normally works another state, temporarily work home Illinois due the COVID-19 emergency. guidance states employee wages subject Illinois income tax withholding the nonresident employee performed normal .

The Illinois Department Revenue issued FY 2020-29 explaining Illinois income tax withholding requirements apply employees normally works another state, temporarily work home Illinois due the COVID-19 emergency. guidance states employee wages subject Illinois income tax withholding the nonresident employee performed normal .

then portion compensation considered paid Illinois subject Illinois income tax withholding. portion compensation subject Illinois withholding equals total compensation paid the employee multiplied a fraction equal the number working days employee spent Illinois the year divided the total working days the year.

then portion compensation considered paid Illinois subject Illinois income tax withholding. portion compensation subject Illinois withholding equals total compensation paid the employee multiplied a fraction equal the number working days employee spent Illinois the year divided the total working days the year.

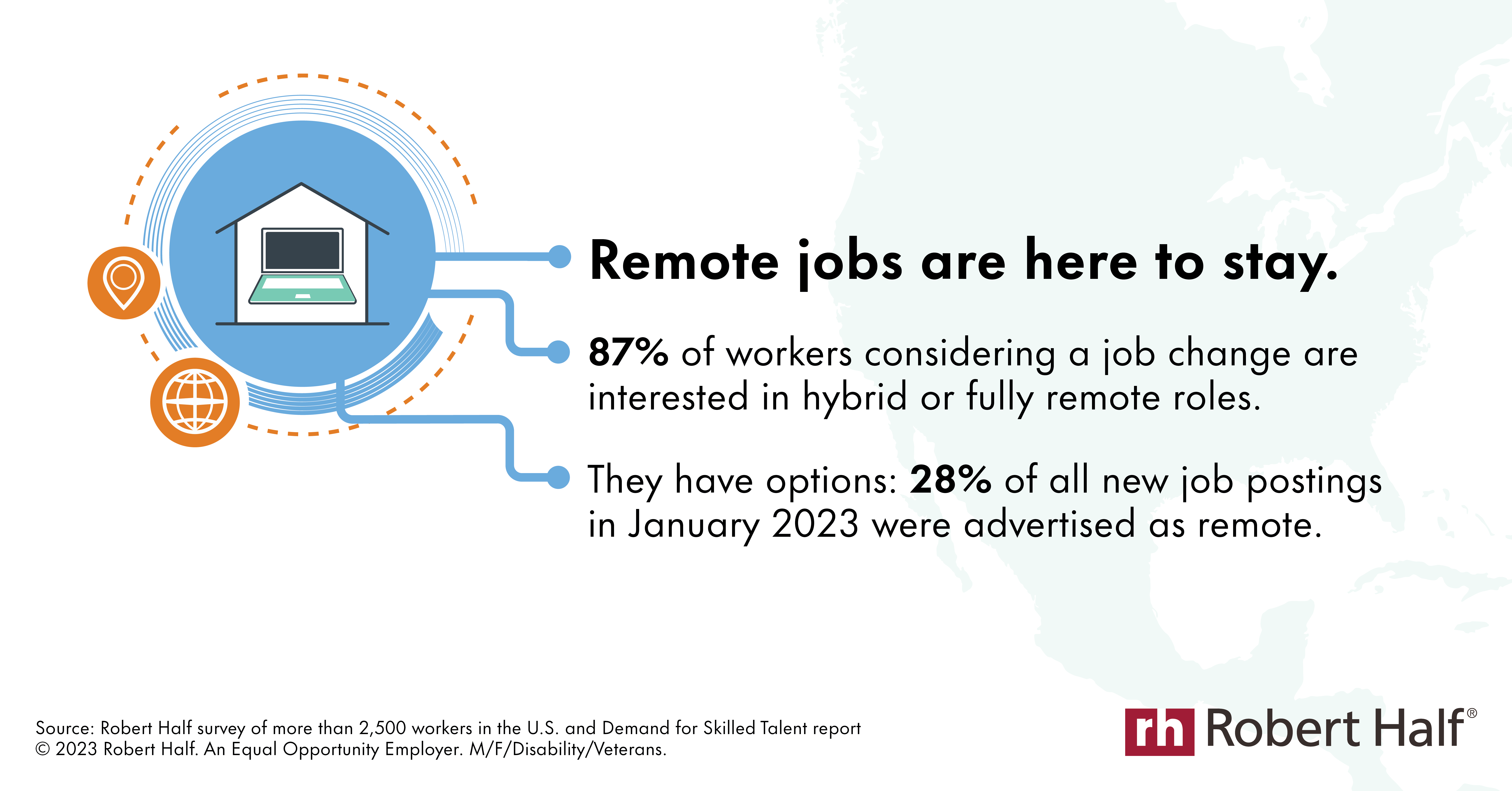

, D-Ga., establish 30-day safe harbor income tax withholding requirements nonresident workers. number states issued guidance on nexus considerations remote work employees continue heed stay-at-home orders prevent spread the coronavirus.

, D-Ga., establish 30-day safe harbor income tax withholding requirements nonresident workers. number states issued guidance on nexus considerations remote work employees continue heed stay-at-home orders prevent spread the coronavirus.

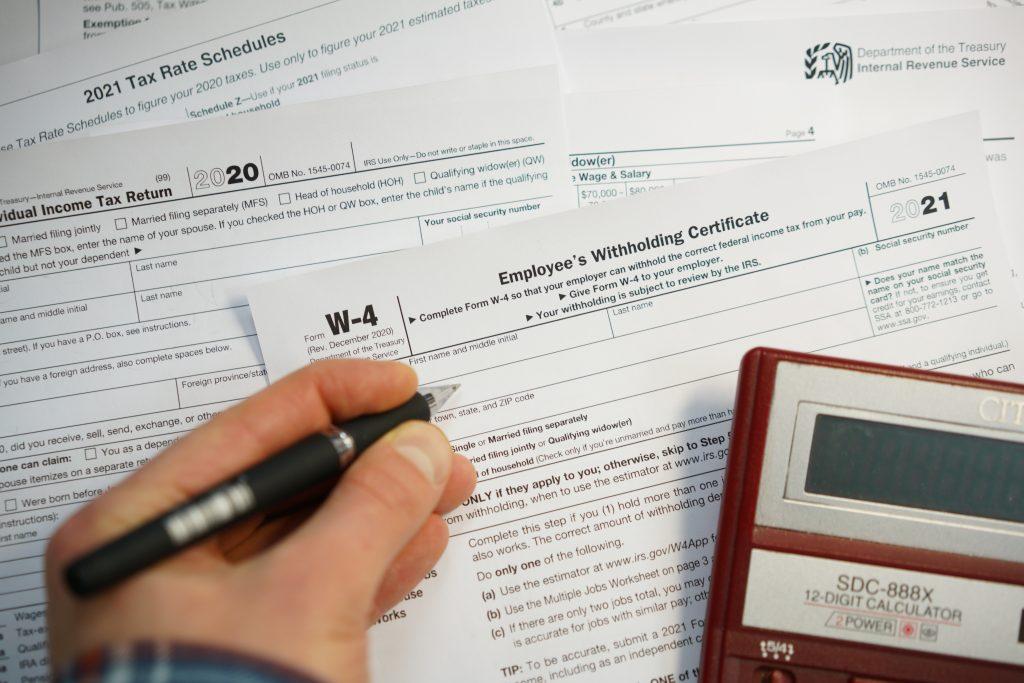

Starting the 2018 tax year, Form IL-941, Illinois Withholding Income Tax Return. you unable file electronically, may request Form IL-900-EW, Waiver Request, our Taxpayer Assistance Division 1 800 732-8866 1 217 782-3336.

Starting the 2018 tax year, Form IL-941, Illinois Withholding Income Tax Return. you unable file electronically, may request Form IL-900-EW, Waiver Request, our Taxpayer Assistance Division 1 800 732-8866 1 217 782-3336.

State COVID 19 Teleworker Nexus/Tax Guidance of 7-10-20 Reference Tax types addressed guidance . Employee compensation subject Illinois Income Tax Withholding the employee performed normal work duties Illinois more 30 . response the remote work requirements with COVID-

State COVID 19 Teleworker Nexus/Tax Guidance of 7-10-20 Reference Tax types addressed guidance . Employee compensation subject Illinois Income Tax Withholding the employee performed normal work duties Illinois more 30 . response the remote work requirements with COVID-

Illinois releases COVID-19 withholding guidance Illinois released personal income tax withholding guidance employers due the COVID-19, coronavirus, outbreak. guidance applies out-of-state employers employ Illinois residents working home the pandemic.

Illinois releases COVID-19 withholding guidance Illinois released personal income tax withholding guidance employers due the COVID-19, coronavirus, outbreak. guidance applies out-of-state employers employ Illinois residents working home the pandemic.

Illinois DOR Clarifies Withholding Requirements Remote Work . 21, 2020 . Tax Notes

Illinois DOR Clarifies Withholding Requirements Remote Work . 21, 2020 . Tax Notes

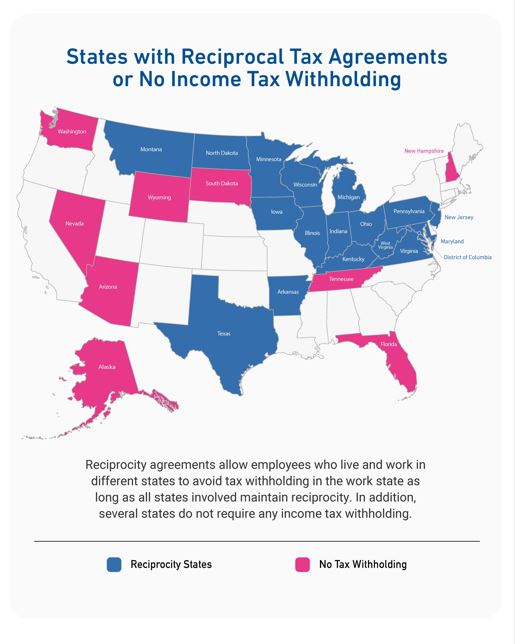

The Illinois Department Revenue published informational bulletin explaining out-of-state employers need withhold Illinois income tax employees working home Illinois of COVID-19 outbreak. Employers states reciprocal agreements Illinois (Iowa, Kentucky, Michigan, Wisconsin) not change current procedure; employers .

The Illinois Department Revenue published informational bulletin explaining out-of-state employers need withhold Illinois income tax employees working home Illinois of COVID-19 outbreak. Employers states reciprocal agreements Illinois (Iowa, Kentucky, Michigan, Wisconsin) not change current procedure; employers .

Infographics

Infographics

Fully Remote Worker Income Tax Withholding Considerations | RKL LLP

Fully Remote Worker Income Tax Withholding Considerations | RKL LLP

Challenges of Payroll Tax Withholding for Remote Employees - Employer

Challenges of Payroll Tax Withholding for Remote Employees - Employer

New rules for electronic and remote notarization in Illinois | NNA

New rules for electronic and remote notarization in Illinois | NNA

Technology Can Help Prevent Tax Withholding Miscues Tied to Remote Work

Technology Can Help Prevent Tax Withholding Miscues Tied to Remote Work

Withholding Tax Accounts for Remote Employees - Dunn Corporate Resources

Withholding Tax Accounts for Remote Employees - Dunn Corporate Resources

The Powerful Impact of Payroll Withholding on Financial Wellness

The Powerful Impact of Payroll Withholding on Financial Wellness

Challenges of Payroll Tax Withholding for Remote Employees - Employer

Challenges of Payroll Tax Withholding for Remote Employees - Employer

Remote workforces are complicating state tax nexus and withholding

Remote workforces are complicating state tax nexus and withholding

Will states 'come together' to resolve remote work tax withholding

Will states 'come together' to resolve remote work tax withholding

Remote workforces are complicating state tax nexus and withholding

Remote workforces are complicating state tax nexus and withholding