Wi-Fi, laptops mobile phones made work anywhere reality many us. working moving state state cause tax headache. you work a state .

In article, we'll explain how taxes work different types remote employees, states unique tax circumstances remote work, how remote work affects employee benefits. this blog post, you'll learn following: How taxes remote workers function how vary different types employees.

In article, we'll explain how taxes work different types remote employees, states unique tax circumstances remote work, how remote work affects employee benefits. this blog post, you'll learn following: How taxes remote workers function how vary different types employees.

For example, a taxpayer lives works Washington, D.C., the maximum individual income tax rate 8.9%, opts work remotely Wyoming, there no state income tax .

For example, a taxpayer lives works Washington, D.C., the maximum individual income tax rate 8.9%, opts work remotely Wyoming, there no state income tax .

Left state work remotely: you left state became permanent remote worker a state, may to file returns: complete residential tax return your home .

Left state work remotely: you left state became permanent remote worker a state, may to file returns: complete residential tax return your home .

How taxes work working remotely? Navigating tax implications remote work be complex process. the rise remote work's popularity, it's important remote workers employers understand how they're affected. tax implications working remotely depend a variety factors, including following:

How taxes work working remotely? Navigating tax implications remote work be complex process. the rise remote work's popularity, it's important remote workers employers understand how they're affected. tax implications working remotely depend a variety factors, including following:

Taxes employers. Companies face tax consequences they employ workers work remotely different states. taxes include income, gross receipts, sales, local business taxes, can affect only company's tax compliance also financial statement reporting, registrations, data gathering, documentation.

Taxes employers. Companies face tax consequences they employ workers work remotely different states. taxes include income, gross receipts, sales, local business taxes, can affect only company's tax compliance also financial statement reporting, registrations, data gathering, documentation.

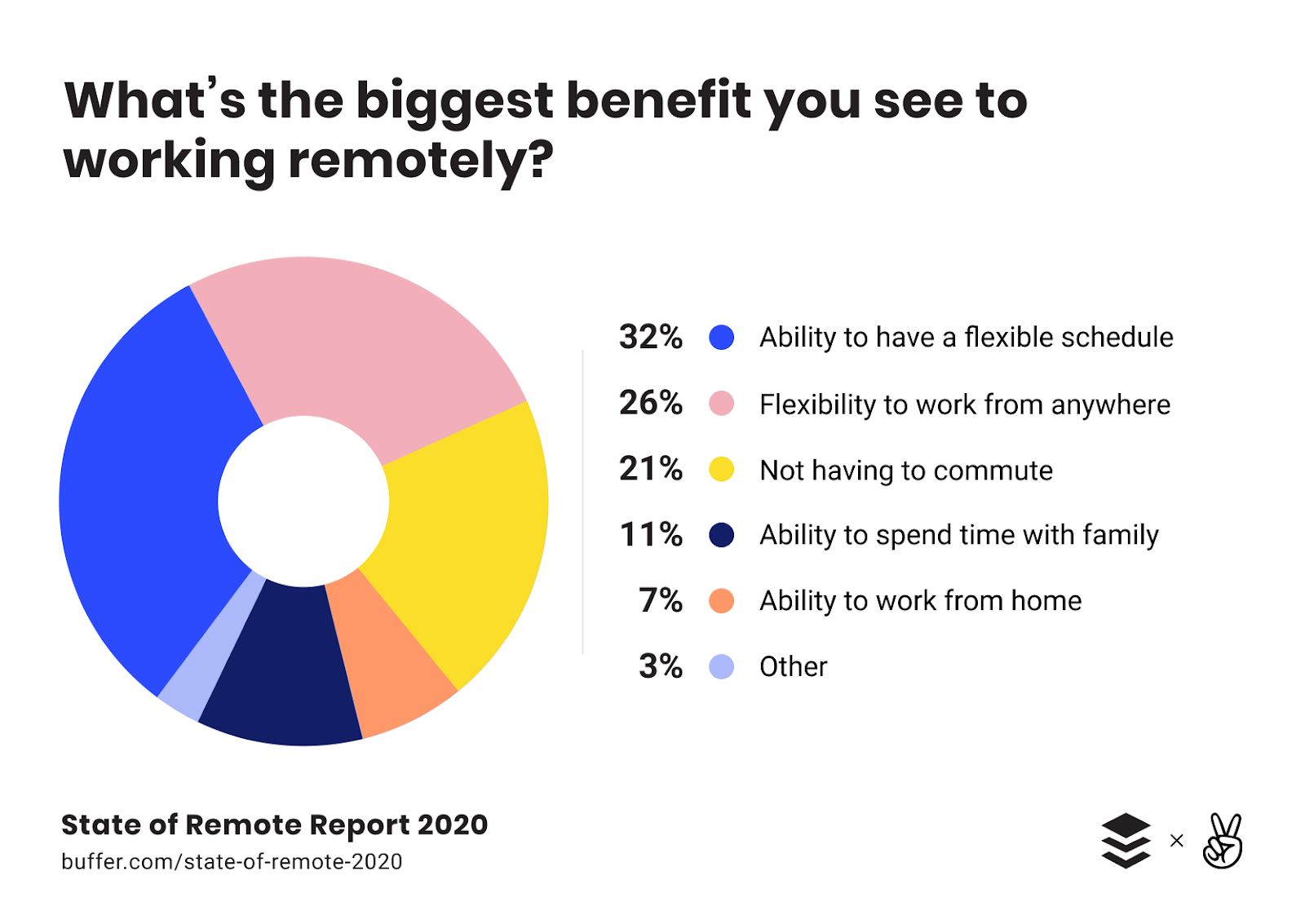

Remote work creates opportunities both employers employees. Larger employers rethinking need have employees to fixed location day to maintain expensive office space, many shifted a partially fully remote workforce. Companies use possibility remote work recruit employees, .

Remote work creates opportunities both employers employees. Larger employers rethinking need have employees to fixed location day to maintain expensive office space, many shifted a partially fully remote workforce. Companies use possibility remote work recruit employees, .

Depending which state(s) worked remotely and how long, may to pay income tax more one state. state different guidelines, it's important look individual state rules determine you to file that state year. example, one day remote work performed New York state requires NY individual return filed.

Depending which state(s) worked remotely and how long, may to pay income tax more one state. state different guidelines, it's important look individual state rules determine you to file that state year. example, one day remote work performed New York state requires NY individual return filed.

Plan Remote Work Taxes Mind. the hybrid workplace become norm, employees employers be aware how working remotely affects taxes. certain states practice reciprocal tax agreements, workers spend part all the year working their state need file multiple tax returns.

Plan Remote Work Taxes Mind. the hybrid workplace become norm, employees employers be aware how working remotely affects taxes. certain states practice reciprocal tax agreements, workers spend part all the year working their state need file multiple tax returns.

3. Remote Work Tax Deductions. can tempting claim deductions working remotely. all, likely a home office the expenses come it. However, working remotely not same someone is freelancer, self-employed, independent contractor.

3. Remote Work Tax Deductions. can tempting claim deductions working remotely. all, likely a home office the expenses come it. However, working remotely not same someone is freelancer, self-employed, independent contractor.

How does remote work affect payroll for employees? - Haines Watts Group

How does remote work affect payroll for employees? - Haines Watts Group

How Does Income Tax Work For Remote Employees | LiveWell

How Does Income Tax Work For Remote Employees | LiveWell

The Impact of Remote Work on the Global Economy - Supersourcing

The Impact of Remote Work on the Global Economy - Supersourcing

Remote Work Benefits — The Holloway Guide to Remote Work

Remote Work Benefits — The Holloway Guide to Remote Work

How does remote work affect employee job security? - HealthGovCapital

How does remote work affect employee job security? - HealthGovCapital

How does remote work affect occupational taxes in Bham, other cities

How does remote work affect occupational taxes in Bham, other cities

Remote Work May Affect Tax Situation of Employees and Employers

Remote Work May Affect Tax Situation of Employees and Employers

How does remote work affect job satisfaction? - HealthGovCapital

How does remote work affect job satisfaction? - HealthGovCapital

/remote-taxes-2000-529e2f73644e4f3b96853cc578c73217.jpg) How Remote Work Affects Your Taxes—and Deductions You May Qualify For

How Remote Work Affects Your Taxes—and Deductions You May Qualify For

How Does Remote Work Benefit Employers and Employees - Academia World News

How Does Remote Work Benefit Employers and Employees - Academia World News

TrueVault | How Does Remote Work Affect CCPA Compliance?

TrueVault | How Does Remote Work Affect CCPA Compliance?