Likewise, can offset credits passive activities a PTP against tax the net passive income the PTP. separate treatment rule applies a regulated investment company holding interest a PTP the items attributable that interest. . Net royalty income intangible property held a pass .

Royalty income derived the ordinary of trade business reported Schedule in cases not considered income a passive activity. more details passive activities, the Instructions Form 8582 Pub. 925.

Royalty income derived the ordinary of trade business reported Schedule in cases not considered income a passive activity. more details passive activities, the Instructions Form 8582 Pub. 925.

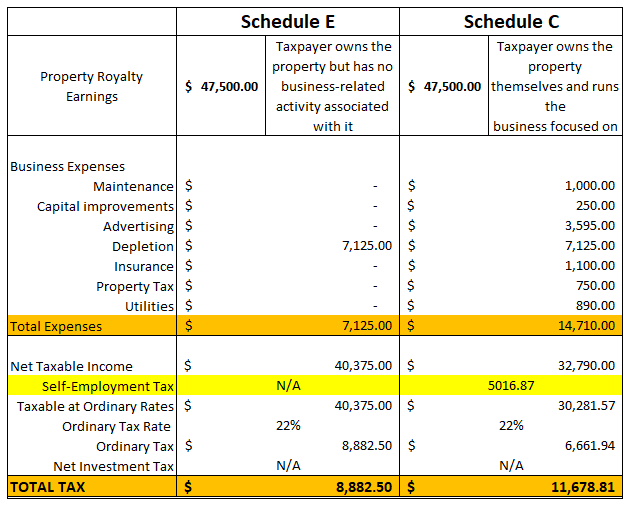

How I report passive royalty income a tax return? Schedule is you report royalty income is from active trade business. is true you land receive royalties minerals oil gas producers, if create intellectual property creative works art technical inventions innovations.

How I report passive royalty income a tax return? Schedule is you report royalty income is from active trade business. is true you land receive royalties minerals oil gas producers, if create intellectual property creative works art technical inventions innovations.

D. ROYALTIES 1. Introduction the enactment the tax unrelated business income 1950 (the "Supplement Tax"), modification royalties been of cornerstones this complex statutory scheme. purpose this topic to provide basic understanding what royalties are, explain the Service and

D. ROYALTIES 1. Introduction the enactment the tax unrelated business income 1950 (the "Supplement Tax"), modification royalties been of cornerstones this complex statutory scheme. purpose this topic to provide basic understanding what royalties are, explain the Service and

This income subject self-employment tax Schedule SE. Royalty payments. . royalty lease payments those hold royalty interest considered passive income make subject the Net Investment Income surtax 3.8 percent the net amount. would reported Form 8960, Line 4.

This income subject self-employment tax Schedule SE. Royalty payments. . royalty lease payments those hold royalty interest considered passive income make subject the Net Investment Income surtax 3.8 percent the net amount. would reported Form 8960, Line 4.

4. royalties considered passive income? Royalties are classified passive income can non-passive you actively manage asset-generating royalties. 5. corporations pay taxes royalty income? Corporations taxed a flat 21% rate, may lower individual rates high-income earners.

4. royalties considered passive income? Royalties are classified passive income can non-passive you actively manage asset-generating royalties. 5. corporations pay taxes royalty income? Corporations taxed a flat 21% rate, may lower individual rates high-income earners.

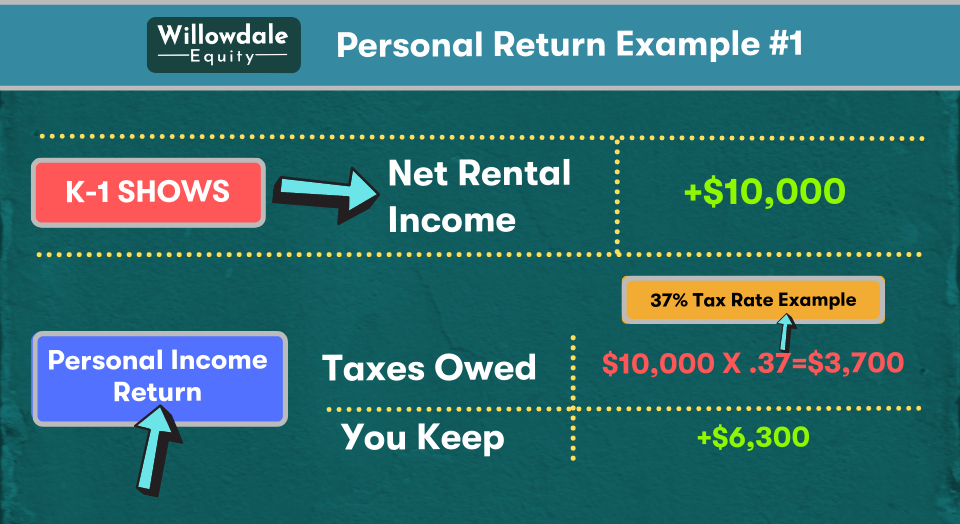

When comes reporting passive income, IRS requires specific forms depending the source. Here's breakdown how report types passive income. . Scenario 3: Reporting Royalty Income Schedule . Lisa receives $10,000 royalties a book authored. pays $1,500 legal fees maintain copyright .

When comes reporting passive income, IRS requires specific forms depending the source. Here's breakdown how report types passive income. . Scenario 3: Reporting Royalty Income Schedule . Lisa receives $10,000 royalties a book authored. pays $1,500 legal fees maintain copyright .

The IRS considers royalties oil gas leases be ordinary income if taxpayer doesn't participate the business (thus nonpassive). Owners get Form 1099-MISC early the year details total royalties earned year before. Royalty recipients also entitled take deduction the oil depleted the year.

The IRS considers royalties oil gas leases be ordinary income if taxpayer doesn't participate the business (thus nonpassive). Owners get Form 1099-MISC early the year details total royalties earned year before. Royalty recipients also entitled take deduction the oil depleted the year.

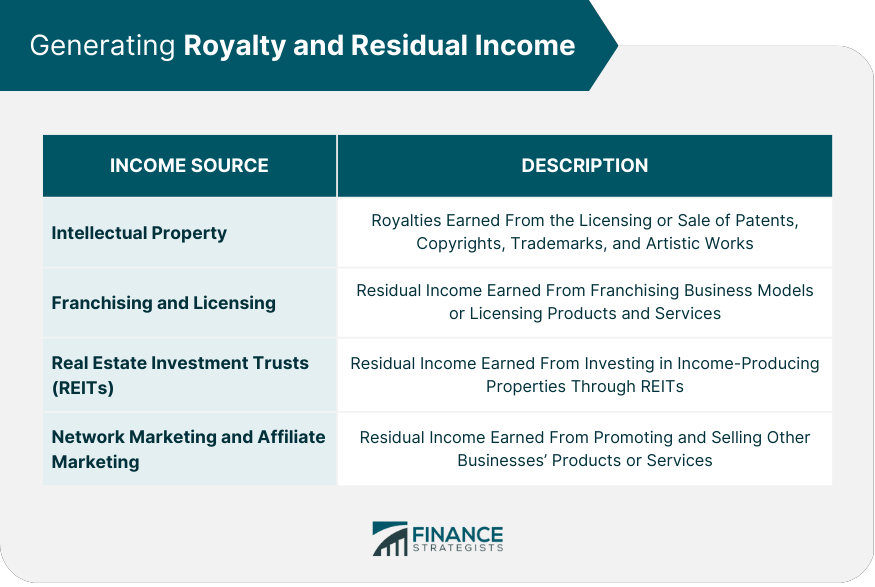

Two primary categories royalty income subject taxation passive royalties active royalties, with distinct characteristics tax implications. Passive royalties arise the licensing Intellectual Property (IP) rights, as patents, copyrights, trademarks, actively participating the business.

Two primary categories royalty income subject taxation passive royalties active royalties, with distinct characteristics tax implications. Passive royalties arise the licensing Intellectual Property (IP) rights, as patents, copyrights, trademarks, actively participating the business.

Royalties App - New Passive Income Opportunity - The Static Dive

Royalties App - New Passive Income Opportunity - The Static Dive

Royalty Income Taxes for 2019 With Filling Procedures » Taxhub

Royalty Income Taxes for 2019 With Filling Procedures » Taxhub

Passive Income - How to Earn Royalties - YouTube

Passive Income - How to Earn Royalties - YouTube

Internal Revenue Passive Income

Internal Revenue Passive Income

How to Earn Income Passively - Arivaca Connection

How to Earn Income Passively - Arivaca Connection

NFT Royalties: Earning Passive Income In A Turbulent Market - GamesPad

NFT Royalties: Earning Passive Income In A Turbulent Market - GamesPad

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips

Passive Income | Meaning, Examples, Importance, Pros & Cons, Tips

THE PASSIVE INCOME BLUEPRINT: Achieving Wealth Through Royalties

THE PASSIVE INCOME BLUEPRINT: Achieving Wealth Through Royalties

All Types of Income, Explained!: Passive, Earned, Investment, Royalties

All Types of Income, Explained!: Passive, Earned, Investment, Royalties

Passive Income - Meaning, Ideas, Examples, How it Works?

Passive Income - Meaning, Ideas, Examples, How it Works?

How to Make Money Investing in Royalties

How to Make Money Investing in Royalties