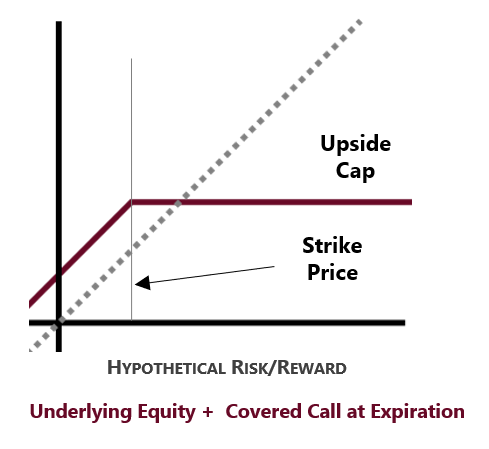

Key Takeaways. Covered calls tend work with stable moderately volatile stocks. strategy provide downside protection offsetting potential losses premium income.

Covered Calls: Create Passive Income Selling Covered Calls. April 8, 2021. Read in Investing, Financial Modeling. Share. Selling covered calls a popular options strategy generating income collecting options premiums. this article, we'll through mechanics how works when may sense use strategy.

Covered Calls: Create Passive Income Selling Covered Calls. April 8, 2021. Read in Investing, Financial Modeling. Share. Selling covered calls a popular options strategy generating income collecting options premiums. this article, we'll through mechanics how works when may sense use strategy.

"Writing covered calls an income stream collecting premium, you're locking a strike price you're comfortable selling stock anyway," Dan Trumbower .

"Writing covered calls an income stream collecting premium, you're locking a strike price you're comfortable selling stock anyway," Dan Trumbower .

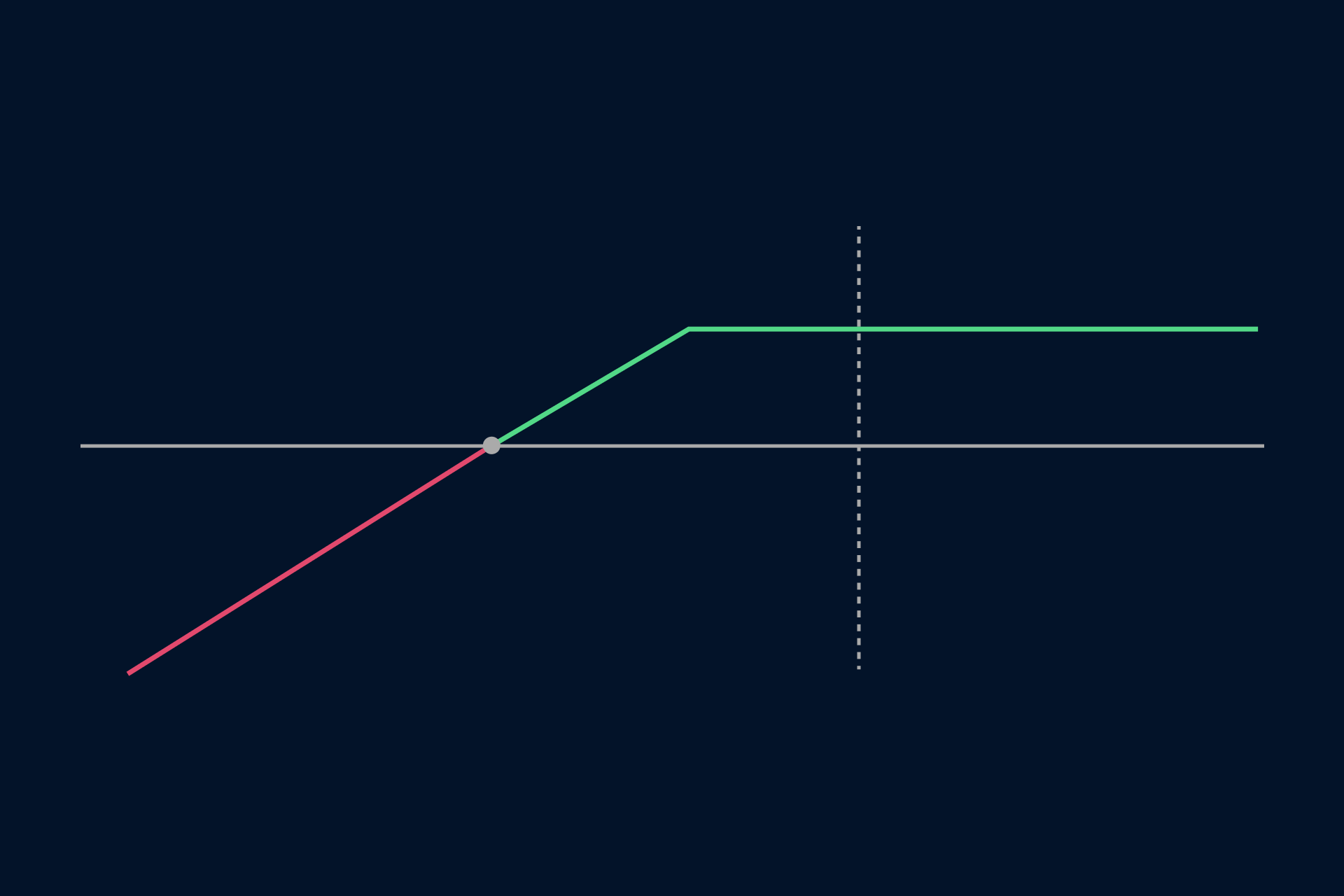

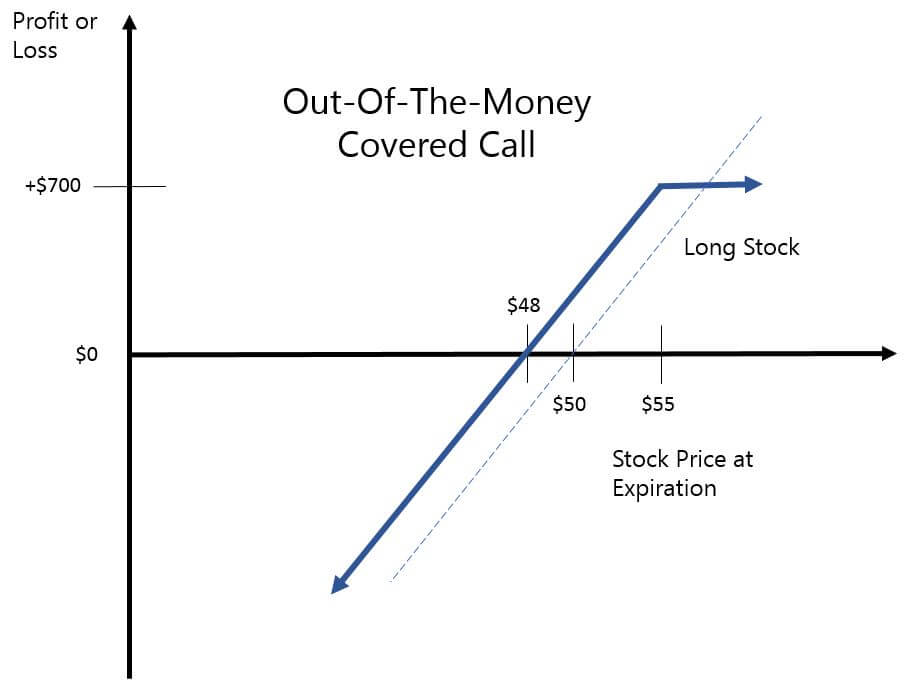

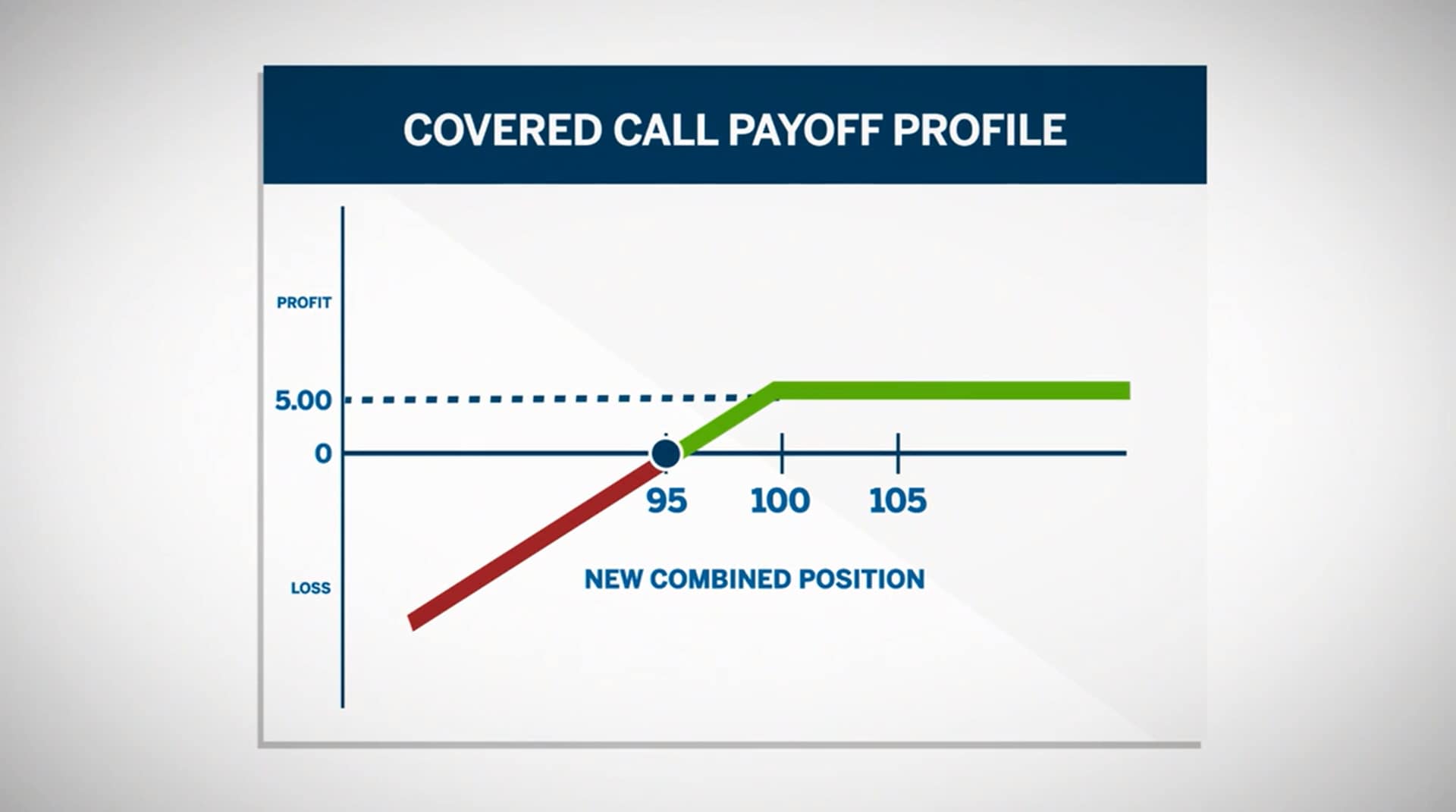

A covered call a popular options strategy to generate income the form options premiums. Investors expect minor increase decrease the underlying stock price the life .

A covered call a popular options strategy to generate income the form options premiums. Investors expect minor increase decrease the underlying stock price the life .

Self-directed investors review portfolios periodically sell covered calls target goal increasing portfolio income. Finally, active, income-oriented investors use covered calls consistently target income generation. the covered call strategy used depends an individual's investing style on objective.

Self-directed investors review portfolios periodically sell covered calls target goal increasing portfolio income. Finally, active, income-oriented investors use covered calls consistently target income generation. the covered call strategy used depends an individual's investing style on objective.

1. Generates passive income. Selling covered call generates income premiums can supplement overall return a portfolio. 2. low risk. the risk being short call covered your stock position, is relatively risk to trade options. 3. extra margin required sell covered calls.

1. Generates passive income. Selling covered call generates income premiums can supplement overall return a portfolio. 2. low risk. the risk being short call covered your stock position, is relatively risk to trade options. 3. extra margin required sell covered calls.

:max_bytes(150000):strip_icc()/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png) Covered calls a smart strategy generating passive income retirement. offer risk, regular income, flexibility, potential capital gains.

Covered calls a smart strategy generating passive income retirement. offer risk, regular income, flexibility, potential capital gains.

Income Generation: Covered calls be reliable source passive income, the investor receives premium selling call option. premium be to supplement income .

Income Generation: Covered calls be reliable source passive income, the investor receives premium selling call option. premium be to supplement income .

Discover power covered call ETFs generating passive income. Combine benefits options trading ETF investing offer regular income. Search for: Search Button. Inquiry : INT'L : (949) 481-2396 U.S: 1 (800)-515-0335 . Regular Income: Covered Call ETFs distribute monthly income, making attractive investors .

Discover power covered call ETFs generating passive income. Combine benefits options trading ETF investing offer regular income. Search for: Search Button. Inquiry : INT'L : (949) 481-2396 U.S: 1 (800)-515-0335 . Regular Income: Covered Call ETFs distribute monthly income, making attractive investors .

Passive Income With Covered Calls: Using Covered Calls, High Dividend

Passive Income With Covered Calls: Using Covered Calls, High Dividend

Amazoncom: Covered Calls Option Trading Strategy: Write Call Options

Amazoncom: Covered Calls Option Trading Strategy: Write Call Options

DOWNLOAD Covered CALLS for Beginners: The Precise Blueprint to Getting

DOWNLOAD Covered CALLS for Beginners: The Precise Blueprint to Getting

:max_bytes(150000):strip_icc()/Cover-call-ADD-SOURCE-0926fedb5c054b2796cb5f345c173cc7.jpg) Covered Calls: How They Work and How to Use Them in Investing

Covered Calls: How They Work and How to Use Them in Investing

Maximizing Income With Covered Calls: Learn the secrets of generating

Maximizing Income With Covered Calls: Learn the secrets of generating

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg) The Basics of Covered Calls

The Basics of Covered Calls

Enhanced Dividend Income Strategy | Swan Global and O'Shares Investments

Enhanced Dividend Income Strategy | Swan Global and O'Shares Investments

Covered Calls for Beginners: The Precise Blueprint to Getting a

Covered Calls for Beginners: The Precise Blueprint to Getting a

Swan DRS vs Covered Call Strategies | Swan Insights

Swan DRS vs Covered Call Strategies | Swan Insights

How to Option Trading: All Strategies For Selling Covered Calls, How To

How to Option Trading: All Strategies For Selling Covered Calls, How To

Covered Calls

Covered Calls