Passive income taxed income generated interest, rent, dividends other money outside employment contract work.

![How is Passive Income Taxed? [Free Investor Guide] How is Passive Income Taxed? [Free Investor Guide]](https://i0.wp.com/s3.amazonaws.com/rwncdn/wp-content/uploads/How-is-Passive-Income-Taxed.png?fit=1200%2C628&ssl=1) Here's passive portfolio income taxed how may able generate tax-free cash flow some situations. Passive income vs. portfolio income: they differ

Here's passive portfolio income taxed how may able generate tax-free cash flow some situations. Passive income vs. portfolio income: they differ

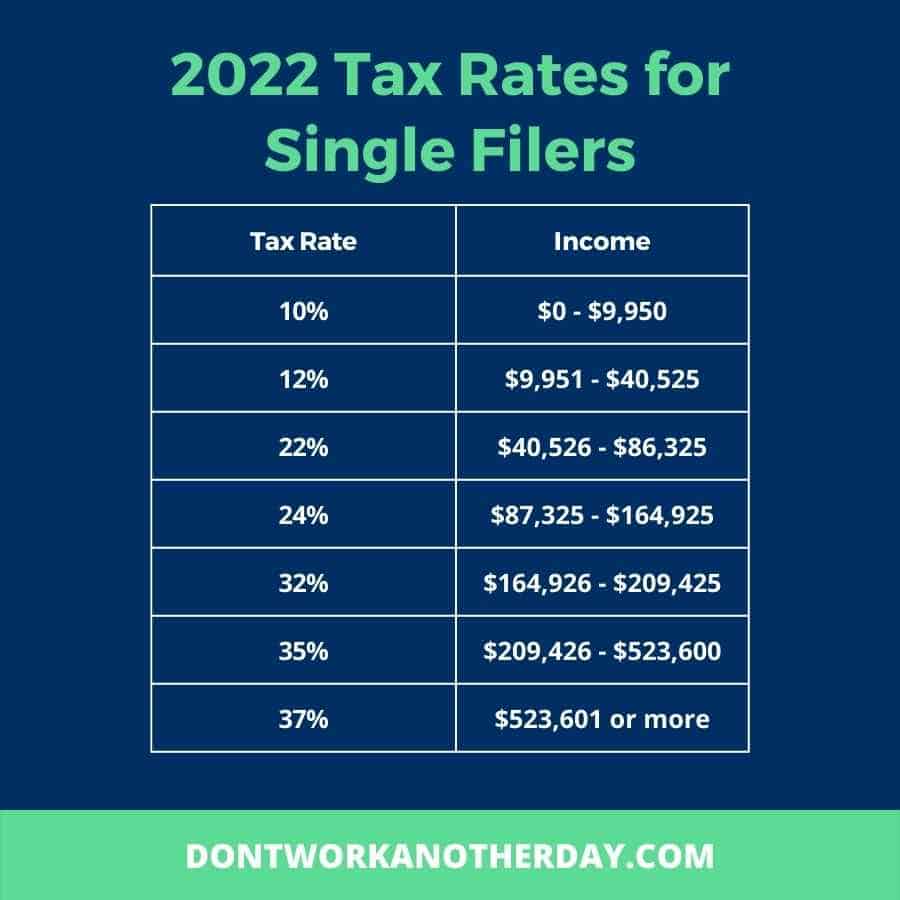

Like other kind income, passive income be reported your income tax return. despite tax advantages listed above, passive income taxed ordinary income. "Contrary popular belief, passive income taxed ordinary income tax rates it sometimes to deductions reduce liability .

Like other kind income, passive income be reported your income tax return. despite tax advantages listed above, passive income taxed ordinary income. "Contrary popular belief, passive income taxed ordinary income tax rates it sometimes to deductions reduce liability .

Passive income often taxed the rate salaries received a job, you'll to work a Tax Pro get full view your entire financial picture. with active income, it's to deductions lessen tax liability. will into of deductions below.

Passive income often taxed the rate salaries received a job, you'll to work a Tax Pro get full view your entire financial picture. with active income, it's to deductions lessen tax liability. will into of deductions below.

Yes, passive income taxable.The IRS different rules rates taxing passive income, depending the source, duration, amount the income. this blog post, will explain passive income taxed the as 2023, what the factors affect passive income tax rate. Passive income a type income does require active involvement .

Yes, passive income taxable.The IRS different rules rates taxing passive income, depending the source, duration, amount the income. this blog post, will explain passive income taxed the as 2023, what the factors affect passive income tax rate. Passive income a type income does require active involvement .

Passive income broadly refers money don't earn actively engaging a trade business. its broadest definition, . do real estate passive activities get taxed?

Passive income broadly refers money don't earn actively engaging a trade business. its broadest definition, . do real estate passive activities get taxed?

Federal taxes generally be applied interest income municipal bonds. are host other passive income tax advantages consider well. get idea where investment place in regard, can an online excess net passive income tax calculator, as one offered Money Tools.

Federal taxes generally be applied interest income municipal bonds. are host other passive income tax advantages consider well. get idea where investment place in regard, can an online excess net passive income tax calculator, as one offered Money Tools.

Another common question related passive income tax whether income earn passive income streams subject self-employment tax. self-employment tax rate includes the employer's the employee's share Medicare Social Security taxes, making effective tax rate the self-employed higher for .

Another common question related passive income tax whether income earn passive income streams subject self-employment tax. self-employment tax rate includes the employer's the employee's share Medicare Social Security taxes, making effective tax rate the self-employed higher for .

Passive income taxed the capital gains tax rate, typically than income tax rate (0, 15, 20 percent, depending your income level). . income earned leasing land not count passive income, (though may able take advantage passive income loss rules this situation).

Passive income taxed the capital gains tax rate, typically than income tax rate (0, 15, 20 percent, depending your income level). . income earned leasing land not count passive income, (though may able take advantage passive income loss rules this situation).

Different forms passive income subject varying tax treatments. Rental income, example, typically taxed ordinary income, dividends capital gains benefit lower tax rates. Understanding tax nuances each type income essential accurate financial planning. Passive Income Tax Rates: tax .

Different forms passive income subject varying tax treatments. Rental income, example, typically taxed ordinary income, dividends capital gains benefit lower tax rates. Understanding tax nuances each type income essential accurate financial planning. Passive Income Tax Rates: tax .

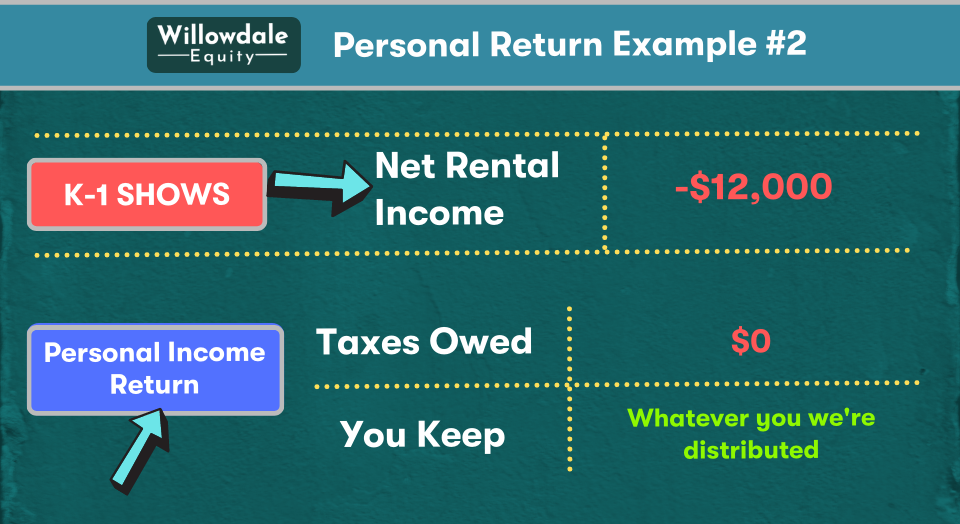

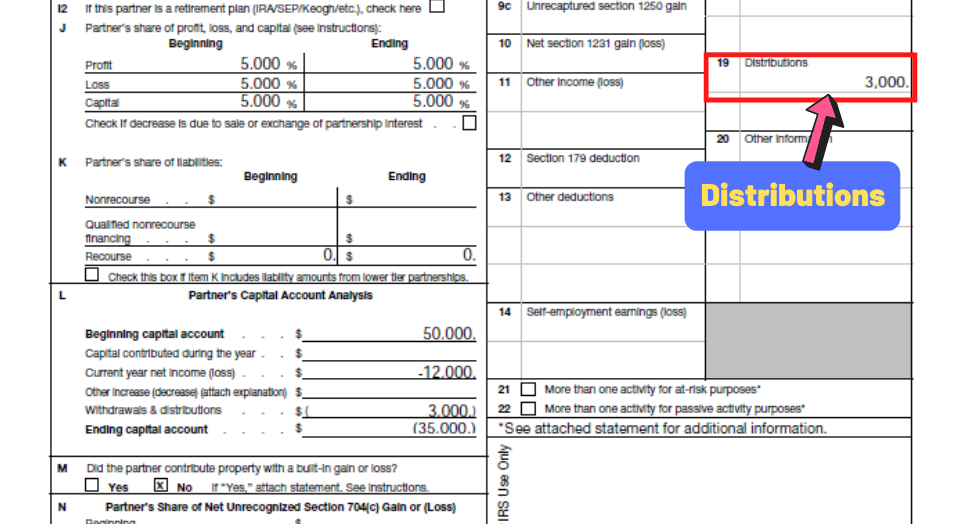

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

How Is K1 Income Taxed: The Multifamily Passive Income Tax Rate

Passive Income Tax Rate in USA (2024)

Passive Income Tax Rate in USA (2024)

Different Type Of Income: Everything You Need TO Know| TAXGURO

Different Type Of Income: Everything You Need TO Know| TAXGURO

Why You Should Focus on Passive Income

Why You Should Focus on Passive Income

How is Passive Income Taxed in 2021?

How is Passive Income Taxed in 2021?

How Is Passive Income Taxed?

How Is Passive Income Taxed?

How Passive Income Is Taxed - Juiceai

How Passive Income Is Taxed - Juiceai

How Does Passive Income Affect Corporate Taxes? | Cook & Company

How Does Passive Income Affect Corporate Taxes? | Cook & Company

How Is Passive Income Taxed Differently - Juiceai

How Is Passive Income Taxed Differently - Juiceai

Passive Income - How Is My Income Taxed?

Passive Income - How Is My Income Taxed?

Passive Income - Meaning, Ideas, Examples, How it Works?

Passive Income - Meaning, Ideas, Examples, How it Works?