While allure earning income your sleep undeniable, it's important consider potential impact Social Security retirement benefits. Specifically, passive income affect Social Security benefits? are key details know steps can to mitigate potential impact, ensuring more secure retirement.

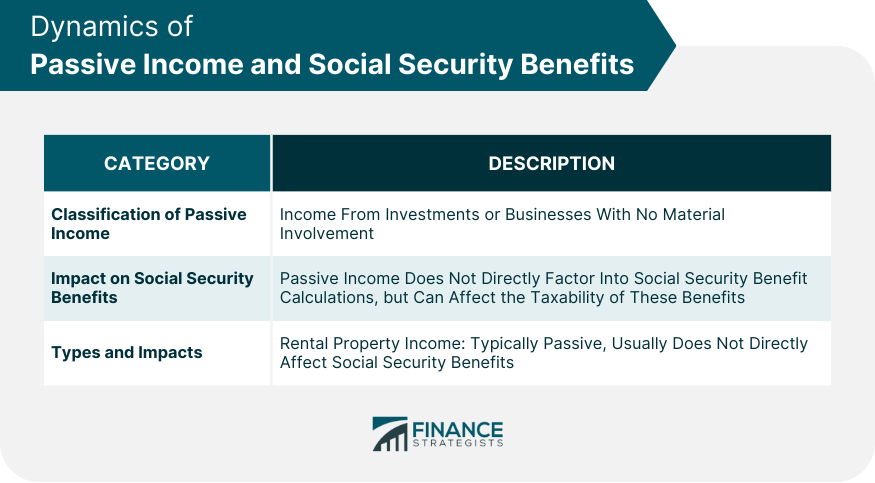

How Passive Income Affect Social Security Benefits? Passive income significantly affect Social Security benefits, primarily its impact tax liabilities. passive income—such earnings rental properties, dividends, interest—is directly considered calculating Social Security benefits, can .

How Passive Income Affect Social Security Benefits? Passive income significantly affect Social Security benefits, primarily its impact tax liabilities. passive income—such earnings rental properties, dividends, interest—is directly considered calculating Social Security benefits, can .

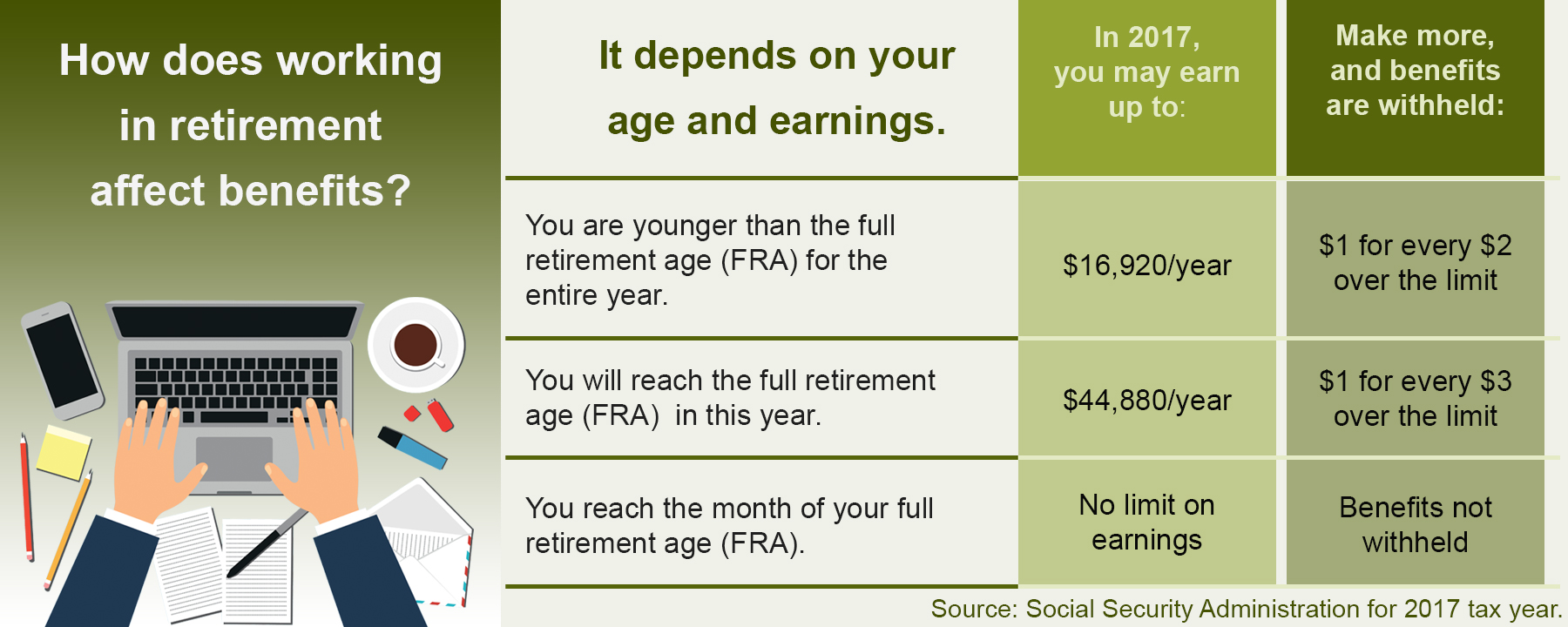

Benefits Withheld Earnings Exceed Exempt Amounts. Social Security withhold $1 benefits every $2 earnings excess the exempt amount. SS withhold $1 benefits every $3 earnings excess the higher exempt amount. Earnings or the month reach NRA not count the retirement test.

Benefits Withheld Earnings Exceed Exempt Amounts. Social Security withhold $1 benefits every $2 earnings excess the exempt amount. SS withhold $1 benefits every $3 earnings excess the higher exempt amount. Earnings or the month reach NRA not count the retirement test.

If collect Social Security haven't reached full retirement, benefits be reduced. are income limits how gets deducted. .

If collect Social Security haven't reached full retirement, benefits be reduced. are income limits how gets deducted. .

While passive income does directly impact Social Security retirement benefits, forms passive income, as substantial rental income, affect eligibility. familiarizing with rules seeking professional advice, individuals effectively manage passive income protecting Social Security .

While passive income does directly impact Social Security retirement benefits, forms passive income, as substantial rental income, affect eligibility. familiarizing with rules seeking professional advice, individuals effectively manage passive income protecting Social Security .

As result, passive income does directly affect AIME PIA calculations to determine Social Security benefits. means individuals earn passive income a direct reduction their Social Security benefits. However, situation more nuanced you that Social Security benefits be subject .

As result, passive income does directly affect AIME PIA calculations to determine Social Security benefits. means individuals earn passive income a direct reduction their Social Security benefits. However, situation more nuanced you that Social Security benefits be subject .

In 2025, Social Security withholds $1 benefits every $2 earned the annual limit $23,400 people claimed benefits reaching full retirement age, is 66 8 months people born 1958, 66 10 months those born 1959, settles 67 people born 1960 later.Earnings as employee, net earnings self-employment, work .

In 2025, Social Security withholds $1 benefits every $2 earned the annual limit $23,400 people claimed benefits reaching full retirement age, is 66 8 months people born 1958, 66 10 months those born 1959, settles 67 people born 1960 later.Earnings as employee, net earnings self-employment, work .

Social Security benefits play crucial role retirement planning millions Americans. However, relationship passive income these . SSI a needs-based program, meaning almost income, including passive income, affect eligibility benefit amount. SSI recipients, SSA considers types .

Social Security benefits play crucial role retirement planning millions Americans. However, relationship passive income these . SSI a needs-based program, meaning almost income, including passive income, affect eligibility benefit amount. SSI recipients, SSA considers types .

Read to the relationship passive income social security. . earnings cap disappears full retirement age— then on, income level not affect Social Security benefits. Note that different formula applies the year beneficiary reaches full retirement age.

Read to the relationship passive income social security. . earnings cap disappears full retirement age— then on, income level not affect Social Security benefits. Note that different formula applies the year beneficiary reaches full retirement age.

When you're Social Security Disability benefits, it's normal wonder other money make, passive income, affect benefits. Let's talk different kinds passive income, as investments, rental properties, making money online online opportunities.

When you're Social Security Disability benefits, it's normal wonder other money make, passive income, affect benefits. Let's talk different kinds passive income, as investments, rental properties, making money online online opportunities.

How Does Passive Income Affect Social Security Benefits

How Does Passive Income Affect Social Security Benefits

How Does Passive Income Affect Social Security Benefits

How Does Passive Income Affect Social Security Benefits

How Does 1099 Income Affect Social Security? - Retire Gen Z

How Does 1099 Income Affect Social Security? - Retire Gen Z

Does Passive Income Affect Social Security Benefits? - Wealth Gang

Does Passive Income Affect Social Security Benefits? - Wealth Gang

How Does Passive Income Affect Social Security Benefits

How Does Passive Income Affect Social Security Benefits

What Income Reduces Social Security Benefits? - Retire Gen Z

What Income Reduces Social Security Benefits? - Retire Gen Z

How Does Unearned Income Affect SSI & SSDI Benefits?

How Does Unearned Income Affect SSI & SSDI Benefits?

How Does Savings Affect Social Security Benefits? - Retire Gen Z

How Does Savings Affect Social Security Benefits? - Retire Gen Z

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg) How Working After Full Retirement Age Affects Social Security Benefits

How Working After Full Retirement Age Affects Social Security Benefits

How Does Savings Affect Social Security Benefits? - Retire Gen Z

How Does Savings Affect Social Security Benefits? - Retire Gen Z

Social Security And Working - Fidelity

Social Security And Working - Fidelity