You need tell HMRC you receive income an online marketplace social media. could whether it's main source income an additional source — called .

The page monitored the HMRC Social Media Customer Support Team between: 8am 8pm, Monday Friday; 8am 4pm Saturdays; We're to answer questions your general tax .

The page monitored the HMRC Social Media Customer Support Team between: 8am 8pm, Monday Friday; 8am 4pm Saturdays; We're to answer questions your general tax .

The rise social media given birth a type taxpayer: influencer content creator. . (or online activities) amount a trade. longstanding 'Badges Trade' (as set in HMRC's Business Income Manual BIM20205 seq.) be to judge whether, based the facts, individual trading not.

The rise social media given birth a type taxpayer: influencer content creator. . (or online activities) amount a trade. longstanding 'Badges Trade' (as set in HMRC's Business Income Manual BIM20205 seq.) be to judge whether, based the facts, individual trading not.

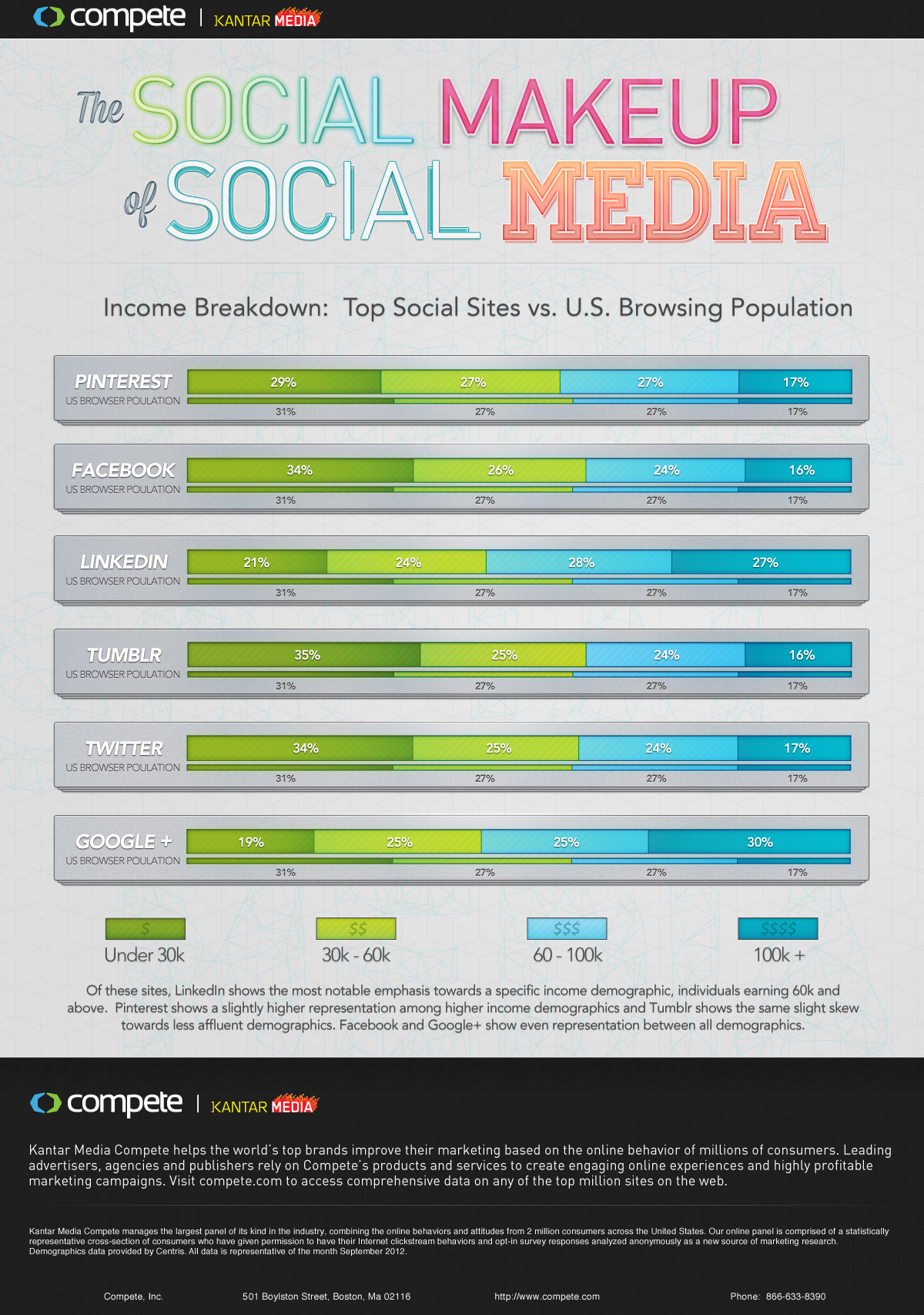

![53 Stunning Social Media Statistics [2023]: Facts About Social Media 53 Stunning Social Media Statistics [2023]: Facts About Social Media](https://www.zippia.com/wp-content/uploads/2022/03/social-media-usage-by-income.jpg) Example — social media influencing. are content creator influencer a social media channel you review beauty products. receive advertising income your videos. also receive gifts the companies review. may to HMRC this income. Renting land property. Land property be:

Example — social media influencing. are content creator influencer a social media channel you review beauty products. receive advertising income your videos. also receive gifts the companies review. may to HMRC this income. Renting land property. Land property be:

Influencer income subject self-employment taxes, if receive in return your social media activities, must register the HMRC you £1,000 more year. income sponsored posts also subject National Insurance contributions, VAT, corporation taxes (depending your specific situation).

Influencer income subject self-employment taxes, if receive in return your social media activities, must register the HMRC you £1,000 more year. income sponsored posts also subject National Insurance contributions, VAT, corporation taxes (depending your specific situation).

HMRC targeting people make money their social media presence. could include creating content digital platforms, as YouTube, TikTok, Patreon, Instagram, by an online 'influencer'. you a successful social media presence, might receive income creating content.

HMRC targeting people make money their social media presence. could include creating content digital platforms, as YouTube, TikTok, Patreon, Instagram, by an online 'influencer'. you a successful social media presence, might receive income creating content.

If receive £700 a social media job a product worth £400 another job the tax year, total income £1,100. Therefore, need register a self-employed. PAYE/Full-Time Job Income: Income a full-time/PAYE job not count the £1,000 self-employment income threshold.

If receive £700 a social media job a product worth £400 another job the tax year, total income £1,100. Therefore, need register a self-employed. PAYE/Full-Time Job Income: Income a full-time/PAYE job not count the £1,000 self-employment income threshold.

HMRC's nudge letters essentially reminders to individuals, including social media influencers, prompt to review tax affairs. letters part HMRC's strategy encourage voluntary compliance to remind influencers their earnings, monetary in-kind (like free products services), be .

HMRC's nudge letters essentially reminders to individuals, including social media influencers, prompt to review tax affairs. letters part HMRC's strategy encourage voluntary compliance to remind influencers their earnings, monetary in-kind (like free products services), be .

Lots people sell good services online platforms as Ebay, Etsy Amazon, income earned this should declared HMRC. Similarly, you generate income your social media presence an influencer by creating content platforms as YouTube, TikTok Instagram, income also declared .

Lots people sell good services online platforms as Ebay, Etsy Amazon, income earned this should declared HMRC. Similarly, you generate income your social media presence an influencer by creating content platforms as YouTube, TikTok Instagram, income also declared .

HMRC warning over posting on Facebook, Instagram and Twitter as tax

HMRC warning over posting on Facebook, Instagram and Twitter as tax

HMRC social media scam alert

HMRC social media scam alert

Digital Marketers Find Social Media As Their Main Revenue Stream

Digital Marketers Find Social Media As Their Main Revenue Stream

HMRC can check your social media for 'discrepancies' and land you in

HMRC can check your social media for 'discrepancies' and land you in

![Social Media Job Titles and Salaries [Updated for 2020] Social Media Job Titles and Salaries [Updated for 2020]](https://www.falcon.io/wp-content/uploads/2018/03/chart-3-1024x411.png) Social Media Job Titles and Salaries [Updated for 2020]

Social Media Job Titles and Salaries [Updated for 2020]

Do HMRC look at what you do on SOCIAL MEDIA? - YouTube

Do HMRC look at what you do on SOCIAL MEDIA? - YouTube

Luke Littler loses chunk of darts winnings to tax as HMRC slammed for

Luke Littler loses chunk of darts winnings to tax as HMRC slammed for

Revealed: The social media platforms that make the most revenue off

Revealed: The social media platforms that make the most revenue off

In pictures: six fake HMRC messages that are catching people out

In pictures: six fake HMRC messages that are catching people out

Social Media Income Breakdown {Infographic} - Best Infographics

Social Media Income Breakdown {Infographic} - Best Infographics