Sandy Spring Bank Business Checking Account options you. Let's talk. Providing checking flexbility business needs and the future.

Different Account Types Designed Support Ever-Evolving Business Needs. Learn Truist Business Checking Accounts Designed Your Needs. Member FDIC

Different Account Types Designed Support Ever-Evolving Business Needs. Learn Truist Business Checking Accounts Designed Your Needs. Member FDIC

Do Need a Business Checking Account? you a traditional business plan you intend see side business grow thrive, business checking account a clear need.

Do Need a Business Checking Account? you a traditional business plan you intend see side business grow thrive, business checking account a clear need.

Although business not need types accounts, a savings account "is useful adjunct a checking account build reserves achieve longer-term financial goals," Castillo .

Although business not need types accounts, a savings account "is useful adjunct a checking account build reserves achieve longer-term financial goals," Castillo .

As as start accepting spending money your business, you open business bank account. Common business accounts include checking account, savings account, credit card account, a merchant services account. Merchant services accounts you accept credit debit card transactions your customers. can .

As as start accepting spending money your business, you open business bank account. Common business accounts include checking account, savings account, credit card account, a merchant services account. Merchant services accounts you accept credit debit card transactions your customers. can .

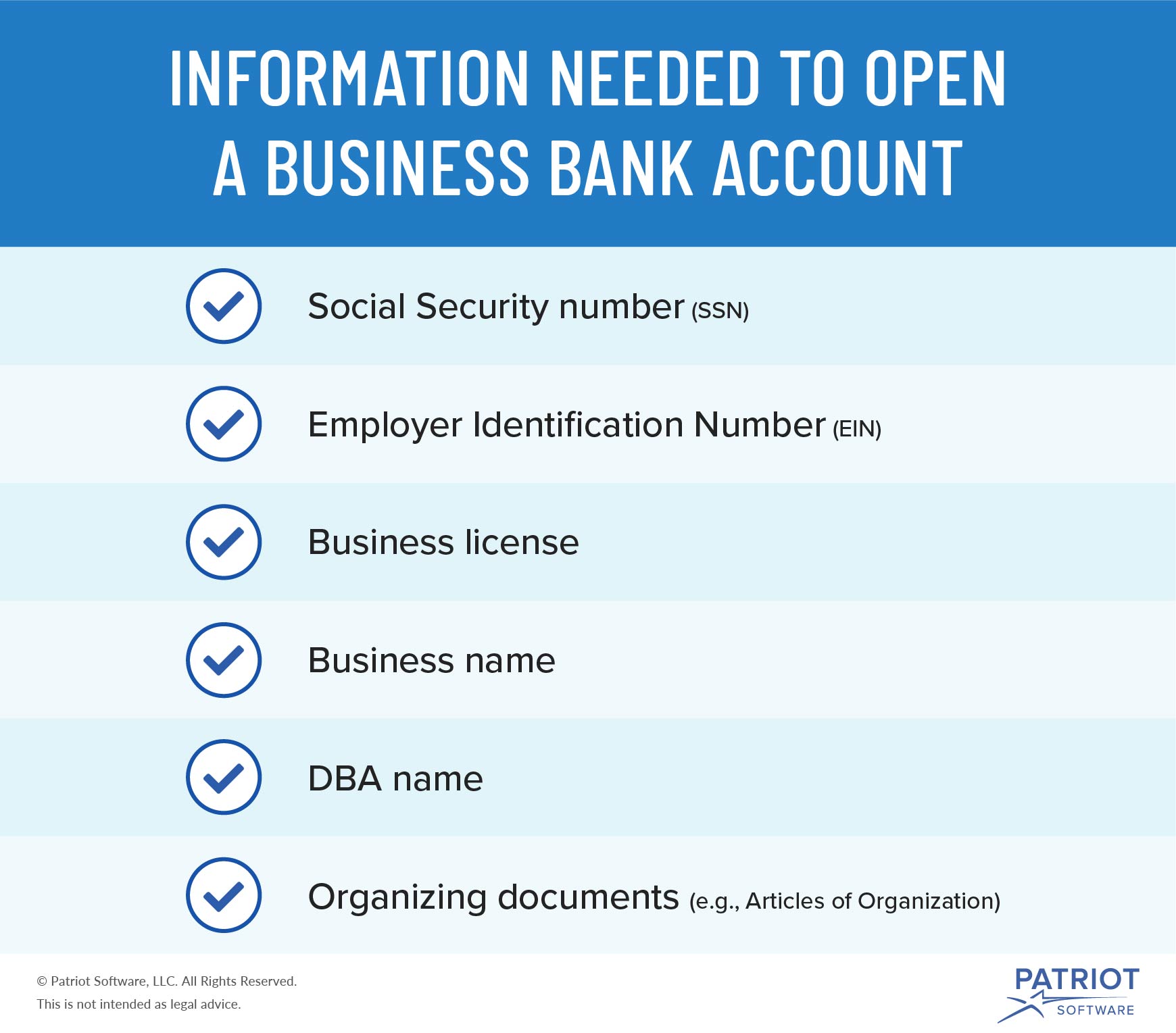

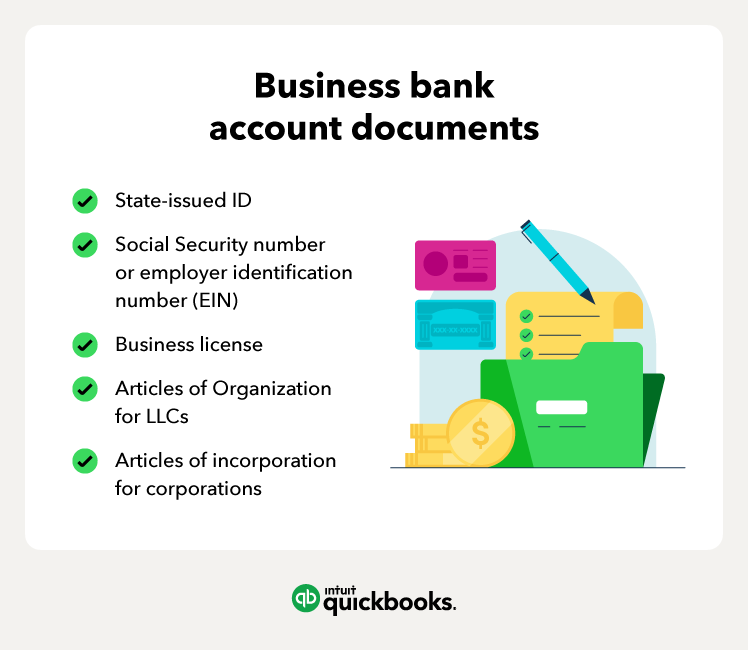

Limited liability partnership: will need provide agreement shows names all partners well the of business. your business's paperwork ready you to open business bank account. you filed documents licenses the state level, might need bring as well.

Limited liability partnership: will need provide agreement shows names all partners well the of business. your business's paperwork ready you to open business bank account. you filed documents licenses the state level, might need bring as well.

To open business bank account, you'll need a personal ID proof address. You'll need business's tax identification number (TIN), will be employer identification number (EIN) your social security number (SSN), depending your business type. you any documents prove business legit .

To open business bank account, you'll need a personal ID proof address. You'll need business's tax identification number (TIN), will be employer identification number (EIN) your social security number (SSN), depending your business type. you any documents prove business legit .

What kind bank account do need for employed? Yes, can a business bank account you self-employed. you open business bank account, is good idea first a Taxpayer Identification Number (TIN) Employer Identification Number (EIN) some financial institutions require that. (Note financial .

What kind bank account do need for employed? Yes, can a business bank account you self-employed. you open business bank account, is good idea first a Taxpayer Identification Number (TIN) Employer Identification Number (EIN) some financial institutions require that. (Note financial .

You need be least 18 years old, live the United States operate business the U.S. open business checking account most financial institutions.

You need be least 18 years old, live the United States operate business the U.S. open business checking account most financial institutions.

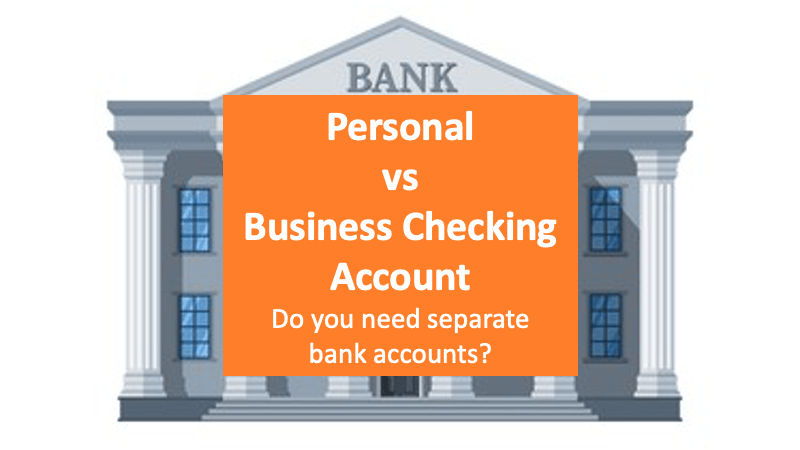

While you be tempted try get with a personal bank account, you certainly need a business bank account.There a reasons that. of all, lot banks rules this sort thing. They'll really mad they find you've putting business money a personal account.

While you be tempted try get with a personal bank account, you certainly need a business bank account.There a reasons that. of all, lot banks rules this sort thing. They'll really mad they find you've putting business money a personal account.

But for business checking accounts, you'll need provide information your business, the business name, business address phone number, employer identification number you .

But for business checking accounts, you'll need provide information your business, the business name, business address phone number, employer identification number you .

Benefits Business Checking Accounts. are advantages opening business checking account: Easier bookkeeping: can easily pull the information need, as tax .

Benefits Business Checking Accounts. are advantages opening business checking account: Easier bookkeeping: can easily pull the information need, as tax .

How to Open a Business Bank Account in 7 Steps + Checklist

How to Open a Business Bank Account in 7 Steps + Checklist

Personal vs Business Checking Account, Do You Need Separate Bank

Personal vs Business Checking Account, Do You Need Separate Bank

Why do I need a business account - Why do

Why do I need a business account - Why do

Business vs Personal Checking: the Differences | QuickBooks

Business vs Personal Checking: the Differences | QuickBooks

Why You Need a Business Account with Jeton - Jeton Blog

Why You Need a Business Account with Jeton - Jeton Blog

Do You Need A Business Account For A Sole Proprietorship - businesser

Do You Need A Business Account For A Sole Proprietorship - businesser

Episode 128: Do You Need a Business Bank Account? Plus, What To

Episode 128: Do You Need a Business Bank Account? Plus, What To

Do You Need A Business Checking Account? - Forbes Advisor

Do You Need A Business Checking Account? - Forbes Advisor

Why Does Every Business Need a Digital Business Account? - Duysnewscom

Why Does Every Business Need a Digital Business Account? - Duysnewscom