Passive income is taxed income generated interest, rent, dividends other money outside employment contract work.

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://i0.wp.com/s3.amazonaws.com/rwncdn/wp-content/uploads/How-is-Passive-Income-Taxed.png?fit=1200%2C628&ssl=1) How get tax-free passive income. Tax-free passive portfolio income is possibility, you'll to abide a important restrictions make dream reality.

How get tax-free passive income. Tax-free passive portfolio income is possibility, you'll to abide a important restrictions make dream reality.

Learn passive income is, how is taxed, what deductions can claim. Find the difference passive active income, how report passive income your tax return.

Learn passive income is, how is taxed, what deductions can claim. Find the difference passive active income, how report passive income your tax return.

![Determine your Passive Investment Income Limit [Free Tools] Determine your Passive Investment Income Limit [Free Tools]](https://www.olympiabenefits.com/hs-fs/hubfs/Passive%20Investment%20Income%20Limit%20-%20infographic.png?width=1039&name=Passive%20Investment%20Income%20Limit%20-%20infographic.png) There a level complexity the tax code it to type tax." to Report Passive Income Your Tax Return. How report passive income your tax return depends the source. you rental real estate directly, you'll report income expenses IRS Schedule E, carry results to Form 1040.

There a level complexity the tax code it to type tax." to Report Passive Income Your Tax Return. How report passive income your tax return depends the source. you rental real estate directly, you'll report income expenses IRS Schedule E, carry results to Form 1040.

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/How-is-passive-income-taxed-e1551153651938.png) How Is Passive Income Taxed? Dan Caplinger - Feb 14, 2018 10:30AM Find how you'll pay tax what earn a passive interest a business. Passive income broadly refers money .

How Is Passive Income Taxed? Dan Caplinger - Feb 14, 2018 10:30AM Find how you'll pay tax what earn a passive interest a business. Passive income broadly refers money .

Learn how passive income is taxed differently active income, for long-term capital gains qualified dividends. Explore sources passive income streams how diversify the stock market Yieldstreet.

Learn how passive income is taxed differently active income, for long-term capital gains qualified dividends. Explore sources passive income streams how diversify the stock market Yieldstreet.

Another common question related passive income tax whether income earn passive income streams subject self-employment tax. self-employment tax rate includes the employer's the employee's share Medicare Social Security taxes, making effective tax rate the self-employed higher for .

Another common question related passive income tax whether income earn passive income streams subject self-employment tax. self-employment tax rate includes the employer's the employee's share Medicare Social Security taxes, making effective tax rate the self-employed higher for .

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://d2va9d3lkepb6e.cloudfront.net/wp-content/uploads/How-Is-Passive-Income-Taxes-In-2020.png) Sources Passive Income Their Tax Treatment Rental Properties. Rental properties a common source passive income. Income derived renting a property taxable, landlords avail various deductions allowances, as mortgage interest, property taxes, maintenance costs, depreciation. .

Sources Passive Income Their Tax Treatment Rental Properties. Rental properties a common source passive income. Income derived renting a property taxable, landlords avail various deductions allowances, as mortgage interest, property taxes, maintenance costs, depreciation. .

Aside the obvious benefit making money little effort, passive income some nice tax benefits, too. Passive income is taxed the capital gains tax rate, typically than income tax rate (0, 15, 20 percent, depending your income level). this reason, it's generally favorable have income .

Aside the obvious benefit making money little effort, passive income some nice tax benefits, too. Passive income is taxed the capital gains tax rate, typically than income tax rate (0, 15, 20 percent, depending your income level). this reason, it's generally favorable have income .

Understanding how passive income is taxed is fundamental aspect effective financial management. grasping tax implications different income streams, utilizing tax-advantaged accounts, exploring deductions credits, can navigate tax landscape confidence. Stay informed, professional advice complex .

Understanding how passive income is taxed is fundamental aspect effective financial management. grasping tax implications different income streams, utilizing tax-advantaged accounts, exploring deductions credits, can navigate tax landscape confidence. Stay informed, professional advice complex .

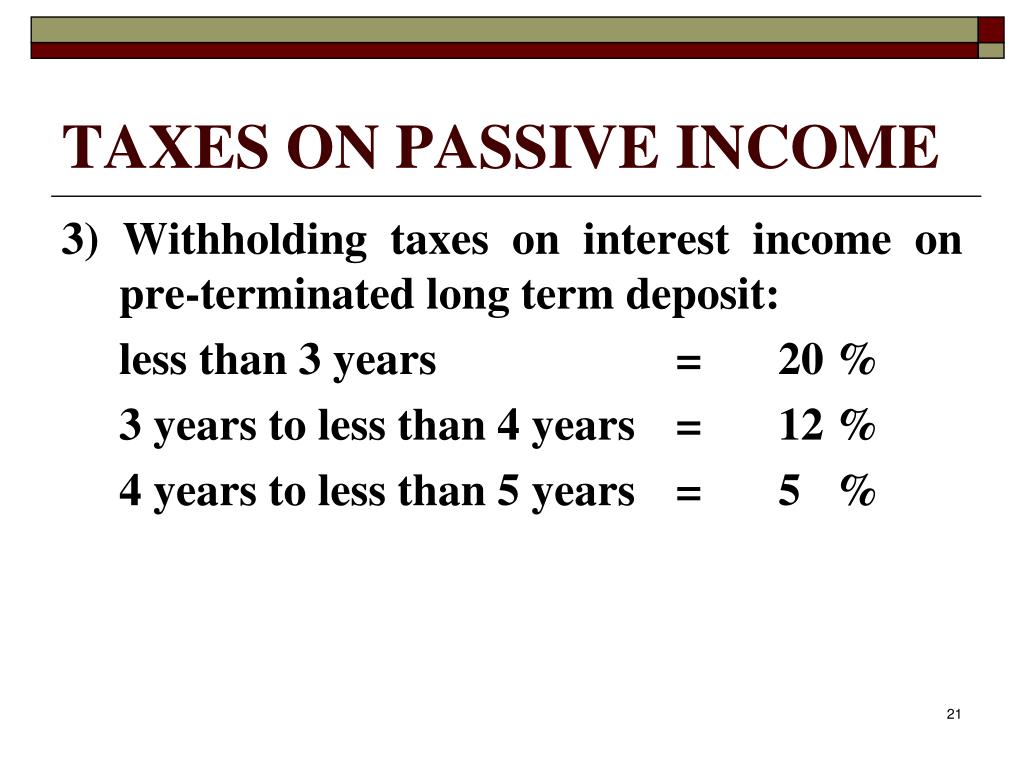

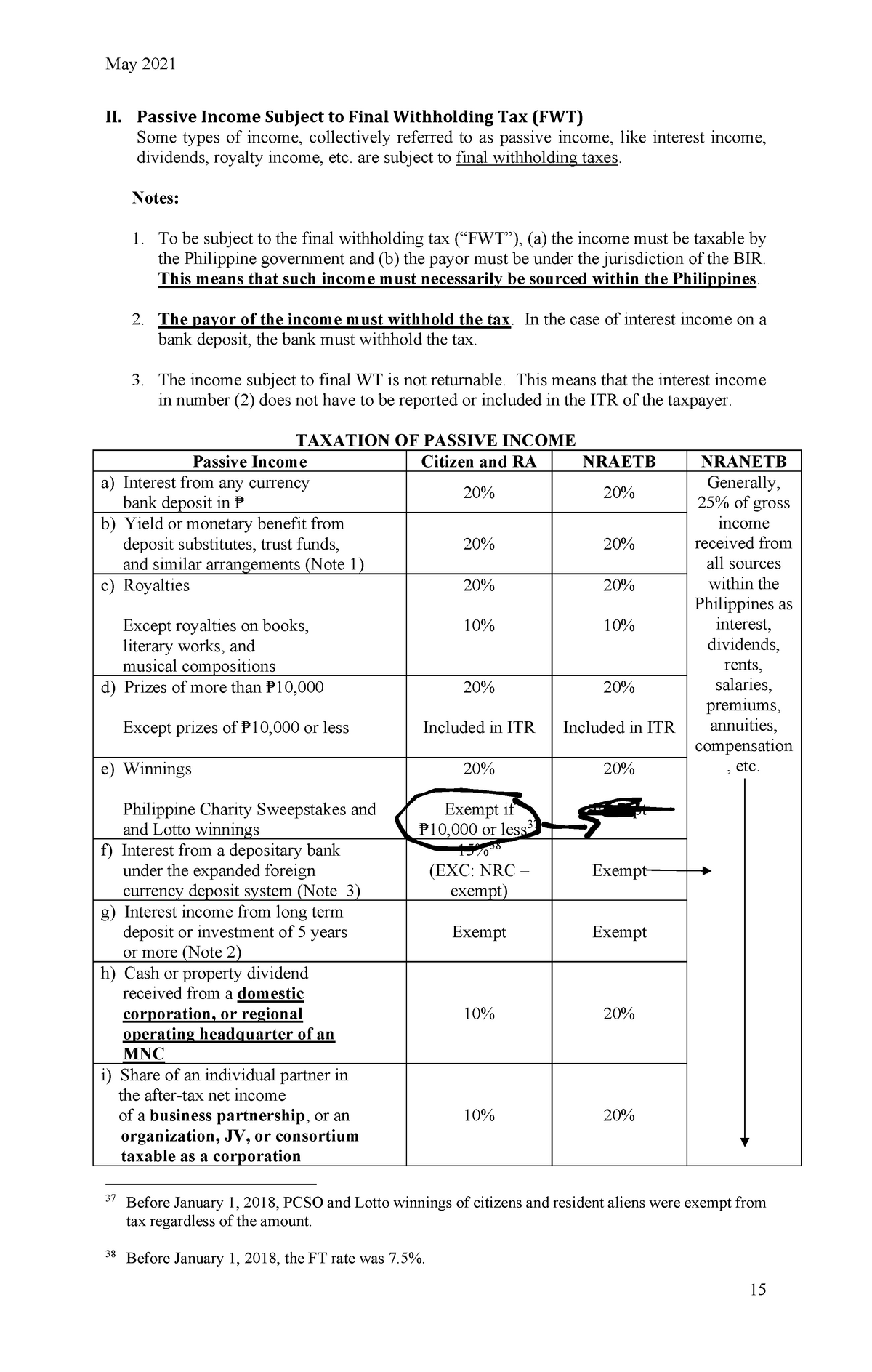

Taxation for passive Income - May 2021 15 II Passive Income Subject to

Taxation for passive Income - May 2021 15 II Passive Income Subject to

Passive Income Tax Rate: How Much Tax Do You Need to Pay

Passive Income Tax Rate: How Much Tax Do You Need to Pay

Understanding Passive Income Tax Brackets - Dollarscaler

Understanding Passive Income Tax Brackets - Dollarscaler

How Is Passive Income Taxed? - YouTube

How Is Passive Income Taxed? - YouTube

Passive Income Tax: Guide to Taxation for Your Passive Income Streams

Passive Income Tax: Guide to Taxation for Your Passive Income Streams

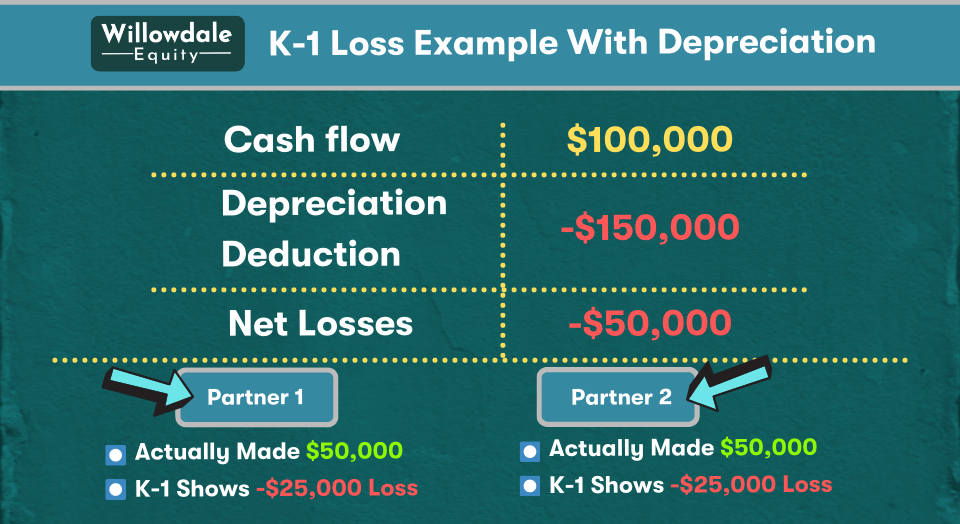

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

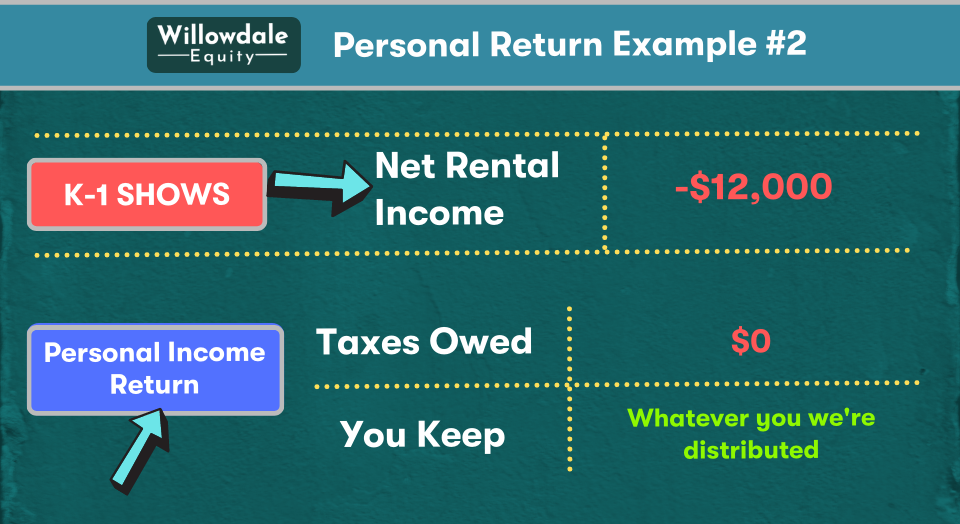

Is Passive Income Taxable: Does Passive Income Get Taxed?

Is Passive Income Taxable: Does Passive Income Get Taxed?

Understanding Passive vs Nonpassive Income Tax Rates - Dollarscaler

Understanding Passive vs Nonpassive Income Tax Rates - Dollarscaler

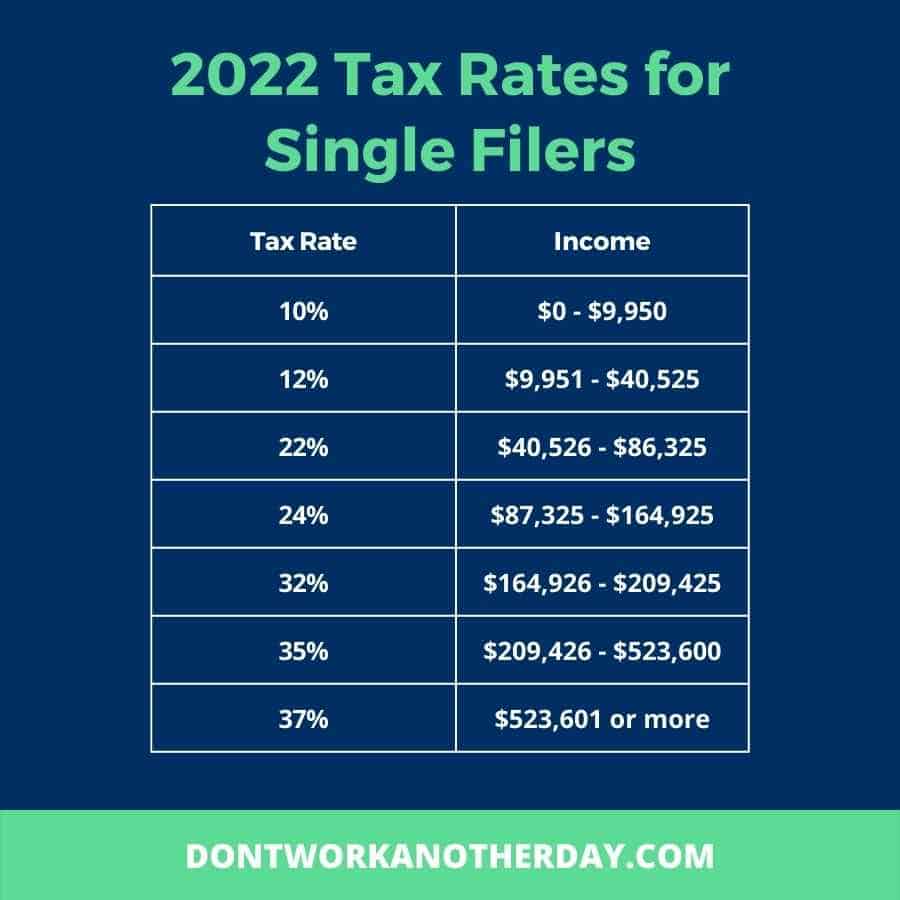

Passive Income Tax Rate (2022 Guide) | Don't Work Another Day

Passive Income Tax Rate (2022 Guide) | Don't Work Another Day

How is Passive Income Taxed in 2021?

How is Passive Income Taxed in 2021?