Unless live work a state no income tax, may get taxed on same income. states offer credit can offset part all taxes must pay the state .

How taxes work working remotely? Navigating tax implications remote work be complex process. the rise remote work's popularity, it's important remote workers employers understand how they're affected. tax implications working remotely depend a variety factors, including following:

How taxes work working remotely? Navigating tax implications remote work be complex process. the rise remote work's popularity, it's important remote workers employers understand how they're affected. tax implications working remotely depend a variety factors, including following:

At federal level, employers withhold federal income tax, Social Security taxes, Federal Unemployment Tax (FUTA), Medicare taxes all W-2 employees, including remote workers. are state income taxes state unemployment tax assessment (SUTA) taxes can differ remote work location.

At federal level, employers withhold federal income tax, Social Security taxes, Federal Unemployment Tax (FUTA), Medicare taxes all W-2 employees, including remote workers. are state income taxes state unemployment tax assessment (SUTA) taxes can differ remote work location.

Remote work tax deductions. an independent contractor freelancer, can write certain job-related expenses your taxes. traditional employees work remotely telecommute cannot deduct expenses, self-employed individuals benefit several common tax deductions. example, you qualify an .

Remote work tax deductions. an independent contractor freelancer, can write certain job-related expenses your taxes. traditional employees work remotely telecommute cannot deduct expenses, self-employed individuals benefit several common tax deductions. example, you qualify an .

Statistics unequivocally show remote work here stay. to Upwork, of world's largest freelancing platforms, number remote workers the United States reach 36.2 million 2025. growing number independent contractors full-time remote workers to up how taxes work you work remotely, tax laws vary state.

Statistics unequivocally show remote work here stay. to Upwork, of world's largest freelancing platforms, number remote workers the United States reach 36.2 million 2025. growing number independent contractors full-time remote workers to up how taxes work you work remotely, tax laws vary state.

Taxes employers. Companies face tax consequences they employ workers work remotely different states. taxes include income, gross receipts, sales, local business taxes, can affect only company's tax compliance also financial statement reporting, registrations, data gathering, documentation.

Taxes employers. Companies face tax consequences they employ workers work remotely different states. taxes include income, gross receipts, sales, local business taxes, can affect only company's tax compliance also financial statement reporting, registrations, data gathering, documentation.

Many employers employees underestimate tax implications remote work. the massive shift remote hybrid work, number people reconsidering life choices, including .

Many employers employees underestimate tax implications remote work. the massive shift remote hybrid work, number people reconsidering life choices, including .

For example, a taxpayer lives works Washington, D.C., the maximum individual income tax rate 8.9%, opts work remotely Wyoming, there no state income tax .

For example, a taxpayer lives works Washington, D.C., the maximum individual income tax rate 8.9%, opts work remotely Wyoming, there no state income tax .

Remote Work Tax Deductions. can tempting claim deductions working remotely. all, likely a home office the expenses come it. However, working remotely not same someone is freelancer, self-employed, independent contractor. Remote employees receive W-2 not eligible take .

Remote Work Tax Deductions. can tempting claim deductions working remotely. all, likely a home office the expenses come it. However, working remotely not same someone is freelancer, self-employed, independent contractor. Remote employees receive W-2 not eligible take .

Left state work remotely: you left state became permanent remote worker a state, may to file returns: complete residential tax return your home .

Left state work remotely: you left state became permanent remote worker a state, may to file returns: complete residential tax return your home .

The Rise Of Remote Work: A Comprehensive Guide To Online Jobs And Work

The Rise Of Remote Work: A Comprehensive Guide To Online Jobs And Work

The Rise Of Remote Work: A Comprehensive Guide To Online Jobs

The Rise Of Remote Work: A Comprehensive Guide To Online Jobs

How Does Remote Work Impact the Boston Housing Market?

How Does Remote Work Impact the Boston Housing Market?

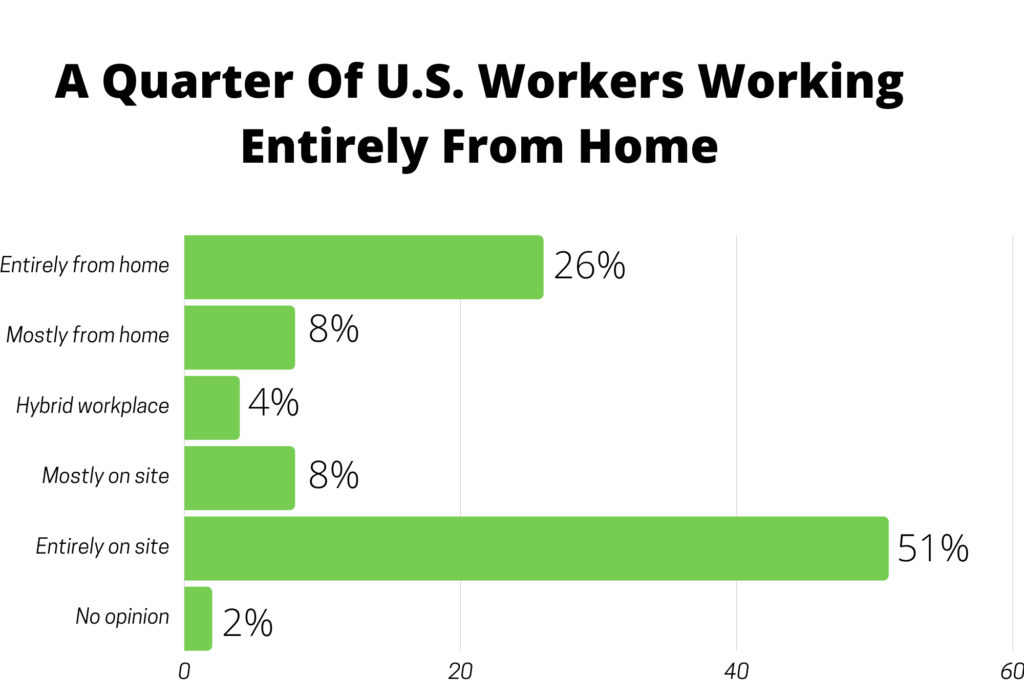

Remote Work Statistics for 2024: Key Trends and Insights

Remote Work Statistics for 2024: Key Trends and Insights

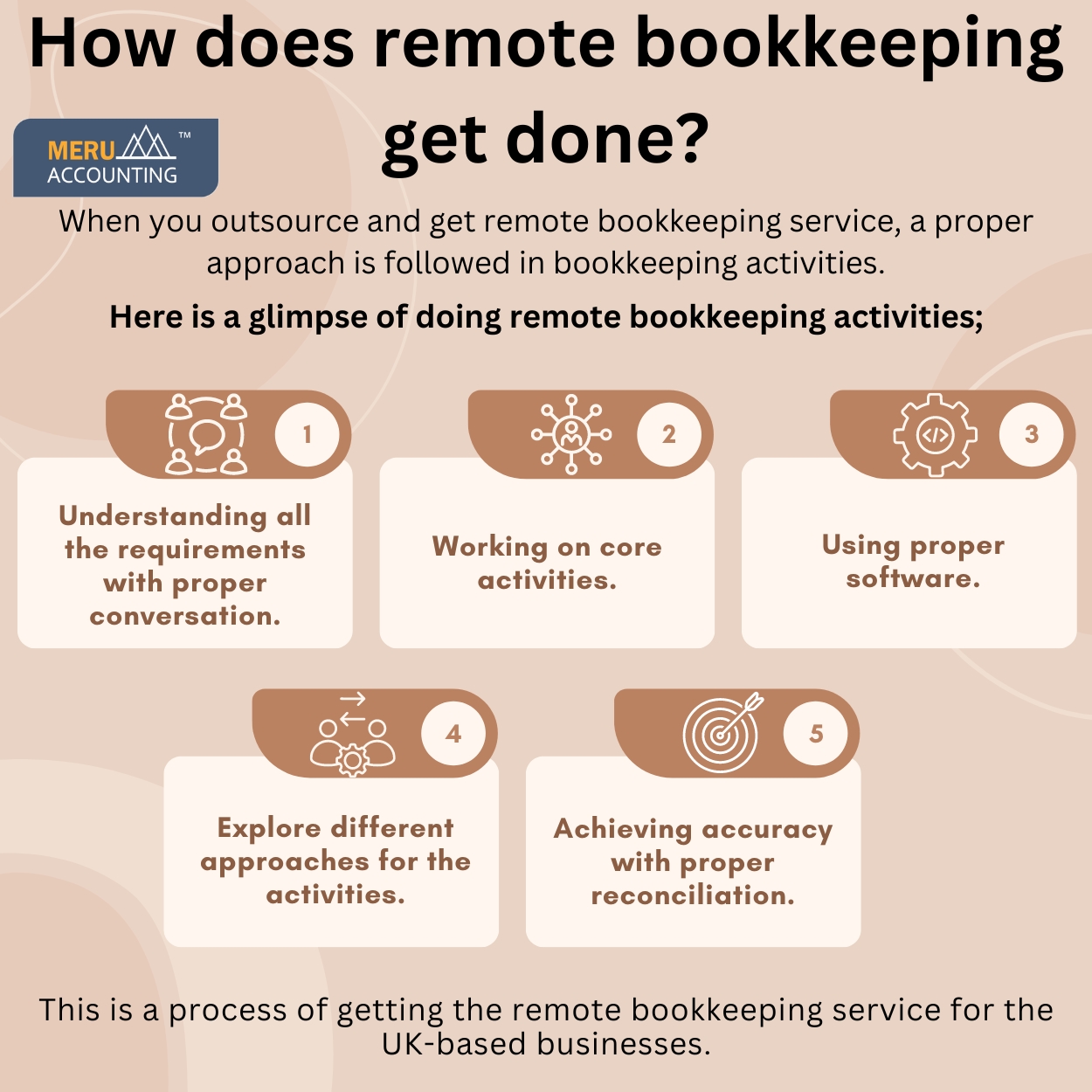

How Remote Bookkeeping Works: Explained Step by Step

How Remote Bookkeeping Works: Explained Step by Step

How Does Remote Work Help Small Businesses?

How Does Remote Work Help Small Businesses?

How does remote work impact employee productivity? - HealthGovCapital

How does remote work impact employee productivity? - HealthGovCapital

Remote Work Statistics In 2023 And How They Influence The Workplace

Remote Work Statistics In 2023 And How They Influence The Workplace

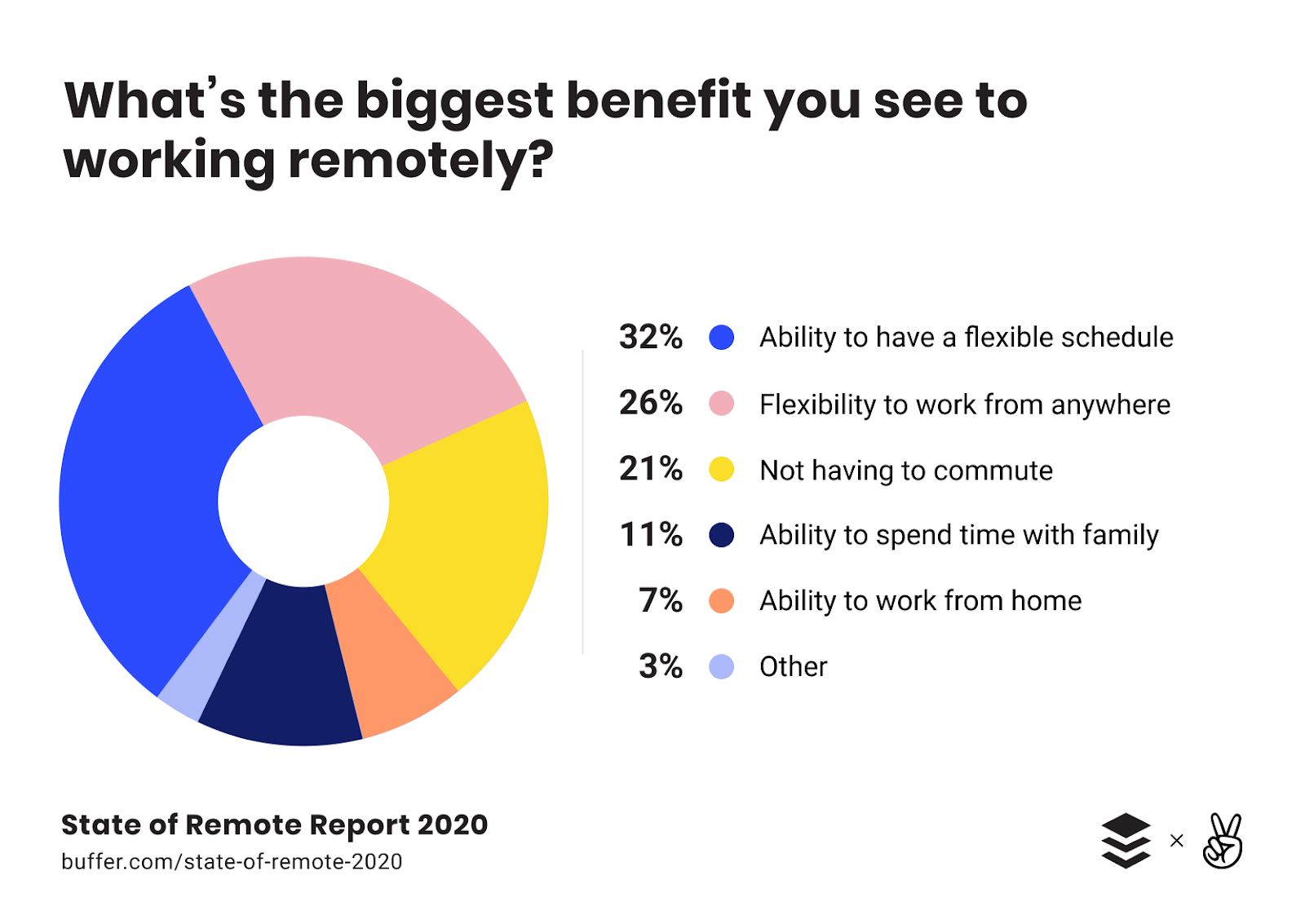

2021 State of Remote Work

2021 State of Remote Work

What is remote working and its benefits? (2024 guide) - Career Gappers

What is remote working and its benefits? (2024 guide) - Career Gappers

4 Proven Benefits of Remote Work (for Employers)

4 Proven Benefits of Remote Work (for Employers)