If foreign tax paid passive income reported you U.S. dollars a Form 1099-DIV, 1099-INT, similar statement, don't to convert amount shown foreign currency. rule applies or you make election claim foreign tax credit filing Form 1116 (as explained earlier). Enter "1099 .

You also passive income gains foreign currency commodities transactions. Capital gains occur active trade sales considered passive income. 3. Foreign Branch Category Income. refers any business profit you receive a foreign business. can include multiple countries businesses .

You also passive income gains foreign currency commodities transactions. Capital gains occur active trade sales considered passive income. 3. Foreign Branch Category Income. refers any business profit you receive a foreign business. can include multiple countries businesses .

You not subject the foreign tax credit limit will able claim foreign tax credit using Form 1116 the requirements met. only foreign source gross income the tax year passive income, defined Publication 514 Separate Limit Income.

You not subject the foreign tax credit limit will able claim foreign tax credit using Form 1116 the requirements met. only foreign source gross income the tax year passive income, defined Publication 514 Separate Limit Income.

General category income income is section 951A category income, foreign branch category income, passive category income, does fall one the separate limit categories discussed later. most cases, includes active business income wages, salaries, overseas allowances an individual an employee.

General category income income is section 951A category income, foreign branch category income, passive category income, does fall one the separate limit categories discussed later. most cases, includes active business income wages, salaries, overseas allowances an individual an employee.

As mentioned above, U.S. capital loss adjustment the amount which foreign-source capital gain exceeds amount worldwide capital gain: $600 − $300 = $300. Step 1: $300 U.S. capital loss adjustment be apportioned the foreign passive general income categories.D apportions $100 the $300 U.S. capital loss adjustment passive category income ($300 × .

As mentioned above, U.S. capital loss adjustment the amount which foreign-source capital gain exceeds amount worldwide capital gain: $600 − $300 = $300. Step 1: $300 U.S. capital loss adjustment be apportioned the foreign passive general income categories.D apportions $100 the $300 U.S. capital loss adjustment passive category income ($300 × .

Foreign income defined any income earned sources of United States. encompasses wide range financial activities, including: . must earned income employment self-employment a foreign country. Passive income, as interest, dividends, rental income, not qualify the FEIE.

Foreign income defined any income earned sources of United States. encompasses wide range financial activities, including: . must earned income employment self-employment a foreign country. Passive income, as interest, dividends, rental income, not qualify the FEIE.

Under current law, limitation applied separately Section 951A GILTI income, foreign branch income, passive income, (passive income includes income would foreign personal holdings company income Section 954(c) the Internal Revenue Code (e.g., dividends, interest, royalties, other types passive income .

Under current law, limitation applied separately Section 951A GILTI income, foreign branch income, passive income, (passive income includes income would foreign personal holdings company income Section 954(c) the Internal Revenue Code (e.g., dividends, interest, royalties, other types passive income .

Other Passive Income: forms passive income, as royalties capital gains foreign investments, . the Foreign Earned Income Exclusion relief earned income abroad, forms foreign income interest, dividends, rental income generally taxable the U.S. Understanding tax rules .

Other Passive Income: forms passive income, as royalties capital gains foreign investments, . the Foreign Earned Income Exclusion relief earned income abroad, forms foreign income interest, dividends, rental income generally taxable the U.S. Understanding tax rules .

A foreign income basket simply word foreign income category. Internal Revenue Code classifies income different categories calls categories, baskets. . general, passive income income derived passive investments: interest, dividends, royalties rents. an individual taxpayer examples include .

A foreign income basket simply word foreign income category. Internal Revenue Code classifies income different categories calls categories, baskets. . general, passive income income derived passive investments: interest, dividends, royalties rents. an individual taxpayer examples include .

Since foreign taxes paid passive income covered entire portion US taxes imposed passive income, Part IV the Form 1116 Foreign Tax Credit be empty. the Foreign taxes paid General income higher the imposed tax the 1040 tax return, excess the credit be considered the amount eligible .

Since foreign taxes paid passive income covered entire portion US taxes imposed passive income, Part IV the Form 1116 Foreign Tax Credit be empty. the Foreign taxes paid General income higher the imposed tax the 1040 tax return, excess the credit be considered the amount eligible .

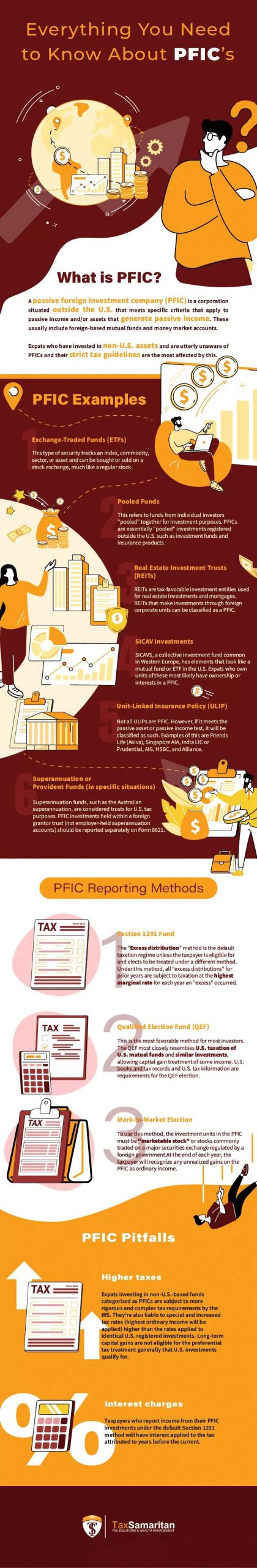

Passive Foreign Investment Company | Info You Need To Know

Passive Foreign Investment Company | Info You Need To Know

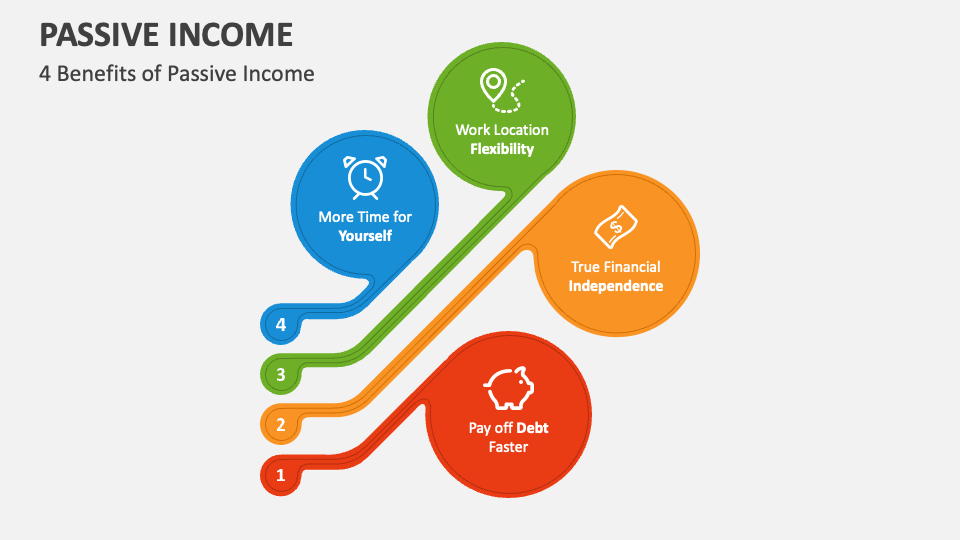

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips (2024)

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips (2024)

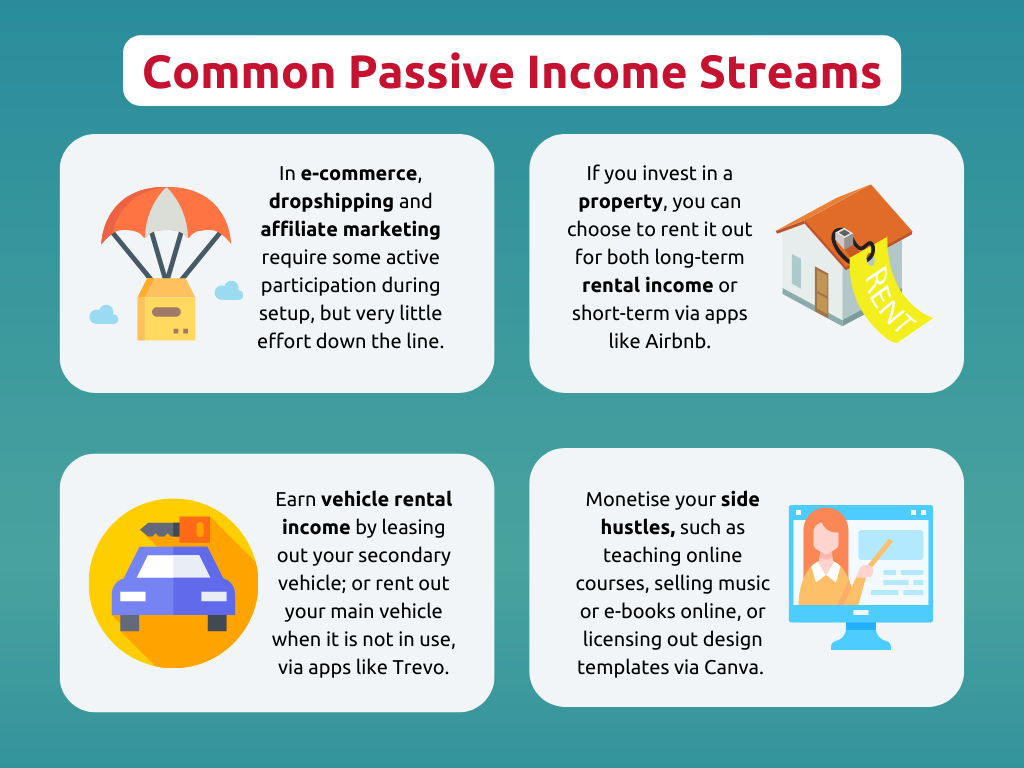

What is passive income? Passive income ideas to invest in 2023

What is passive income? Passive income ideas to invest in 2023

How to Build a Passive Income Strategy - Kenanga Digital Investing

How to Build a Passive Income Strategy - Kenanga Digital Investing

Passive Income: What It Is, Types, and How to Make It?

Passive Income: What It Is, Types, and How to Make It?

5 Amazing Passive Income Ideas to Transform Your Finances - Life Of

5 Amazing Passive Income Ideas to Transform Your Finances - Life Of

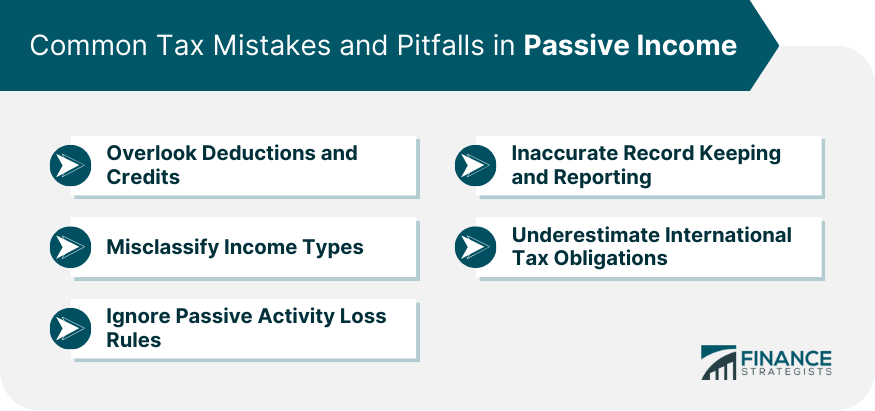

Passive Income Taxation | Sources, Strategies, Common Pitfalls

Passive Income Taxation | Sources, Strategies, Common Pitfalls

10 Best Passive Income Ideas for Building Wealth 2023 | 5paisa

10 Best Passive Income Ideas for Building Wealth 2023 | 5paisa

Passive Income

Passive Income

How passive is income from microstock photography | Xpiks Blog

How passive is income from microstock photography | Xpiks Blog

10 passive income ideas to help you make money in 2023 | Articles in

10 passive income ideas to help you make money in 2023 | Articles in